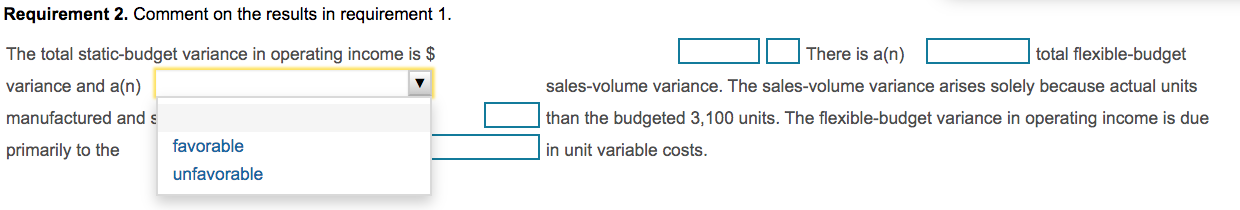

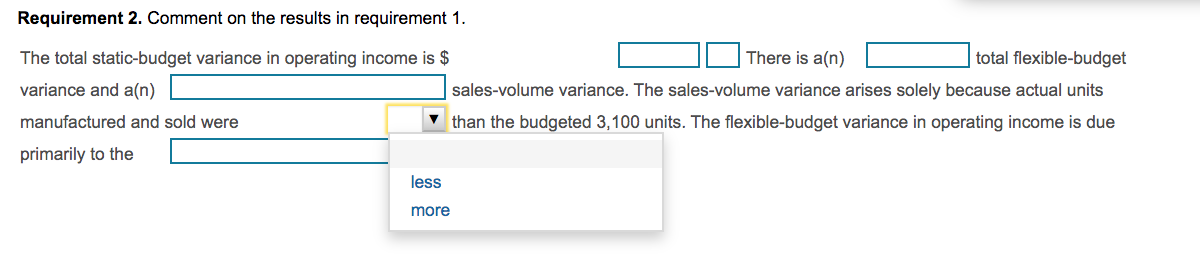

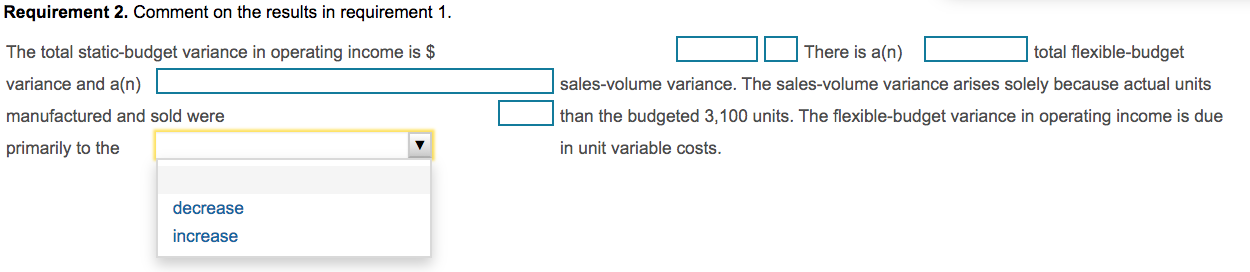

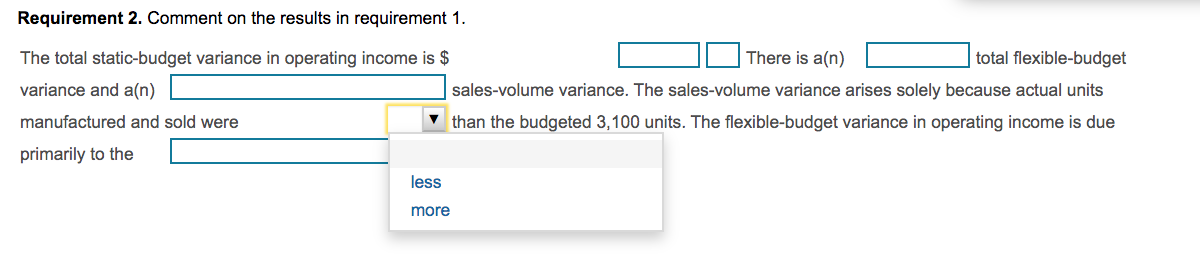

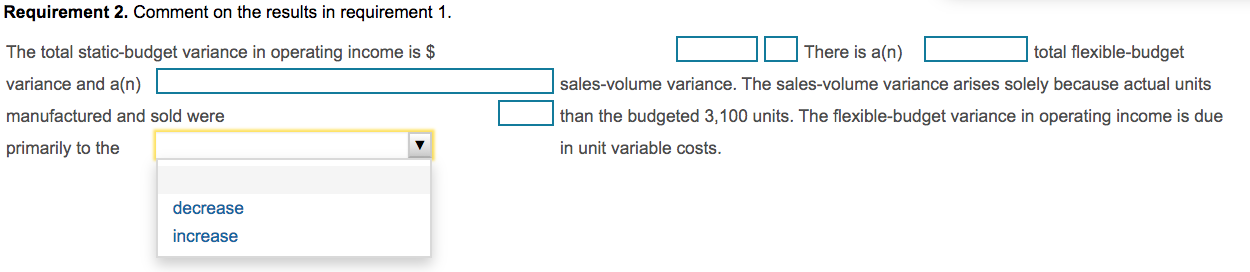

