Mark is employed by ABC Ltd, a small family company, in which he holds 20,000 1 ordinary shares; the remaining 80% are held by

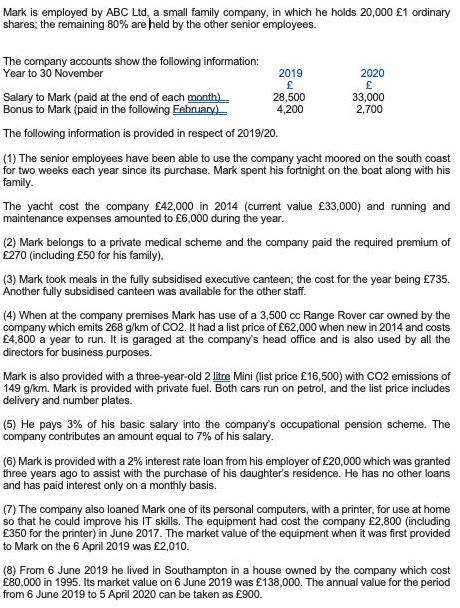

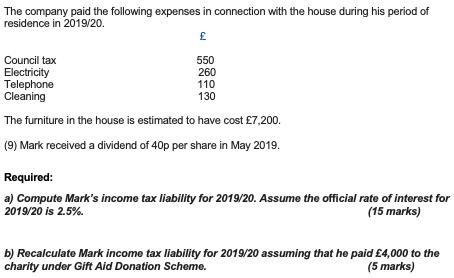

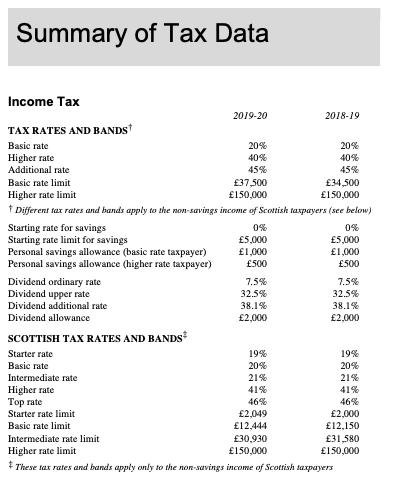

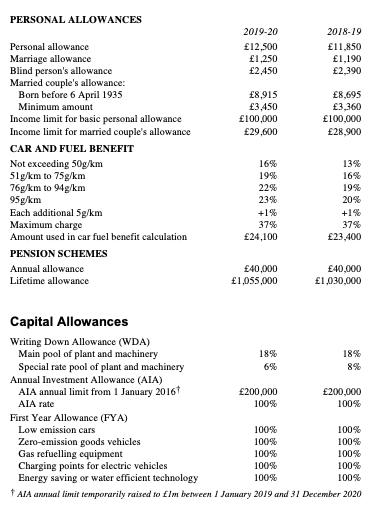

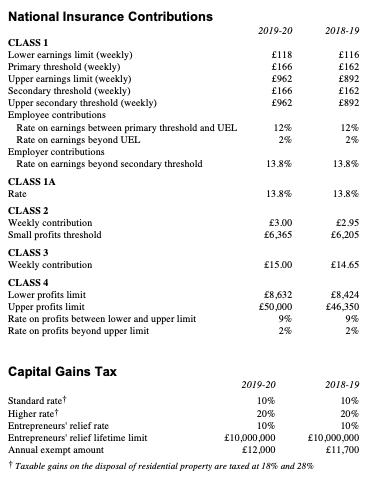

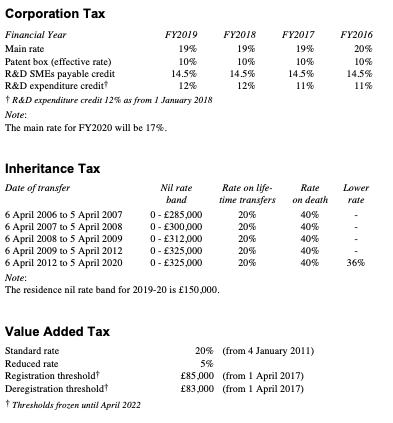

Mark is employed by ABC Ltd, a small family company, in which he holds 20,000 1 ordinary shares; the remaining 80% are held by the other senior employees. The company accounts show the following information: Year to 30 November 2019 2020 Salary to Mark (paid at the end of each month) Bonus to Mark (paid in the following Eehruary 28,500 4,200 33,000 2,700 The following information is provided in respect of 2019/20. (1) The senior employees have been able to use the company yacht moored on the south coast for two weeks each year since its purchase. Mark spent his fortnight on the boat along with his family. The yacht cost the company 42,000 in 2014 (current value 33,000) and running and maintenance expenses amounted to 6,000 during the year. (2) Mark belongs to a private medical scheme and the company paid the required premium of 270 (including 50 for his family), (3) Mark took meals in the fully subsidised executive canteen; the cost for the year being 735. Another fully subsidised canteen was available for the other staff. (4) When at the company premises Mark has use of a 3,500 cc Range Rover car owned by the company which emits 268 g/km of CO2. It had a list price of 62,000 when new in 2014 and costs 4,800 a year to run. It is garaged at the company's head office and is also used by all the directors for business purposes. Mark is also provided with a three-year-old 2 litre Mini (list price 16,500) with CO2 emissions of 149 g/km. Mark is provided with private fuel. Both cars run on petrol, and the list price includes delivery and number plates. (5) He pays 3% of his basic salary into the company's occupational pension scheme. The company contributes an amount equal to 7% of his salary. (6) Mark is provided with a 2% interest rate loan from his employer of 20,000 which was granted three years ago to assist with the purchase of his daughter's residence. He has no other loans and has paid interest only on a monthly basis. (7) The company also loaned Mark one of its personal computers, with a printer, for use at home so that he could improve his IT skills. The equipment had cost the company 2,800 (including 350 for the printer) in June 2017. The market