Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1: List two advantages of policy loan. (12 points) Rubric: 12 points in total. 6 points for each advantages corrected listed and explained,

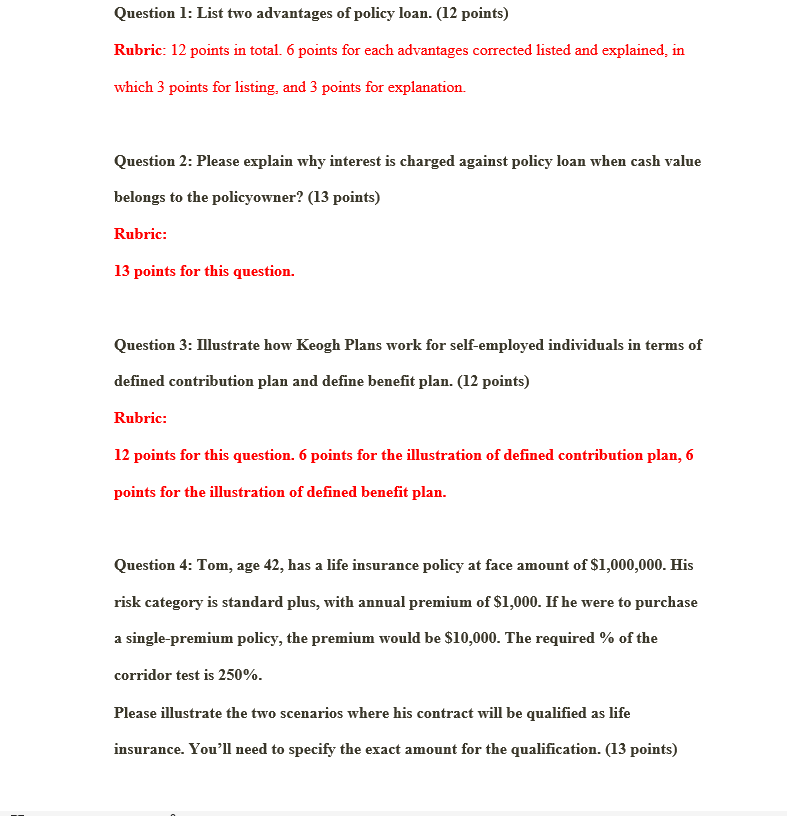

Question 1: List two advantages of policy loan. (12 points) Rubric: 12 points in total. 6 points for each advantages corrected listed and explained, in which 3 points for listing, and 3 points for explanation. Question 2: Please explain why interest is charged against policy loan when cash value belongs to the policyowner? (13 points) Rubric: 13 points for this question. Question 3: Illustrate how Keogh Plans work for self-employed individuals in terms of defined contribution plan and define benefit plan. (12 points) Rubric: 12 points for this question. 6 points for the illustration of defined contribution plan, 6 points for the illustration of defined benefit plan. Question 4: Tom, age 42, has a life insurance policy at face amount of $1,000,000. His risk category is standard plus, with annual premium of $1,000. If he were to purchase a single-premium policy, the premium would be $10,000. The required % of the corridor test is 250%. Please illustrate the two scenarios where his contract will be qualified as life insurance. You'll need to specify the exact amount for the qualification. (13 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question 1 Policy Loan Advantages Here are two advantages of policy loans Access to Cash A policy loan allows you to borrow money against the cash value of your policy This can be helpful for emergenc...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started