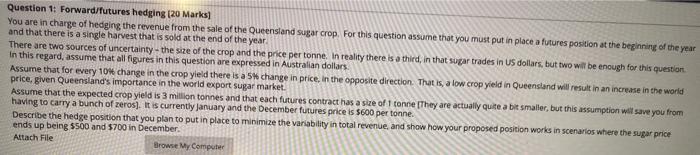

Question 1: Forward/futures hedging (20 Marks You are in charge of hedging the revenue from the sale of the Queensland sugar crop. For this question assume that you must put in place a futures position at the beginning of the year and that there is a single harvest that is sold at the end of the year There are two sources of uncertainty - the size of the crop and the price per tonne. In reality there is a third, in that sugar trade in US dollars, but two will be enough for this question In this regard, assume that all figures in this question are expressed in Australian dollars Assume that for every 10% change in the crop yield there is a change in price, in the opposite direction. That is a low crop yield in Queensland will result in an increase in the world price, given Queensland's importance in the world export sugar market. Assume that the expected crop yield is 3 million tonnes and that each futures contract has a size of 1 tonne [They are actually quite a bit smaller, but this assumption will save you from having to carry a bunch of zeros). It is currently January and the December futures price is 5600 per tonne. Describe the hedge position that you plan to put in place to minimize the variability in total revenue and show how your proposed position works in scenarios where the sugar price ends up being $500 and 5700 in December Attach File Browse My Computer Question 1: Forward/futures hedging (20 Marks You are in charge of hedging the revenue from the sale of the Queensland sugar crop. For this question assume that you must put in place a futures position at the beginning of the year and that there is a single harvest that is sold at the end of the year There are two sources of uncertainty - the size of the crop and the price per tonne. In reality there is a third, in that sugar trade in US dollars, but two will be enough for this question In this regard, assume that all figures in this question are expressed in Australian dollars Assume that for every 10% change in the crop yield there is a change in price, in the opposite direction. That is a low crop yield in Queensland will result in an increase in the world price, given Queensland's importance in the world export sugar market. Assume that the expected crop yield is 3 million tonnes and that each futures contract has a size of 1 tonne [They are actually quite a bit smaller, but this assumption will save you from having to carry a bunch of zeros). It is currently January and the December futures price is 5600 per tonne. Describe the hedge position that you plan to put in place to minimize the variability in total revenue and show how your proposed position works in scenarios where the sugar price ends up being $500 and 5700 in December Attach File Browse My Computer