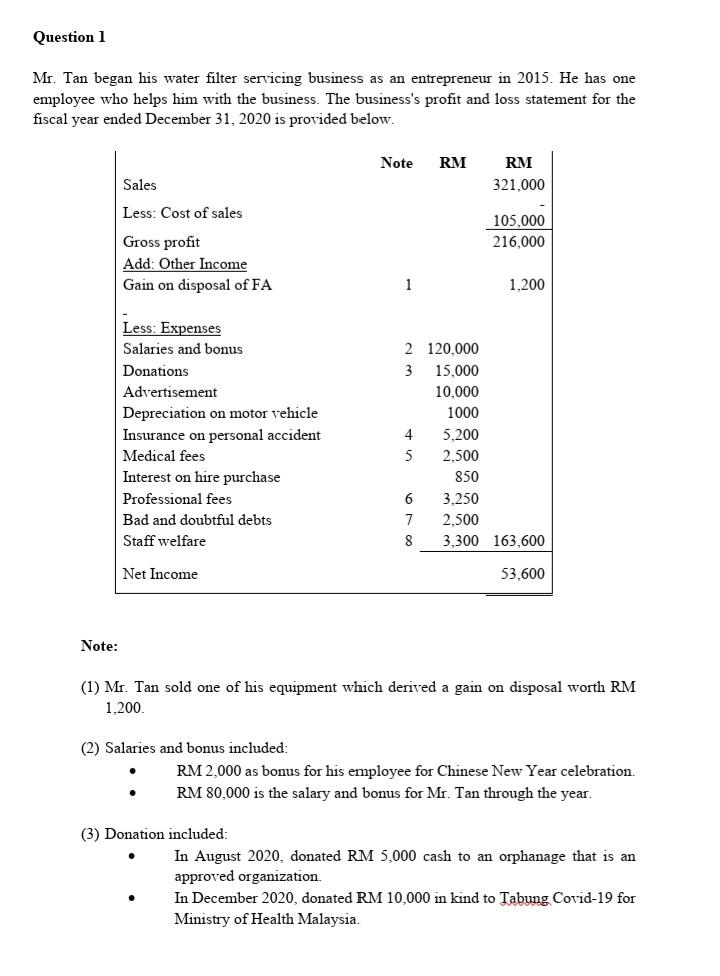

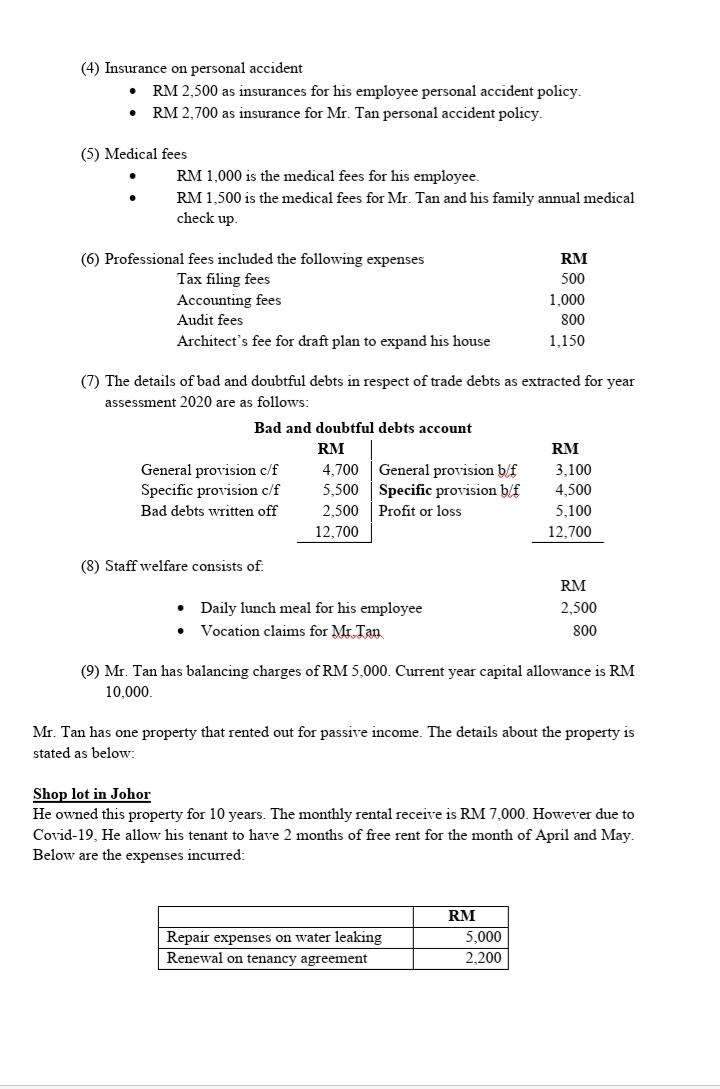

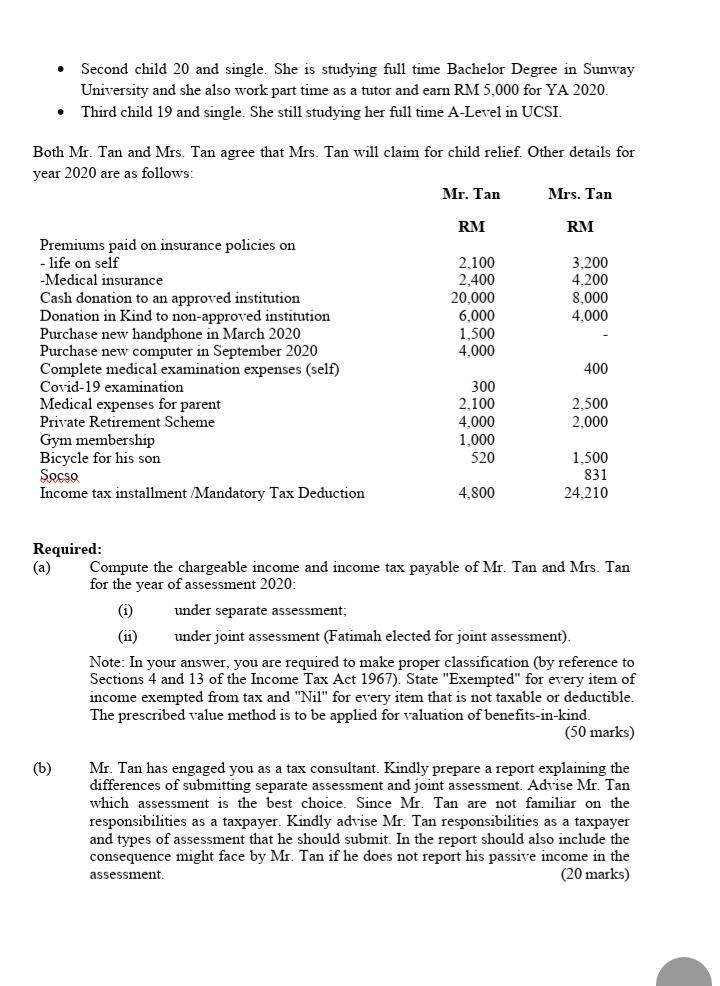

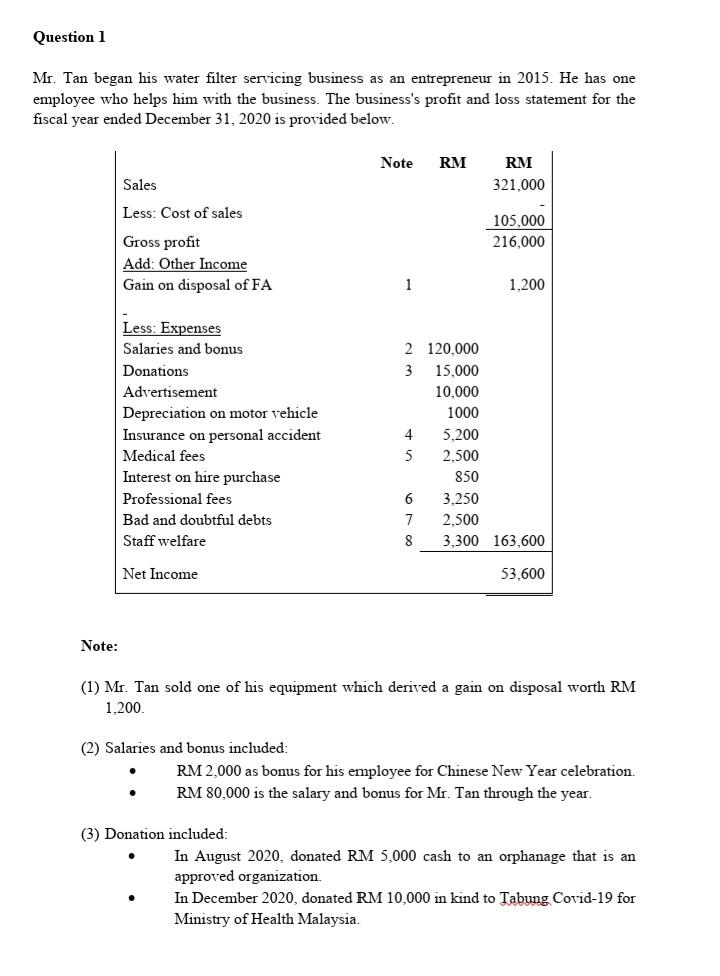

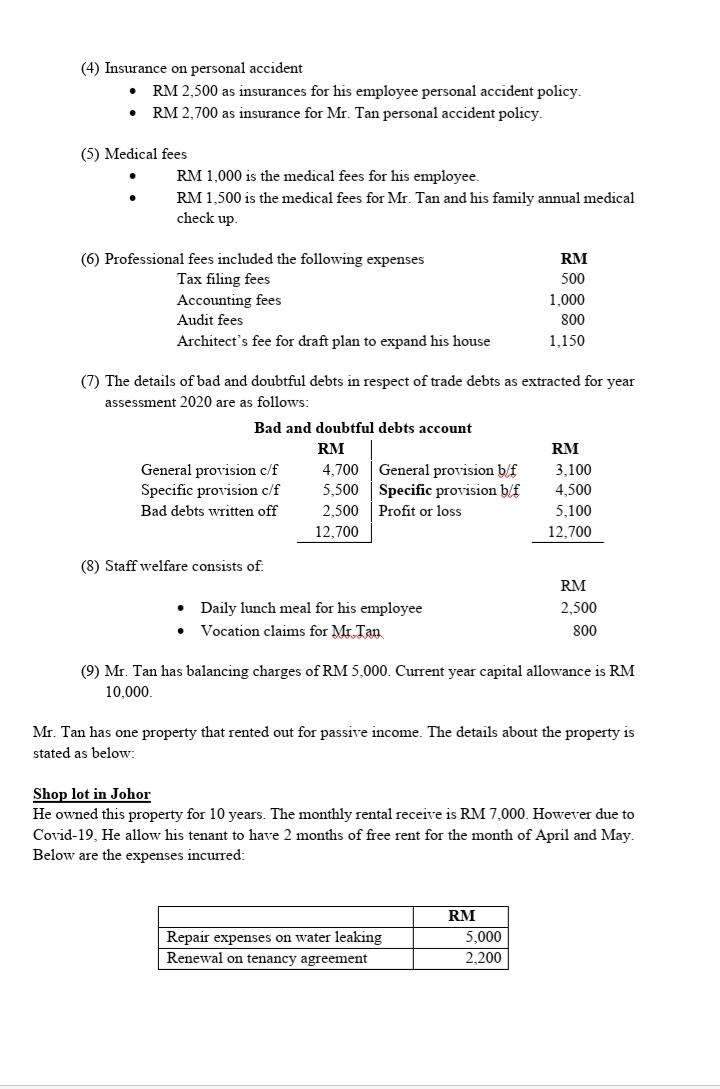

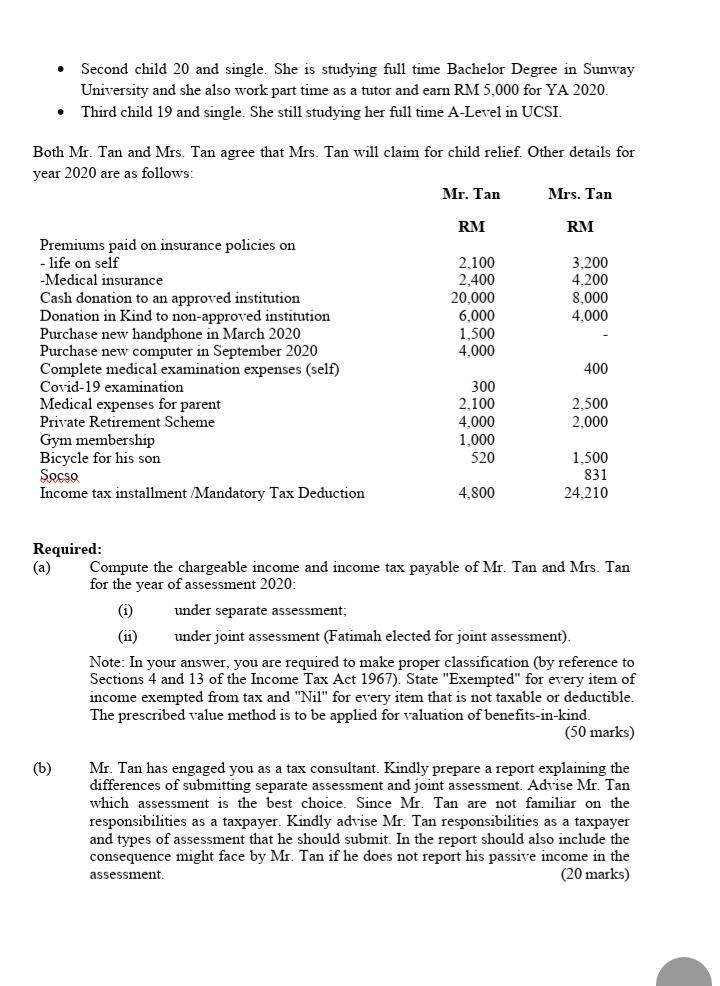

Question 1 Mr. Tan began his water filter servicing business as an entrepreneur in 2015. He has one employee who helps him with the business. The business's profit and loss statement for the fiscal year ended December 31, 2020 is provided below. Note RM RM 321,000 Sales Less: Cost of sales 105,000 216,000 Gross profit Add: Other Income Gain on disposal of FA 1 1,200 Less: Expenses Salaries and bonus Donations Advertisement Depreciation on motor vehicle Insurance on personal accident Medical fees Interest on hire purchase Professional fees Bad and doubtful debts Staff welfare 2 120,000 3 15,000 10,000 1000 4 5,200 5 2,500 850 6 3,250 7 2,500 8 3,300 163,600 Net Income 53,600 Note: (1) Mr. Tan sold one of his equipment which derived a gain on disposal worth RM 1,200 (2) Salaries and bonus included: RM 2,000 as bonus for his employee for Chinese New Year celebration. RM 80,000 is the salary and bonus for Mr. Tan through the year (3) Donation included: In August 2020, donated RM 5,000 cash to an orphanage that is an approved organization. In December 2020, donated RM 10,000 in kind to Tabung Covid-19 for Ministry of Health Malaysia (4) Insurance on personal accident RM 2,500 as insurances for his employee personal accident policy. RM 2,700 as insurance for Mr. Tan personal accident policy. . . (5) Medical fees