Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1. Jacee lives on the edge of Crystal Springs and has decided to enter the bottled water business, doing business as 'Manatee Splash'. She

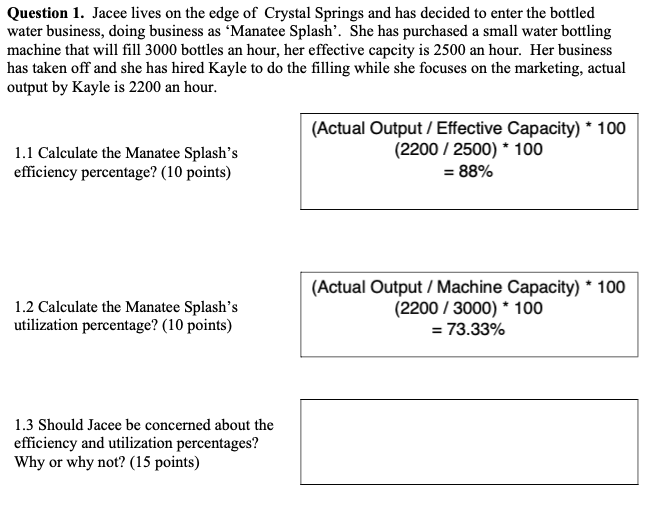

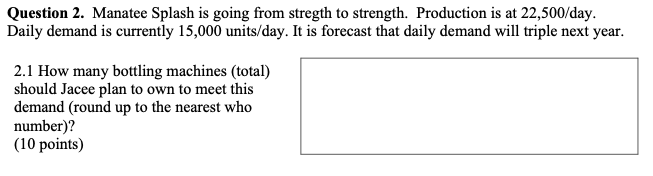

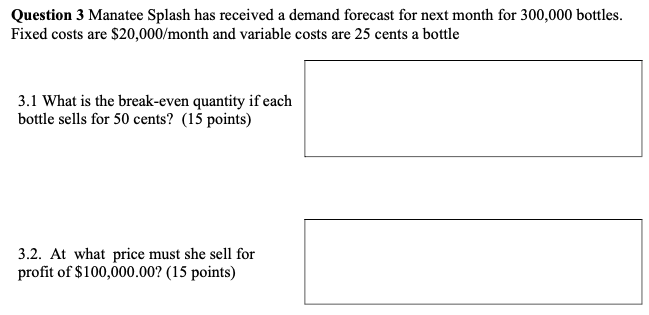

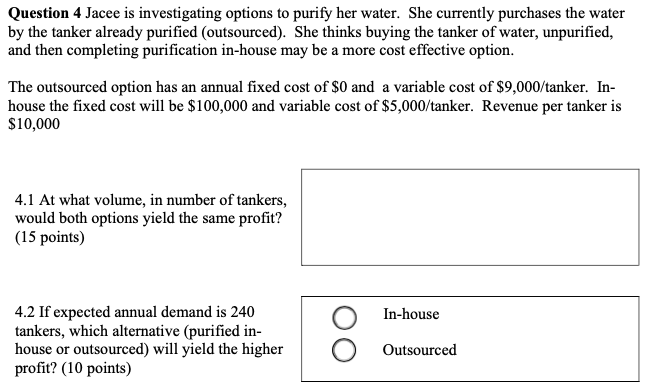

Question 1. Jacee lives on the edge of Crystal Springs and has decided to enter the bottled water business, doing business as 'Manatee Splash'. She has purchased a small water bottling machine that will fill 3000 bottles an hour, her effective capcity is 2500 an hour. Her business has taken off and she has hired Kayle to do the filling while she focuses on the marketing, actual output by Kayle is 2200 an hour. 1.1 Calculate the Manatee Splash's efficiency percentage? (10 points) 1.2 Calculate the Manatee Splash's utilization percentage? (10 points) (Actual Output / Effective Capacity) 100 (2200/2500)100 =88% (Actual Output / Machine Capacity) 100 (2200/3000)100 =73.33% 1.3 Should Jacee be concerned about the efficiency and utilization percentages? Why or why not? (15 points) Question 2. Manatee Splash is going from stregth to strength. Production is at 22,500/day. Daily demand is currently 15,000 units/day. It is forecast that daily demand will triple next year. 2.1 How many bottling machines (total) should Jacee plan to own to meet this demand (round up to the nearest who number)? (10 points) Question 3 Manatee Splash has received a demand forecast for next month for 300,000 bottles. Fixed costs are $20,000/ month and variable costs are 25 cents a bottle 3.1 What is the break-even quantity if each bottle sells for 50 cents? (15 points) 3.2. At what price must she sell for profit of $100,000.00 ? (15 points) Question 4 Jacee is investigating options to purify her water. She currently purchases the water by the tanker already purified (outsourced). She thinks buying the tanker of water, unpurified, and then completing purification in-house may be a more cost effective option. The outsourced option has an annual fixed cost of $0 and a variable cost of $9,000/ tanker. Inhouse the fixed cost will be $100,000 and variable cost of $5,000/ tanker. Revenue per tanker is $10,000 4.1 At what volume, in number of tankers, would both options yield the same profit? (15 points) 4.2 If expected annual demand is 240 tankers, which alternative (purified inhouse or outsourced) will yield the higher profit? (10 points) \begin{tabular}{|l|} \hline In-house \\ Outsourced \\ \hline \end{tabular}

Question 1. Jacee lives on the edge of Crystal Springs and has decided to enter the bottled water business, doing business as 'Manatee Splash'. She has purchased a small water bottling machine that will fill 3000 bottles an hour, her effective capcity is 2500 an hour. Her business has taken off and she has hired Kayle to do the filling while she focuses on the marketing, actual output by Kayle is 2200 an hour. 1.1 Calculate the Manatee Splash's efficiency percentage? (10 points) 1.2 Calculate the Manatee Splash's utilization percentage? (10 points) (Actual Output / Effective Capacity) 100 (2200/2500)100 =88% (Actual Output / Machine Capacity) 100 (2200/3000)100 =73.33% 1.3 Should Jacee be concerned about the efficiency and utilization percentages? Why or why not? (15 points) Question 2. Manatee Splash is going from stregth to strength. Production is at 22,500/day. Daily demand is currently 15,000 units/day. It is forecast that daily demand will triple next year. 2.1 How many bottling machines (total) should Jacee plan to own to meet this demand (round up to the nearest who number)? (10 points) Question 3 Manatee Splash has received a demand forecast for next month for 300,000 bottles. Fixed costs are $20,000/ month and variable costs are 25 cents a bottle 3.1 What is the break-even quantity if each bottle sells for 50 cents? (15 points) 3.2. At what price must she sell for profit of $100,000.00 ? (15 points) Question 4 Jacee is investigating options to purify her water. She currently purchases the water by the tanker already purified (outsourced). She thinks buying the tanker of water, unpurified, and then completing purification in-house may be a more cost effective option. The outsourced option has an annual fixed cost of $0 and a variable cost of $9,000/ tanker. Inhouse the fixed cost will be $100,000 and variable cost of $5,000/ tanker. Revenue per tanker is $10,000 4.1 At what volume, in number of tankers, would both options yield the same profit? (15 points) 4.2 If expected annual demand is 240 tankers, which alternative (purified inhouse or outsourced) will yield the higher profit? (10 points) \begin{tabular}{|l|} \hline In-house \\ Outsourced \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started