Answered step by step

Verified Expert Solution

Question

1 Approved Answer

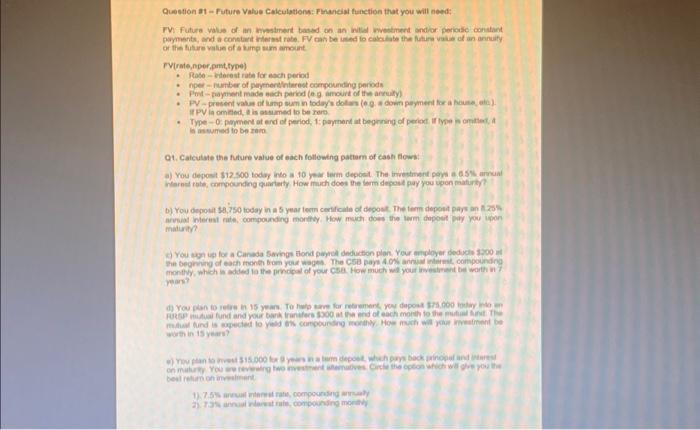

Question #1 - Future Value Calculations: Financial function that you will need: FV: Future value of an investment based on an initial investment and/or periodic

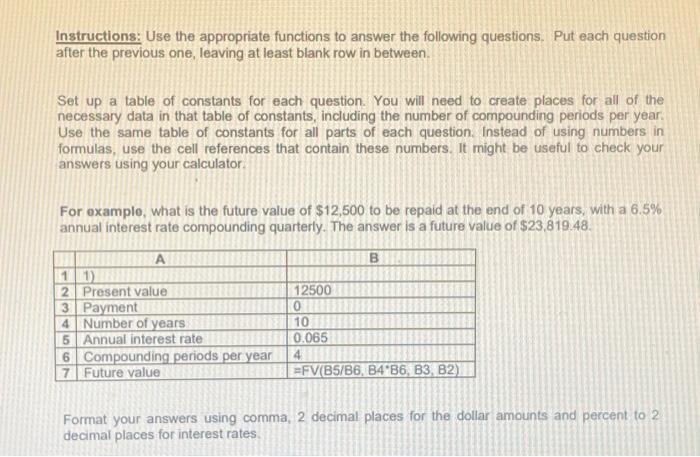

Question #1 - Future Value Calculations: Financial function that you will need: FV: Future value of an investment based on an initial investment and/or periodic constant payments, and a constant interest rate. FV can be used to calculate the future value of an annuity or the future value of a lump sum amount. FV(rate,nper,pmt,type) . # B # . Rate - interest rate for each period nper- number of payment/interest compounding periods Pmt - payment made each period (e.g. amount of the annuity) PV - present value of lump sum in today's dollars (e.g. a down payment for a house, etc.). If PV is omitted, it is assumed to be zero. Type - 0: payment at end of period, 1: payment at beginning of period. If type is omitted, it is assumed to be zero. Q1. Calculate the future value of each following pattern of cash flows: a) You deposit $12,500 today into a 10 year term deposit. The investment pays a 6.5% annual interest rate, compounding quarterly. How much does the term deposit pay you upon maturity? b) You deposit $8,750 today in a 5 year term certificate of deposit. The term deposit pays an 8.25% annual interest rate, compounding monthly. How much does the term deposit pay you upon maturity? c) You sign up for a Canada Savings Bond payroll deduction plan. Your employer deducts $200 at the beginning of each month from your wages. The CSB pays 4.0% annual interest, compounding monthly, which is added to the principal of your CSB. How much will your investment be worth in 7 years? d) You plan to retire in 15 years. To help save for retirement, you deposit $75,000 today into an RRSP mutual fund and your bank transfers $300 at the end of each month to the mutual fund. The mutual fund is expected to yield 8% compounding monthly. How much will your investment be worth in 15 years? e) You plan to invest $15,000 for 9 years in a term deposit, which pays back principal and interest on maturity. You are reviewing two investment alternatives. Circle the option which will give you the best return on investment. 1)-7.5% annual interest rate, compounding annually 2). 7.3% annual interest rate, compounding monthly

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started