Question 1 John borrowed $3,000,000 from a bank that charges interest at a rate i = 10% per annum. He can choose one of the

Question 1

John borrowed $3,000,000 from a bank that charges interest at a rate i = 10% per annum. He can choose one of the following three different ways to make the repayment in the coming 10 years:

- Method 1: The principal sum of $3,000,000 will be amortized in 10 years, $300,000 at the end of each year;

- Method 2: The principal sum will be amortized in 10 years in an increasing manner from

$210,000 to $390,000 with an annual increase of $20,000;

- Method 3: The principal sum will be paid in a lump sum at the end of Year 10.

If for all the three methods, annual interest incurred will be paid at the end of each of the 10 years, what is the total annual amount John needs to pay to the bank at the end of each of the 10 years?

Question 2

ABC Corporation purchases a piece of equipment at a cost of $50,000. Its service life is 5 years (assuming its salvage value is zero at the end of the service life) and the annual operation & maintenance cost is estimated to be $1,0000 (assuming this cost occurs at the end of each year). The manager of the company is thinking of hiring it out so that he has to estimate the minimum (i.e., at breakeven condition) hire rate on a daily basis. Assuming the average number of days that the equipment can be for hire is 300 days a year, estimate the minimum hire charge per day (i = 10%).

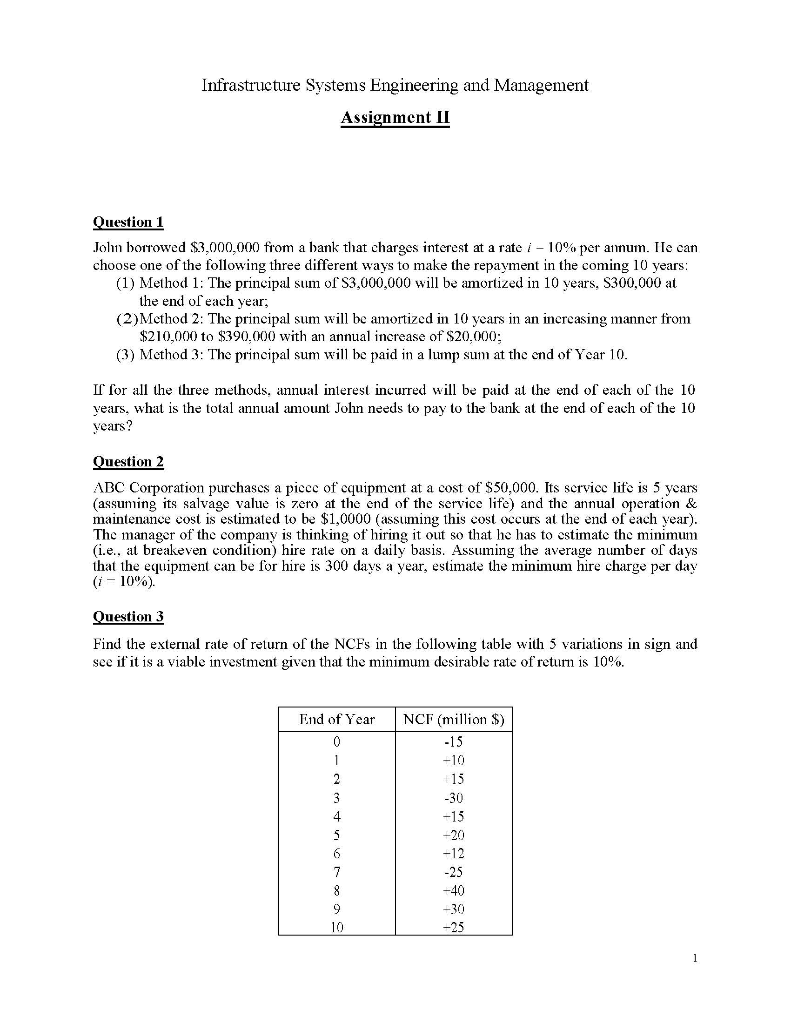

Question 3

Find the external rate of return of the NCFs in the following table with 5 variations in sign and see if it is a viable investment given that the minimum desirable rate of return is 10%.