QUESTION 1. - (HAS 2 REQUIREMENTS) OPTIONS TO REQUIREMENT 2 DROP BOXES!!!!!!!!!!

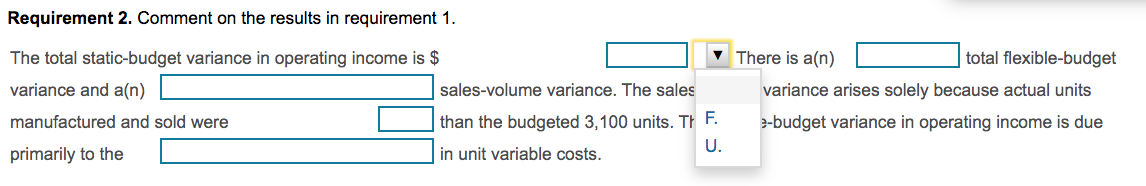

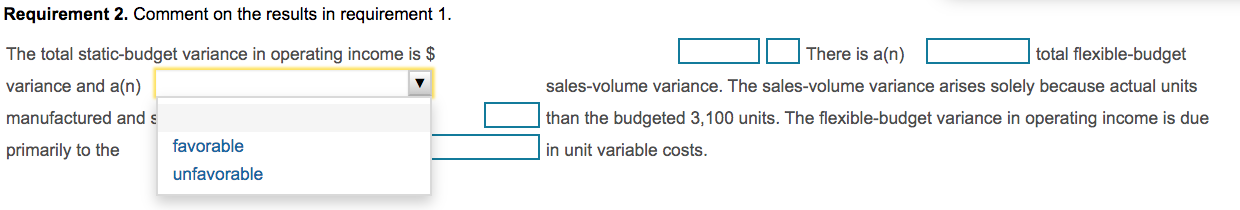

OPTIONS TO REQUIREMENT 2 DROP BOXES!!!!!!!!!!

