Answered step by step

Verified Expert Solution

Question

1 Approved Answer

In the following, different parts of the question are independent and not related to each other. (a) Suppose that the effective 3-month risk-free interest

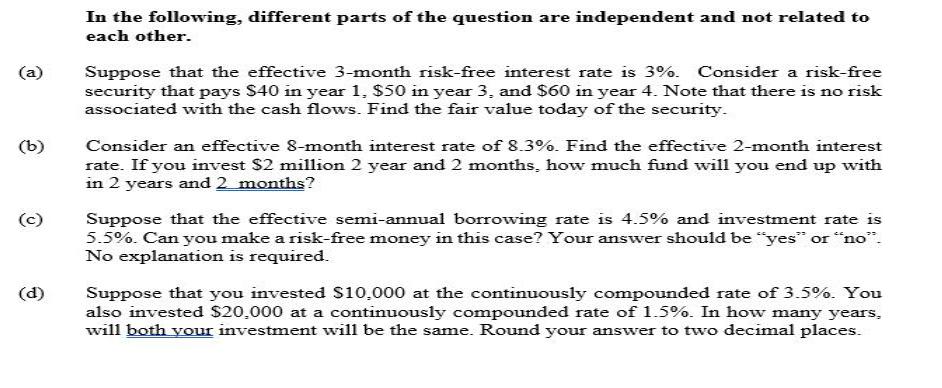

In the following, different parts of the question are independent and not related to each other. (a) Suppose that the effective 3-month risk-free interest rate is 3%. Consider a risk-free security that pays $40 in year 1, $50 in year 3, and $60 in year 4. Note that there is no risk associated with the cash flows. Find the fair value today of the security. (b) Consider an effective 8-month interest rate of 8.3%. Find the effective 2-month interest rate. If you invest $2 million 2 year and 2 months, how much fund will you end up with in 2 years and 2 months? Suppose that the effective semi-annual borrowing rate is 4.5% and investment rate is 5.5%. Can you make a risk-free money in this case? Your answer should be "yes" or "no". No explanation is required. (d) Suppose that you invested $10,000 at the continuously compounded rate of 3.5%. You also invested $20,000 at a continuously compounded rate of 1.5%. In how many years, will both your investment will be the same. Round your answer to two decimal places.

Step by Step Solution

★★★★★

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

a40103 501033 601034 14621 b The effective 2month interest rate w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started