RM 1,000 is the medical fees for his employee. RM 1,500 is the medical fees for Mr. Tan and his family annual medical check up (6) Professional fees included the following expenses Tax filing fees Accounting fees Audit fees Architect's fee for draft plan to expand his house RM 500 1,000 800 1,150 (7) The details of bad and doubtful debts in respect of trade debts as extracted for year assessment 2020 are as follows: Bad and doubtful debts account RM RM General provision c/f 4,700 General provision b/f 3.100 Specific provision c/f 5,500 Specific provision bf 4,500 Bad debts written off 2,500 Profit or loss 5.100 12,700 12.700 (8) Staff welfare consists of . Daily lunch meal for his employee Vocation claims for Mr Tan RM 2,500 800 (9) Mr. Tan has balancing charges of RM 5,000. Current year capital allowance is RM 10,000 Mr. Tan has one property that rented out for passive income. The details about the property is stated as below: Shop lot in Johor He owned this property for 10 years. The monthly rental receive is RM 7.000. However due to Covid-19. He allow his tenant to have 2 months of free rent for the month of April and May. Below are the expenses incurred: Repair expenses on water leaking Renewal on tenancy agreement RM 5,000 2.200 . Second child 20 and single. She is studying full time Bachelor Degree in Sunway University and she also work part time as a tutor and earn RM 5,000 for YA 2020. Third child 19 and single. She still studying her full time A-Level in UCSI. Both Mr. Tan and Mrs. Tan agree that Mrs. Tan will claim for child relief. Other details