Question

QUESTION 1 Joy Bhd has been an established public listed company since 2015 that involved in manufacturing and distributing of aromatherapy products such as therapeutic

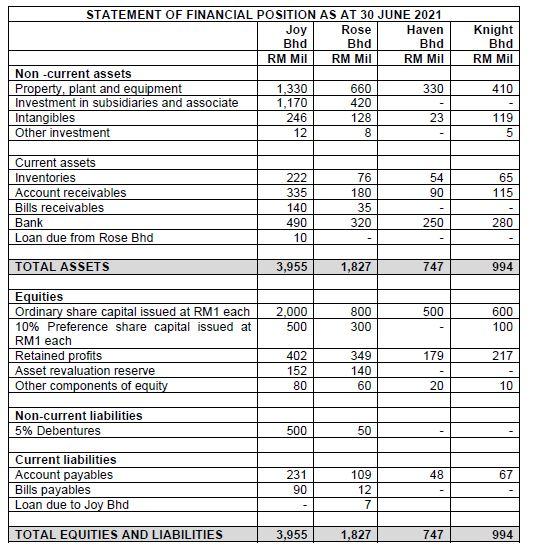

QUESTION 1 Joy Bhd has been an established public listed company since 2015 that involved in manufacturing and distributing of aromatherapy products such as therapeutic grade essential oils, aromatherapy diffusers, aroma sticks, etc. Over the years, the company has made a few investments by acquiring some companies as subsidiaries and associates to strengthen its position in the market. The acquisitions of the subsidiaries and associates were as follows:

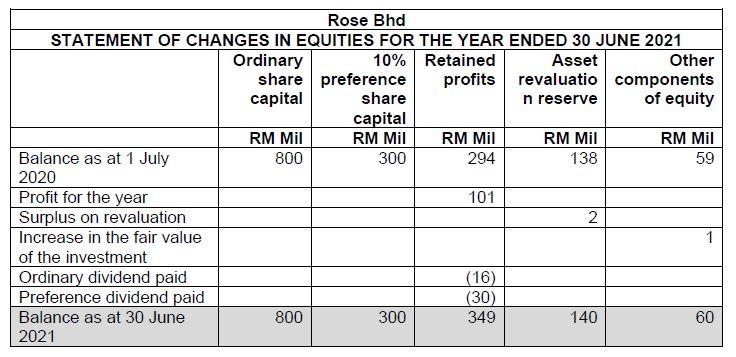

Investment in Rose Bhd On 1 July 2018, Joy Bhd acquired 240 million ordinary shares of Rose Bhd at RM300 million when the retained profits and other equity components of Rose Bhd were RM109 million and RM45 million, respectively. Subsequently, on 1 July 2019, Joy Bhd acquired another 30% of the ordinary shares of Rose Bhd for RM500 million and 20% of the preference shares of the company for RM70 million when the reserves of Rose Bhd were as follows:

Retained profit RM245 million Asset revaluation reserve RM120 million Other components of equity RM52 million

At the acquisition date, the fair value of the land and building of Rose Bhd was RM2.4 million and RM5.5 million more than their respective carrying value. No adjustment has been made in Rose Bhd accounts to incorporate these values. The remaining useful life of the building as at the date of acquisition was 25 years. As at that date, the fair value of the ordinary share of Rose Bhd was RM 2.10 each.

