Answered step by step

Verified Expert Solution

Question

1 Approved Answer

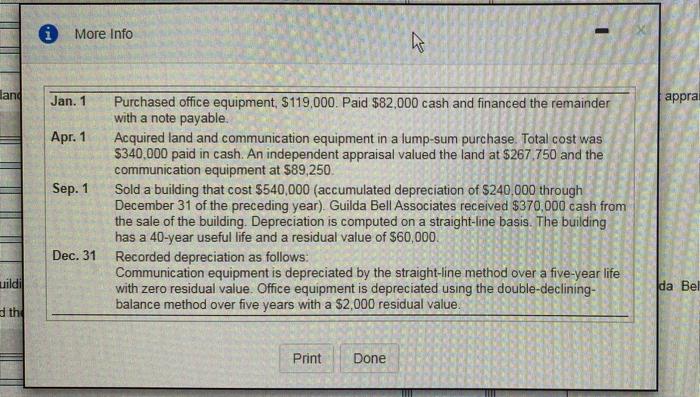

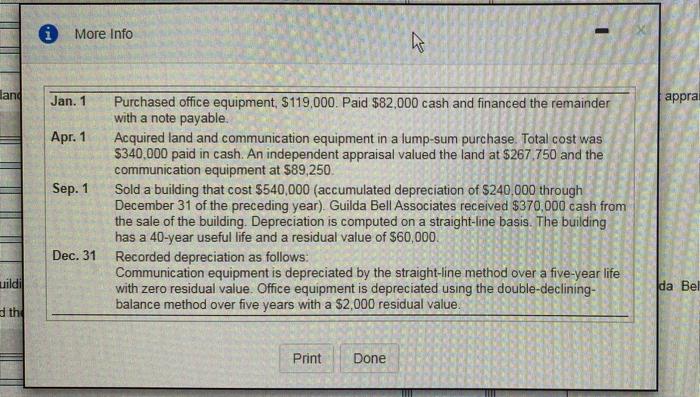

question 1: G u i l d a B e l l Associates surveys American eating habits. The company's accounts include Land, Buildings, Office Equipment,

question 1:

i More Info a land Jan. 1 appral Apr. 1 Sep. 1 Purchased office equipment, $119,000. Paid $82,000 cash and financed the remainder with a note payable. Acquired land and communication equipment in a lump-sum purchase. Total cost was $340,000 paid in cash. An independent appraisal valued the land at $267,750 and the communication equipment at $89,250 Sold a building that cost $540,000 (accumulated depreciation of $240.000 through December 31 of the preceding year). Guilda Bell Associates received $370,000 cash from the sale of the building. Depreciation is computed on a straight-line basis. The building has a 40-year useful life and a residual value of $60,000. Recorded depreciation as follows: Communication equipment is depreciated by the straight-line method over a five-year life with zero residual value. Office equipment is depreciated using the double-declining- balance method over five years with a $2,000 residual value. Dec. 31 uildi da Bel d the Print Done Ul and Gas Properties Emesta 56,100,000 for reserves holding an estimated 200 000 ham oil Record all of Emes's transactions including depletion for the first year. (Record debits first the credits Select the explanation on Emest paid 56,100,000 for reserves holding an estimated 200.000 barrels of oil. Record the payment for the reserves. Do not record payment for any additional costs associated with the reserves geological testir Date Accounts and Explanation Debil Credit Assume the company paid $540,000 for additional geological tests of the property and $460.000 to prepare for dig Record the payment for additional geological ens of the property and for mange property for drilling Records.com Date Accounts and Explanation Debit Credit During the first year Emestromoved and sold 96.000 barrel of a Record the depletion pense for the first year AmenovalceRound intercalculations to the reason and your bat Date Accounts and Explanation Debit Credit Choose from any list or enter any number memputes and men continue to the next question mundo Guilda

Bell

Associates surveys American eating habits. The company's accounts include Land, Buildings, Office Equipment, and Communication Equipment, with a separate Accumulated Depreciation account for each depreciable asset. During 2024,

Guilda

Bell

Associates completed the following transactions: Record the transactions in the journal of

Guilda

Bell

Associates. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.) Question 2:

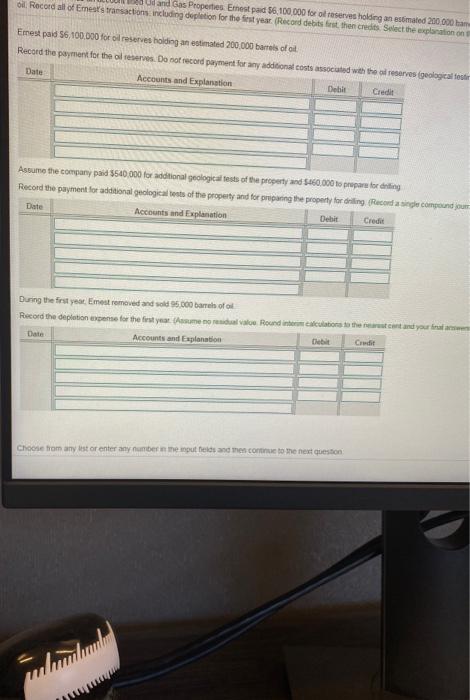

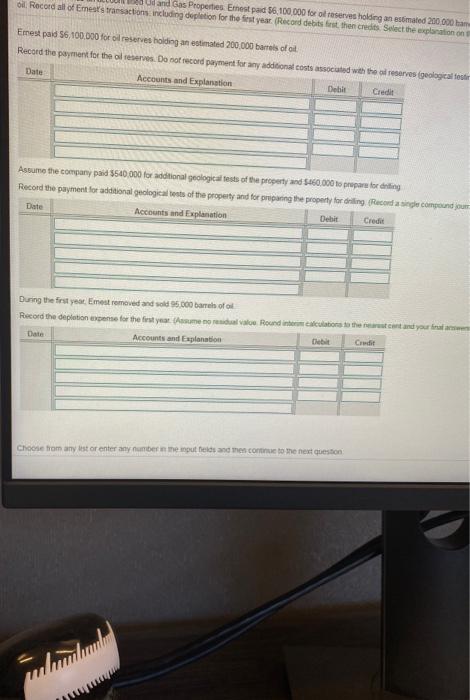

Ernest

Oil, Inc. has an account titled Oil and Gas Properties. Ernest

paid $6,100,000

for oil reserves holding an estimated 200,000

barrels of oil. Assume the company paid $540,000

for additional geological tests of the property and $460,000

to prepare for drilling. During the first year, Ernest

removed and sold 95,000

barrels of oil. Record all of Ernest's

transactions, including depletion for the first year. (Record debits first, then credits. Select the explanation on the last line of the journal entry table.)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started