| End of Year | NCF (million $) |

| 0 | -15 |

| 1 | +10 |

| 2 | +15 |

| 3 | -30 |

| 4 | +15 |

| 5 | +20 |

| 6 | +12 |

| 7 | -25 |

| 8 | +40 |

| 9 | +30 |

| 10 | +25 |

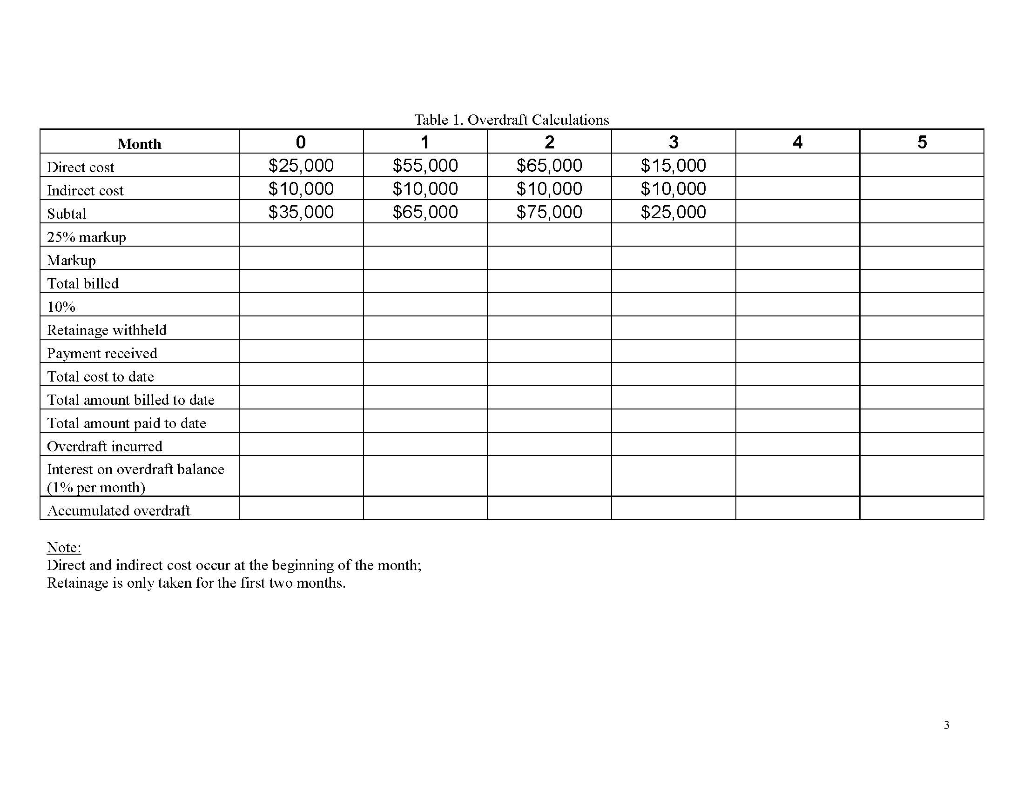

Question 4

The estimated construction cost of a stadium is $42 million. The owner is authorized to issue $46 million in view of risks and uncertainties. Half of the bonds will be redeemable at the end of 10 years with annual interest at 10% of the bond principal and half of the bonds will be redeemable at the end of 15 years with annual interest at 15% of the bond principal. Banks bid the amounts they are willing to secure payment support. The banks recover their expense and profit by offering to provide a sum of money slightly less than the amount to be repaid. The highest bid received is $44 million. What is the rate of financial cost in issuing the bonds?

Question 5

Given the cost expenditures for a small project as shown in Table 1,

- Calculate the overdraft and determine the peak financial requirement;

- Develop the cash flow profile that is needed to calculate the rate of return of the project;

- Find the rate of return from the project.

Assume: 25% markup

10% retainage for only the first two months Interest rate = 1% per month

Payments are billed at the end of a month and received one month later.

Infrastructure Systems Engineering and Management Assignment II uestion 1 Jonil borrowed $3,000,000 fiom a bank that charges interest at a rate i-10% per annum. Ile can choose one of the following three different ways to make the repayment in the coming 10 years (1) Method 1: The principal sum of S3,000,000 wll be amortized in 10 years, S300,000 at the end of each year; (2)Method 2: The principal sum will be amortized in 10 years in an incrcasing manner from $210,000 to $390.000 with an annual increase of $20.000 (3) Mcthod 3: The principal sum will be paid in a lump sum at the end of Ycar 10 II for all the three methods, annual interest incurred will be paid at the end of each of the 10 years, what is the total annual amount John needs to pay to the bank at the end of each of the 10 vears? uestion 2 BC Corporation purchascs a picee of cquipment at a cost of S50,000. Its servicc life is 5 ycars (assuming its salvage value is zero at the end of the service life) and the annual operation & maintenance cost is estimated to be $1,0000 (assuming this cost occurs at the end of each year). The manager of the company is thinking of hiring t out so that he has to estimate the minimum (i.e., at breakeven condition) hire rate on a daily basis. Assuming the average number of days that the equipment can be for hire is 300 days a year, estimate the minimum hire charge per day (1-10%). uestion 3 Find the external rate of return of the NCFs in the following table with 5 variations in sign and see if it is a viable investment given that the minimum desirable rate of return is 10%. End of Year NCF (million $) 15 -30 -15 -20 -12 -25 10 25 Question 4 The estimated construction cost of a stadium is $42lion. he owner is authorized to issue S46 million in view of risks and uncertainties. Helofthe bonds will be redeemable at the end 0 years with annual interest at 10% of the bond principal and half of the bonds will be redeemable at the end of 15 years with annual interest at 15% of the bond principal. Banks bid the amounts they are willing to secure payment support. The banks recover their expense and profit biy offering to provide a sum of money slightly Iess than the amount to be repaid. Thc highest bid received is $44 million. What is the rate of financial cost in issuing the bonds? Qucstion 5 Given the cost expenditures for a small project as shown in Table 1, (1) Calculate the overdraft and determine the peak financial requirement (2) Develop the cash flow profile that is needed to calculate the rate of return of the project (3) Find the rate of return from the project Assume: 25% markup 10% retainage for only the first two months Interest rate per month Payments are billed at the end of a month and received one month later. Table 1. Overdral Calclations 2 $65,000 $10,000 $75,000 3 $15,000 $10,000 $25,000 Month $25,000 $10,000 $35,000 $55,000 $10,000 $65,000 Direct cost Indircct cost Subtal 25% marku Marku Total billed 10% Retainage withheld Payment received Total cost to date Total amount billed to date Total amount paid to date Ovcrdraft incurred Interest on overdraft balance (100 per month Accumulated overdraft Note Direct and indirect cost occur at the beginning of the month Retainage is only taken for the firs two months

Step by Step Solution

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started