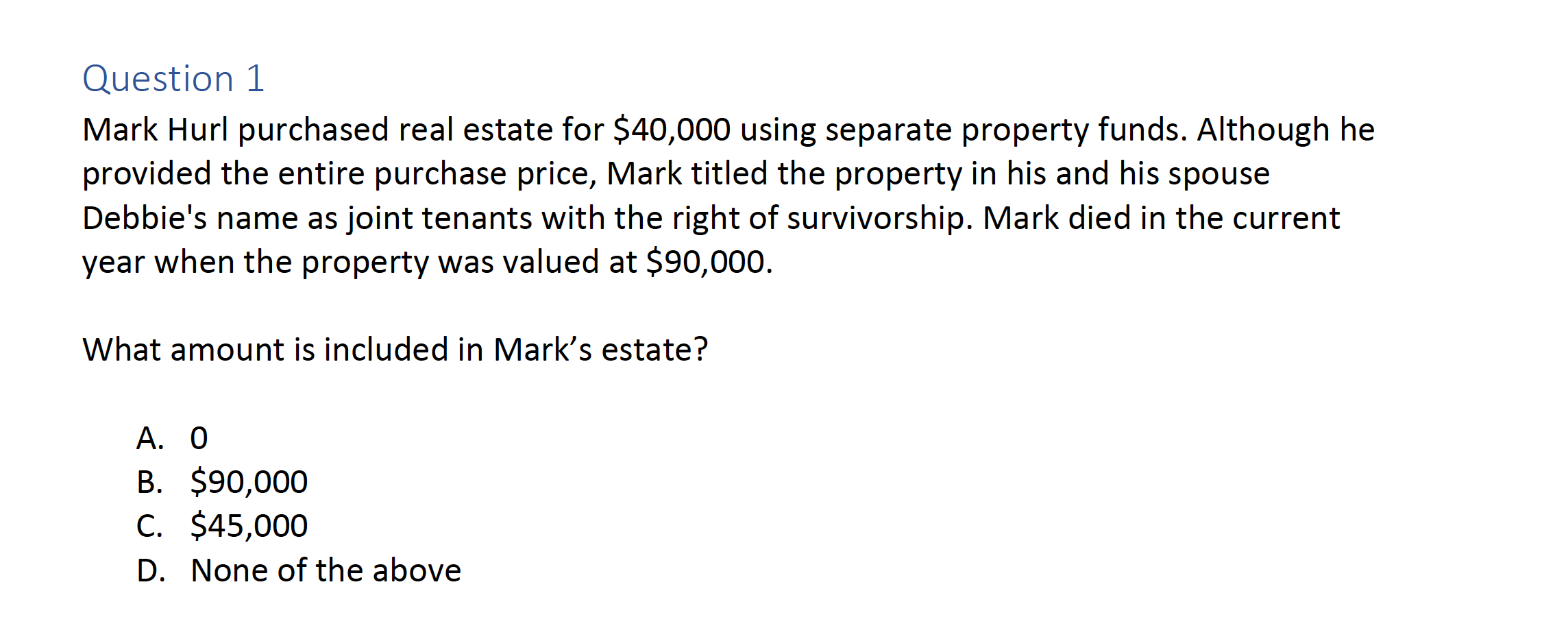

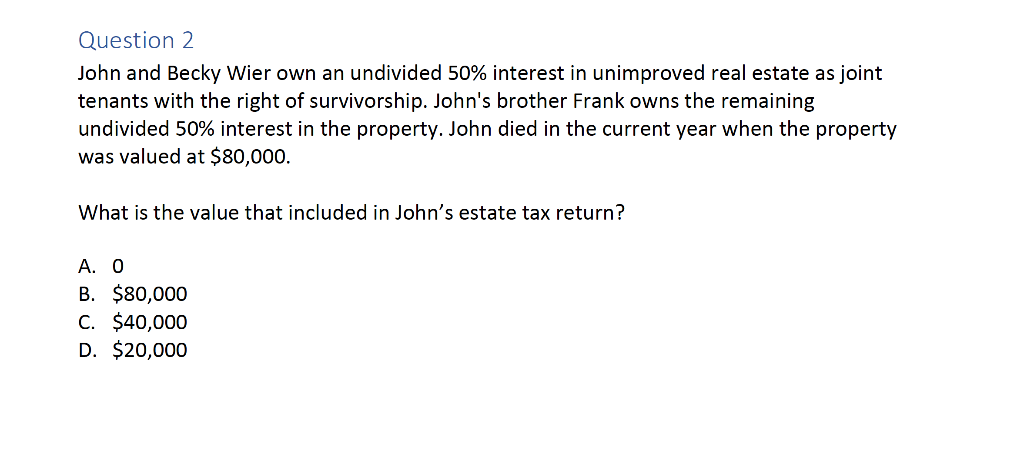

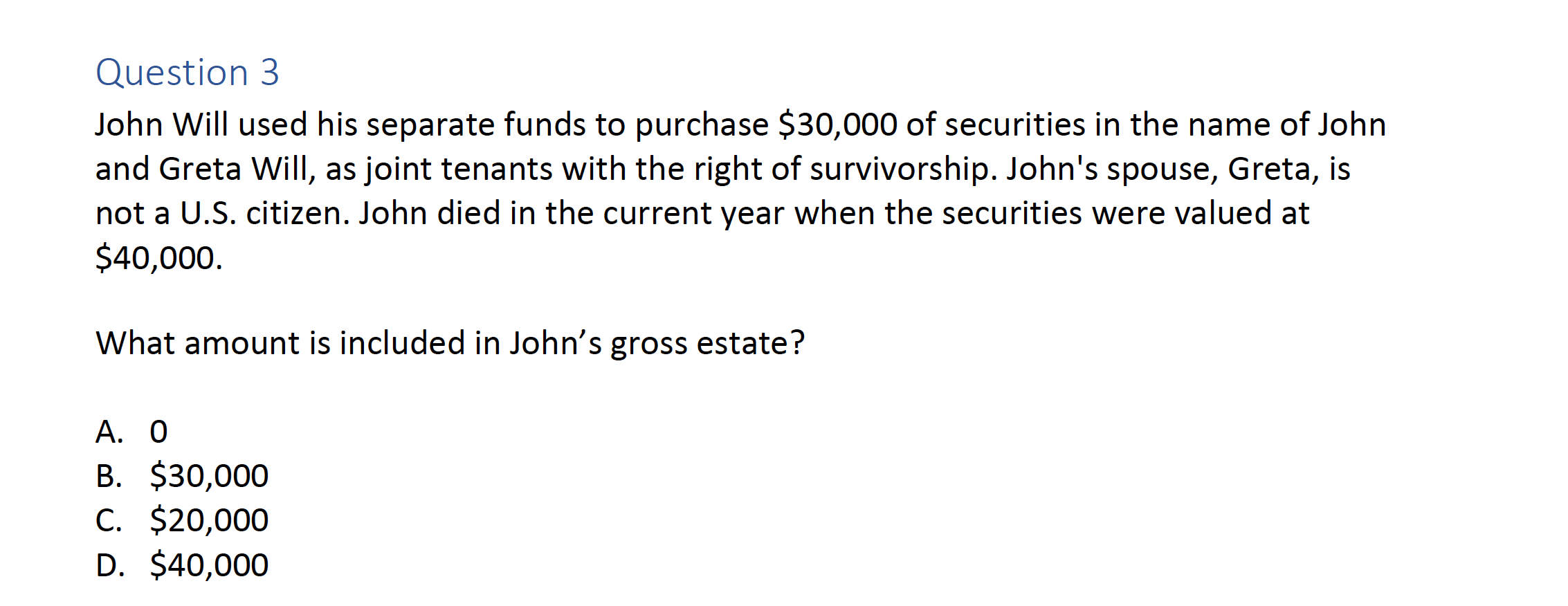

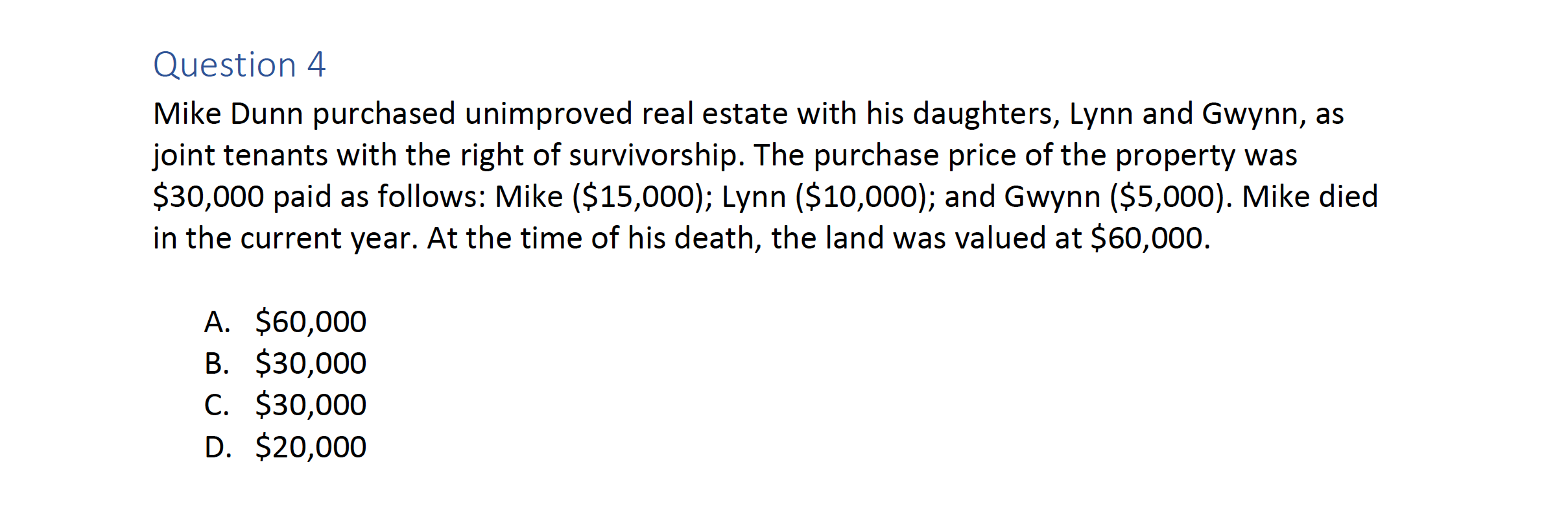

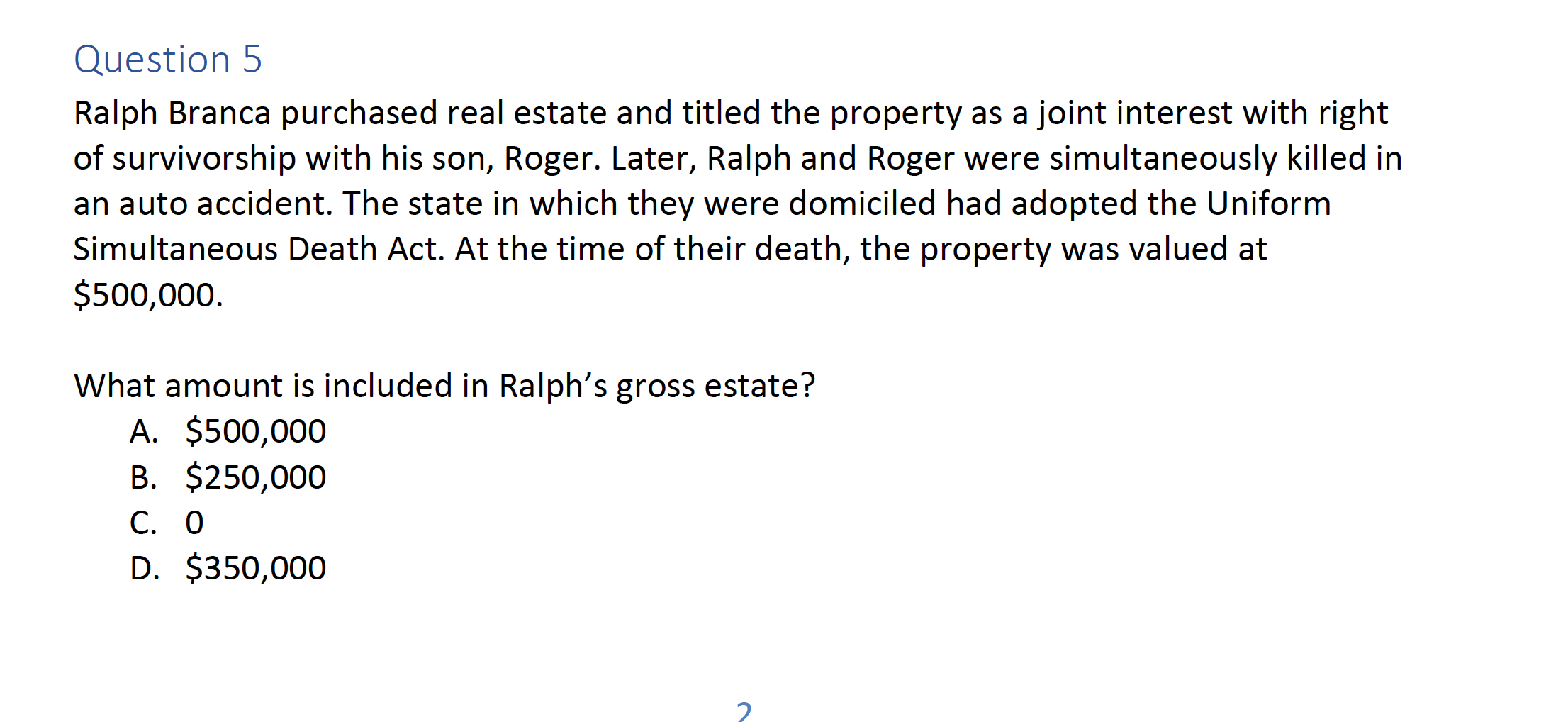

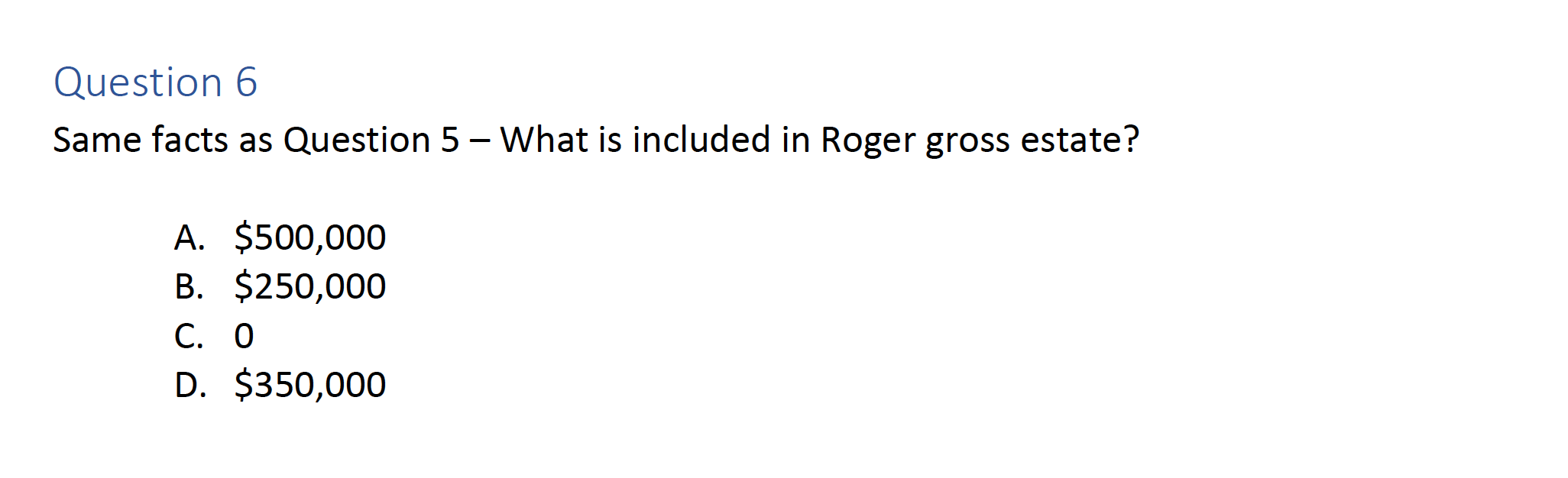

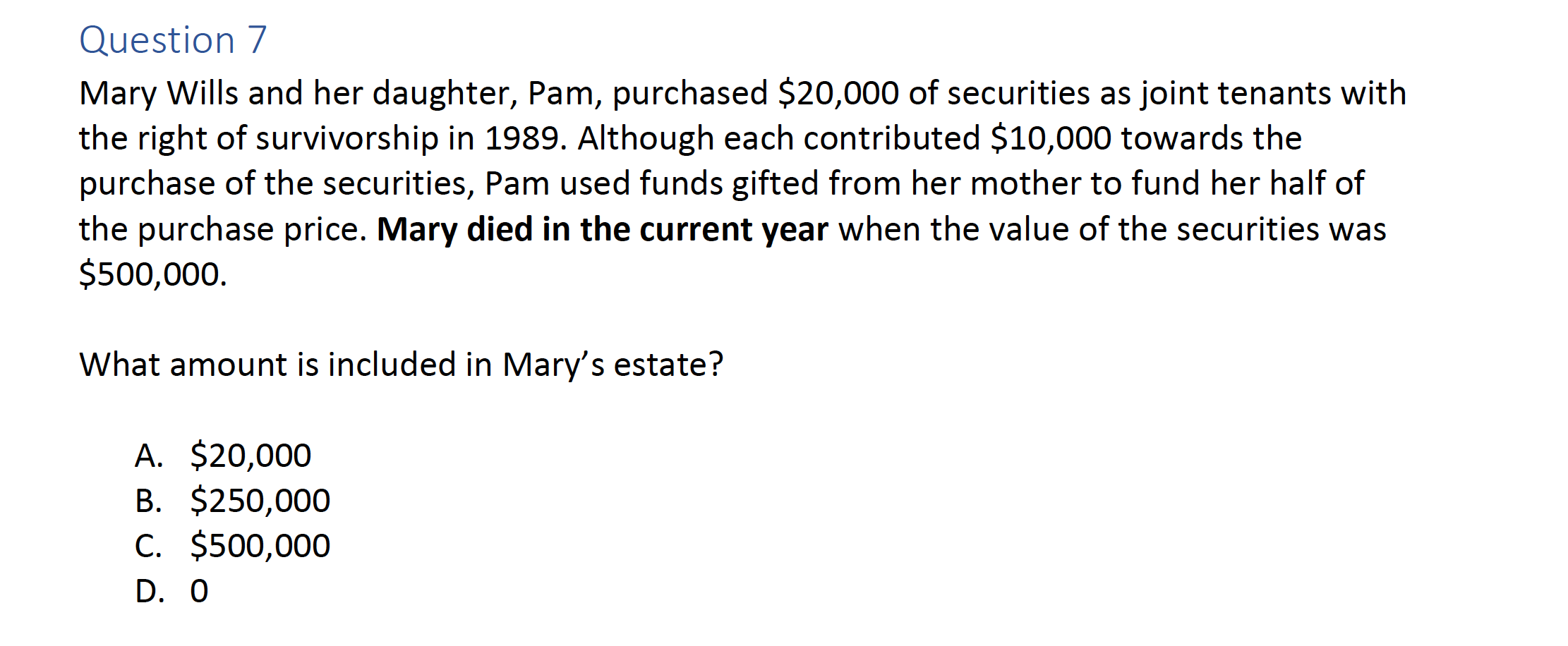

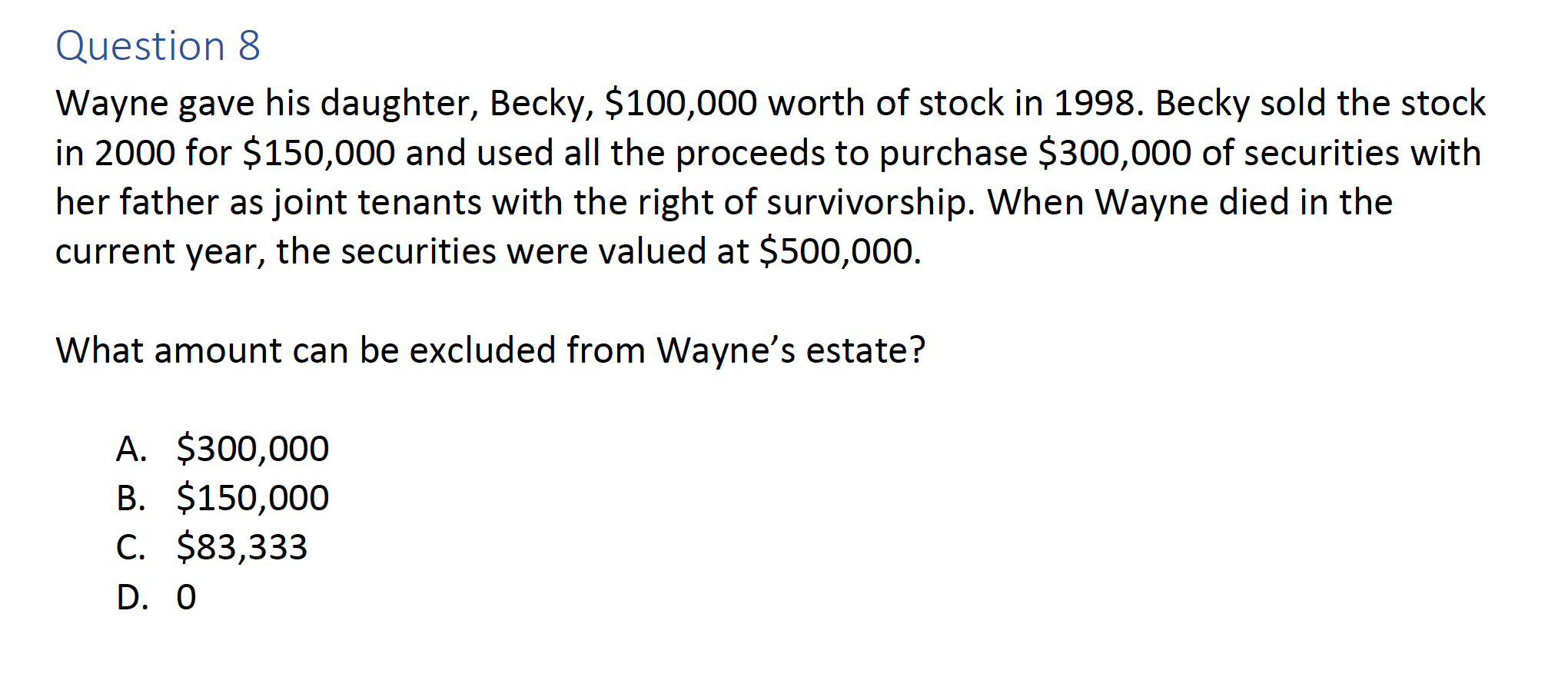

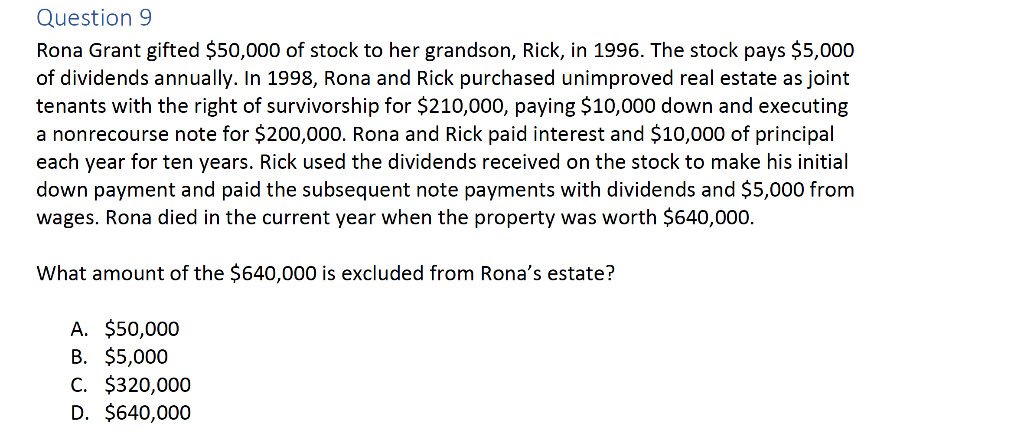

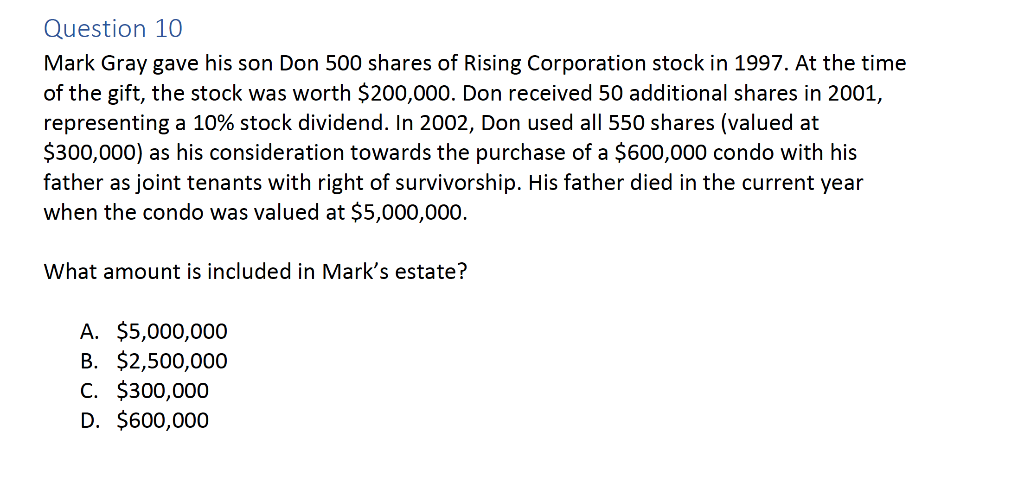

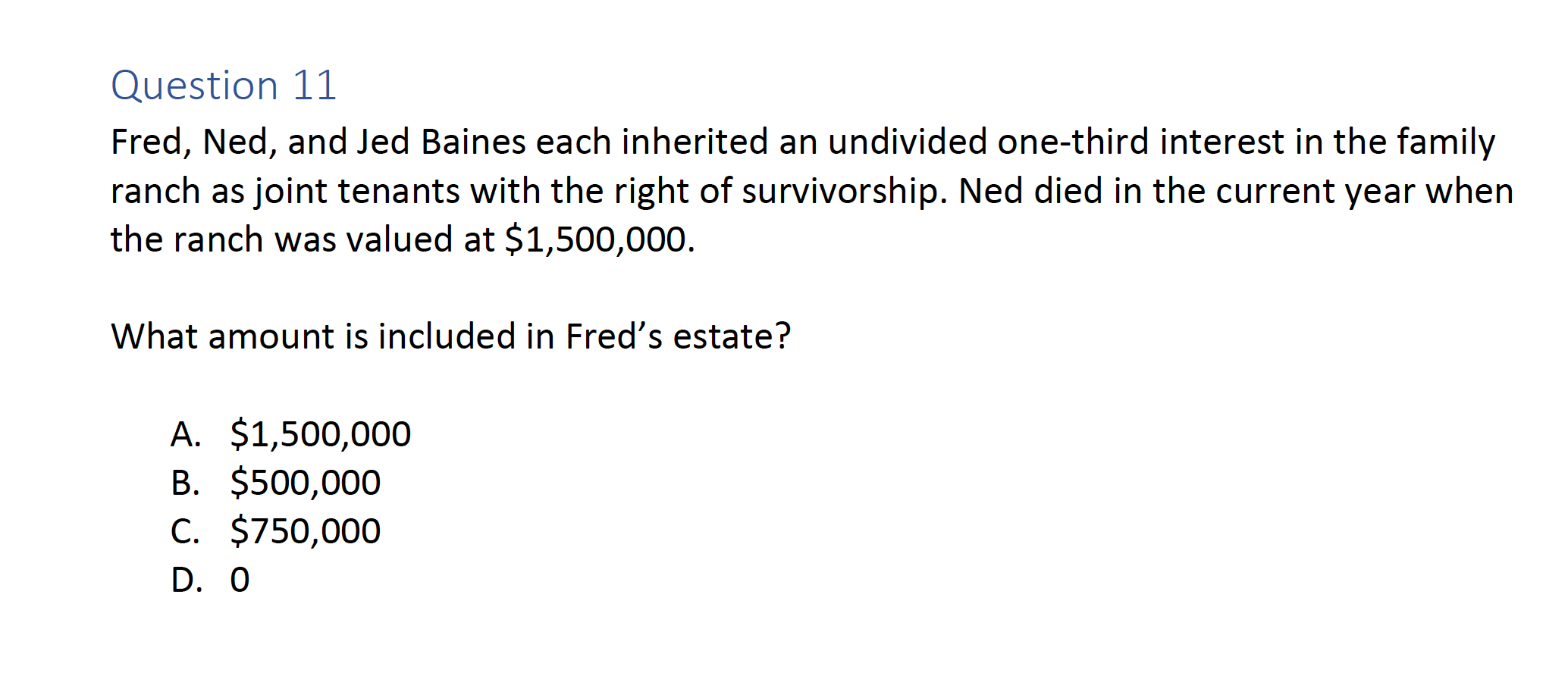

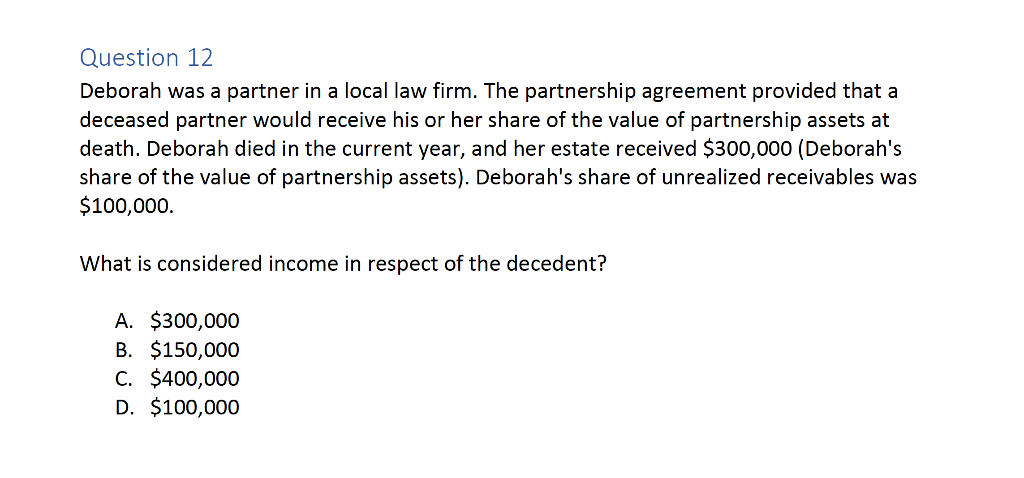

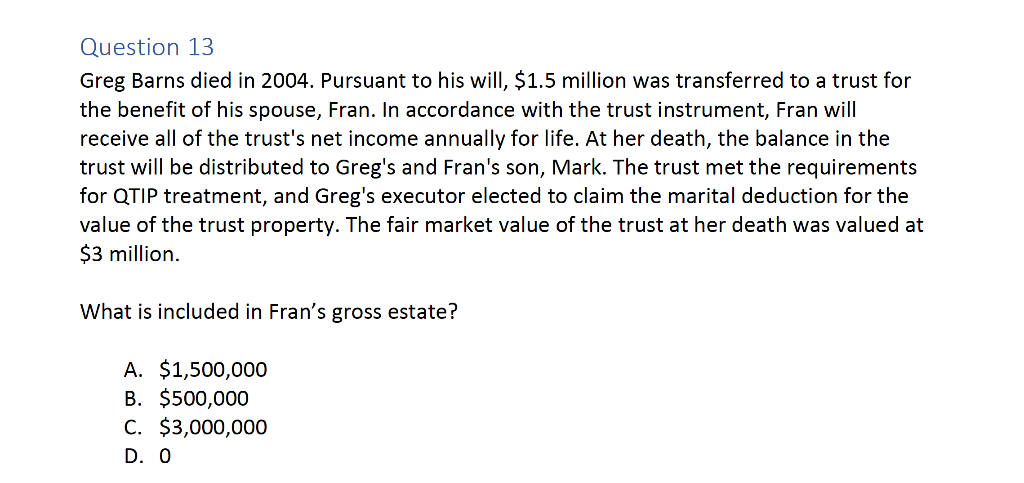

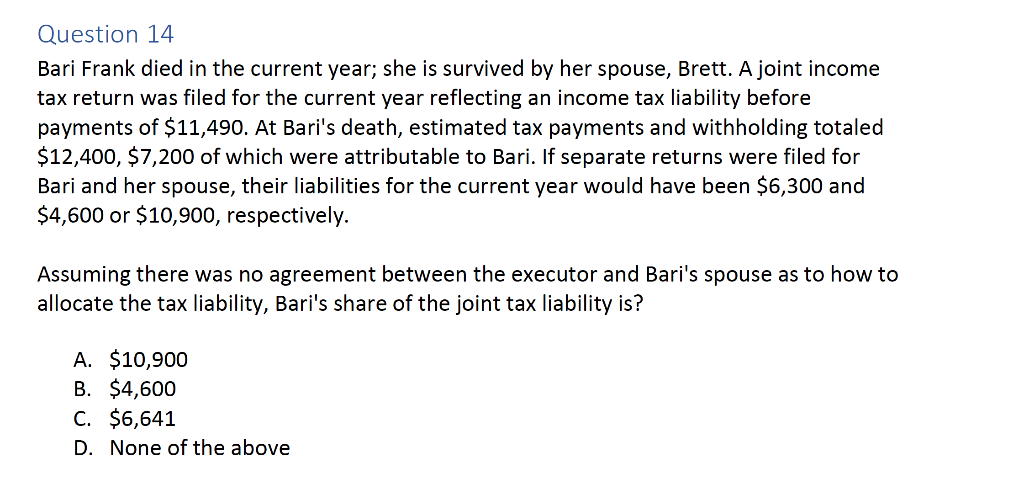

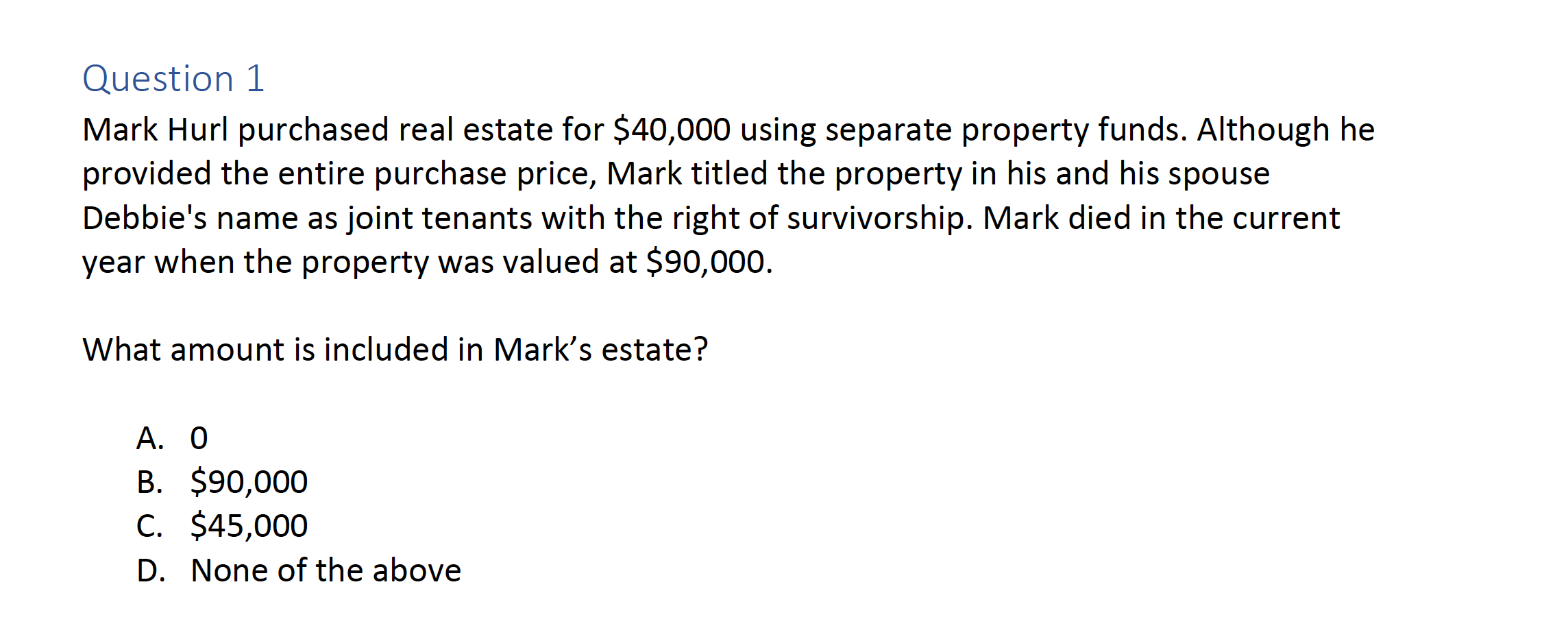

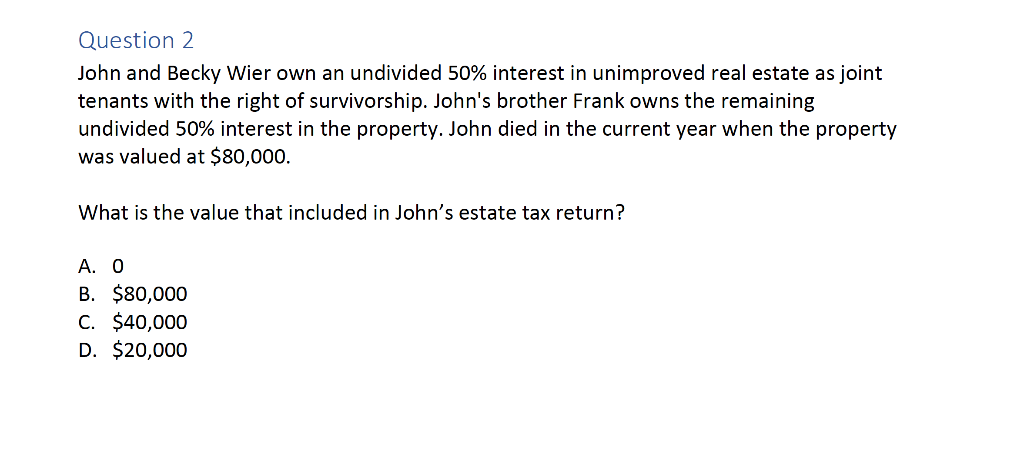

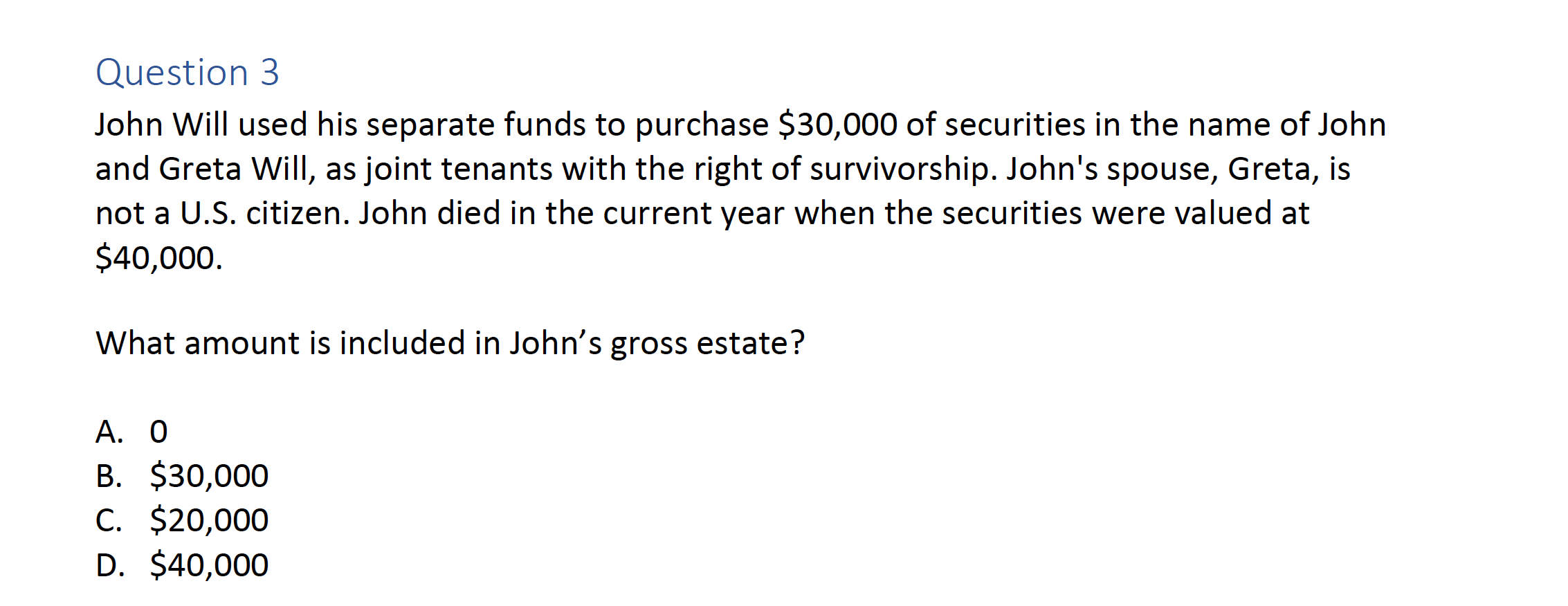

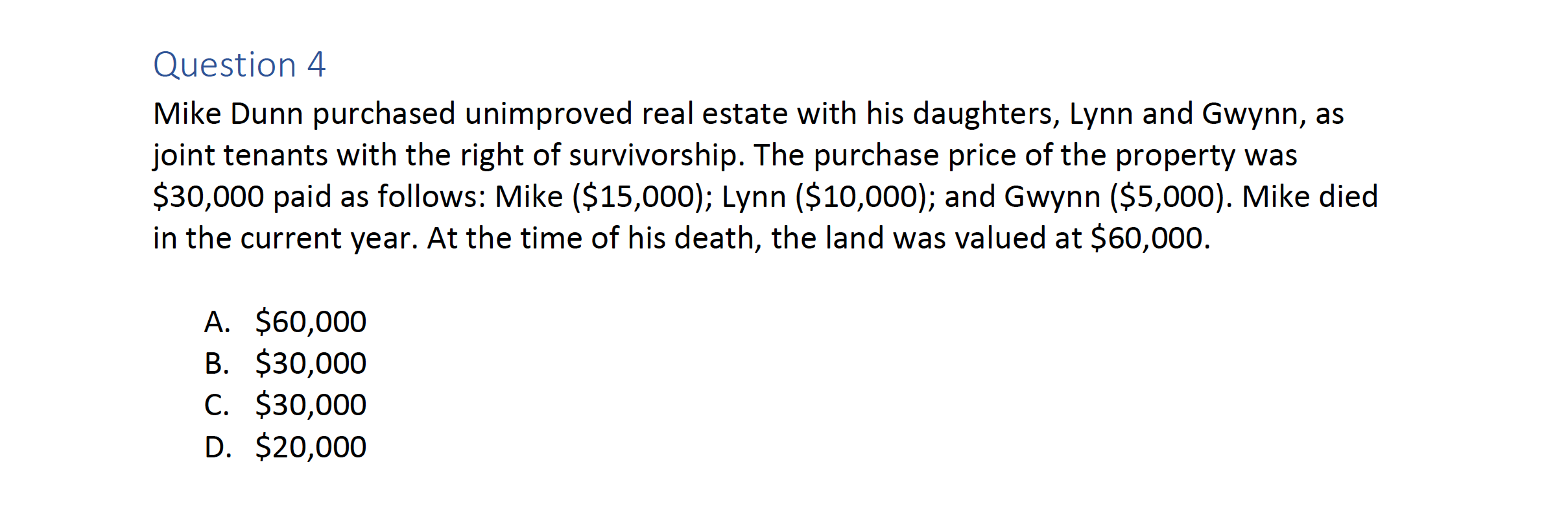

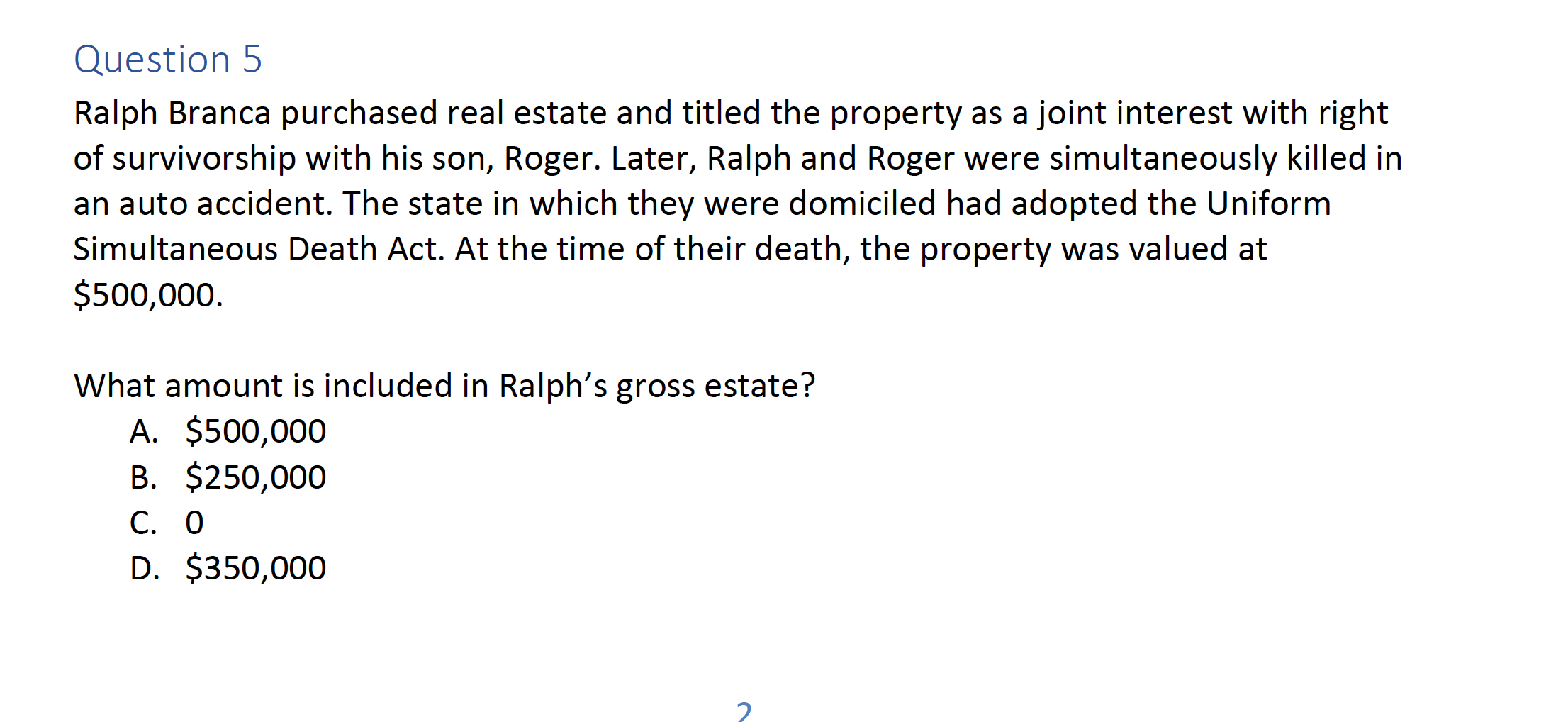

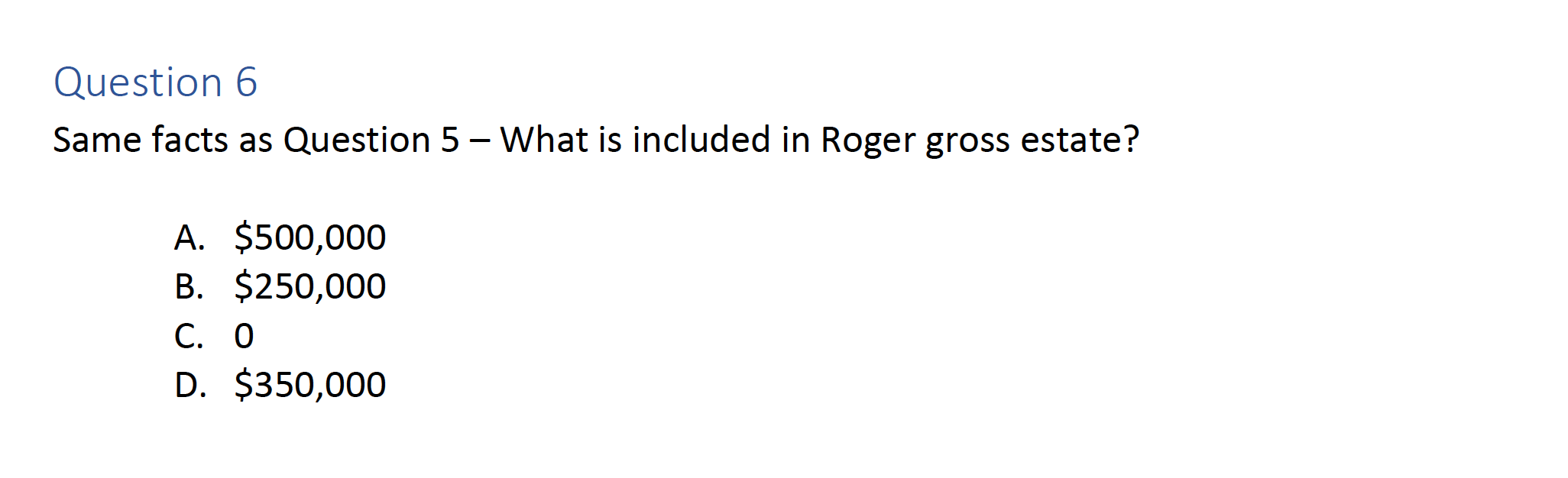

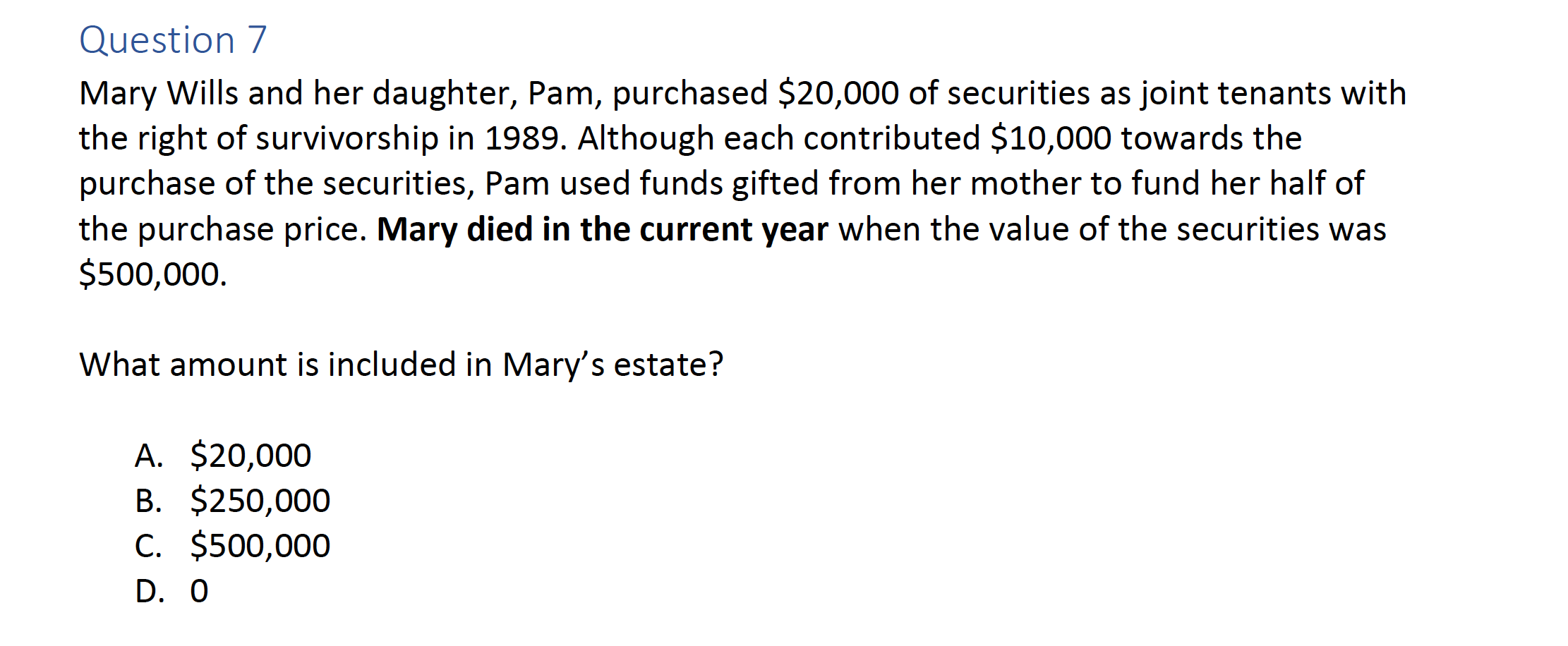

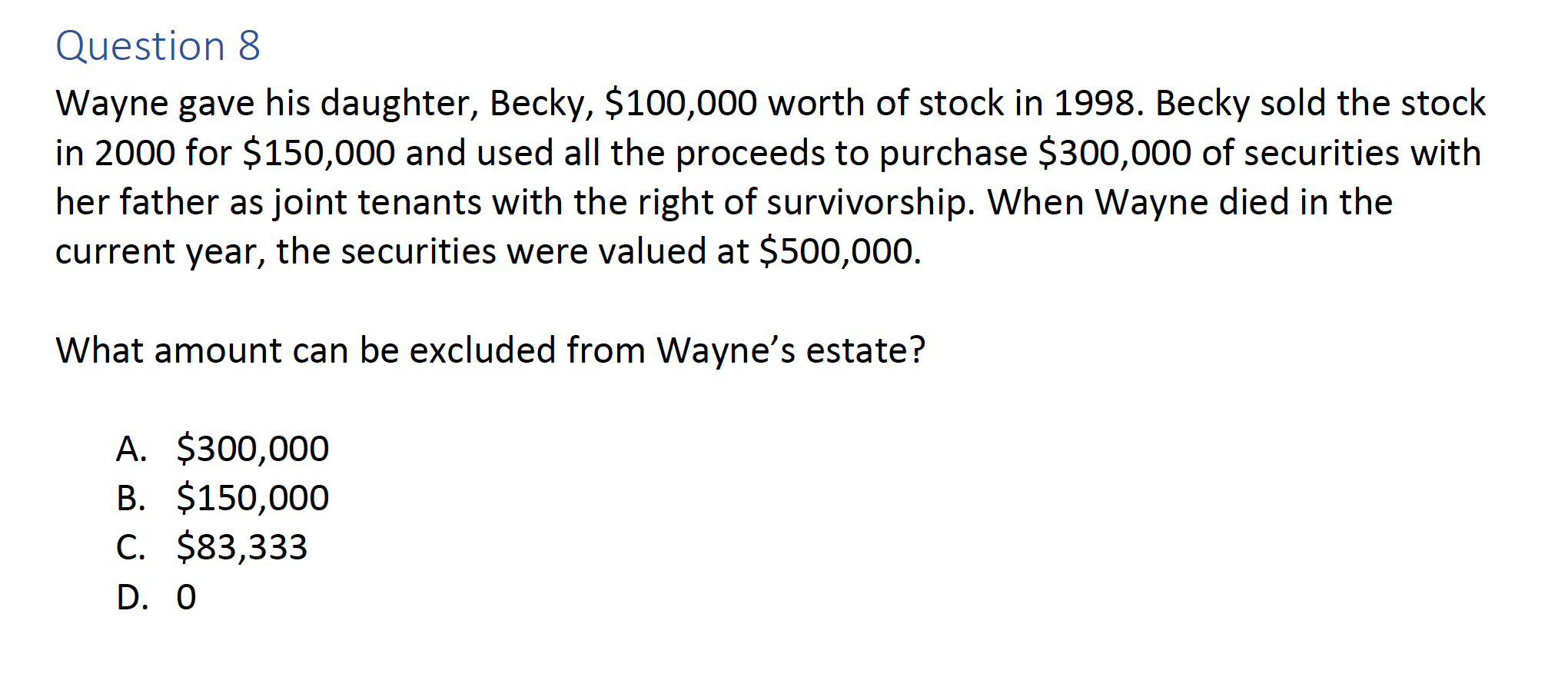

