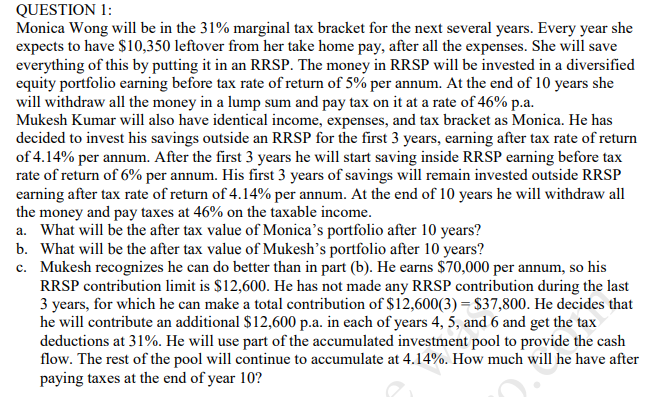

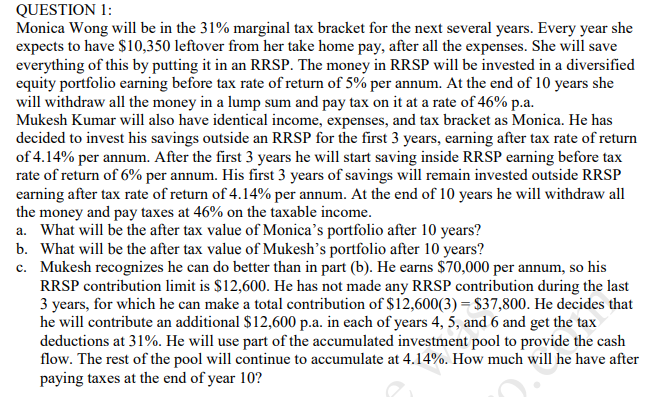

QUESTION 1: Monica Wong will be in the 31% marginal tax bracket for the next several years. Every year she expects to have $10,350 leftover from her take home pay, after all the expenses. She will save everything of this by putting it in an RRSP. The money in RRSP will be invested in a diversified equity portfolio earning before tax rate of return of 5% per annum. At the end of 10 years she will withdraw all the money in a lump sum and pay tax on it at a rate of 46% p.a. Mukesh Kumar will also have identical income, expenses, and tax bracket as Monica. He has decided to invest his savings outside an RRSP for the first 3 years, earning after tax rate of return of 4.14% per annum. After the first 3 years he will start saving inside RRSP earning before tax rate of return of 6% per annum. His first 3 years of savings will remain invested outside RRSP earning after tax rate of return of 4.14% per annum. At the end of 10 years he will withdraw all the money and pay taxes at 46% on the taxable income. a. What will be the after tax value of Monica's portfolio after 10 years? b. What will be the after tax value of Mukesh's portfolio after 10 years? c. Mukesh recognizes he can do better than in part (b). He earns $70,000 per annum, so his RRSP contribution limit is $12,600. He has not made any RRSP contribution during the last 3 years, for which he can make a total contribution of $12,600(3) = $37,800. He decides that he will contribute an additional $12,600 p.a. in each of years 4, 5, and 6 and get the tax deductions at 31%. He will use part of the accumulated investment pool to provide the cash flow. The rest of the pool will continue to accumulate at 4.14%. How much will he have after paying taxes at the end of year 10? QUESTION 1: Monica Wong will be in the 31% marginal tax bracket for the next several years. Every year she expects to have $10,350 leftover from her take home pay, after all the expenses. She will save everything of this by putting it in an RRSP. The money in RRSP will be invested in a diversified equity portfolio earning before tax rate of return of 5% per annum. At the end of 10 years she will withdraw all the money in a lump sum and pay tax on it at a rate of 46% p.a. Mukesh Kumar will also have identical income, expenses, and tax bracket as Monica. He has decided to invest his savings outside an RRSP for the first 3 years, earning after tax rate of return of 4.14% per annum. After the first 3 years he will start saving inside RRSP earning before tax rate of return of 6% per annum. His first 3 years of savings will remain invested outside RRSP earning after tax rate of return of 4.14% per annum. At the end of 10 years he will withdraw all the money and pay taxes at 46% on the taxable income. a. What will be the after tax value of Monica's portfolio after 10 years? b. What will be the after tax value of Mukesh's portfolio after 10 years? c. Mukesh recognizes he can do better than in part (b). He earns $70,000 per annum, so his RRSP contribution limit is $12,600. He has not made any RRSP contribution during the last 3 years, for which he can make a total contribution of $12,600(3) = $37,800. He decides that he will contribute an additional $12,600 p.a. in each of years 4, 5, and 6 and get the tax deductions at 31%. He will use part of the accumulated investment pool to provide the cash flow. The rest of the pool will continue to accumulate at 4.14%. How much will he have after paying taxes at the end of year 10