Answered step by step

Verified Expert Solution

Question

1 Approved Answer

We know that in a closed economy with our modern two-tier banking system 5% of the money stock is cash amounting to 199 $.

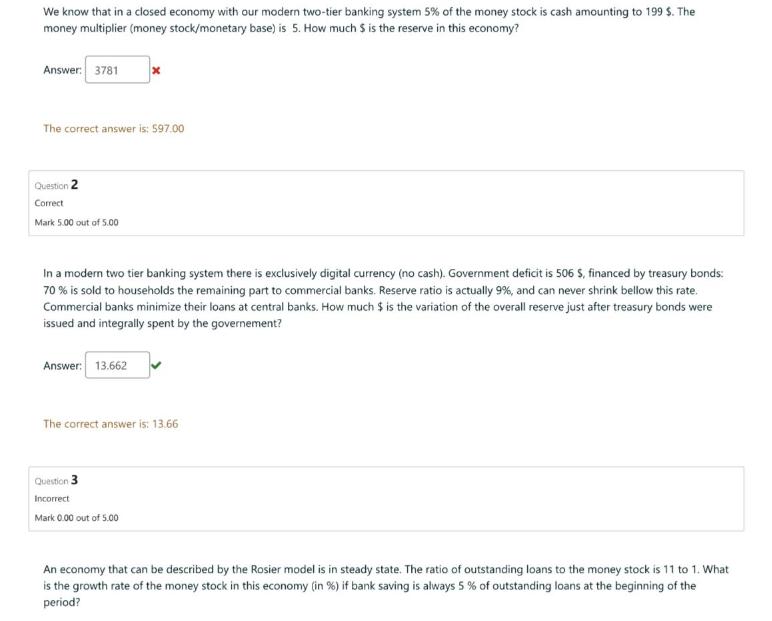

We know that in a closed economy with our modern two-tier banking system 5% of the money stock is cash amounting to 199 $. The money multiplier (money stock/monetary base) is 5. How much $ is the reserve in this economy? Answer: 3781 The correct answer is: 597.00 Question 2 Correct Mark 5.00 out of 5.00 x In a modern two tier banking system there is exclusively digital currency (no cash). Government deficit is 506 $, financed by treasury bonds: 70 % is sold to households the remaining part to commercial banks. Reserve ratio is actually 9%, and can never shrink bellow this rate. Commercial banks minimize their loans at central banks. How much $ is the variation of the overall reserve just after treasury bonds were issued and integrally spent by the governement? Answer: 13.662 The correct answer is: 13.66 Question 3 Incorrect Mark 0.00 out of 5.00 An economy that can be described by the Rosier model is in steady state. The ratio of outstanding loans to the money stock is 11 to 1. What is the growth rate of the money stock in this economy (in %) if bank saving is always 5% of outstanding loans at the beginning of the period?

Step by Step Solution

★★★★★

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To solve the first question we can use the money multiplier formula to find the monetary base Money ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started