Question #1 is definitely the one I need help with the most, but feel free to help with the rest!

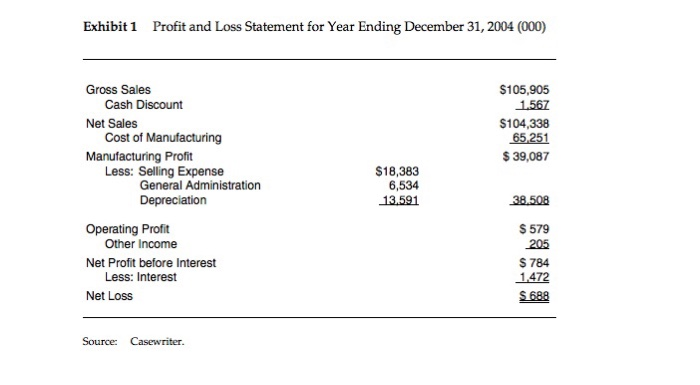

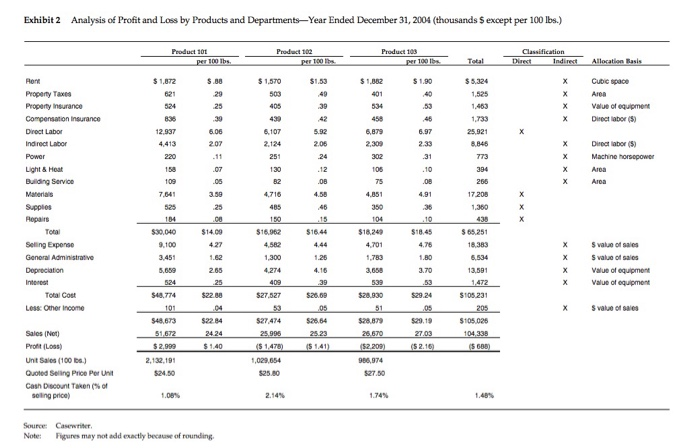

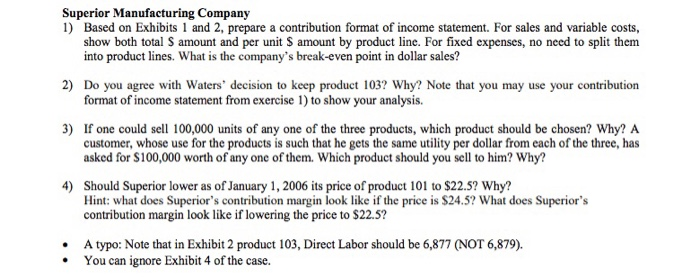

Superior Manufacturing Company 1) Based on Exhibits 1 and 2, prepare a contribution format of income statement. For sales and variable costs, show both total S amount and per unit S amount by product line. For fixed expenses, no need to split them into product lines. What is the company's break-even point in dollar sales? 2) Do you agree with Waters' decision to keep product 103? Why? Note that you may use your contribution format of income statement from exercise1) to show your analysis. 3) If one could sell 100,000 units of any one of the three products, which product should be chosen? Why? A customer, whose use for the products is such that he gets the same utility per dollar from each of the three, has asked for S100,000 worth of any one of them. Which product should you sell to him? Why? 4) Should Superor lower as of January 1, 2006 its price of product 101 to $22.5? Why? Hint: what does Superior's contribution margin look like if the price is $24.5? What does Superior's contribution margin look like if lowering the price to S22.5? .A typo: Note that in Exhibit 2 product 103, Direct Labor should be 6,877 (NOT 6,879) You can ignore Exhibit 4 of the case. Exhibit 1 Profit and Loss Statement for Year Ending December 31, 2004 (000) Gross Sales Net Sales Manufacturing Profit Cash Discount Cost of Manufacturing Less: Selling Expense S105,905 1.567 $104,338 65 251 $ 39,087 $18,383 6,534 13,591 General Administration 38.508 S 579 205 S 784 1472 $688 Operating Profit Other Income Net Profit before Interest Less: Interest Net Loss Source: Casewriter Exhibit 2 Analysis of Profit and Loss by Products and Departments Year Ended December 31, 2004 (thousands S except per 100 lbs.) $ 1,872 5.88 1,570 $1.53 $ 1,882 S 1.90 $5.324 1,525 1.463 Cubic space Peoperty Taxes Property insurance Value oea.pment Diroct Labor 2,937 5.06 2.07 6,107 2,124 2.06 2.33 Direct labor (s) Machino horsepower Ind rect Labor 773 Light & Hoat Building Service 7 208 1.360 $14.09 516.44 $18.24 $18.45 5 65.251 Seling Expense General Administrative 9,100 4,76 1,300 ,783 3.70 Value of pment Value of equipment Total Cost 548,774 22.88 527.527 $105.231 Less Cner Income S value ot sales $22.84 527 474 529.19 Sales (Not Profit (Loss) Unt Sales (100 D) Quoted Seling Price Por Unit Cash Do ount Taken%of 2,999 2,132,19 ,029,654 $2580 527.50 soling price) 1.74% Source: Casewriter Note: Figures may not add exactly because of rounding