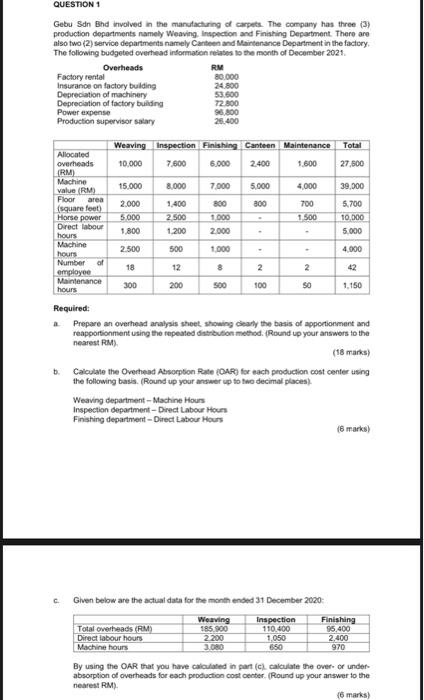

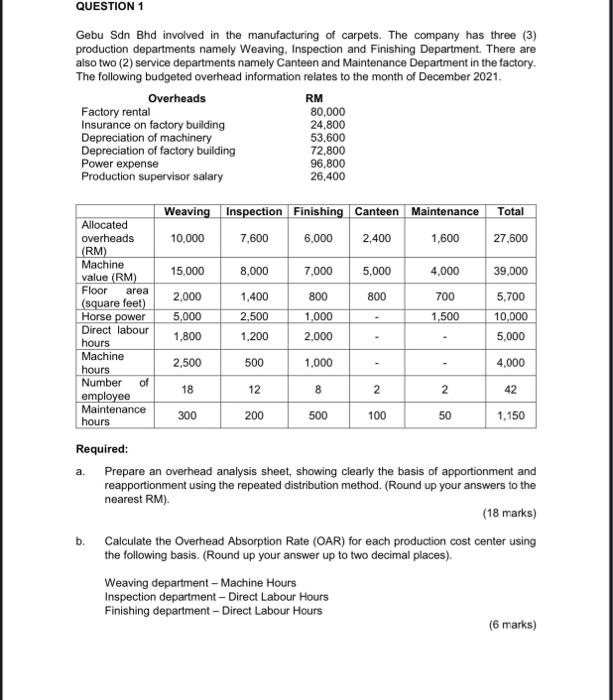

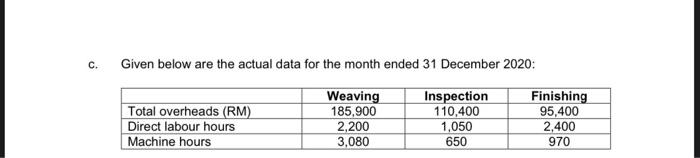

QUESTION 1 Gebu Sdn Bhd involved in the manufacturing of carpets. The company has three (3) production departments namely Weaving Inspection and Finishing Department. There are also two (2) service departments namely Cartoon and Maintenance Department in the factory The following budgeted overhead information relates to the month of December 2021 Overheads RM Factory rental 80,000 Insurance on factory bulding 24.800 Depreciation of machinery 53.600 Depreciation of factory building 72.800 Power expense 96.800 Production supervisor salary 26.400 Total 2400 27.500 Allocated overheads (RM) Machine value (RM) Floor area square feet) Horse power Direct labour hours Machine hours Number of employee Maintenance hours Weaving Inspection Finishing Canteen Maintenance 10.000 7.600 6.000 1.600 15.000 8.000 7.000 5,000 4,000 2.000 1,400 800 700 5000 2500 1000 1 500 1.800 1.200 2.000 2.500 500 1 000 39,000 5,700 10,000 5,000 4000 18 12 2 2 42 NS 300 200 500 100 1.150 Required: Prepare an overhead analysis short showing only the basis of apportionment and reapportionment using the repeated distribution method. (Round up your answers to the nearest RM) (18 marks) b. Calculate the Overhead Absorption Rate (DAR) for each production cost center using the following basis. (Round up your answer up to two decimal places Weaving department - Machine Hours Inspection department - Direct Labour Hours Finishing department - Direct Labour Hours (6 marks) c. Given below are the actual data for the month ended 31 December 2020 Weaving Inspection Finishing Total overheads (RM) 185.900 110.400 95.400 Direct labour hours 2200 1.050 2.400 Machine hours 3.080 650 970 By using the OAR that you have calculated in part (c. calculate the over- or under absorption of overheads for each production cost center (Round up your answer to the nearest RM) (6 marks) QUESTION 1 Gebu Sdn Bhd involved in the manufacturing of carpets. The company has three (3) production departments namely Weaving, Inspection and Finishing Department. There are also two (2) service departments namely Canteen and Maintenance Department in the factory. The following budgeted overhead information relates to the month of December 2021. Overheads RM Factory rental 80,000 Insurance on factory building 24.800 Depreciation of machinery 53,600 Depreciation of factory building 72,800 Power expense 96,800 Production supervisor salary 26,400 N N Weaving Inspection Finishing Canteen Maintenance Total Allocated overheads 10,000 7,600 6,000 2,400 1,600 27,600 (RM) Machine value (RM) 15,000 8,000 7,000 5,000 4,000 39,000 Floor area 2.000 (square feet) 1,400 800 800 700 5,700 Horse power 5,000 2,500 1.000 1,500 10,000 Direct labour 1,800 1,200 hours 2,000 5,000 Machine 2,500 500 1.000 hours 4,000 Number of 18 12 employee 8 42 Maintenance 300 200 500 100 50 hours 1,150 Required: a. Prepare an overhead analysis sheet, showing clearly the basis of apportionment and reapportionment using the repeated distribution method. (Round up your answers to the nearest RM). (18 marks) b. Calculate the Overhead Absorption Rate (CAR) for each production cost center using the following basis. (Round up your answer up to two decimal places). Weaving department - Machine Hours Inspection department - Direct Labour Hours Finishing department - Direct Labour Hours (6 marks) C. Given below are the actual data for the month ended 31 December 2020: Total overheads (RM) Direct labour hours Machine hours Weaving 185,900 2,200 