QUESTION 1

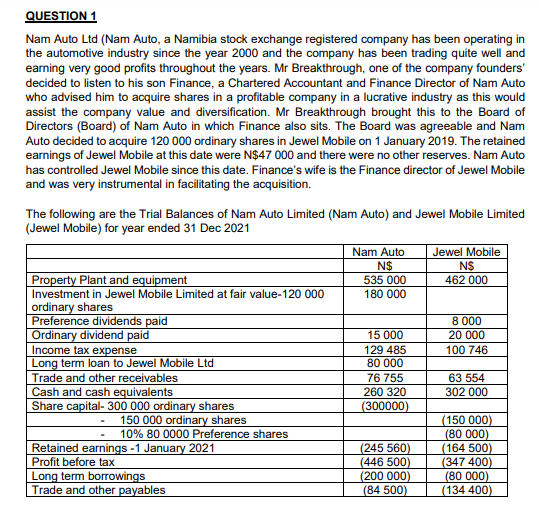

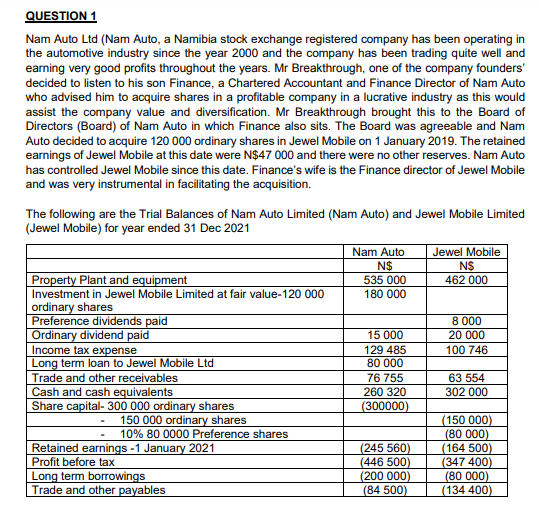

Nam Auto Ltd (Nam Auto, a Namibia stock exchange registered company has been operating in the automotive industry since the year 2000 and the company has been trading quite well and earning very good profits throughout the years. Mr Breakthrough, one of the company founders decided to listen to his son Finance, a Chartered Accountant and Finance Director of Nam Auto who advised him to acquire shares in a profitable company in a lucrative industry as this would assist the company value and diversification. Mr Breakthrough brought this to the Board of Directors (Board) of Nam Auto in which Finance also sits. The Board was agreeable and Nam Auto decided to acquire 120 000 ordinary shares in Jewel Mobile on 1 January 2019. The retained earnings of Jewel Mobile at this date were N$47 000 and there were no other reserves. Nam Auto has controlled Jewel Mobile since this date. Finances wife is the Finance director of Jewel Mobile and was very instrumental in facilitating the acquisition. The following are the Trial Balances of Nam Auto Limited (Nam Auto) and Jewel Mobile Limited (Jewel Mobile) for year ended 31 Dec 2021.

