Answered step by step

Verified Expert Solution

Question

1 Approved Answer

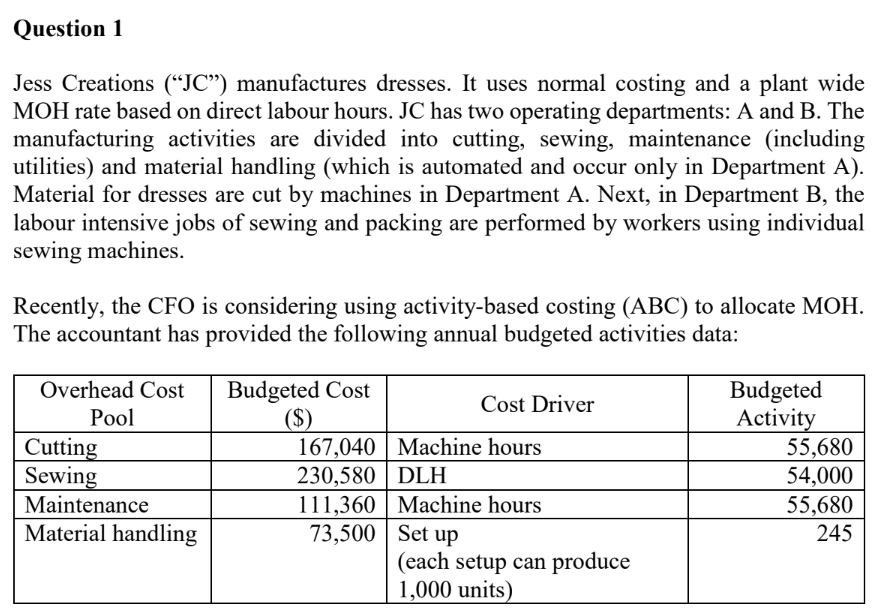

Question 1 Jess Creations (JC) manufactures dresses. It uses normal costing and a plant wide MOH rate based on direct labour hours. JC has

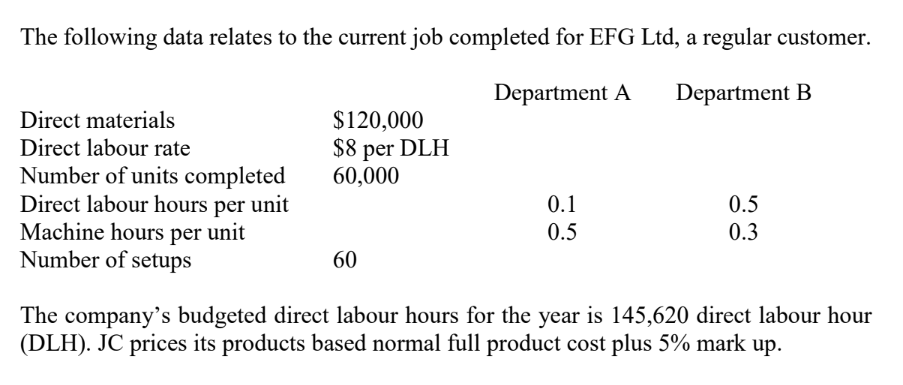

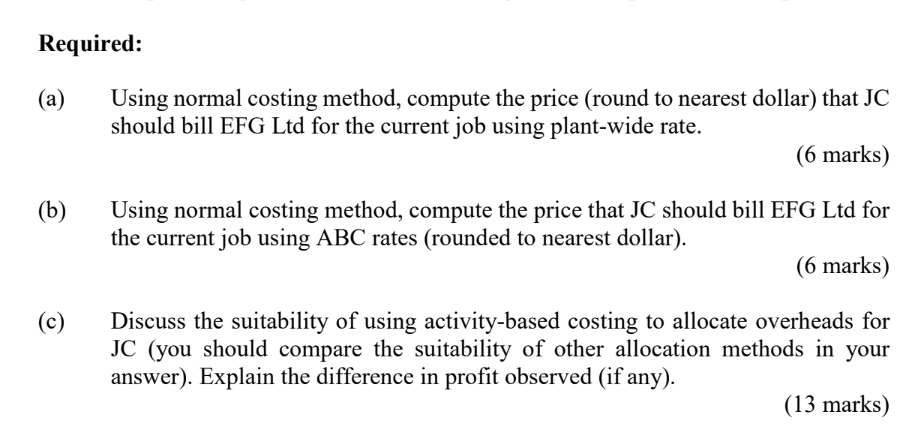

Question 1 Jess Creations (JC) manufactures dresses. It uses normal costing and a plant wide MOH rate based on direct labour hours. JC has two operating departments: A and B. The manufacturing activities are divided into cutting, sewing, maintenance (including utilities) and material handling (which is automated and occur only in Department A). Material for dresses are cut by machines in Department A. Next, in Department B, the labour intensive jobs of sewing and packing are performed by workers using individual sewing machines. Recently, the CFO is considering using activity-based costing (ABC) to allocate MOH. The accountant has provided the following annual budgeted activities data: Overhead Cost Pool Budgeted Cost ($) Budgeted Cost Driver Activity Cutting 167,040 Machine hours 55,680 Sewing 230,580 DLH 54,000 Maintenance 111,360 Machine hours 55,680 Material handling 73,500 Set up 245 (each setup can produce 1,000 units) The following data relates to the current job completed for EFG Ltd, a regular customer. Department A Department B Direct materials $120,000 Direct labour rate Number of units completed $8 per DLH 60,000 Direct labour hours per unit 0.1 0.5 60 Machine hours per unit Number of setups The company's budgeted direct labour hours for the year is 145,620 direct labour hour (DLH). JC prices its products based normal full product cost plus 5% mark up. 0.5 0.3 Required: (a) Using normal costing method, compute the price (round to nearest dollar) that JC should bill EFG Ltd for the current job using plant-wide rate. (6 marks) (b) (c) Using normal costing method, compute the price that JC should bill EFG Ltd for the current job using ABC rates (rounded to nearest dollar). (6 marks) Discuss the suitability of using activity-based costing to allocate overheads for JC (you should compare the suitability of other allocation methods in your answer). Explain the difference in profit observed (if any). (13 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started