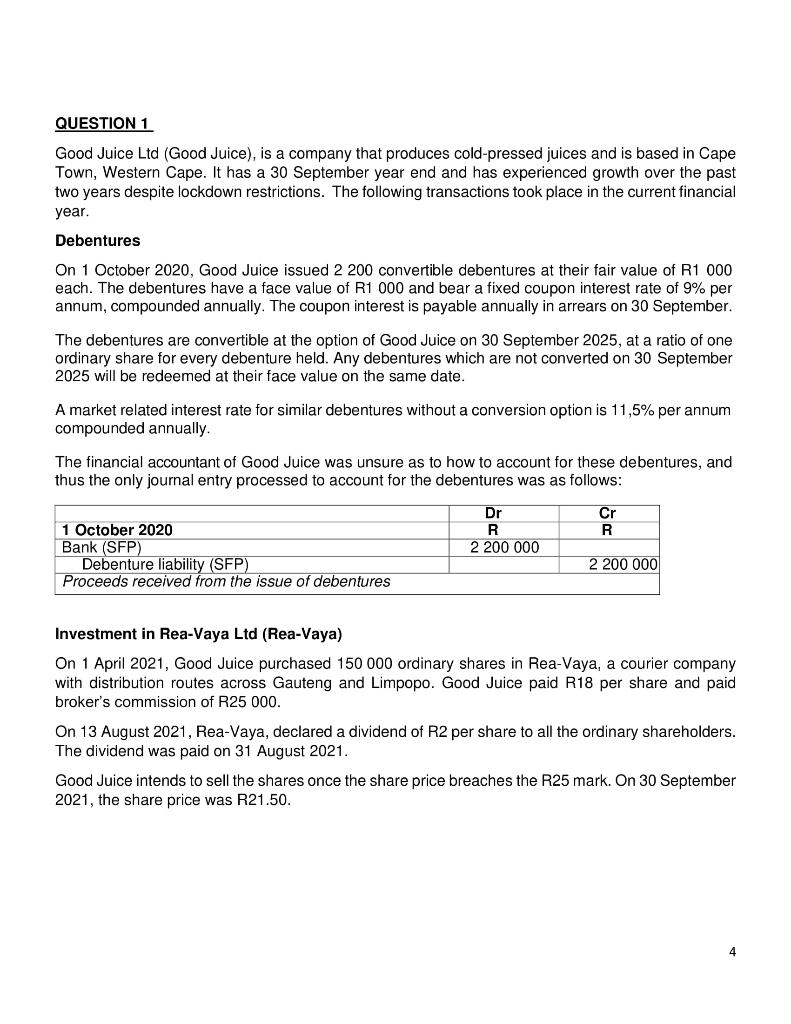

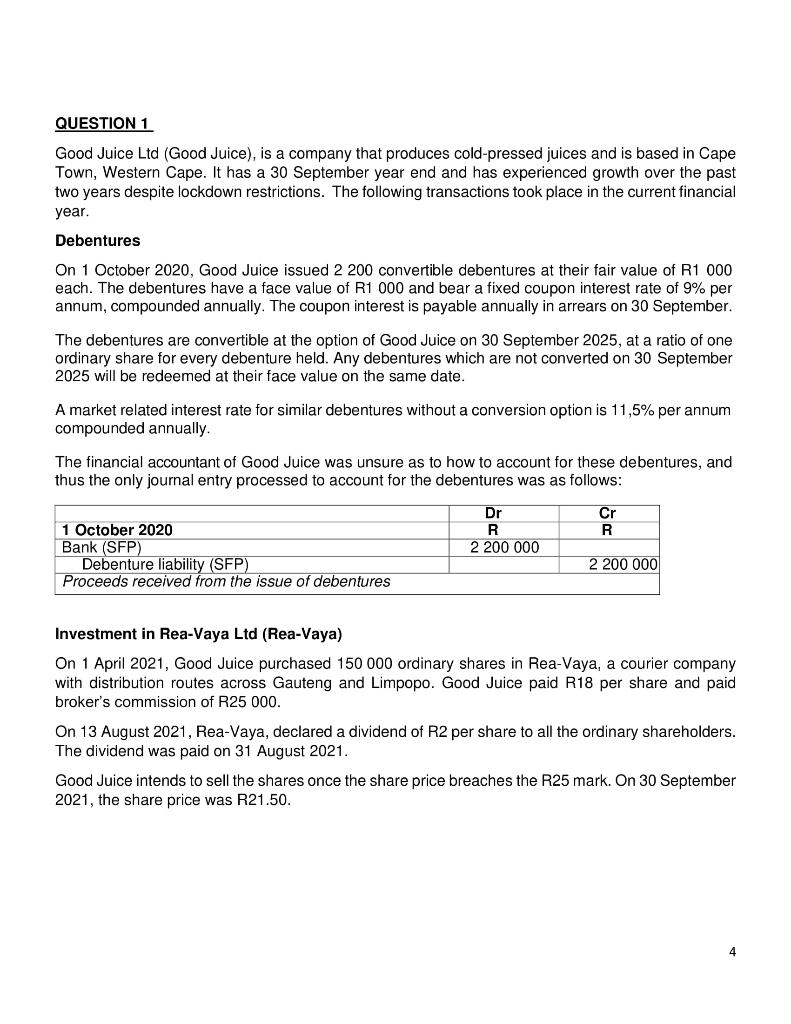

QUESTION 1 Good Juice Ltd (Good Juice), is a company that produces cold-pressed juices and is based in Cape Town, Western Cape. It has a 30 September year end and has experienced growth over the past two years despite lockdown restrictions. The following transactions took place in the current financial year. Debentures On 1 October 2020, Good Juice issued 2 200 convertible debentures at their fair value of R1 000 each. The debentures have a face value of R1 000 and bear a fixed coupon interest rate of 9% per annum, compounded annually. The coupon interest is payable annually in arrears on 30 September. The debentures are convertible at the option of Good Juice on 30 September 2025, at a ratio of one ordinary share for every debenture held. Any debentures which are not converted on 30 September 2025 will be redeemed at their face value on the same date. A market related interest rate for similar debentures without a conversion option is 11,5% per annum compounded annually. and The financial accountant of Good Juice unsure as how to CCOU for these debenture thus the only journal entry processed to account for the debentures was as follows: Dr R 2 200 000 Cr R 1 October 2020 Bank (SFP) Debenture liability (SFP) Proceeds received from the issue of debentures 2 200 000 Investment in Rea-Vaya Ltd (Rea-Vaya) On 1 April 2021, Good Juice purchased 150 000 ordinary shares in Rea-Vaya, a courier company with distribution routes across Gauteng and Limpopo. Good Juice paid R18 per share and paid broker's commission of R25 000. On 13 August 2021, Rea-Vaya, declared a dividend of R2 per share to all the ordinary shareholders. The dividend was paid on 31 August 2021. Good Juice intends to sell the shares once the share price breaches the R25 mark. On 30 September 2021, the share price was R21.50. 4 Investment in Mixer (Pty) Ltd (Mixer) On 1 July 2021, Good Juice acquired a 55% stake in Mixer, a small start-up company, based in Johannesburg, which makes and sells fresh juice. Good Juice paid R1 500 000 for its stake and incurred direct acquisition costs of R37 500. This acquisition is part of a strategy to expand its operations into Gauteng. Good Juice has control over Mixer as defined in IFRS 10-Consolidated Financial Statements. Good Juice made the irrevocable election in terms of IFRS 9-Financial Instruments to measure the investment in Mixer shares at fair value through other comprehensive income in its separate accounting records. The fair value gain to be processed at year end is R48 500. On 30 September 2021, Mixer declared a dividend of R125 000. Human resource matters The average gross salaries (excluding bonusses) for the employees of Good Juice were R7 260 000 for the year ended 30 September 2021. All employees are entitled to a bonus equal to one month's gross salary. Bonusses are paid out at the end of June each year. The accrued bonuses on 30 September 2020 amounted to R217 500. On 1 September 2021 the directors of Good Juice approved a salary increase of 6% as from 1 October 2021. The company's leave cycle runs from 1 July to 30 June of each year. There are 252 working days in a year. Employees are entitled