value of the equipment when it was first provided to Mark on the 6 April 2019 was 2,010. (8) From 6 June 2019 he lived in Southampton in a house owned by the company which cost 80,000 in 1995. Its market value on 6 June 2019 was 138,000. The annual value for the period from 6 June 2019 to 5 April 2020 can be taken as 900. The company paid the following expenses in connection with the house during his period of residence in 2019/20. Council tax 550 Electricity Telephone Cleaning 260 110 130 The furniture in the house is estimated to have cost 7,200. (9) Mark received a dividend of 40p per share in May 2019. Required: a) Compute Mark's income tax liability for 2019/20. Assume the official rate of interest for 2019/20 is 2.5%. (15 marks) b) Recalculate Mark income tax liability for 2019/20 assuming that he paid 4,000 to the charity under Gift Aid Donation Scheme. (5 marks) Summary of Tax Data Income Tax 2019-20 2018-19 TAX RATES AND BANDS Basic rate 20% 20% Higher rate 40% 40% Additional rate 45% 45% Basic rate limit 37,500 34,500 150,000 Higher rate limit 150,000 f Different tax rates and bands apply to the non-savings income of Scottish taxpayers (see below) Starting rate for savings Starting rate limit for savings Personal savings allowance (basic rate taxpayer) Personal savings allowance (higher rate taxpayer) 0% 5,000 1,000 0% 5,000 1,000 500 500 Dividend ordinary rate Dividend upper rate 7.5% 7.5% 32.5% 38.1% 32.5% 38.1% 2,000 Dividend additional rate Dividend allowance 2,000 SCOTTISH TAX RATES AND BANDS Starter rate 19% 19% Basic rate 20% 20% Intermediate rate 21% 21% Higher rate Top rate Starter rate limit 41% 46% 2,000 12,150 41% 46% 2,049 Basic rate limit 12,444 Intermediate rate limit 30,930 150,000 31,580 150,000 Higher rate limit F These tax rates and bands apply only to the non-savings income of Scottish taxpayers PERSONAL ALLOWANCES 2019-20 2018-19 Personal allowance 12,500 1,250 2,450 11,850 1,190 2,390 Marriage allowance Blind person's allowance Married couple's allowance: Born before 6 April 1935 Minimum amount Income limit for basic personal allowance Income limit for married couple's allowance 8,915 3,450 100,000 8,695 3,360 100,000 29,600 28,900 CAR AND FUEL BENEFIT Not exceeding 50g/km 51g/km to 75g/km 76g/km to 94g/km 95g/km Each additional 5g/km Maximum charge Amount used in car fuel benefit calculation 16% 13% 16% 19% 22% 19% 23% 20% +1% +1% 37% 37% 24,100 23,400 PENSION SCHEMES Annual allowance 40,000 40,000 1,030,000 Lifetime allowance 1,055,000 Capital Allowances Writing Down Allowance (WDA) Main