for year 2020 are as follows: Mr. Tan Mrs. Tan RM RM 3,200 2.100 2,400 20,000 6,000 1,500 4,000 4,200 8.000 4,000 Premiums paid on insurance policies on - life on self -Medical insurance Cash donation to an approved institution Donation in Kind to non-approved institution Purchase new handphone in March 2020 Purchase new computer in September 2020 Complete medical examination expenses (self) Covid-19 examination Medical expenses for parent Private Retirement Scheme Gym membership Bicycle for his son Socso Income tax installment /Mandatory Tax Deduction 400 300 2.100 4,000 1,000 520 2,500 2.000 1,500 831 24,210 4,800 Required: (a) Compute the chargeable income and income tax payable of Mr. Tan and Mrs. Tan for the year of assessment 2020: (1) under separate assessment; (11) under joint assessment (Fatimah elected for joint assessment). Note: In your answer, you are required to make proper classification (by reference to Sections 4 and 13 of the Income Tax Act 1967). State "Exempted" for every item of income exempted from tax and "Nil" for every item that is not taxable or deductible. The prescribed value method is to be applied for valuation of benefits-in-kind. (50 marks) (6) Mr. Tan has engaged you as a tax consultant. Kindly prepare a report explaining the differences of submitting separate assessment and joint assessment. Advise Mr. Tan which assessment is the best choice. Since Mr. Tan are not familiar on the responsibilities as a taxpayer. Kindly advise Mr. Tan responsibilities as a taxpayer and types of assessment that he should submit. In the