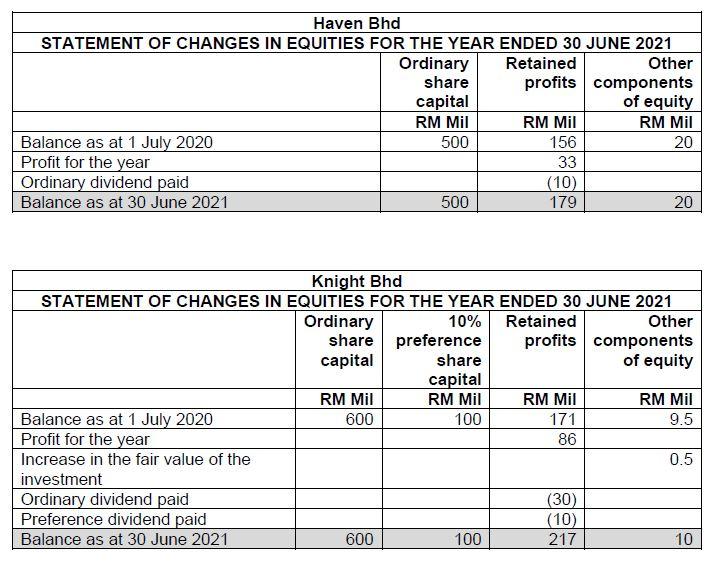

Investment in Haven Bhd On 1 July 2020, Rose Bhd acquired 70% of the ordinary shares of Haven Bhd at RM420 million cash. The fair value of the ordinary shares of Haven Bhd as at that date was RM1.70 each. As at the acquisition date, Rose Bhd recognised an internally generated brand in Haven Bhd and valued it at RM15 million. It was determined that the brand has 10 years of useful life. At the same date, Joy Bhd also acquired 10% of the ordinary shares of Haven Bhd at RM75 million. The acquisition was settled through issuance of 10 million units of ordinary shares of Joy Bhd at RM7.50 per share. This acquisition has not been recorded in any Joy Bhd's account as at 30 June 2021.

Investment in Knight Bhd Joy Bhd acquired 40% of the ordinary shares of Knight Bhd on 1 January 2021 at RM300 million. In May 2021, Joy Bhd sold goods costing RM10 million to Knight Bhd at an invoice price of RM12 million. Three-quarters of the goods were still in Knight Bhd's store on 30 June 2021. The following are the financial statements of Joy Bhd and its group for the financial year ended 30 June 2021:

