Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ITG Pte Ltd (ITG) is a company specialising in air-conditioner maintenance and servicing. It makes adjusting and closing entries every 31 December, which is

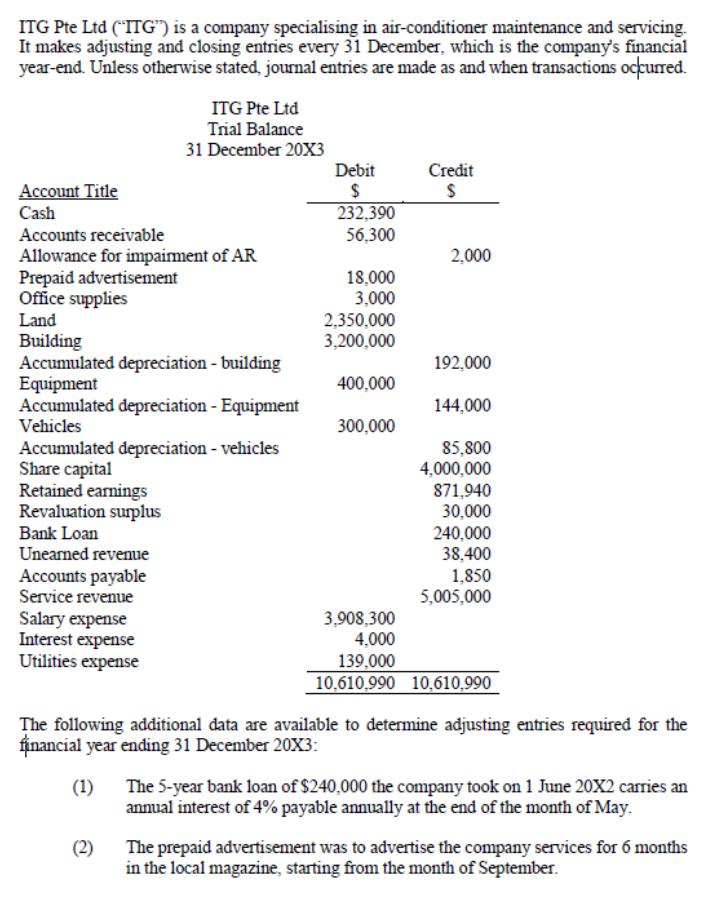

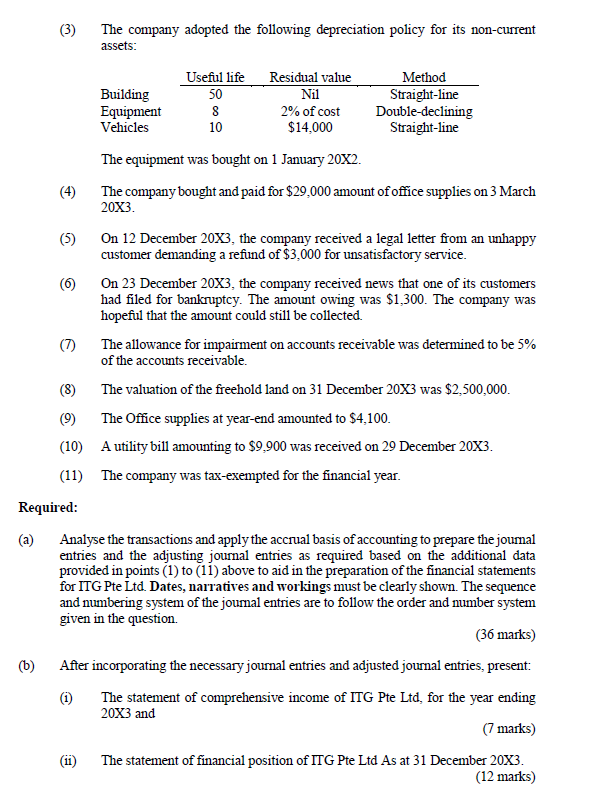

ITG Pte Ltd (ITG") is a company specialising in air-conditioner maintenance and servicing. It makes adjusting and closing entries every 31 December, which is the company's financial year-end. Unless otherwise stated, journal entries are made as and when transactions occurred. Account Title Cash Accounts receivable Allowance for impairment of AR Prepaid advertisement Office supplies Land Building Accumulated depreciation - building Equipment Accumulated depreciation - Equipment Vehicles Accumulated depreciation - vehicles Share capital Retained earnings Revaluation surplus Bank Loan Unearned revenue Accounts payable Service revenue Salary expense Interest expense Utilities expense ITG Pte Ltd Trial Balance 31 December 20X3 (2) Debit $ 232,390 56,300 18,000 3,000 2,350,000 3,200,000 400,000 300,000 3,908,300 4,000 139,000 10,610,990 Credit $ 2,000 192,000 144,000 85,800 4,000,000 871,940 30,000 240,000 38,400 1,850 5,005,000 10,610,990 The following additional data are available to determine adjusting entries required for the financial year ending 31 December 20X3: The 5-year bank loan of $240,000 the company took on 1 June 20X2 carries an annual interest of 4% payable annually at the end of the month of May. The prepaid advertisement was to advertise the company services for 6 months in the local magazine, starting from the month of September. (a) (3) (b) (5) (9) (10) (11) Required: (7) The company adopted the following depreciation policy for its non-current assets: Building Equipment Vehicles Useful life 50 8 10 Residual value Nil 2% of cost $14,000 Method Straight-line Double-declining Straight-line The equipment was bought on 1 January 20X2. The company bought and paid for $29,000 amount of office supplies on 3 March 20X3. (6) On 23 December 20X3, the company received news that one of its customers had filed for bankruptcy. The amount owing was $1,300. The company was hopeful that the amount could still be collected. On 12 December 20X3, the company received a legal letter from an unhappy customer demanding a refund of $3,000 for unsatisfactory service. The allowance for impairment on accounts receivable was determined to be 5% of the accounts receivable. The valuation of the freehold land on 31 December 20X3 was $2,500,000. The Office supplies at year-end amounted to $4,100. A utility bill amounting to $9.900 was received on 29 December 20X3. The company was tax-exempted for the financial year. Analyse the transactions and apply the accrual basis of accounting to prepare the journal entries and the adjusting journal entries as required based on the additional data provided in points (1) to (11) above to aid in the preparation of the financial statements for ITG Pte Ltd. Dates, narratives and workings must be clearly shown. The sequence and numbering system of the journal entries are to follow the order and number system given in the question. (36 marks) After incorporating the necessary journal entries and adjusted journal entries, present: (1) The statement of comprehensive income of ITG Pte Ltd, for the year ending 20X3 and (7 marks) The statement of financial position of ITG Pte Ltd As at 31 December 20X3. (12 marks)

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the necessary journal entries and adjusted journal entries we need to analyze the transactions and apply the accrual basis of accounting based on the additional data provided Here are the j...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started