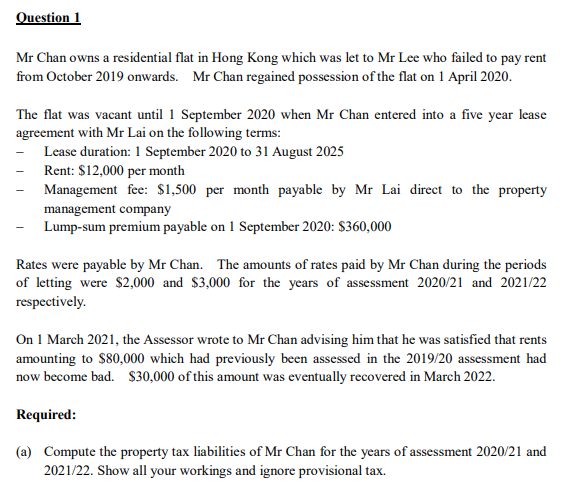

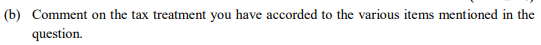

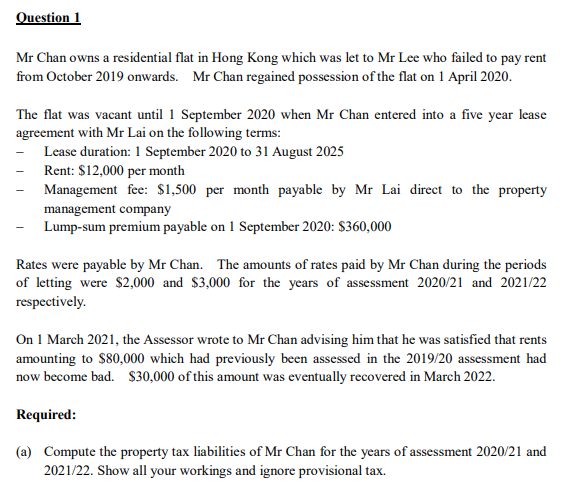

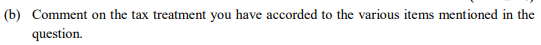

Question 1 Mr Chan owns a residential flat in Hong Kong which was let to Mr Lee who failed to pay rent from October 2019 onwards. Mr Chan regained possession of the flat on 1 April 2020. The flat was vacant until 1 September 2020 when Mr Chan entered into a five year lease agreement with Mr Lai on the following terms: Lease duration: 1 September 2020 to 31 August 2025 Rent: $12,000 per month Management fee: $1,500 per month payable by Mr Lai direct to the property management company Lump-sum premium payable on 1 September 2020: $360,000 - Rates were payable by Mr Chan. The amounts of rates paid by Mr Chan during the periods of letting were $2,000 and $3,000 for the years of assessment 2020/21 and 2021/22 respectively. On 1 March 2021, the Assessor wrote to Mr Chan advising him that he was satisfied that rents amounting to $80,000 which had previously been assessed in the 2019/20 assessment had now become bad. $30,000 of this amount was eventually recovered in March 2022. Required: (a) Compute the property tax liabilities of Mr Chan for the years of assessment 2020/21 and 2021/22. Show all your workings and ignore provisional tax. (b) Comment on the tax treatment you have accorded to the various items mentioned in the question. Question 1 Mr Chan owns a residential flat in Hong Kong which was let to Mr Lee who failed to pay rent from October 2019 onwards. Mr Chan regained possession of the flat on 1 April 2020. The flat was vacant until 1 September 2020 when Mr Chan entered into a five year lease agreement with Mr Lai on the following terms: Lease duration: 1 September 2020 to 31 August 2025 Rent: $12,000 per month Management fee: $1,500 per month payable by Mr Lai direct to the property management company Lump-sum premium payable on 1 September 2020: $360,000 - Rates were payable by Mr Chan. The amounts of rates paid by Mr Chan during the periods of letting were $2,000 and $3,000 for the years of assessment 2020/21 and 2021/22 respectively. On 1 March 2021, the Assessor wrote to Mr Chan advising him that he was satisfied that rents amounting to $80,000 which had previously been assessed in the 2019/20 assessment had now become bad. $30,000 of this amount was eventually recovered in March 2022. Required: (a) Compute the property tax liabilities of Mr Chan for the years of assessment 2020/21 and 2021/22. Show all your workings and ignore provisional tax. (b) Comment on the tax treatment you have accorded to the various items mentioned in the