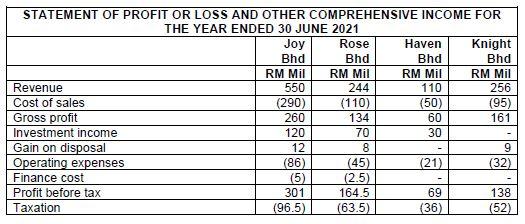

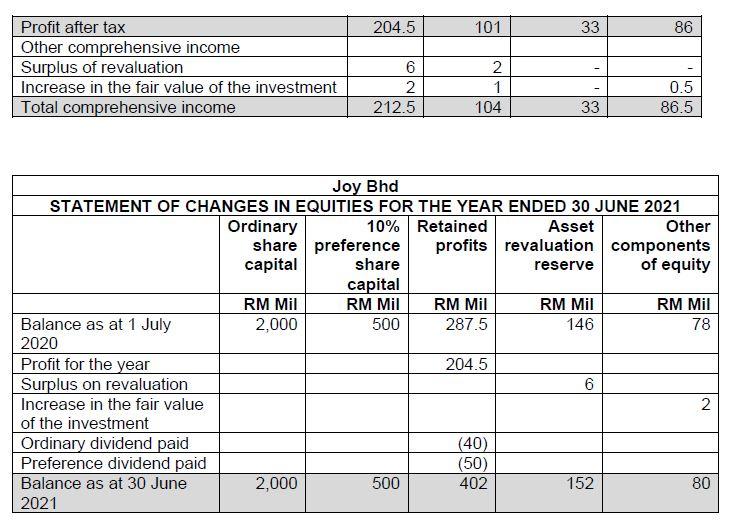

Additional information: 1. During the year ended 30 June 2021, Rose Bhd sold to Joy Bhd goods worth RM25 million. Rose Bhd priced its sales to Joy Bhd at cost plus 25%. Half of the invoiced amount was still due from Joy Bhd on 30 June 2021. At the end of the year, RM5 million of these goods remained unsold. There was also an unrealised profit of RM2 million in the opening inventory of Joy Bhd. The opening inventory was also purchased from Rose Bhd. 2. On 1 January 2021, Haven Bhd sold a plant to Rose Bhd for RM12 million when the carrying value of the plant was RM9.5 million. The remaining life of the plant was 5 years on that date. 3. On 28 June 2021, Rose Bhd sent a cheque to Joy Bhd of RM3 million as part of the settlement on the loan due to Joy Bhd. This was only received by Joy Bhd on 3 July 2021. 4. Bills receivables of RM8 million in Joy Bhd were issued in favour of Rose Bhd. Joy Bhd had discounted RM2 million of these bills as at year-end. 5. The surplus on revaluation in Joy Bhd and Rose Bhd was related to subsequent revaluations of some properties in the current year. 6. The increase in the fair value of investments was related to changes in the fair value of financial assets measured at fair value through other comprehensive income on 30 June 2021. The reserves have been included as part of other components of equity. 7. On 1 April 2021, Joy Bhd issued RM20 million 5% Redeemable Preference shares of RM1 each for cash. The interest on these shares was still accrued at year end and no record were made by Joy Bhd as at 30 June 2021. 8. The ordinary shares and 10% preference shares dividends are declared and paid on 28 June 2021. 9. The impairment test revealed that the goodwill in Rose Bhd had been impaired by 10% as at 30 June 2021. 10. The group's policy is to measure the non-controlling interest at its fair value. 11. Depreciation for property, plant and equipment is recognised in the statement of profit or loss to write off the cost or revaluation amount of each asset over its estimated useful life. Depreciation on property, plant and equipment is using the straight line method calculated on a yearly basis with no residual value, where full-year depreciation is charged in the year of purchase and none in the year of disposal. 12. Profits are assumed to accrue evenly throughout 2018 to 2021.

Additional information: 1. During the year ended 30 June 2021, Rose Bhd sold to Joy Bhd goods worth RM25 million. Rose Bhd priced its sales to Joy Bhd at cost plus 25%. Half of the invoiced amount was still due from Joy Bhd on 30 June 2021. At the end of the year, RM5 million of these goods remained unsold. There was also an unrealised profit of RM2 million in the opening inventory of Joy Bhd. The opening inventory was also purchased from Rose Bhd. 2. On 1 January 2021, Haven Bhd sold a plant to Rose Bhd for RM12 million when the carrying value of the plant was RM9.5 million. The remaining life of the plant was 5 years on that date. 3. On 28 June 2021, Rose Bhd sent a cheque to Joy Bhd of RM3 million as part of the settlement on the loan due to Joy Bhd. This was only received by Joy Bhd on 3 July 2021. 4. Bills receivables of RM8 million in Joy Bhd were issued in favour of Rose Bhd. Joy Bhd had discounted RM2 million of these bills as at year-end. 5. The surplus on revaluation in Joy Bhd and Rose Bhd was related to subsequent revaluations of some properties in the current year. 6. The increase in the fair value of investments was related to changes in the fair value of financial assets measured at fair value through other comprehensive income on 30 June 2021. The reserves have been included as part of other components of equity. 7. On 1 April 2021, Joy Bhd issued RM20 million 5% Redeemable Preference shares of RM1 each for cash. The interest on these shares was still accrued at year end and no record were made by Joy Bhd as at 30 June 2021. 8. The ordinary shares and 10% preference shares dividends are declared and paid on 28 June 2021. 9. The impairment test revealed that the goodwill in Rose Bhd had been impaired by 10% as at 30 June 2021. 10. The group's policy is to measure the non-controlling interest at its fair value. 11. Depreciation for property, plant and equipment is recognised in the statement of profit or loss to write off the cost or revaluation amount of each asset over its estimated useful life. Depreciation on property, plant and equipment is using the straight line method calculated on a yearly basis with no residual value, where full-year depreciation is charged in the year of purchase and none in the year of disposal. 12. Profits are assumed to accrue evenly throughout 2018 to 2021.

