Answered step by step

Verified Expert Solution

Question

1 Approved Answer

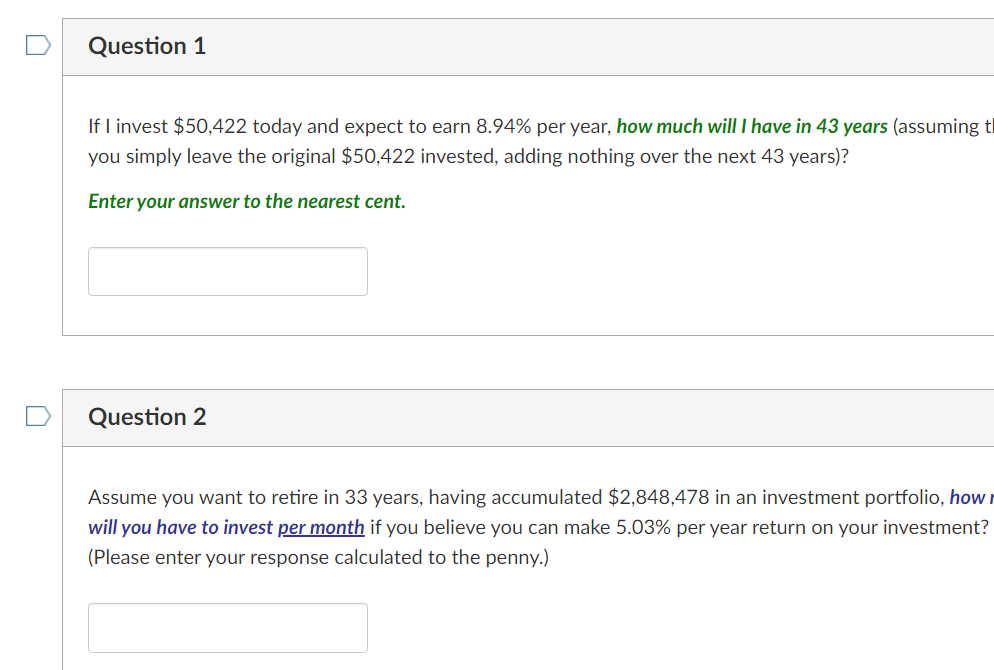

Question 1 If I invest $50,422 today and expect to earn 8.94% per year, how much will I have in 43 years (assuming t