QUESTION 2

QUESTION 2

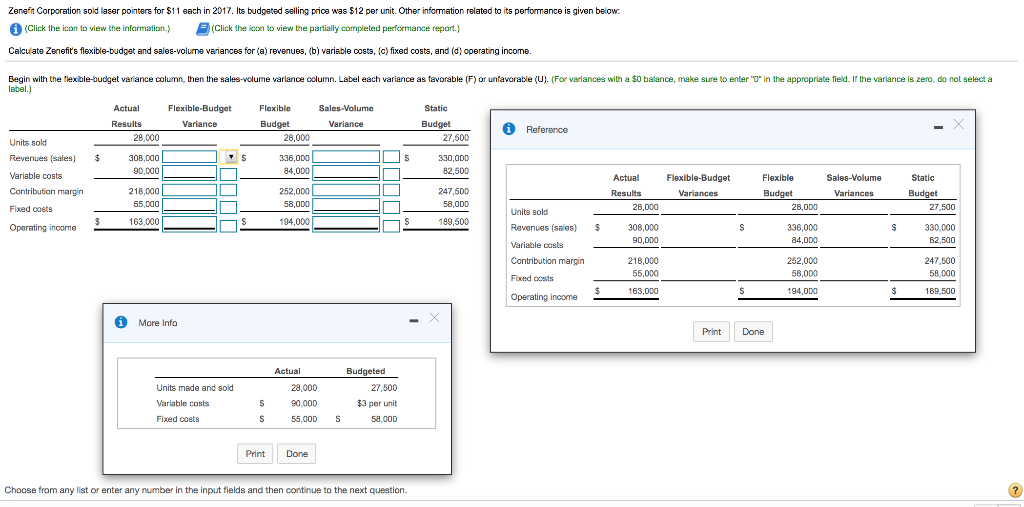

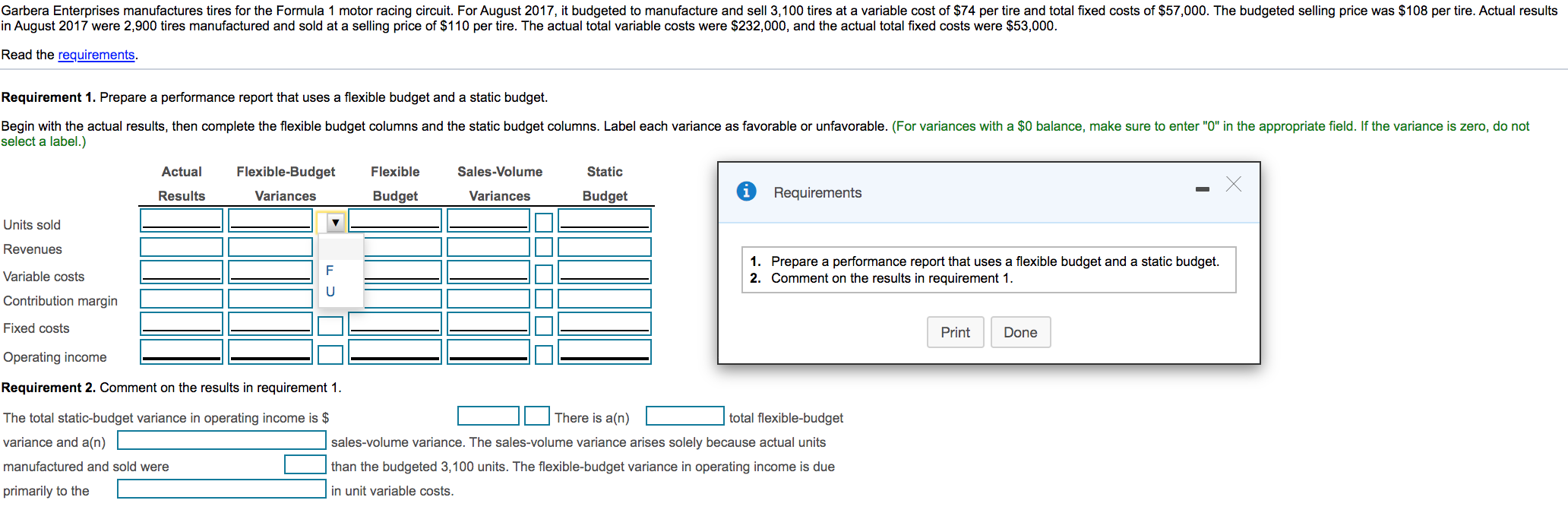

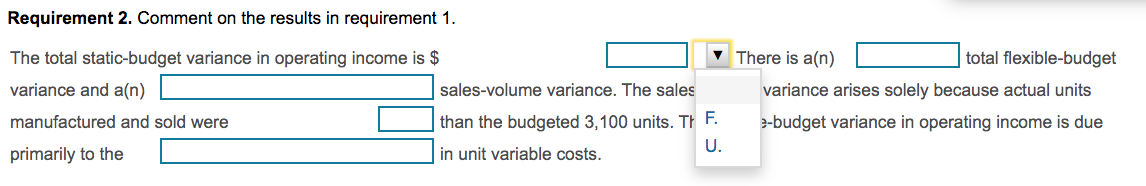

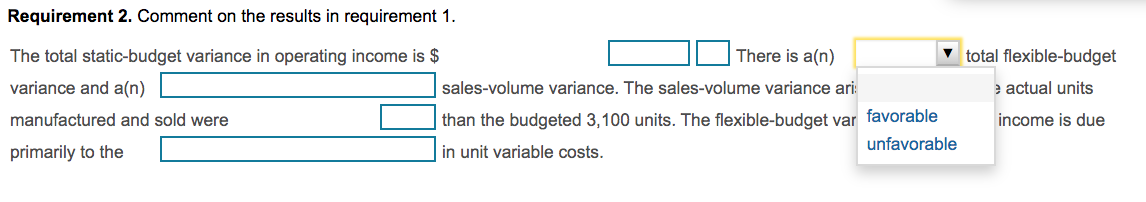

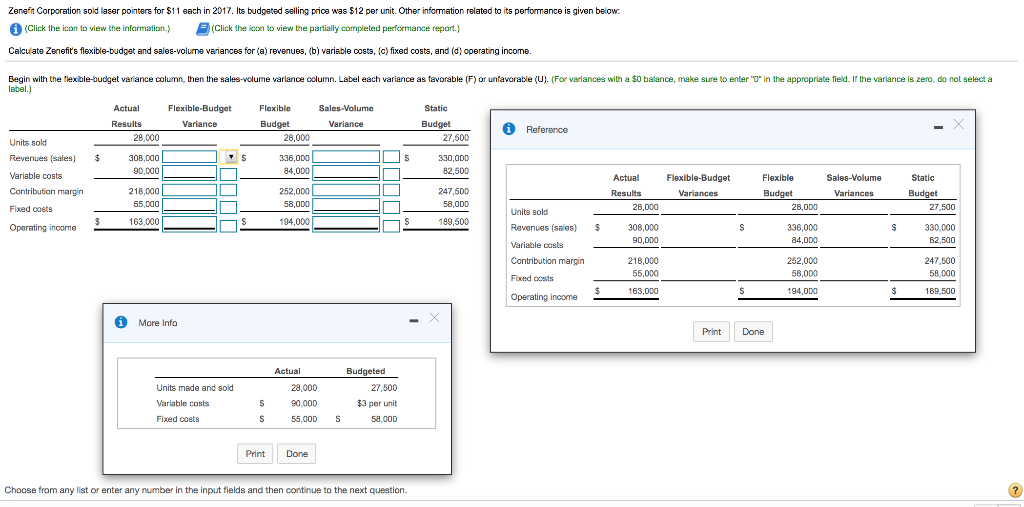

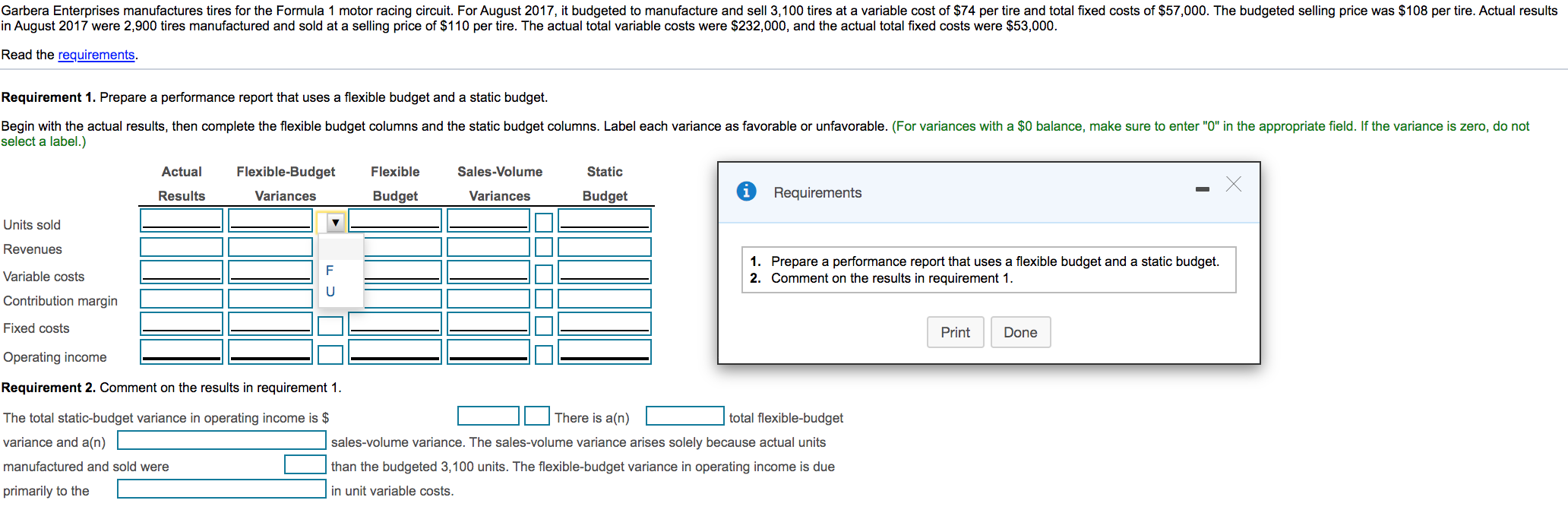

Garbera Enterprises manufactures tires for the Formula 1 motor racing circuit. For August 2017, it budgeted to manufacture and sell 3,100 tires at a variable cost of $74 per tire and total fixed costs of $57,000. The budgeted selling price was $108 per tire. Actual results in August 2017 were 2,900 tires manufactured and sold at a selling price of $110 per tire. The actual total variable costs were $232,000, and the actual total fixed costs were $53,000. Read the requirements. Requirement 1. Prepare a performance report that uses a flexible budget and a static budget. Begin with the actual results, then complete the flexible budget columns and the static budget columns. Label each variance as favorable or unfavorable. (For variances with a $0 balance, make sure to enter "O" in the appropriate field. If the variance is zero, do not select a label.) Actual Flexible Sales-Volume Static Flexible-Budget Variances Results Budget Variances Budget Requirements Units sold Revenues F Variable costs 1. Prepare a performance report that uses a flexible budget and a static budget. 2. Comment on the results in requirement 1. U Contribution margin Fixed costs Print Done Operating income Requirement 2. Comment on the results in requirement 1. The total static-budget variance in operating income is $ There is an) total flexible-budget variance and a(n) sales-volume variance. The sales-volume variance arises solely because actual units manufactured and sold were than the budgeted 3,100 units. The flexible-budget variance in operating income is due primarily to the in unit variable