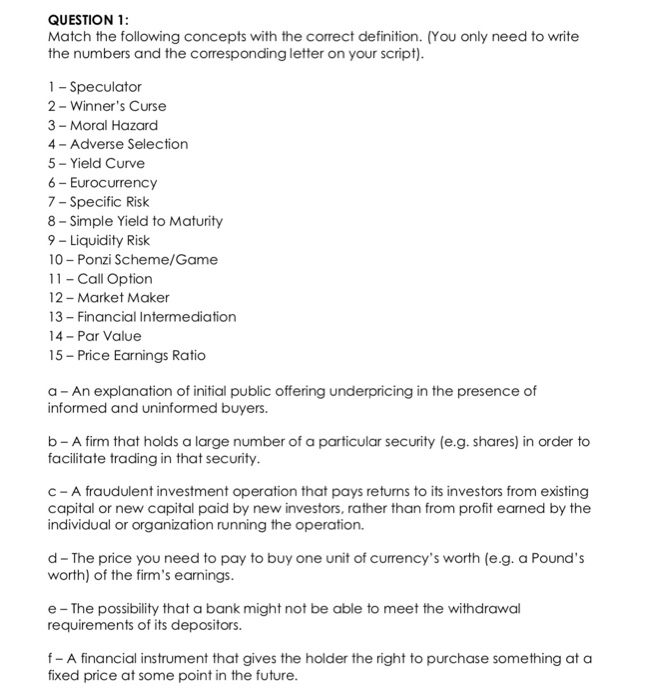

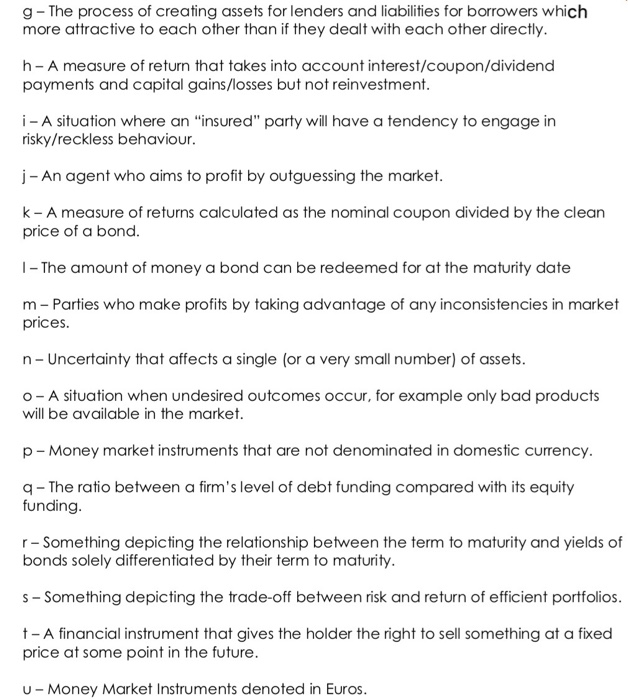

QUESTION 1 Match the following concepts with the correct definition. (You only need to write the numbers and the corresponding letter on your script) 1 -Speculator 2 - Winner's Curse 3- Moral Hazard 4 - Adverse Selection 5 - Yield Curve 6- Eurocurrency 7 - Specific Risk 8- Simple Yield to Maturity 9 - Liquidity Risk 10 Ponzi Scheme/Game 11 - Call Option 12 Market Maker 13- Financial Intermediation 14-Par Value 15 - Price Earnings Ratio a - An explanation of initial public offering underpricing in the presence of informed and uninformed b Uyers b - A firm that holds a large number of a particular security (e.g. shares) in order to facilitate trading in that security c - A fraudulent investment operation that pays returns to its investors from existing capital or new capital paid by new investors, rather than from profit earned by the individual or organization running the operation. d - The price you need to pay to buy one unit of currency's worth (e.g. a Pound's worth) of the firm's earnings e The possibility that a bank might not be able to meet the withdrawal requirements of its depositors. f - A financial instrument that gives the holder the right to purchase something ata fixed price at some point in the future g - The process of creating assets for lenders and liabilities for borrowers which more attractive to each other than if they dealt with each other directly. h- A measure of return that takes into account interest/coupon/dividend payments and capital gains/losses but not reinvestment. i-A situation where an "insured" party will have a tendency to engage in risky/reckless behaviour. j - An agent who aims to profit by outguessing the market. k - A measure of returns calculated as the nominal coupon divided by the clean price of a bond. I- The amount of money a bond can be redeemed for at the maturity date m - Parties who make profits by taking advantage of any inconsistencies in market prices n - Uncertainty that affects a single (or a very small number) of assets. o - A situation when undesired outcomes occur, for example only bad products will be available in the market. p- Money market instruments that are not denominated in domestic currency. q The ratio between a firm's level of debt funding compared with its equity funding r- Something depicting the relationship between the term to maturity and yields of bonds solely differentiated by their term to maturity s- Something depicting the trade-off between risk and return of efficient portfolios. t- A financial instrument that gives the holder the right to sell something at a fixed price at some point in the future u- Money Market Instruments denoted in Euros