to 18 days' vacation leave per annum Unused leave days can be carried forward to the next leave cycle but must be taken before the end of October of the next leave cycle. Five and a half unused leave days were carried forward to 1 July 2021 and six days were taken from 1 July 2021 to 30 September 2021. The accrued leave (excluding accumulated leave) for the year ended 30 September 2020 amounted to R47 904. The company contributes 7,5% and the employees 6,5% on the gross salaries to the Good Juice Provident Fund. The provident fund of the company is classified as a defined contribution plan. 5 REQUIRED Marks (a) Discuss, in terms of IAS 32, Financial Instruments: Presentation, the correct classification and initial measurement of the convertible debentures issued by Good Juice on 1 October 2020. 12 Your discussion must include all relevant calculations. Communication skills - logical argument 1 (b) Prepare the profit before tax note that will be disclosed in the financial statements of Good Juice for the year ended 30 September 2021. 17 (c) Prepare the statement of financial position of Good Juice as at 30 September 2021 as far as possible from the given information. 9 The cash and cash equivalents and retained earnings/accumulated loss need not be presented. The split between the current and non-current portions of the debentures need not be presented. 1 Communication skills - layout and format TOTAL 40 Please note: Your answers must comply with the requirements of International Financial Reporting Standards (IFRS). Round all amounts to the nearest Rand. You may ignore income tax and value added tax. Comparative figures are not required 6 QUESTION 1 Good Juice Ltd (Good Juice), is a company that produces cold-pressed juices and is based in Cape Town, Western Cape. It has a 30 September year end and has experienced growth over the past two years despite lockdown restrictions. The following transactions took place in the current financial year. Debentures On 1 October 2020, Good Juice issued 2 200 convertible debentures at their fair value of R1 000 each. The debentures have a face value of R1 000 and bear a fixed coupon interest rate of 9% per annum, compounded annually. The coupon interest is payable annually in arrears on 30 September. The debentures are convertible at the option of Good Juice on 30 September 2025, at a ratio of one ordinary share for every debenture held. Any debentures which are not converted on 30 September 2025 will be redeemed at their face value on the same date. A market related interest rate for similar debentures without a conversion option is 11,5% per annum compounded annually. and The financial accountant of Good Juice unsure as how to CCOU for these debenture thus the only journal entry processed to account for the debentures was as follows: Dr R 2 200 000 Cr R 1 October 2020 Bank (SFP) Debenture liability (SFP) Proceeds received from the issue of debentures 2 200 000 Investment in Rea-Vaya Ltd (Rea-Vaya) On 1 April 2021, Good Juice purchased 150 000 ordinary shares in Rea-Vaya, a courier company with distribution routes across Gauteng and Limpopo. Good Juice paid R18 per share and paid broker's commission of R25 000. On 13 August 2021, Rea-Vaya, declared a dividend of R2 per share to all the ordinary shareholders. The dividend was paid on 31 August 2021. Good Juice intends to sell the shares once the share price breaches the R25 mark. On 30 September 2021, the share price was R21.50. 