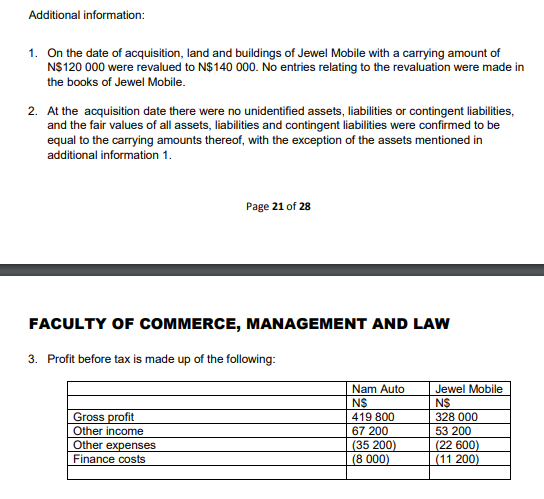

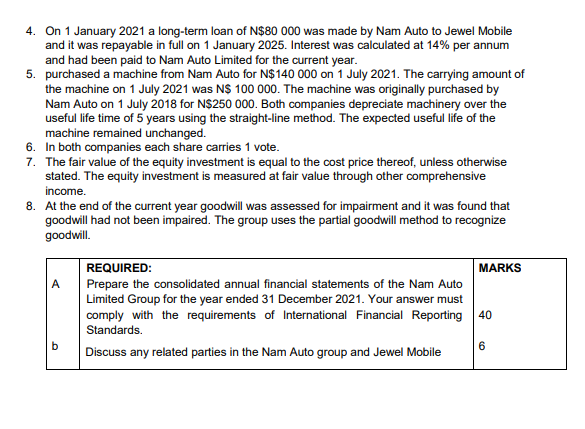

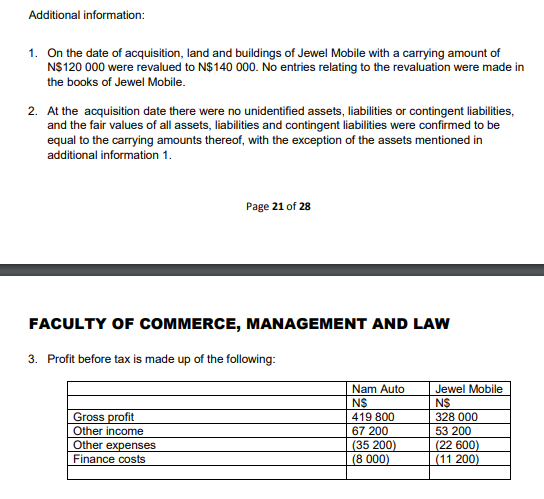

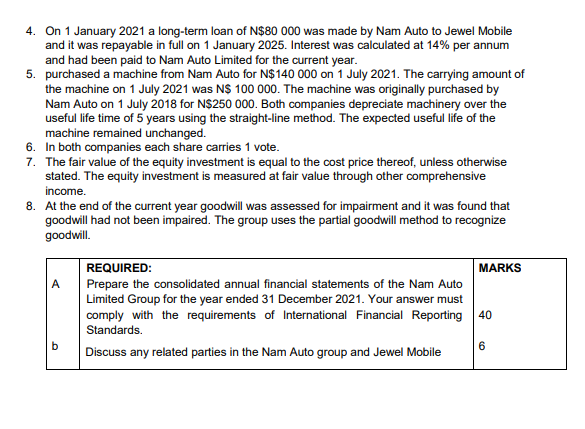

Nam Auto Ltd (Nam Auto, a Namibia stock exchange registered company has been operating in the automotive industry since the year 2000 and the company has been trading quite well and earning very good profits throughout the years. Mr Breakthrough, one of the company founders' decided to listen to his son Finance, a Chartered Accountant and Finance Director of Nam Auto who advised him to acquire shares in a profitable company in a lucrative industry as this would assist the company value and diversification. Mr Breakthrough brought this to the Board of Directors (Board) of Nam Auto in which Finance also sits. The Board was agreeable and Nam Auto decided to acquire 120000 ordinary shares in Jewel Mobile on 1 January 2019. The retained earnings of Jewel Mobile at this date were N47000 and there were no other reserves. Nam Auto has controlled Jewel Mobile since this date. Finance's wife is the Finance director of Jewel Mobile and was very instrumental in facilitating the acquisition. 1. On the date of acquisition, land and buildings of Jewel Mobile with a carrying amount of N$120000 were revalued to N$140000. No entries relating to the revaluation were made in the books of Jewel Mobile. 2. At the acquisition date there were no unidentified assets, liabilities or contingent liabilities, and the fair values of all assets, liabilities and contingent liabilities were confirmed to be equal to the carrying amounts thereof, with the exception of the assets mentioned in additional information 1. Page 21 of 28 FACULTY OF COMMERCE, MANAGEMENT AND LAW 3. Profit before tax is made up of the following: 4. On 1 January 2021 a long-term loan of N$80000 was made by Nam Auto to Jewel Mobile and it was repayable in full on 1 January 2025 . Interest was calculated at 14% per annum and had been paid to Nam Auto Limited for the current year. 5. purchased a machine from Nam Auto for N$140000 on 1 July 2021. The carrying amount of the machine on 1 July 2021 was N\$ 100000 . The machine was originally purchased by Nam Auto on 1 July 2018 for N\$250 000. Both companies depreciate machinery over the useful life time of 5 years using the straight-line method. The expected useful life of the machine remained unchanged. 6. In both companies each share carries 1 vote. 7. The fair value of the equity investment is equal to the cost price thereof, unless otherwise stated. The equity investment is measured at fair value through other comprehensive income. 8. At the end of the current year goodwill was assessed for impairment and it was found that goodwill had not been impaired. The group uses the partial goodwill method to recognize goodwill. Nam Auto Ltd (Nam Auto, a Namibia stock exchange registered company has been operating in the automotive industry since the year 2000 and the company has been trading quite well and earning very good profits throughout the years. Mr Breakthrough, one of the company founders' decided to listen to his son Finance, a Chartered Accountant and Finance Director of Nam Auto who advised him to acquire shares in a profitable company in a lucrative industry as this would assist the company value and diversification. Mr Breakthrough brought this to the Board of Directors (Board) of Nam Auto in which Finance also sits. The Board was agreeable and Nam Auto decided to acquire 120000 ordinary shares in Jewel Mobile on 1 January 2019. The retained earnings of Jewel Mobile at this date were N47000 and there were no other reserves. Nam Auto has controlled Jewel Mobile since this date. Finance's wife is the Finance director of Jewel Mobile and was very instrumental in facilitating the acquisition. 1. On the date of acquisition, land and buildings of Jewel Mobile with a carrying amount of N$120000 were revalued to N$140000. No entries relating to the revaluation were made in the books of Jewel Mobile. 2. At the acquisition date there were no unidentified assets, liabilities or contingent liabilities, and the fair values of all assets, liabilities and contingent liabilities were confirmed to be equal to the carrying amounts thereof, with the exception of the assets mentioned in additional information 1. Page 21 of 28 FACULTY OF COMMERCE, MANAGEMENT AND LAW 3. Profit before tax is made up of the following: 4. On 1 January 2021 a long-term loan of N$80000 was made by Nam Auto to Jewel Mobile and it was repayable in full on 1 January 2025 . Interest was calculated at 14% per annum and had been paid to Nam Auto Limited for the current year. 5. purchased a machine from Nam Auto for N$140000 on 1 July 2021. The carrying amount of the machine on 1 July 2021 was N\$ 100000 . The machine was originally purchased by Nam Auto on 1 July 2018 for N\$250 000. Both companies depreciate machinery over the useful life time of 5 years using the straight-line method. The expected useful life of the machine remained unchanged. 6. In both companies each share carries 1 vote. 7. The fair value of the equity investment is equal to the cost price thereof, unless otherwise stated. The equity investment is measured at fair value through other comprehensive income. 8. At the end of the current year goodwill was assessed for impairment and it was found that goodwill had not been impaired. The group uses the partial goodwill method to recognize goodwill