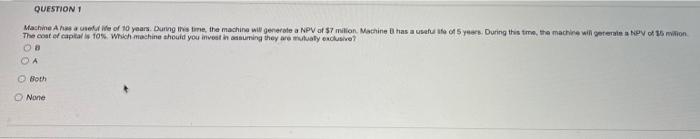

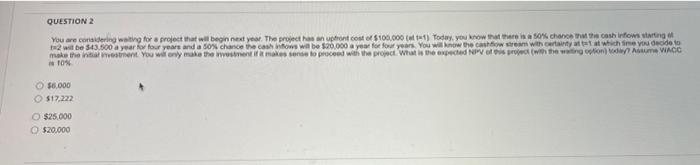

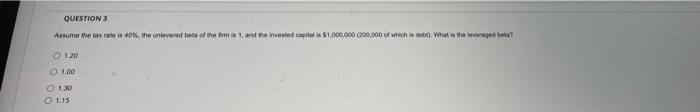

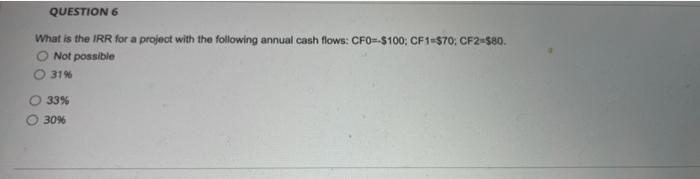

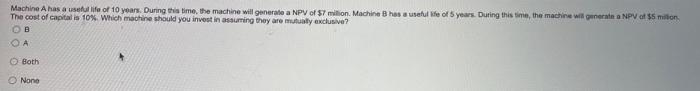

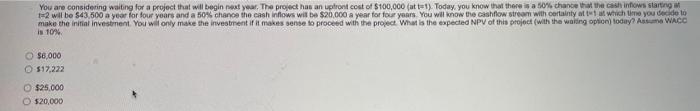

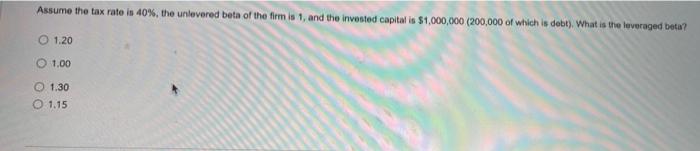

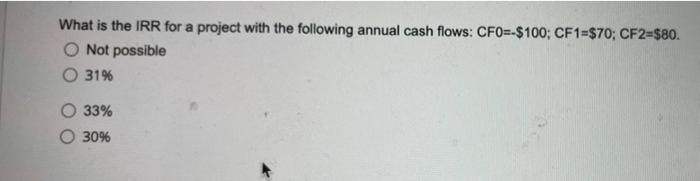

QUESTION 1 Machine And We of 10 years. During the time, the machine will generato a NPV of 57 milion Machine has a use a 15 years. During this time, the machine will operate a NOV 16 rion The cost of capital is 10% Wisch machine should you invat hasuming they are mutually exclusive Oa Both None QUESTION 2 You are considering waiting for a project that will begin next year. The project has pronto 100.000 (1) Today, you know that there is a 50% chance the cash flows iting 2 will be $43.500 a year for four years and a 50% chance the cash flows will be $20,000 a year for four years. You will now the core with which you decide to make the mostment you will only make the west mes sense to proceed with the project. What is the expected NPV (with wing ontm WACO 104 56.000 $17.222 O $25.000 $20,000 QUESTION 3 Assume the tax ratei 40 the never be of the finis 1 and invested capital is $1000,000 C200,000 of which is What is go? 1.20 1.00 1,30 T.15 QUESTION 6 What is the IRR for a project with the following annual cash flows: CF0--$100 CF1=570: CF2-580 Not possible 31% 33% 30% Machine A has a settife of 10 years. During this time, the machine will generate a NPV of 7 milion Machine B has a useful life of years. During this time, the machine will generate a NPV of million The cost of capital is 10% Which machine should you invest in assuring they are mutually exclusive? Both Nono You are considering waiting for a project that will begin next year. The project has an upfront cost of $100,000 (at). Today, you know that there is a 50% chance that the cash infows starting 1-2 will be $43.500 a year for four years and a 50% chance the cash inflows will be $20,000 a year for four years. You will know the cashflow stron with certainty at which time you decide to make the initial investiment. You will only make the investment if it makes sense to proceed with the project. What is the expected NPV of this project (with the waling option today? As WACO is 10% $6.000 517.222 $25.000 0 $20,000 Assume the tax rate is 40%, the unlevered beta of the firm is 1, and the invested capital is $1,000,000 (200,000 of which is debe). What is the leveraged beta? 1.20 1,00 1.30 1.15 What is the IRR for a project with the following annual cash flows: CF0=-$100; CF1=$70; CF2=$80. O Not possible O 31% 33% 3096