4 Investment in Mixer (Pty) Ltd (Mixer) On 1 July 2021, Good Juice acquired a 55% stake in Mixer, a small start-up company, based in Johannesburg, which makes and sells fresh juice. Good Juice paid R1 500 000 for its stake and incurred direct acquisition costs of R37 500. This acquisition is part of a strategy to expand its operations into Gauteng. Good Juice has control over Mixer as defined in IFRS 10-Consolidated Financial Statements. Good Juice made the irrevocable election in terms of IFRS 9-Financial Instruments to measure the investment in Mixer shares at fair value through other comprehensive income in its separate accounting records. The fair value gain to be processed at year end is R48 500. On 30 September 2021, Mixer declared a dividend of R125 000. Human resource matters The average gross salaries (excluding bonusses) for the employees of Good Juice were R7 260 000 for the year ended 30 September 2021. All employees are entitled to a bonus equal to one month's gross salary. Bonusses are paid out at the end of June each year. The accrued bonuses on 30 September 2020 amounted to R217 500. On 1 September 2021 the directors of Good Juice approved a salary increase of 6% as from 1 October 2021. The company's leave cycle runs from 1 July to 30 June of each year. There are 252 working days in a year. Employees are entitled to 18 days' vacation leave per annum Unused leave days can be carried forward to the next leave cycle but must be taken before the end of October of the next leave cycle. Five and a half unused leave days were carried forward to 1 July 2021 and six days were taken from 1 July 2021 to 30 September 2021. The accrued leave (excluding accumulated leave) for the year ended 30 September 2020 amounted to R47 904. The company contributes 7,5% and the employees 6,5% on the gross salaries to the Good Juice Provident Fund. The provident fund of the company is classified as a defined contribution plan. 5 REQUIRED Marks (a) Discuss, in terms of IAS 32, Financial Instruments: Presentation, the correct classification and initial measurement of the convertible debentures issued by Good Juice on 1 October 2020. 12 Your discussion must include all relevant calculations. Communication skills - logical argument 1 (b) Prepare the profit before tax note that will be disclosed in the financial statements of Good Juice for the year ended 30 September 2021. 17 (c) Prepare the statement of financial position of Good Juice as at 30 September 2021 as far as possible from the given information. 9 The cash and cash equivalents and retained earnings/accumulated loss need not be presented. The split between the current and non-current portions of the debentures need not be presented. 1 Communication skills - layout and format TOTAL 40 Please note: Your answers must comply with the requirements of International Financial Reporting Standards (IFRS). Round all amounts to the nearest Rand. You may ignore income tax and value added tax. Comparative figures are not required 6