Required: e) Prepare Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2021 for Joy Bhd's Group. (22 marks)

Knight Bhd RM Mil STATEMENT OF FINANCIAL POSITION AS AT 30 JUNE 2021 Joy Rose Haven Bhd Bhd Bhd RM Mil RM Mil RM Mil Non-current assets Property, plant and equipment 1,330 660 330 Investment in subsidiaries and associate 1,170 420 Intangibles 246 128 23 Other investment 8 410 119 5 12 54 90 65 115 Current assets Inventories Account receivables Bills receivables Bank Loan due from Rose Bhd 222 335 140 490 10 76 180 35 320 250 280 TOTAL ASSETS 3,955 1,827 747 994 500 2,000 500 800 300 600 100 Equities Ordinary share capital issued at RM1 each 10% Preference share capital issued at RM1 each Retained profits Asset revaluation reserve Other components of equity 179 217 402 152 80 349 140 60 20 10 Non-current liabilities 5% Debentures 500 50 48 67 Current liabilities Account payables Bills payables Loan due to Joy Bhd 231 90 109 12 7 TOTAL EQUITIES AND LIABILITIES 3,955 1,827 747 994 STATEMENT OF PROFIT OR LOSS AND OTHER COMPREHENSIVE INCOME FOR THE YEAR ENDED 30 JUNE 2021 Joy Rose Haven Knight Bhd Bhd Bhd Bhd RM Mil RM Mil RM Mil RM Mil Revenue 550 244 110 256 Cost of sales (290) (110) (50) (95) Gross profit 260 134 60 161 Investment income 120 70 30 Gain on disposal 12 8 9 Operating expenses (86) (45) (21) (32) Finance cost (5) (2.5) Profit before tax 301 164.5 69 Taxation (96.5) (63.5) (36) (52) 138 204.5 101 33 86 Profit after tax Other comprehensive income Surplus of revaluation Increase in the fair value of the investment Total comprehensive income 6 2 212.5 2 1 104 0.5 86.5 33 Joy Bhd STATEMENT OF CHANGES IN EQUITIES FOR THE YEAR ENDED 30 JUNE 2021 Ordinary 10% Retained Asset Other share preference profits revaluation components capital share reserve of equity capital RM Mil RM Mil RM Mil RM Mil RM Mil Balance as at 1 July 2,000 500 287.5 146 78 2020 Profit for the year 204.5 Surplus on revaluation 6 Increase in the fair value of the investment Ordinary dividend paid (40) Preference dividend paid (50) Balance as at 30 June 2,000 500 402 152 80 2021 N Rose Bhd STATEMENT OF CHANGES IN EQUITIES FOR THE YEAR ENDED 30 JUNE 2021 Ordinary 10% Retained Asset Other share preference profits revaluatio components capital share n reserve of equity capital RM Mil RM Mil RM Mil RM Mil RM Mil Balance as at 1 July 800 300 294 138 59 2020 Profit for the year 101 Surplus on revaluation 2 Increase in the fair value 1 of the investment Ordinary dividend paid (16) Preference dividend paid (30) Balance as at 30 June 800 300 349 140 60 2021 Haven Bhd STATEMENT OF CHANGES IN EQUITIES FOR THE YEAR ENDED 30 JUNE 2021 Ordinary Retained Other share profits components capital of equity RM Mil RM Mil RM Mil Balance as at 1 July 2020 500 156 20 Profit for the year 33 Ordinary dividend paid (10) Balance as at 30 June 2021 500 179 20 Knight Bhd STATEMENT OF CHANGES IN EQUITIES FOR THE YEAR ENDED 30 JUNE 2021 Ordinary 10% Retained Other share preference profits components capital share of equity capital RM Mil RM Mil RM Mil RM Mil Balance as at 1 July 2020 600 100 171 9.5 Profit for the year 86 Increase in the fair value of the 0.5 investment Ordinary dividend paid (30) Preference dividend paid (10) Balance as at 30 June 2021 600 100 217 10Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started