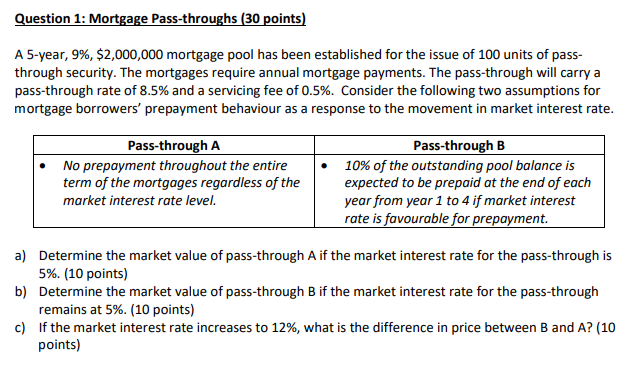

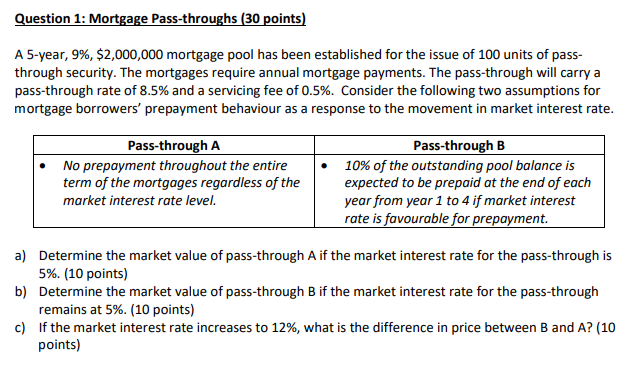

Question 1: Mortgage Pass-throughs (30 points) A 5-year, 9%, $2,000,000 mortgage pool has been established for the issue of 100 units of pass- through security. The mortgages require annual mortgage payments. The pass-through will carry a pass-through rate of 8.5% and a servicing fee of 0.5%. Consider the following two assumptions for mortgage borrowers' prepayment behaviour as a response to the movement in market interest rate. Pass-through A No prepayment throughout the entire term of the mortgages regardless of the market interest rate level. Pass-through B 10% of the outstanding pool balance is expected to be prepaid at the end of each year from year 1 to 4 if market interest rate is favourable for prepayment. a) Determine the market value of pass-through A if the market interest rate for the pass-through is 5%. (10 points) b) Determine the market value of pass-through B if the market interest rate for the pass-through remains at 5%. (10 points) c) If the market interest rate increases to 12%, what is the difference in price between B and A? (10 points) Question 1: Mortgage Pass-throughs (30 points) A 5-year, 9%, $2,000,000 mortgage pool has been established for the issue of 100 units of pass- through security. The mortgages require annual mortgage payments. The pass-through will carry a pass-through rate of 8.5% and a servicing fee of 0.5%. Consider the following two assumptions for mortgage borrowers' prepayment behaviour as a response to the movement in market interest rate. Pass-through A No prepayment throughout the entire term of the mortgages regardless of the market interest rate level. Pass-through B 10% of the outstanding pool balance is expected to be prepaid at the end of each year from year 1 to 4 if market interest rate is favourable for prepayment. a) Determine the market value of pass-through A if the market interest rate for the pass-through is 5%. (10 points) b) Determine the market value of pass-through B if the market interest rate for the pass-through remains at 5%. (10 points) c) If the market interest rate increases to 12%, what is the difference in price between B and A? (10 points)