Question

Question 1 . Michael and Jordan who have a co partnership have purchased a machine worth $ 5 1 , 0 0 0 . ?The

Question . Michael and Jordan who have a co partnership have purchased a machine worth $ ?The machine is expected to have a salvage value of $ ?at the end of its ?Year Useful Ufe with an expected usage of ?hours.?

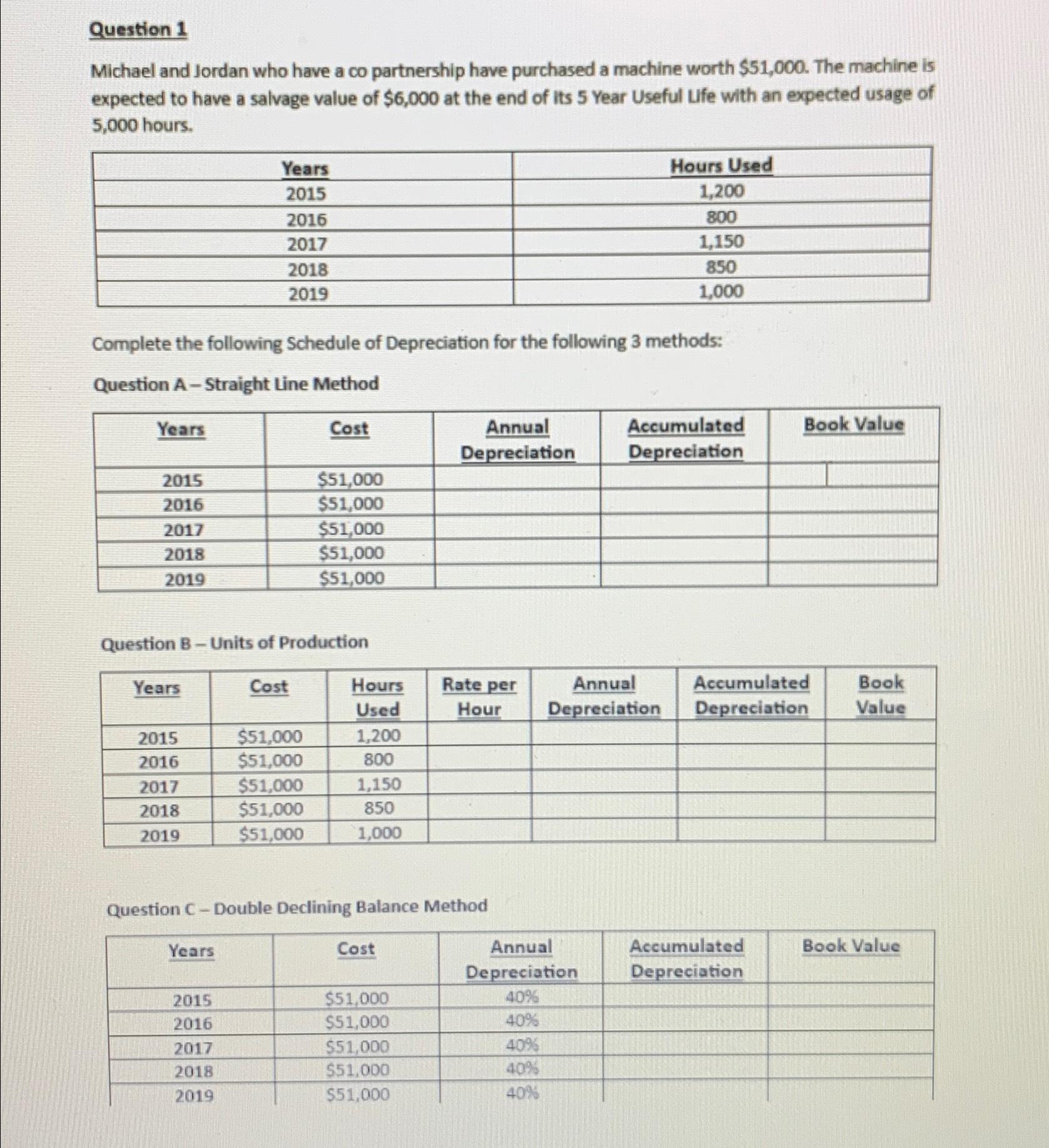

tableYearsHours Used Complete the following Schedule of Depreciation for the following ?methods:

Question A ?Straight Line Method tableYearsCost,tableAnnualDepreciationtableAccumulatedDepreciationtableBook Value$$$$$

Question B ?Units of ProductiontableYearsCost,tableAnnualDepreciationtableAccumulatedDepreciationtableBookValue$$$$$ Question C ?Double Declining Balance Method

tableYearsCost,tableAnnualDepreciationtableAccumulatedDepreciationBook Value$$$$$

Question 1 Michael and Jordan who have a co partnership have purchased a machine worth $51,000. The machine is expected to have a salvage value of $6,000 at the end of its 5 Year Useful Life with an expected usage of 5,000 hours. Years 2015 2016 2017 2018 2019 Hours Used 1,200 800 1,150 850 1,000 Complete the following Schedule of Depreciation for the following 3 methods: Question A Straight Line Method Years Cost Annual Depreciation Accumulated Depreciation Book Value 2015 $51,000 2016 $51,000 2017 $51,000 2018 $51,000 2019 $51,000 Question B-Units of Production Years Cost Hours Rate per Annual Accumulated Book Used Hour Depreciation Depreciation Value 2015 $51,000 1,200 2016 $51,000 800 2017 $51,000 1,150 2018 $51,000 850 2019 $51,000 1,000 Question C-Double Declining Balance Method Years Cost 2015 $51,000 Annual Depreciation 40% Accumulated Depreciation Book Value 2016 $51,000 40% 2017 $51,000 40% 2018 $51,000 40% 2019 $51,000 40%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Question A Straight Line Method YearsCostAnnual DepreciationAccumulated DepreciationBook Value 20155...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started