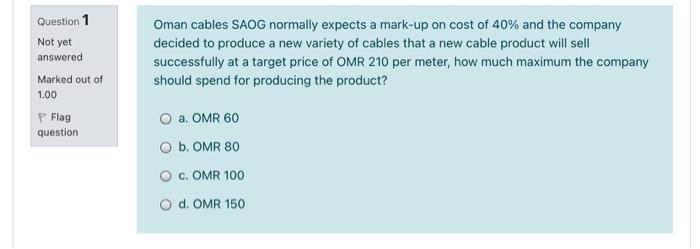

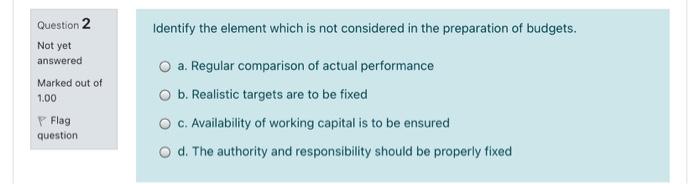

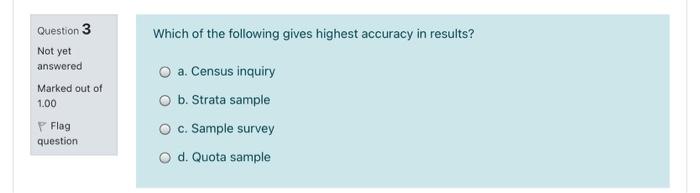

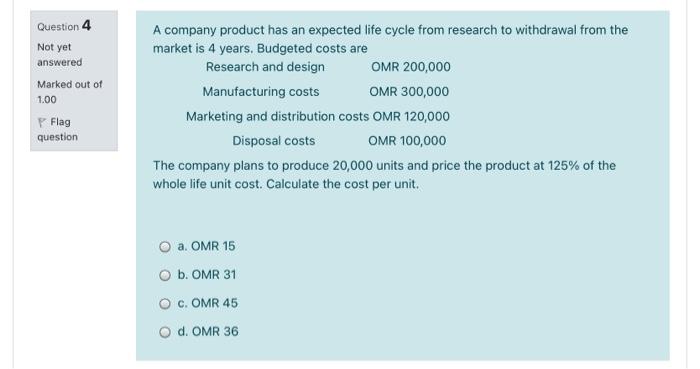

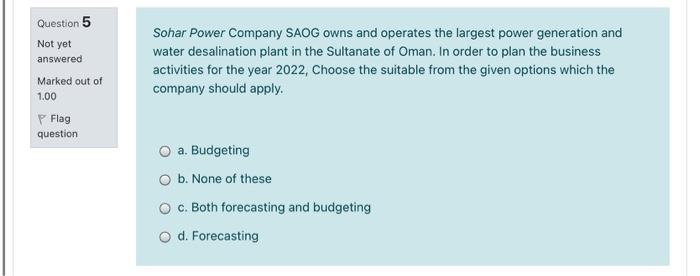

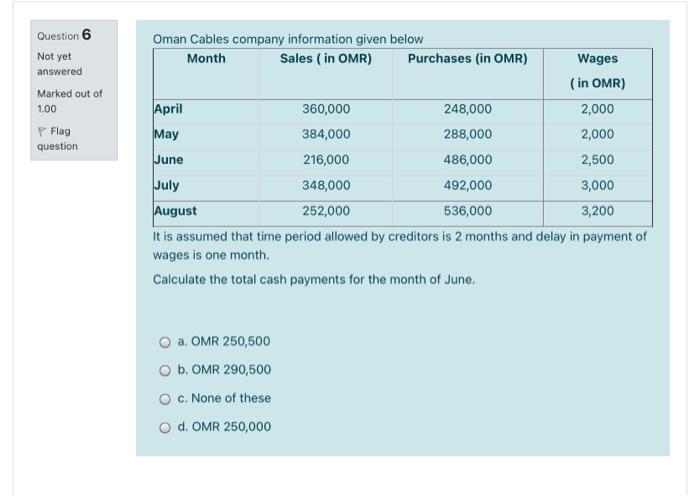

Question 1 Not yet answered Marked out of 1.00 Oman cables SAOG normally expects a mark-up on cost of 40% and the company decided to produce a new variety of cables that a new cable product will sell successfully at a target price of OMR 210 per meter, how much maximum the company should spend for producing the product? P Flag question O a OMR 60 O b. OMR 80 c. OMR 100 O d. OMR 150 Identify the element which is not considered in the preparation of budgets. Question 2 Not yet answered Marked out of 1.00 a. Regular comparison of actual performance b. Realistic targets are to be fixed c. Availability of working capital is to be ensured d. The authority and responsibility should be properly fixed P Flag question Question 3 Which of the following gives highest accuracy in results? Not yet answered Marked out of 1.00 O a. Census inquiry O b. Strata sample c. Sample survey O d. Quota sample P Flag question Question 4 Not yet answered Marked out of 1.00 A company product has an expected life cycle from research to withdrawal from the market is 4 years. Budgeted costs are Research and design OMR 200,000 Manufacturing costs OMR 300,000 Marketing and distribution costs OMR 120,000 Disposal costs OMR 100,000 The company plans to produce 20,000 units and price the product at 125% of the whole life unit cost. Calculate the cost per unit. Flag question a. OMR 15 O b. OMR 31 c. OMR 45 O d. OMR 36 Question 5 Not yet answered Marked out of 1.00 P Flag question Sohar Power Company SAOG owns and operates the largest power generation and water desalination plant in the Sultanate of Oman. In order to plan the business activities for the year 2022, Choose the suitable from the given options which the company should apply. a. Budgeting ob. None of these c. Both forecasting and budgeting O d. Forecasting Question 6 Not yet answered Marked out of 1.00 Flag question Oman Cables company information given below Month Sales (in OMR) Purchases (in OMR) Wages (in OMR) April 360,000 248,000 2,000 May 384,000 288,000 2,000 June 216,000 486,000 2,500 July 348,000 492,000 3,000 August 252,000 536,000 3,200 It is assumed that time period allowed by creditors is 2 months and delay in payment of wages is one month Calculate the total cash payments for the month of June. a. OMR 250,500 O b. OMR 290,500 c. None of these O d. OMR 250,000