Answered step by step

Verified Expert Solution

Question

1 Approved Answer

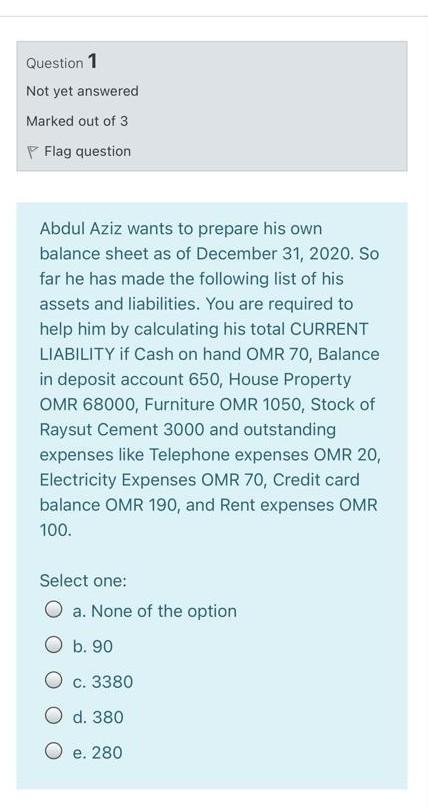

Question 1 Not yet answered Marked out of 3 Flag question Abdul Aziz wants to prepare his own balance sheet as of December 31, 2020.

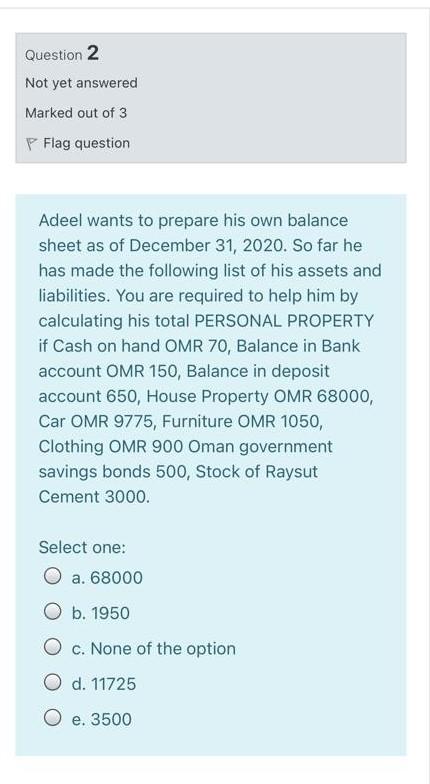

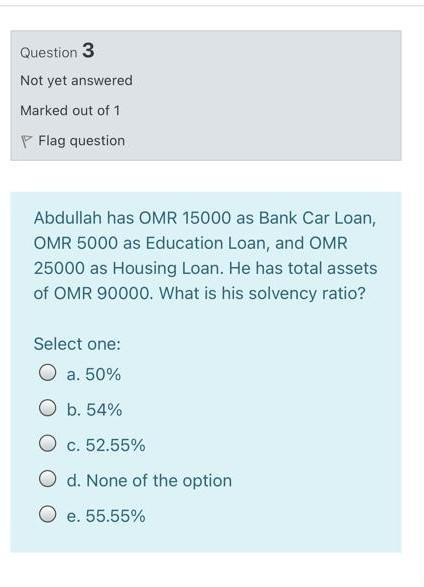

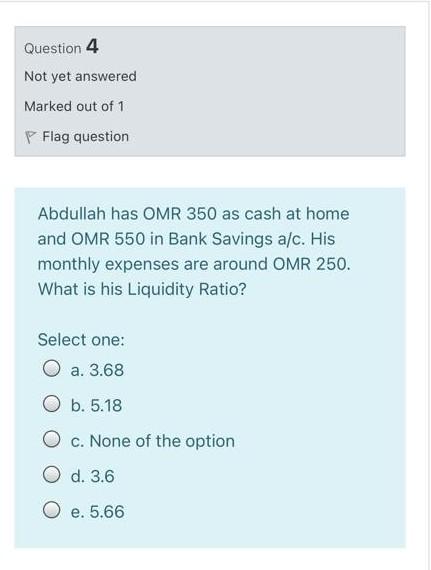

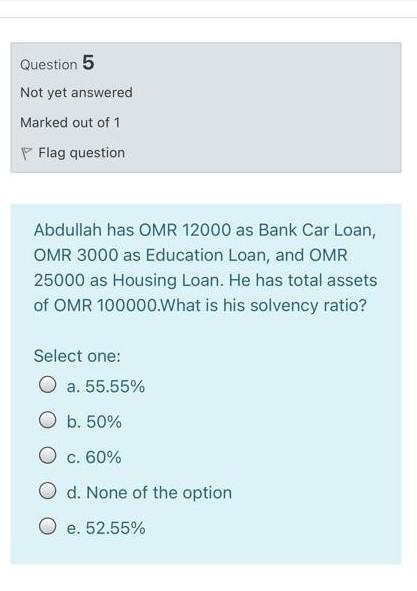

Question 1 Not yet answered Marked out of 3 Flag question Abdul Aziz wants to prepare his own balance sheet as of December 31, 2020. So far he has made the following list of his assets and liabilities. You are required to help him by calculating his total CURRENT LIABILITY if Cash on hand OMR 70, Balance in deposit account 650, House Property OMR 68000, Furniture OMR 1050, Stock of Raysut Cement 3000 and outstanding expenses like Telephone expenses OMR 20, Electricity Expenses OMR 70, Credit card balance OMR 190, and Rent expenses OMR 100 Select one: O a. None of the option O b. 90 O c. 3380 O d. 380 O e. 280 Question 2 Not yet answered Marked out of 3 P Flag question Adeel wants to prepare his own balance sheet as of December 31, 2020. So far he has made the following list of his assets and liabilities. You are required to help him by calculating his total PERSONAL PROPERTY if Cash on hand OMR 70, Balance in Bank account OMR 150, Balance in deposit account 650, House Property OMR 68000, Car OMR 9775, Furniture OMR 1050, Clothing OMR 900 Oman government savings bonds 500, Stock of Raysut Cement 3000. Select one: O a. 68000 b. 1950 O c. None of the option O d. 11725 O e. 3500 Question 3 Not yet answered Marked out of 1 P Flag question Abdullah has OMR 15000 as Bank Car Loan, OMR 5000 as Education Loan, and OMR 25000 as Housing Loan. He has total assets of OMR 90000. What is his solvency ratio? Select one: O a. 50% O b. 54% O c. 52.55% O d. None of the option O e. 55.55% Question 4 Not yet answered Marked out of 1 p Flag question Abdullah has OMR 350 as cash at home and OMR 550 in Bank Savings a/c. His monthly expenses are around OMR 250. What is his Liquidity Ratio? Select one: O a. 3.68 O b. 5.18 O c. None of the option O d. 3.6 O e. 5.66 Question 5 Not yet answered Marked out of 1 P Flag question Abdullah has OMR 12000 as Bank Car Loan, OMR 3000 as Education Loan, and OMR 25000 as Housing Loan. He has total assets of OMR 100000.What is his solvency ratio? Select one: O a. 55.55% O b. 50% O c. 60% O d. None of the option O e. 52.55%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started