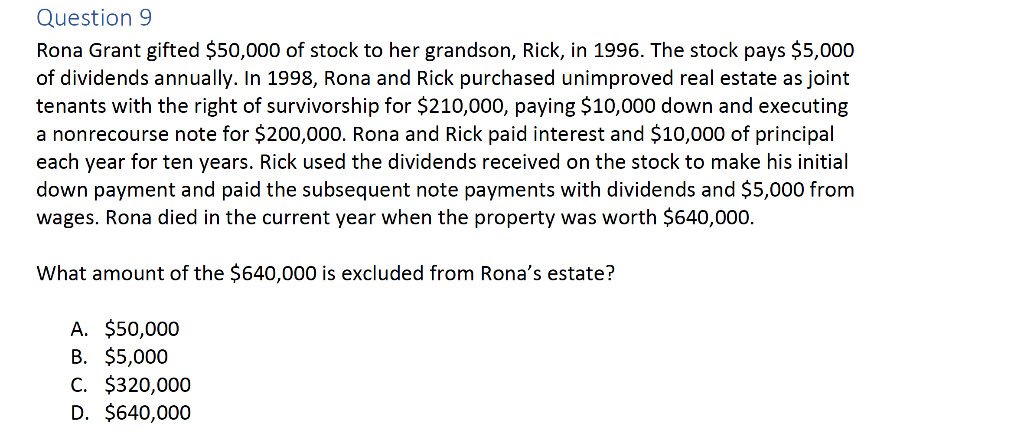

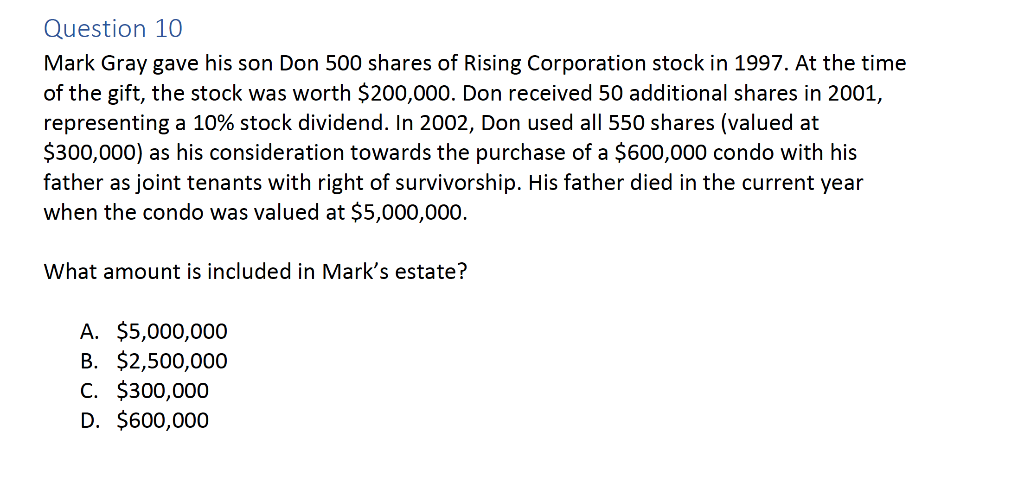

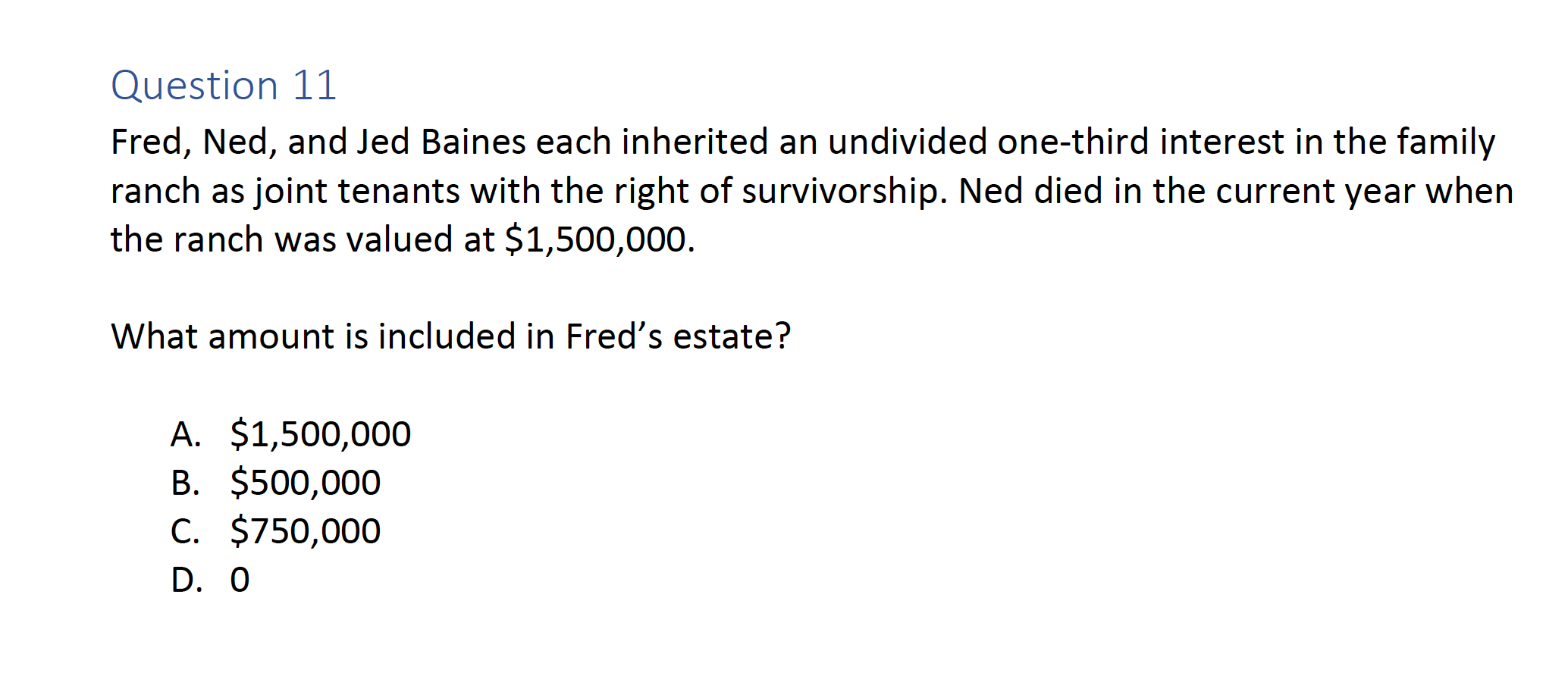

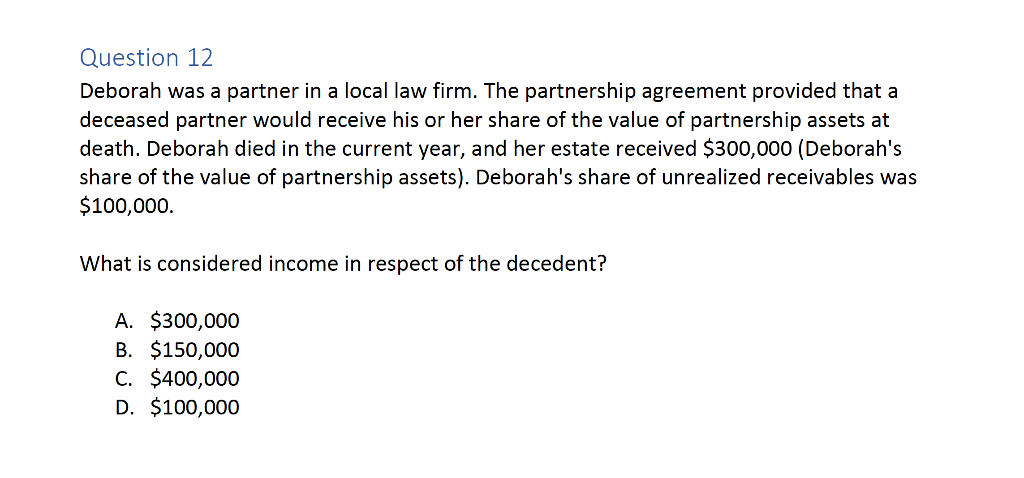

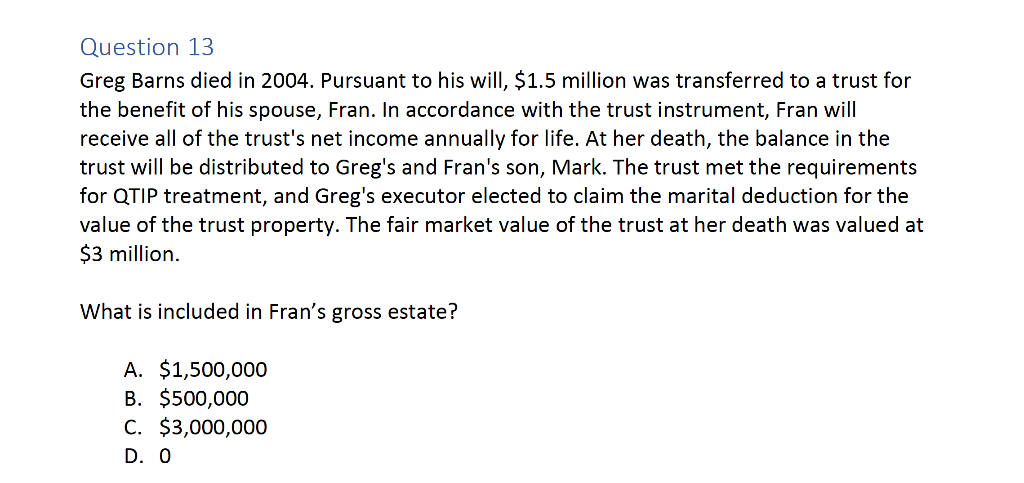

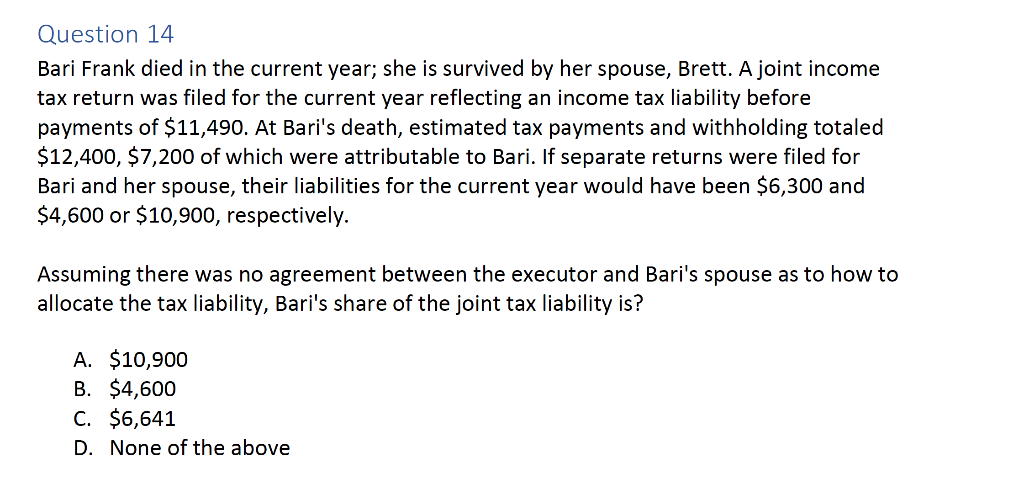

Question 1 Mark Hurl purchased real estate for $40,000 using separate property funds. Although he provided the entire purchase price, Mark titled the property in his and his spouse Debbie's name as joint tenants with the right of survivorship. Mark died in the current year when the property was valued at $90,000. What amount is included in Mark's estate? A. 0 B. $90,000 C. $45,000 D. None of the above Question 2 John and Becky Wier own an undivided 50% interest in unimproved real estate as joint tenants with the right of survivorship. John's brother Frank owns the remaining undivided 50% interest in the property. John died in the current year when the property was valued at $80,000. What is the value