report should also include the consequence might face by Mr. Tan if he does not report his passive income in the asses (20 marks) Question 1 Mr. Tan began his water filter servicing business as an entrepreneur in 2015. He has one employee who helps him with the business. The business's profit and loss statement for the fiscal year ended December 31, 2020 is provided below. Note RM RM 321,000 Sales Less: Cost of sales 105,000 216,000 Gross profit Add: Other Income Gain on disposal of FA 1 1,200 Less: Expenses Salaries and bonus Donations Advertisement Depreciation on motor vehicle Insurance on personal accident Medical fees Interest on hire purchase Professional fees Bad and doubtful debts Staff welfare 2 120,000 3 15,000 10,000 1000 4 5,200 5 2,500 850 6 3,250 7 2,500 8 3,300 163,600 Net Income 53,600 Note: (1) Mr. Tan sold one of his equipment which derived a gain on disposal worth RM 1,200 (2) Salaries and bonus included: RM 2,000 as bonus for his employee for Chinese New Year celebration. RM 80,000 is the salary and bonus for Mr. Tan through the year (3) Donation included: In August 2020, donated RM 5,000 cash to an orphanage that is an approved organization. In December 2020, donated RM 10,000 in kind to Tabung Covid-19 for Ministry of Health Malaysia (4) Insurance on personal accident RM 2,500 as insurances for his employee personal accident policy. RM 2,700 as insurance for Mr. Tan personal accident policy. . . (5) Medical fees RM 1,000 is the medical fees for his employee. RM 1,500 is the medical fees for Mr. Tan and his family annual medical check up (6) Professional fees included the following expenses Tax filing fees Accounting fees Audit fees Architect's fee for draft plan to expand his house RM 500 1,000 800 1,150 (7) The details of bad and doubtful debts in respect of trade debts as extracted for year assessment 2020 are as follows: Bad and doubtful debts account RM RM General provision c/f 4,700 General provision b/f 3.100 Specific provision c/f 5,500 Specific provision bf 4,500 Bad debts written off 2,500 Profit or loss 5.100 12,700 12.700 (8) Staff welfare consists of . Daily lunch meal for his employee Vocation claims for Mr Tan RM 2,500 800 (9) Mr. Tan has balancing charges of RM 5,000. Current year capital allowance is RM 10,000 Mr. Tan has one property that rented out for passive income. The details about the property is stated as below: Shop lot in Johor He owned this property for 10 years. The monthly rental receive is RM 7.000. However due to Covid-19. He allow his tenant to have 2 months of free rent for the month of April and May. Below are the expenses incurred: Repair expenses on water leaking Renewal on tenancy agreement RM 5,000 2.200 . Second child 20 and single. She is studying full time Bachelor Degree in Sunway University and she also work part time as a tutor and earn RM 5,000 for YA 2020. Third child 19 and single. She still studying her full time A-Level in UCSI. Both Mr. Tan and Mrs. Tan agree that Mrs. Tan will claim for child relief. Other details for year 2020 are as follows: Mr. Tan Mrs. Tan RM RM 3,200 2.100 2,400 20,000 6,000 1,500 4,000 4,200 8.000 4,000 Premiums