Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: Gareth is a rugby fan and collects all sorts of rugby memorabilia. Over the past three years he has started running a

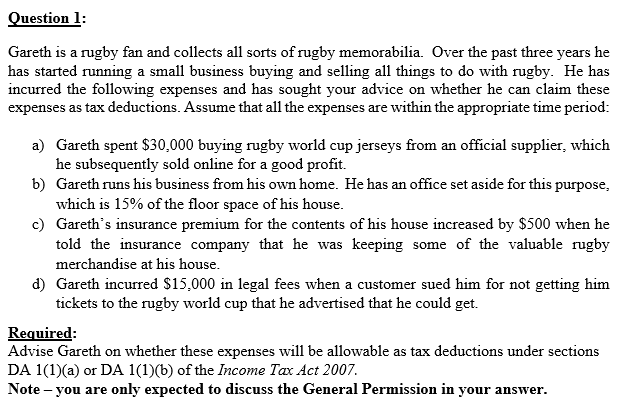

Question 1: Gareth is a rugby fan and collects all sorts of rugby memorabilia. Over the past three years he has started running a small business buying and selling all things to do with rugby. He has incurred the following expenses and has sought your advice on whether he can claim these expenses as tax deductions. Assume that all the expenses are within the appropriate time period: a) Gareth spent $30,000 buying rugby world cup jerseys from an official supplier, which he subsequently sold online for a good profit. b) Gareth runs his business from his own home. He has an office set aside for this purpose, which is 15% of the floor space of his house. c) Gareth's insurance premium for the contents of his house increased by $500 when he told the insurance company that he was keeping some of the valuable rugby merchandise at his house. d) Gareth incurred $15,000 in legal fees when a customer sued him for not getting him tickets to the rugby world cup that he advertised that he could get. Required: Advise Gareth on whether these expenses will be allowable as tax deductions under sections DA 1(1)(a) or DA 1(1)(b) of the Income Tax Act 2007. Note - you are only expected to discuss the General Permission in your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Gareths Rugby Memorabilia Expenses and Tax Deductibility Based on the General Permission in sections ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started