that included in John's estate tax return? A. 0 B. $80,000 C. $40,000 D. $20,000 Question 3 John Will used his separate funds to purchase $30,000 of securities in the name of John and Greta Will, as joint tenants with the right of survivorship. John's spouse, Greta, is not a U.S. citizen. John died in the current year when the securities were valued at $40,000. What amount is included in John's gross estate? A. 0 B. $30,000 C. $20,000 D. $40,000 Question 4 Mike Dunn purchased unimproved real estate with his daughters, Lynn and Gwynn, as joint tenants with the right of survivorship. The purchase price of the property was $30,000 paid as follows: Mike ($15,000); Lynn ($10,000); and Gwynn ($5,000). Mike died in the current year. At the time of his death, the land was valued at $60,000. A. $60,000 B. $30,000 C. $30,000 D. $20,000 Question 5 Ralph Branca purchased real estate and titled the property as a joint interest with right of survivorship with his son, Roger. Later, Ralph and Roger were simultaneously killed in an auto accident. The state in which they were domiciled had adopted the Uniform Simultaneous Death Act. At the time of their death, the property was valued at $500,000. What amount is included in Ralph's gross estate? A. $500,000 B. $250,000 C. 0 D. $350,000 Question 6 Same facts as Question 5 - What is included in Roger gross estate? A. $500,000 B. $250,000 C. 0 D. $350,000 Question 7 Mary Wills and her daughter, Pam, purchased $20,000 of securities as joint tenants with the right of survivorship in 1989. Although each contributed $10,000 towards the purchase of the securities, Pam used funds gifted from her mother to fund her half of the purchase price. Mary died in the current year when the value of the securities was $500,000. What amount is included in Mary's estate? A. $20,000 B. $250,000 C. $500,000 D. 0 Question 8 Wayne gave his