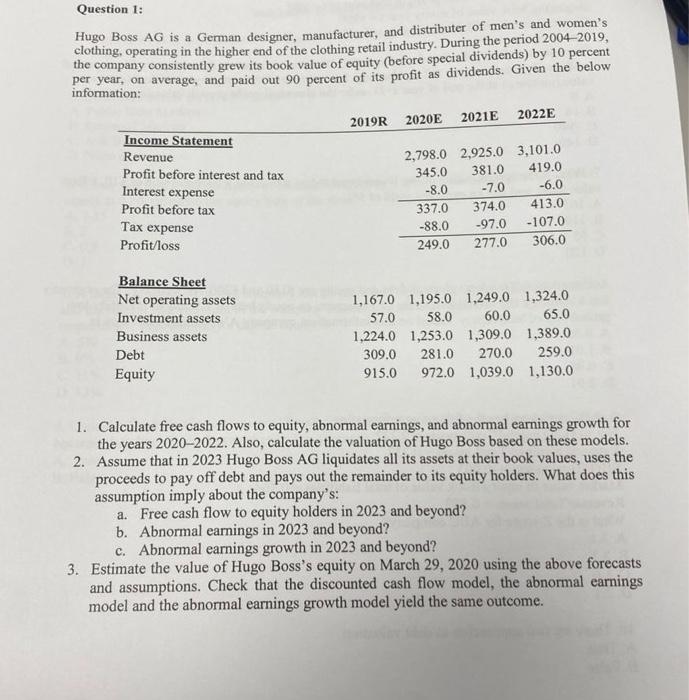

Question 1: Hugo Boss AG is a German designer, manufacturer, and distributer of men's and women's clothing, operating in the higher end of the clothing retail industry. During the period 2004 2019, the company consistently grew its book value of equity (before special dividends) by 10 percent per year, on average, and paid out 90 percent of its profit as dividends. Given the below information: 1. Calculate free cash flows to equity, abnormal earnings, and abnormal earnings growth for the years 2020-2022. Also, calculate the valuation of Hugo Boss based on these models. 2. Assume that in 2023 Hugo Boss AG liquidates all its assets at their book values, uses the proceeds to pay off debt and pays out the remainder to its equity holders. What does this assumption imply about the company's: a. Free cash flow to equity holders in 2023 and beyond? b. Abnormal earnings in 2023 and beyond? c. Abnormal earnings growth in 2023 and beyond? 3. Estimate the value of Hugo Boss's equity on March 29,2020 using the above forecasts and assumptions. Check that the discounted cash flow model, the abnormal earnings model and the abnormal earnings growth model yield the same outcome. Question 1: Hugo Boss AG is a German designer, manufacturer, and distributer of men's and women's clothing, operating in the higher end of the clothing retail industry. During the period 2004 2019, the company consistently grew its book value of equity (before special dividends) by 10 percent per year, on average, and paid out 90 percent of its profit as dividends. Given the below information: 1. Calculate free cash flows to equity, abnormal earnings, and abnormal earnings growth for the years 2020-2022. Also, calculate the valuation of Hugo Boss based on these models. 2. Assume that in 2023 Hugo Boss AG liquidates all its assets at their book values, uses the proceeds to pay off debt and pays out the remainder to its equity holders. What does this assumption imply about the company's: a. Free cash flow to equity holders in 2023 and beyond? b. Abnormal earnings in 2023 and beyond? c. Abnormal earnings growth in 2023 and beyond? 3. Estimate the value of Hugo Boss's equity on March 29,2020 using the above forecasts and assumptions. Check that the discounted cash flow model, the abnormal earnings model and the abnormal earnings growth model yield the same outcome