Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1. Negative cash balances could be avoided by Bob taking no salary for the first two months. Renting premises where he pays at the

QUESTION 1.

Negative cash balances could be avoided by

- Bob taking no salary for the first two months.

- Renting premises where he pays at the end of the quarter (i.e. 31st March).

- Buying inventory on credit from the beginning of February.

- Buying 30% less bicycles at the start.

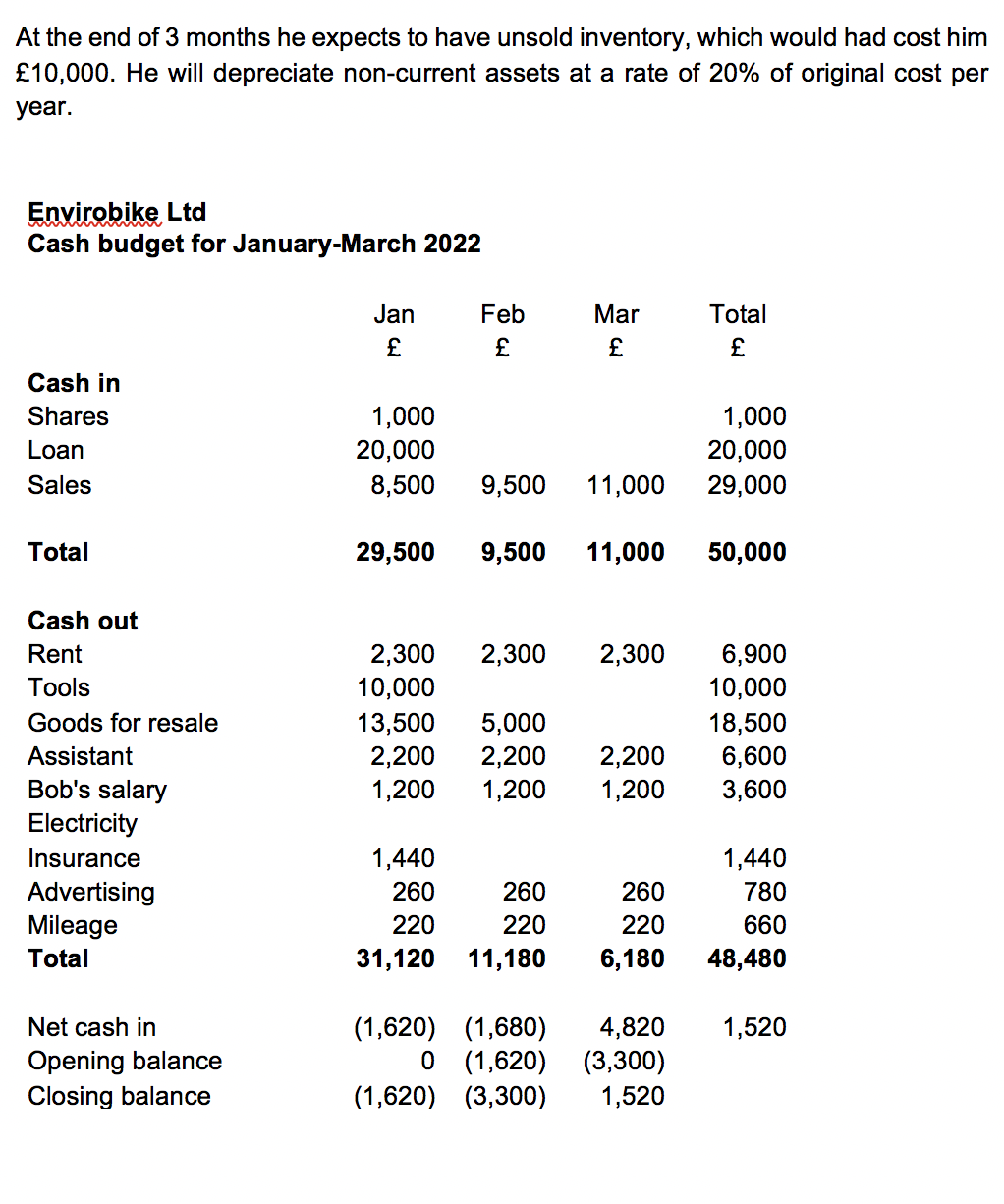

QUESTION 2.

Assuming a cost of capital of 1% per month, the present value of the operating cash flows for the first 3 months will be:

- (9,480)

- (9,464)

- 11,328

- 11,520

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started