Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Fragrance Limited manufactures mini-barbecue units for use in the summer months. These are sold to hardware stores and supermarkets. (Fragrance Limited's budgeted price is

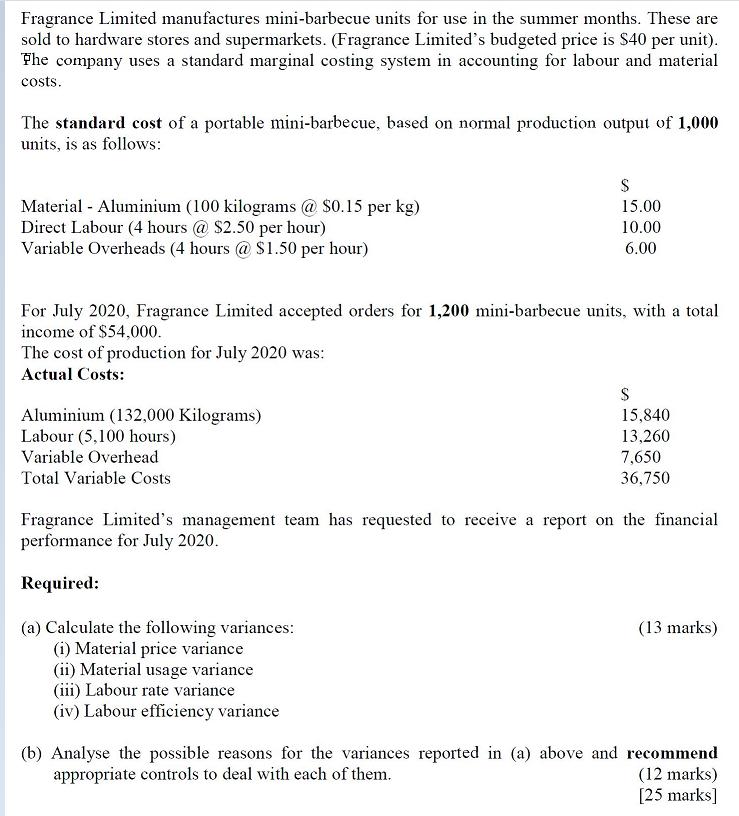

Fragrance Limited manufactures mini-barbecue units for use in the summer months. These are sold to hardware stores and supermarkets. (Fragrance Limited's budgeted price is $40 per unit). Fhe company uses a standard marginal costing system in accounting for labour and material costs. The standard cost of a portable mini-barbecue, based on normal production output of 1,000 units, is as follows: Material - Aluminium (100 kilograms @ $0.15 per kg) Direct Labour (4 hours @ $2.50 per hour) Variable Overheads (4 hours @ S1.50 per hour) 15.00 10.00 6.00 For July 2020, Fragrance Limited accepted orders for 1,200 mini-barbecue units, with a total income of $54,000. The cost of production for July 2020 was: Actual Costs: Aluminium (132,000 Kilograms) Labour (5,100 hours) 15,840 13,260 Variable Overhead 7,650 Total Variable Costs 36,750 Fragrance Limited's management team has requested to receive a report on the financial performance for July 2020. Required: (a) Calculate the following variances: (i) Material price variance (ii) Material usage variance (iii) Labour rate variance (iv) Labour efficiency variance (13 marks) (b) Analyse the possible reasons for the variances reported in (a) above and recommend (12 marks) [25 marks] appropriate controls to deal with each of them.

Step by Step Solution

★★★★★

3.52 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started