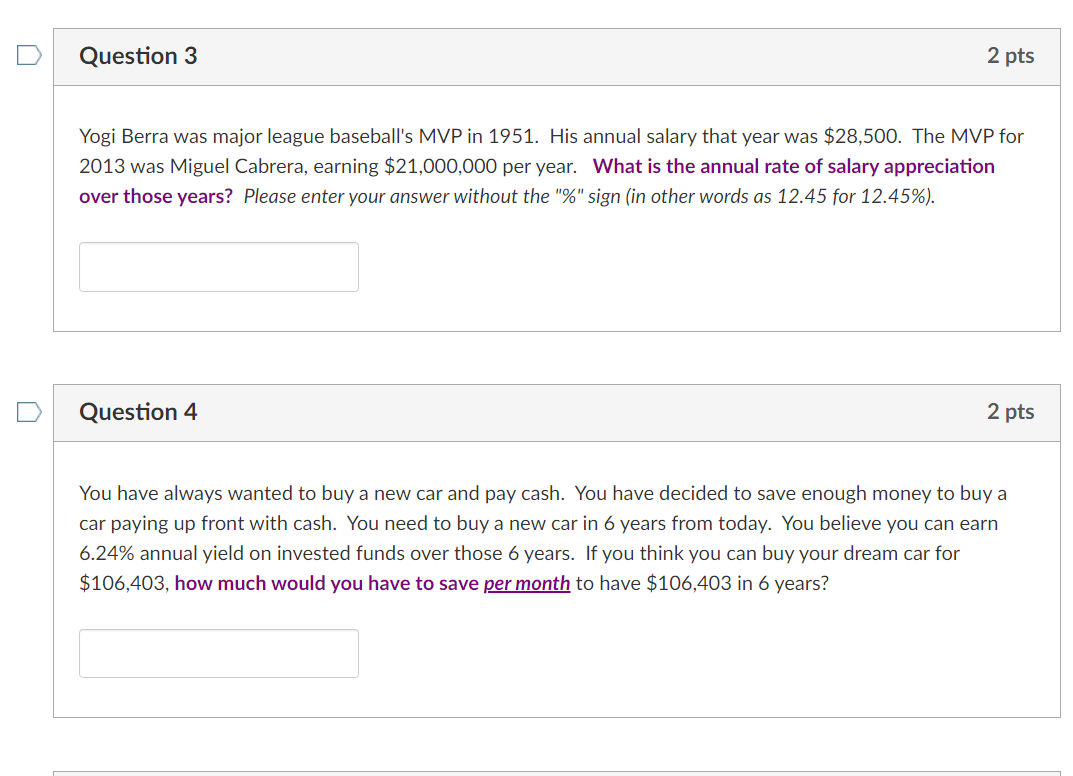

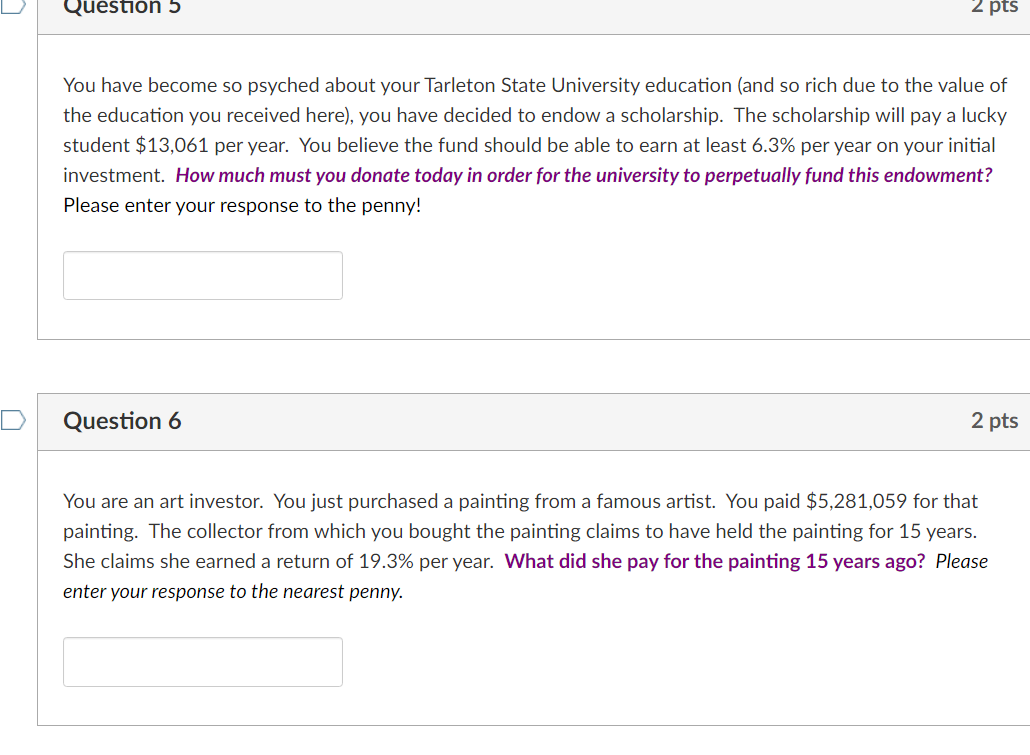

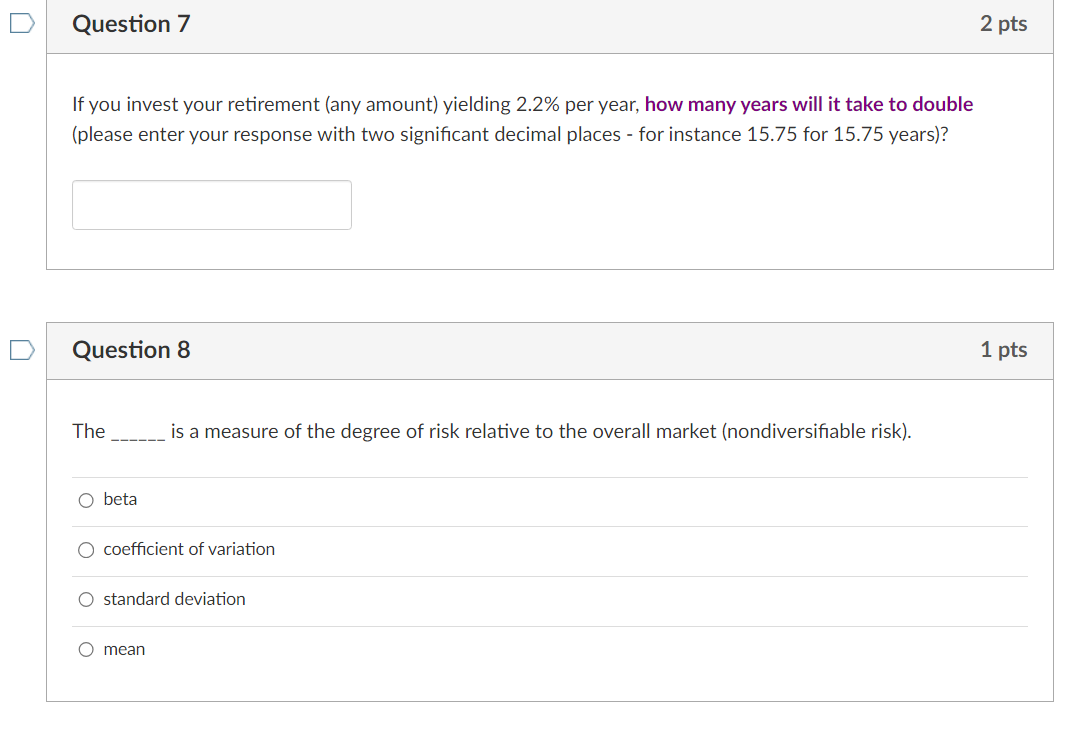

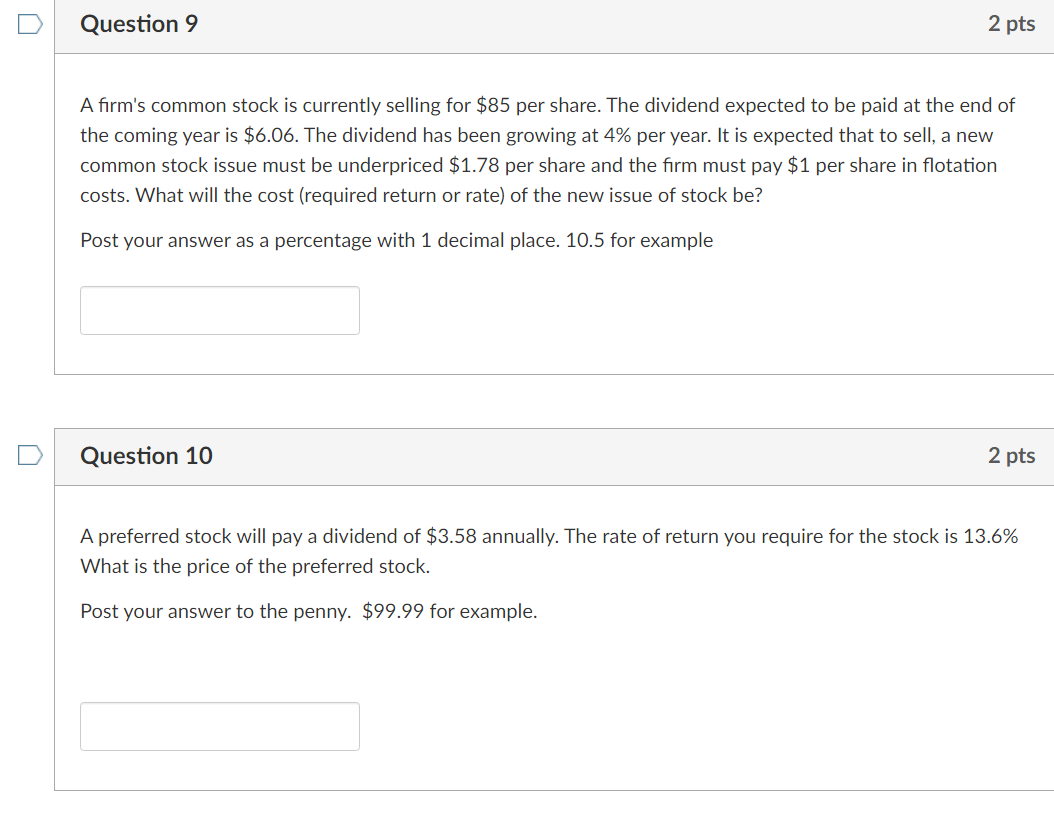

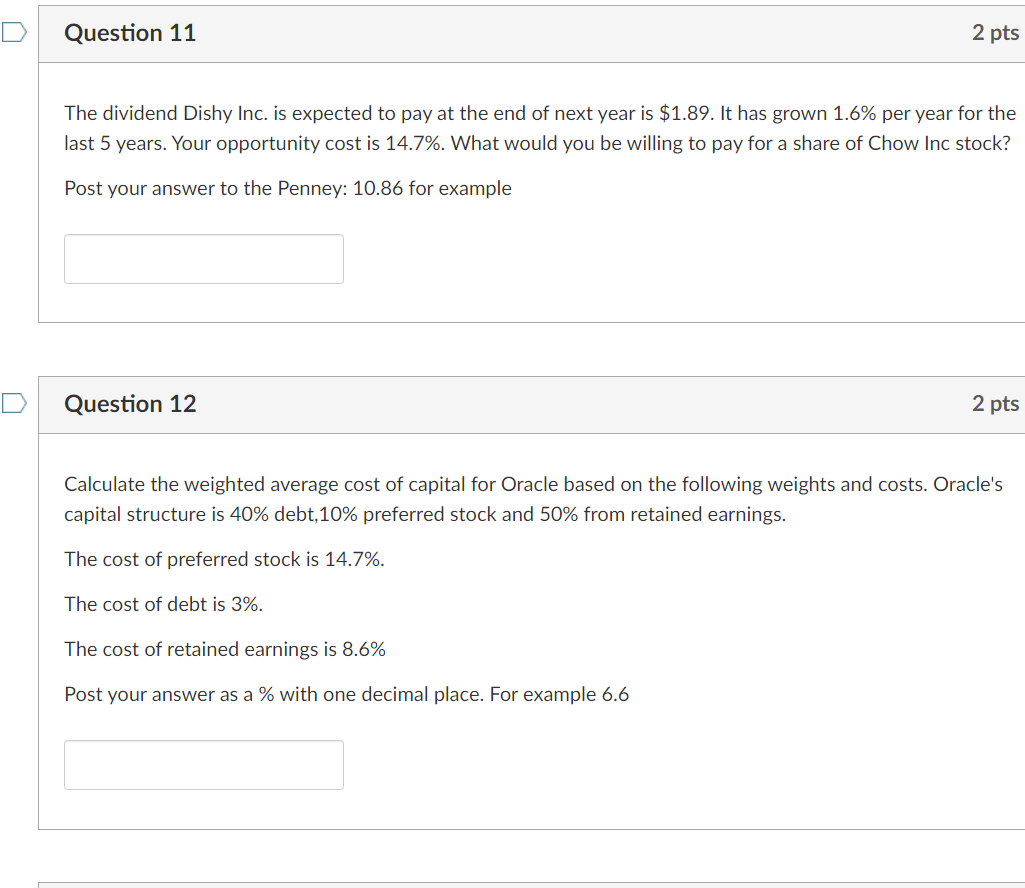

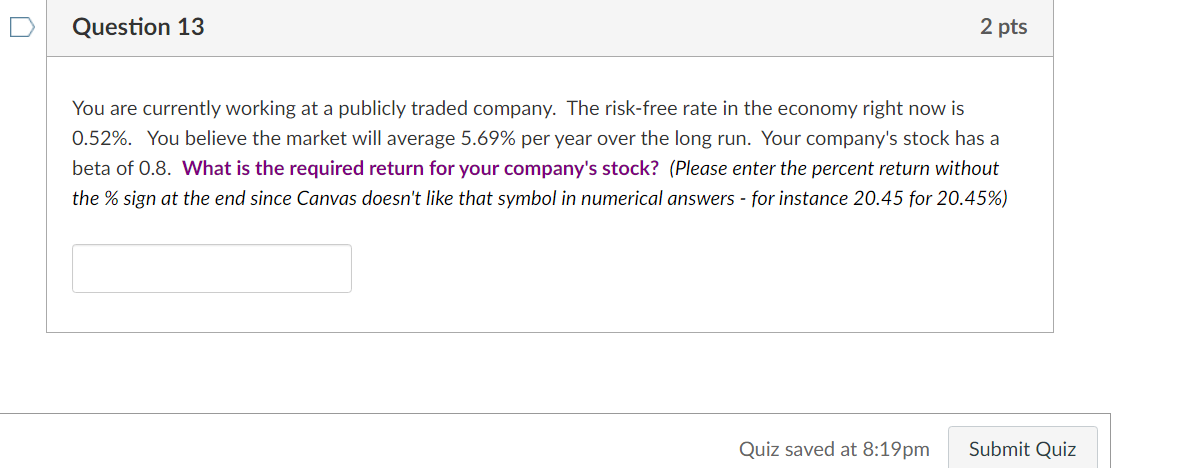

Question 1 If I invest $50,422 today and expect to earn 8.94% per year, how much will I have in 43 years (assuming t you simply leave the original $50,422 invested, adding nothing over the next 43 years)? Enter your answer to the nearest cent. Question 2 Assume you want to retire in 33 years, having accumulated $2,848,478 in an investment portfolio, how will you have to invest per month if you believe you can make 5.03% per year return on your investment? (Please enter your response calculated to the penny.) Question 3 2 pts Yogi Berra was major league baseball's MVP in 1951. His annual salary that year was $28,500. The MVP for 2013 was Miguel Cabrera, earning $21,000,000 per year. What is the annual rate of salary appreciation over those years? Please enter your answer without the "%" sign (in other words as 12.45 for 12.45%). Question 4 2 pts You have always wanted to buy a new car and pay cash. You