pool of plant and machinery 18% 18% Special rate pool of plant and machinery Annual Investment Allowance (AIA) AIA annual limit from 1 January 2016 6% 8% 200,000 200,000 AIA rate 100% 100% First Year Allowance (FYA) Low emission cars 100% 100% Zero-emission goods vehicles Gas refuelling equipment Charging points for electric vehicles Energy saving or water efficient technology 100% 100% 100% 100% 100% 100% 100% 100% AIA annual limit temporarily raised to Elm between I January 2019 and 31 December 2020 National Insurance Contributions 2019-20 2018-19 CLASS I Lower earnings limit (weekly) Primary threshold (weekly) Upper earnings limit (weekly) Secondary threshold (weekly) Upper secondary threshold (weekly) Employee contributions Rate on earnings between primary threshold and UEL Rate on earnings beyond UEL Employer contributions Rate on earnings beyond secondary threshold 118 116 166 162 962 892 166 162 962 892 12% 12% 2% 2% 13.8% 13.8% CLASS 1A Rate 13.8% 13.8% CLASS 2 Weekly contribution Small profits threshold 3.00 2.95 6,205 6,365 CLASS 3 Weekly contribution 15.00 14.65 CLASS 4 Lower profits limit Upper profits limit Rate on profits between lower and upper limit Rate on profits beyond upper limit 8,632 50,000 8,424 46,350 9% 2% 9% 2% Capital Gains Tax 2019-20 2018-19 Standard ratet Higher ratet Entrepreneurs' relief rate Entrepreneurs' relief lifetime limi Annual exempt amount 10% 10% 20% 20% 10% 10,000,000 11,700 10% 10,000,000 12,000 f Taxable gains on the disposal of residential property are taxed at 18% and 28% Corporation Tax Financial Year FY2019 FY2018 FY2017 FY2016 Main rate 19% 19% 19% 20% Patent box (effective rate) R&D SMES payable credit R&D expenditure credit t R&D expenditure credit 12% as from 1 Jannary 2018 10% 10% 10% 10% 14.5% 14.5% 14.5% 14.5% 12% 12% 11% 11% Note: The main rate for FY2020 will be 17%. Inheritance Tax Date of transfer Nil rate Rate on life- time transfers on death Rate Lower band rate 6 April 2006 to 5 April 2007 6 April 2007 to 5 April 2008 6 April 2008 to 5 April 2009 6 April 2009 to 5 April 2012 6 April 2012 to 5 April 2020 0 - 285,000 0- 300,000 0- 312,000 0- 325,000 0- 325,000 20% 40% 20% 40% 20% 40% 20% 40% 20% 40% 36% Note: The residence nil rate band for 2019-20 is 150,000. Value Added Tax Standard rate 20% (from 4 January 2011) Reduced rate 5% Registration thresholdt Deregistration thresholdt 85,000 (from I April 2017) 83,000 (from 1 April 2017) f Thresholds frozen until April 2022

Step by Step Solution

3.57 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started