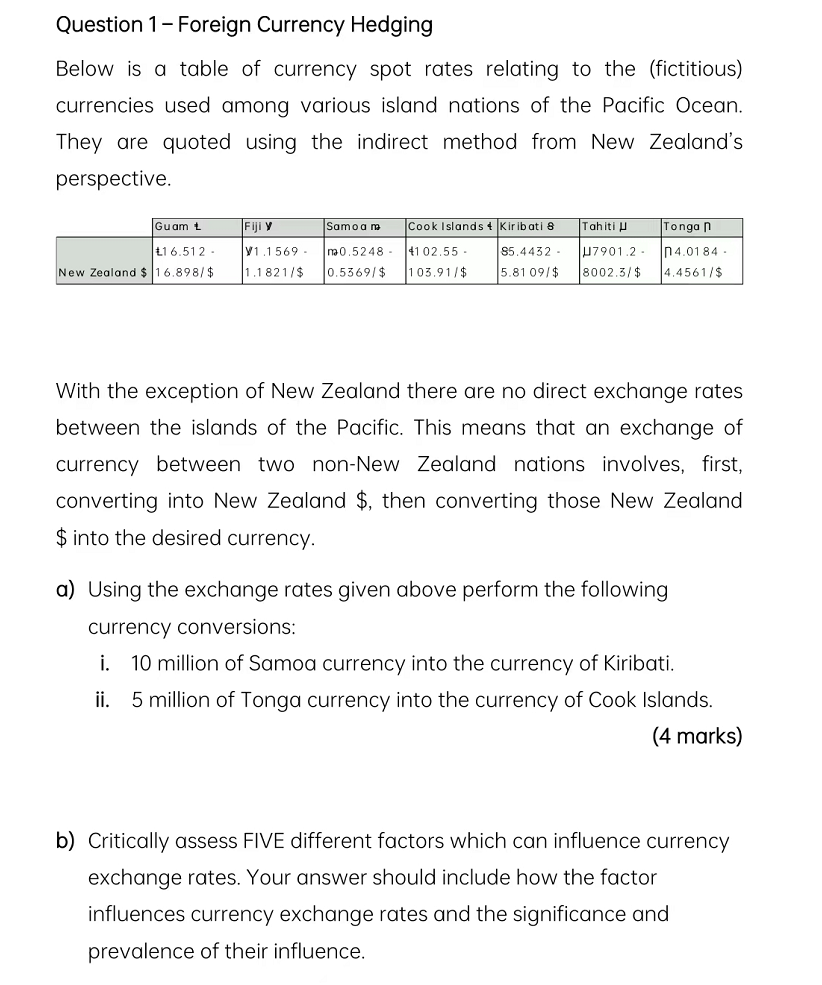

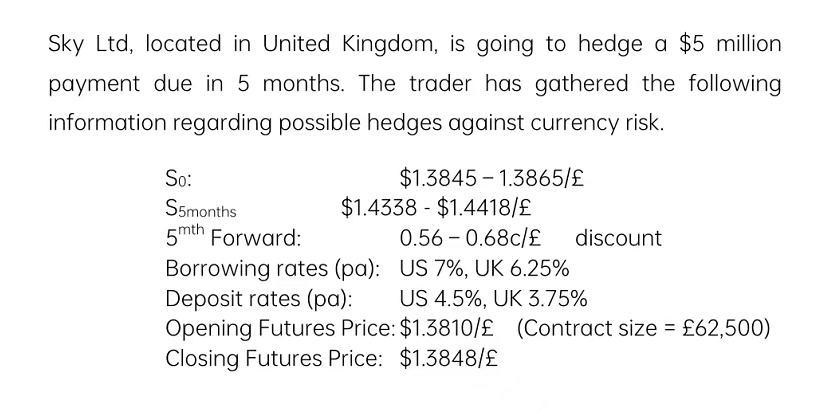

Question 1- Foreign Currency Hedging Below is a table of currency spot rates relating to the (fictitious) currencies used among various island nations of the Pacific Ocean. They are quoted using the indirect method from New Zealand's perspective. Fiji y V1.1569 Samoa m Cook Islands + Kiribati 8 41 02.55- 16.512 m0.5248 85.4432 5.81 09/$ New Zealand $ 16.898/$ 1.1821/$ 0.5369/$ 103.91/$ Guam L Tahiti U Tonga n U7901.2 n4.0184- 8002.3/$ 4.4561/$ With the exception of New Zealand there are no direct exchange rates between the islands of the Pacific. This means that an exchange of currency between two non-New Zealand nations involves, first, converting into New Zealand $, then converting those New Zealand $ into the desired currency. a) Using the exchange rates given above perform the following currency conversions: i. 10 million of Samoa currency into the currency of Kiribati. ii. 5 million of Tonga currency into the currency of Cook Islands. (4 marks) b) Critically assess FIVE different factors which can influence currency exchange rates. Your answer should include how the factor influences currency exchange rates and the significance and prevalence of their influence. Sky Ltd, located in United Kingdom, is going to hedge a $5 million payment due in 5 months. The trader has gathered the following information regarding possible hedges against currency risk. So: S5months 5mth Forward: $1.3845-1.3865/ $1.4338 $1.4418/ 0.56 0.68c/ US 7%, UK 6.25% US 4.5%, UK 3.75% Borrowing rates (pa): Deposit rates (pa): Opening Futures Price: Closing Futures Price: $1.3848/ discount $1.3810/ (Contract size = 62,500) Question 1- Foreign Currency Hedging Below is a table of currency spot rates relating to the (fictitious) currencies used among various island nations of the Pacific Ocean. They are quoted using the indirect method from New Zealand's perspective. Fiji y V1.1569 Samoa m Cook Islands + Kiribati 8 41 02.55- 16.512 m0.5248 85.4432 5.81 09/$ New Zealand $ 16.898/$ 1.1821/$ 0.5369/$ 103.91/$ Guam L Tahiti U Tonga n U7901.2 n4.0184- 8002.3/$ 4.4561/$ With the exception of New Zealand there are no direct exchange rates between the islands of the Pacific. This means that an exchange of currency between two non-New Zealand nations involves, first, converting into New Zealand $, then converting those New Zealand $ into the desired currency. a) Using the exchange rates given above perform the following currency conversions: i. 10 million of Samoa currency into the currency of Kiribati. ii. 5 million of Tonga currency into the currency of Cook Islands. (4 marks) b) Critically assess FIVE different factors which can influence currency exchange rates. Your answer should include how the factor influences currency exchange rates and the significance and prevalence of their influence. Sky Ltd, located in United Kingdom, is going to hedge a $5 million payment due in 5 months. The trader has gathered the following information regarding possible hedges against currency risk. So: S5months 5mth Forward: $1.3845-1.3865/ $1.4338 $1.4418/ 0.56 0.68c/ US 7%, UK 6.25% US 4.5%, UK 3.75% Borrowing rates (pa): Deposit rates (pa): Opening Futures Price: Closing Futures Price: $1.3848/ discount $1.3810/ (Contract size = 62,500)