3,080 Inspection 110,400 1,050 650 Finishing 95,400 2,400 970 QUESTION 1 Gebu Sdn Bhd involved in the manufacturing of carpets. The company has three (3) production departments namely Weaving Inspection and Finishing Department. There are also two (2) service departments namely Cartoon and Maintenance Department in the factory The following budgeted overhead information relates to the month of December 2021 Overheads RM Factory rental 80,000 Insurance on factory bulding 24.800 Depreciation of machinery 53.600 Depreciation of factory building 72.800 Power expense 96.800 Production supervisor salary 26.400 Total 2400 27.500 Allocated overheads (RM) Machine value (RM) Floor area square feet) Horse power Direct labour hours Machine hours Number of employee Maintenance hours Weaving Inspection Finishing Canteen Maintenance 10.000 7.600 6.000 1.600 15.000 8.000 7.000 5,000 4,000 2.000 1,400 800 700 5000 2500 1000 1 500 1.800 1.200 2.000 2.500 500 1 000 39,000 5,700 10,000 5,000 4000 18 12 2 2 42 NS 300 200 500 100 1.150 Required: Prepare an overhead analysis short showing only the basis of apportionment and reapportionment using the repeated distribution method. (Round up your answers to the nearest RM) (18 marks) b. Calculate the Overhead Absorption Rate (DAR) for each production cost center using the following basis. (Round up your answer up to two decimal places Weaving department - Machine Hours Inspection department - Direct Labour Hours Finishing department - Direct Labour Hours (6 marks) c. Given below are the actual data for the month ended 31 December 2020 Weaving Inspection Finishing Total overheads (RM) 185.900 110.400 95.400 Direct labour hours 2200 1.050 2.400 Machine hours 3.080 650 970 By using the OAR that you have calculated in part (c. calculate the over- or under absorption of overheads for each production cost center (Round up your answer to the nearest RM) (6 marks) QUESTION 1 Gebu Sdn Bhd involved in the manufacturing of carpets. The company has three (3) production departments namely Weaving, Inspection and Finishing Department. There are also two (2) service departments namely Canteen and Maintenance Department in the factory. The following budgeted overhead information relates to the month of December 2021. Overheads RM Factory rental 80,000 Insurance on factory building 24.800 Depreciation of machinery 53,600 Depreciation of factory building 72,800 Power expense 96,800 Production supervisor salary 26,400 N N Weaving Inspection Finishing Canteen Maintenance Total Allocated overheads 10,000 7,600 6,000 2,400 1,600 27,600 (RM) Machine value (RM) 15,000 8,000 7,000 5,000 4,000 39,000 Floor area 2.000 (square feet) 1,400 800 800 700 5,700 Horse power 5,000 2,500 1.000 1,500 10,000 Direct labour 1,800 1,200 hours 2,000 5,000 Machine 2,500 500 1.000 hours 4,000 Number of 18 12 employee 8 42 Maintenance 300 200 500 100 50 hours 1,150 Required: a. Prepare an overhead analysis sheet, showing clearly the basis of apportionment and reapportionment using the repeated distribution method. (Round up your answers to the nearest RM). (18 marks) b. Calculate the Overhead Absorption Rate (CAR) for each production cost center using the following basis. (Round up your answer up to two decimal places). Weaving department - Machine Hours Inspection department - Direct Labour Hours Finishing department - Direct Labour Hours (6 marks) C. Given below are the actual data for the month ended 31 December 2020: Total overheads (RM) Direct labour hours Machine hours Weaving 185,900 2,200 3,080 Inspection 110,400 1,050 650 Finishing 95,400 2,400 970