have decided to save enough money to buy a car paying up front with cash. You need to buy a new car in 6 years from today. You believe you can earn 6.24% annual yield on invested funds over those 6 years. If you think you can buy your dream car for $106,403, how much would you have to save per month to have $106,403 in 6 years? Question 5 2 pts You have become so psyched about your Tarleton State University education (and so rich due to the value of the education you received here), you have decided to endow a scholarship. The scholarship will pay a lucky student $13,061 per year. You believe the fund should be able to earn at least 6.3% per year on your initial investment. How much must you donate today in order for the university to perpetually fund this endowment? Please enter your response to the penny! Question 6 2 pts You are an art investor. You just purchased a painting from a famous artist. You paid $5,281,059 for that painting. The collector from which you bought the painting claims to have held the painting for 15 years. She claims she earned a return of 19.3% per year. What did she pay for the painting 15 years ago? Please enter your response to the nearest penny. Question 7 If you invest your retirement (any amount) yielding 2.2% per year, how many years will it take to double (please enter your response with two significant decimal places - for instance 15.75 for 15.75 years)? Question 8 The beta is a measure of the degree of risk relative to the overall market (nondiversifiable risk). coefficient of variation standard deviation O mean 1 pts 2 pts Question 9 2 pts A firm's common stock is currently selling for $85 per share. The dividend expected to be paid at the end of the coming year is $6.06. The dividend has been growing at 4% per year. It is expected that to sell, a new common stock issue must be underpriced $1.78 per share and the firm must pay $1 per share in flotation costs. What will the cost (required return or rate) of the new issue of stock be? Post your answer as a percentage with 1 decimal place. 10.5 for example Question 10 2 pts A preferred stock will pay a dividend of $3.58 annually. The rate of return you require for the stock is 13.6% What is the price of the preferred stock. Post your answer to the penny. $99.99 for example. Question 11 2 pts The dividend Dishy Inc. is expected to pay at the end of next year is $1.89. It has grown 1.6% per year for the last 5 years. Your opportunity cost is 14.7%. What would you be willing to pay for a share of Chow Inc stock? Post your answer to the Penney: 10.86 for example Question 12 2 pts Calculate the weighted average cost of capital for Oracle based on the following weights and costs. Oracle's capital structure is 40% debt, 10% preferred stock and 50% from retained earnings. The cost of preferred stock is 14.7%. The cost of debt is 3%. The cost of retained earnings is 8.6% Post your answer as a % with one decimal place. For example 6.6 Question 13 2 pts You are currently working at a publicly traded company. The risk-free rate in the economy right now is 0.52%. You believe the market will average 5.69% per year over the long run. Your company's stock has a beta of 0.8. What is the required return for your company's stock? (Please enter the percent return without the % sign at the end since Canvas doesn't like that symbol in numerical answers - for instance 20.45 for 20.45%) Quiz saved at 8:19pm Submit Quiz

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started