paid on insurance policies on - life on self -Medical insurance Cash donation to an approved institution Donation in Kind to non-approved institution Purchase new handphone in March 2020 Purchase new computer in September 2020 Complete medical examination expenses (self) Covid-19 examination Medical expenses for parent Private Retirement Scheme Gym membership Bicycle for his son Socso Income tax installment /Mandatory Tax Deduction 400 300 2.100 4,000 1,000 520 2,500 2.000 1,500 831 24,210 4,800 Required: (a) Compute the chargeable income and income tax payable of Mr. Tan and Mrs. Tan for the year of assessment 2020: (1) under separate assessment; (11) under joint assessment (Fatimah elected for joint assessment). Note: In your answer, you are required to make proper classification (by reference to Sections 4 and 13 of the Income Tax Act 1967). State "Exempted" for every item of income exempted from tax and "Nil" for every item that is not taxable or deductible. The prescribed value method is to be applied for valuation of benefits-in-kind. (50 marks) (6) Mr. Tan has engaged you as a tax consultant. Kindly prepare a report explaining the differences of submitting separate assessment and joint assessment. Advise Mr. Tan which assessment is the best choice. Since Mr. Tan are not familiar on the responsibilities as a taxpayer. Kindly advise Mr. Tan responsibilities as a taxpayer and types of assessment that he should submit. In the report should also include the consequence might face by Mr. Tan if he does not report his passive income in the asses (20 marks)