daughter, Becky, $100,000 worth of stock in 1998. Becky sold the stock in 2000 for $150,000 and used all the proceeds to purchase $300,000 of securities with her father as joint tenants with the right of survivorship. When Wayne died in the current year, the securities were valued at $500,000. What amount can be excluded from Wayne's estate? A. $300,000 B. $150,000 C. $83,333 D. 0 Question 9 Rona Grant gifted $50,000 of stock to her grandson, Rick, in 1996. The stock pays $5,000 of dividends annually. In 1998, Rona and Rick purchased unimproved real estate as joint tenants with the right of survivorship for $210,000, paying $10,000 down and executing a nonrecourse note for $200,000. Rona and Rick paid interest and $10,000 of principal each year for ten years. Rick used the dividends received on the stock to make his initial down payment and paid the subsequent note payments with dividends and $5,000 from wages. Rona died in the current year when the property was worth $640,000. What amount of the $640,000 is excluded from Rona's estate? A. $50,000 B. $5,000 C. $320,000 D. $640,000 Question 10 Mark Gray gave his son Don 500 shares of Rising Corporation stock in 1997. At the time of the gift, the stock was worth $200,000. Don received 50 additional shares in 2001, representing a 10% stock dividend. In 2002, Don used all 550 shares (valued at $300,000) as his consideration towards the purchase of a $600,000 condo with his father as joint tenants with right of survivorship. His father died in the current year when the condo was valued at $5,000,000. What amount is included in Mark's estate? A. $5,000,000 B. $2,500,000 C. $300,000 D. $600,000 Question 11 Fred, Ned, and Jed Baines each inherited an undivided one-third interest in the family ranch as joint tenants with the right of survivorship. Ned died in the current year when the ranch was valued at $1,500,000. What amount is included in Fred's estate? A. $1,500,000 B. $500,000 C. $750,000 D. 0 Question 12 Deborah was a partner in a local law firm. The partnership agreement provided that a deceased partner would receive his or her share of the value of partnership assets at death. Deborah died in the current year, and her estate received $300,000 (Deborah's share of the value of partnership assets). Deborah's share of unrealized receivables was $100,000 What is considered income in respect of the decedent? A. $300,000 B. $150,000 C. $400,000 D. $100,000 Question 13 Greg Barns died in 2004. Pursuant to his will, $1.5 million was transferred to a trust for the benefit of his spouse, Fran. In accordance with the trust instrument, Fran will receive all of the trust's net income annually for life. At her death, the balance in the trust will be distributed to Greg's and Fran's son, Mark. The trust met the requirements for QTIP treatment, and Greg's executor elected to claim the marital deduction for the value of the trust property. The fair market value of the trust at her death was valued at $3 million. What is included in Fran's gross estate? A. $1,500,000 B. $500,000 C. $3,000,000 D. O Question 14 Bari Frank died in the current year; she is survived by her spouse, Brett. A joint income tax return was filed for the current year reflecting an income tax liability before payments of $11,490. At Bari's death, estimated tax payments and withholding totaled $12,400, $7,200 of which were attributable to Bari. If separate returns were filed for Bari and her spouse, their liabilities for the current year would have been $6,300 and $4,600 or $10,900, respectively. Assuming there was no agreement between the executor and Bari's spouse as to how to allocate the tax liability, Bari's share of the joint tax liability is? A. $10,900 B. $4,600 C. $6,641 D. None of the above