costs. Requirement 2. Comment on the results in requirement 1. There is an) total flexible-budget The total static-budget variance in operating income is $ variance and a(n) sales-volume variance. The sales manufactured and sold were than the budgeted 3,100 units. TH F. U. primarily to the in unit variable costs. variance arises solely because actual units z-budget variance in operating income is due Requirement 2. Comment on the results in requirement 1. total flexible-budget actual units The total static-budget variance in operating income is $ There is an) variance and a(n) sales-volume variance. The sales-volume variance ari manufactured and sold were than the budgeted 3,100 units. The flexible-budget var favorable primarily to the in unit variable costs. unfavorable income is due Requirement 2. Comment on the results in requirement 1. The total static-budget variance in operating income is $ variance and a(n) manufactured and primarily to the favorable unfavorable There is a(n) total flexible-budget sales-volume variance. The sales-volume variance arises solely because actual units than the budgeted 3,100 units. The flexible-budget variance in operating income is due in unit variable costs. Requirement 2. Comment on the results in requirement 1. The total static-budget variance in operating income is $ There is an) total flexible-budget variance and a(n) sales-volume variance. The sales-volume variance arises solely because actual units manufactured and sold were than the budgeted 3,100 units. The flexible-budget variance in operating income is due primarily to the less more Requirement 2. Comment on the results in requirement 1. The total static-budget variance in operating income is $ variance and a(n) There is a(n) total flexible-budget sales-volume variance. The sales-volume variance arises solely because actual units than the budgeted 3,100 