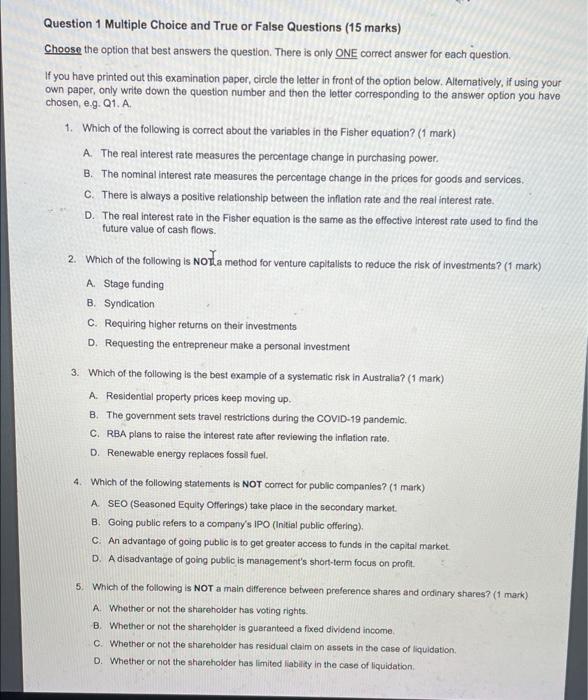

Question 1 Multiple Choice and True or False Questions (15 marks) Choose the option that best answers the question. There is only ONE correct answer for each question. If you have printed out this examination paper, circle the letter in front of the option below. Alternatively, if using your own paper, only write down the question number and then the letter corresponding to the answer option you have chosen, e.g. 01. A 1. Which of the following is correct about the variables in the Fisher equation? (1 mark) A. The real interest rate measures the percentage change in purchasing power. B. The nominal interest rate measures the percentage change in the prices for goods and services. C. There is always a positive relationship between the inflation rate and the real interest rate. D. The real interest rate in the Fisher equation is the same as the effective interest rate used to find the future value of cash flows. 2. Which of the following is not a method for venture capitalists to reduce the risk of investments? (1 mark) A. Stage funding B. Syndication C. Requiring higher returns on their investments D. Requesting the entrepreneur make a personal Investment 3. Which of the following is the best example of a systematic risk in Australia? (1 mark) A. Residential property prices keep moving up. B. The government sets travel restrictions during the COVID-19 pandemic. C. RBA plans to raise the interest rate after reviewing the inflation rato. D. Renewable energy replaces fossil fuel. 4. Which of the following statements is NOT correct for public companies? (1 mark) A SEO (Seasoned Equity Offerings) take place in the secondary market. B. Going public refers to a company's IPO (Initial public offering) C. An advantage of going public is to get greater access to funds in the capital market D. A disadvantage of going public is management's short-term focus on profit. 5. Which of the following is NOT a main difference between preference shares and ordinary shares? (1 mark) A. Whether or not the shareholder has voting rights B. Whether or not the shareholder is guaranteed a fixed dividend income c. Whether or not the shareholder has residual claim on assets in the case of liquidation D. Whether or not the shareholder has limited liability in the case of liquidation