units. The flexible-budget variance in operating income is due in unit variable costs. manufactured and sold were primarily to the decrease increase Zenefit Corporation sold laser pointers for $11 each in 2017. Its budgeted selling price was $12 per unit. Other information related to its performance is given below. (Click the icon to view the information) (Click the icon to view the partially completed performance report.) Calculate Zenefit's flexible-budget and sales-volume variances for (a) revenues, (b) variable costs, (c) fixed costs, and (d) operating income. Begin with the flexiole-budget variance column, then the sales-volume variance column. Label each variance as favorable (F) or unfavorable (U). (For variances with a $0 balance, make sure to enter " in the appropriate field. If the variance is zero, do not select a label. Actual Flexible-Budget Flexible Sales-Volume Static Results Variance Budget Variance Budget Reference 28,000 28,000 27,500 Units sold Revenues (sales) $ 308,000 S 336,000 S 330,000 90,000 Variable costs 84,000 82,500 Actual Flexible-Budget Flexible Sales-Volume Static Contribution margin 218,000 252,000 247,500 Results Variances Budget Variances Budget 55,000 Fixed costs 58,000 58,000 Units sold 28,000 28,000 27.500 $ 163,000 S 194,000 S Operating income 189,500 Revenues (sales) $ 308,000 S 336,000 S 330,000 90,000 84,000 B2.500 Variable costs Contribution margin 218,000 252,000 247,500 55,000 Fixed costs 56,000 58,000 $ 163,000 S 194,000 $ 189,500 Operating income More Info Print Done Units made and sold Variable costs Fixed costs Actual 28,000 90.000 Budgeted 27,500 $3 per unit 58,000 S S 56,000 S Print Done Choose from any list or enter any number in the input fields and then continue to the next

OPTIONS TO REQUIREMENT 2 DROP BOXES!!!!!!!!!!

OPTIONS TO REQUIREMENT 2 DROP BOXES!!!!!!!!!!

QUESTION 2

QUESTION 2