Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 Notes for question 1 3 figures plus for initial cash flows. Question 2 Notes for question 2 V E =D 1 /(R E

Question 1

Notes for question 1

3 figures plus for initial cash flows.

Question 2

Notes for question 2

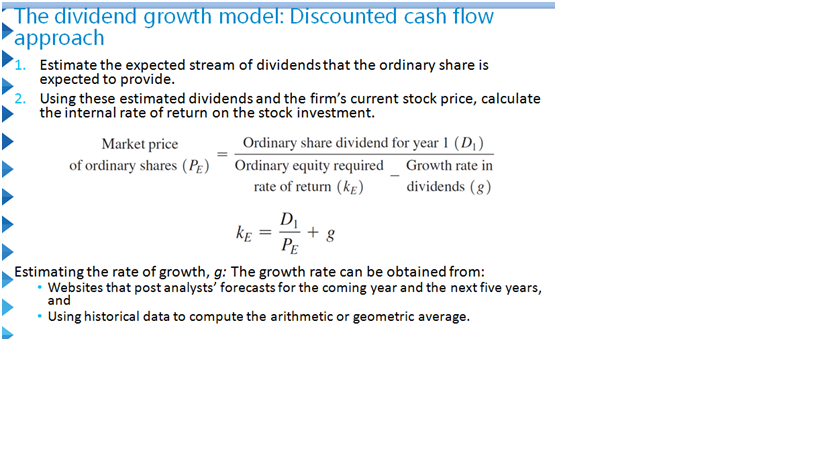

VE=D1/(RE-g)

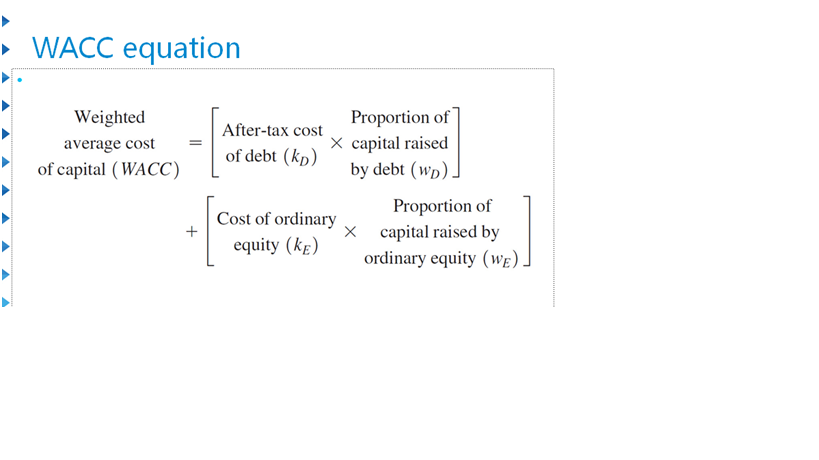

Market value relate to calculate WACC

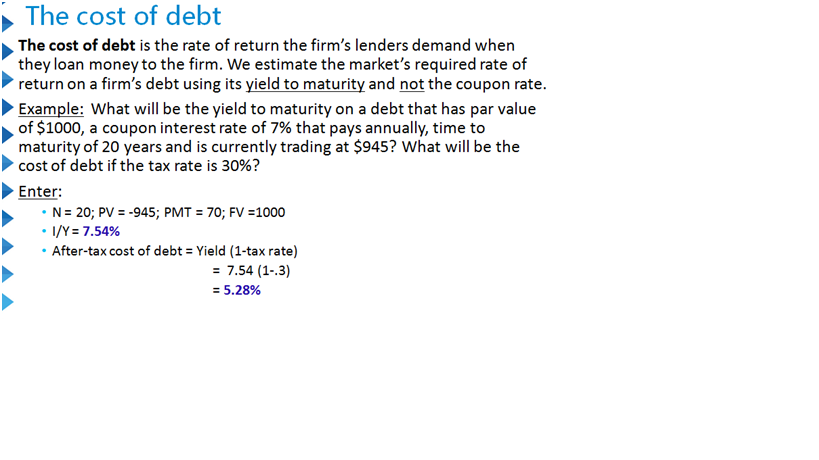

Cost of debt=3.87%*2(1-28%)=5.57%

Cost of equity???

Cost of preference share: Kp=DIVp/pp =6.5*10/32=2.031%

Question 3

Notes for question 3

It needs to draw a table, for 6 years data.

| 0 | 1 | 2 | 3 | 4 | 5 | 6 |

|

| OCF | OCF | OCF | OCF | OCF | OCF |

| Cost |

|

|

|

|

|

|

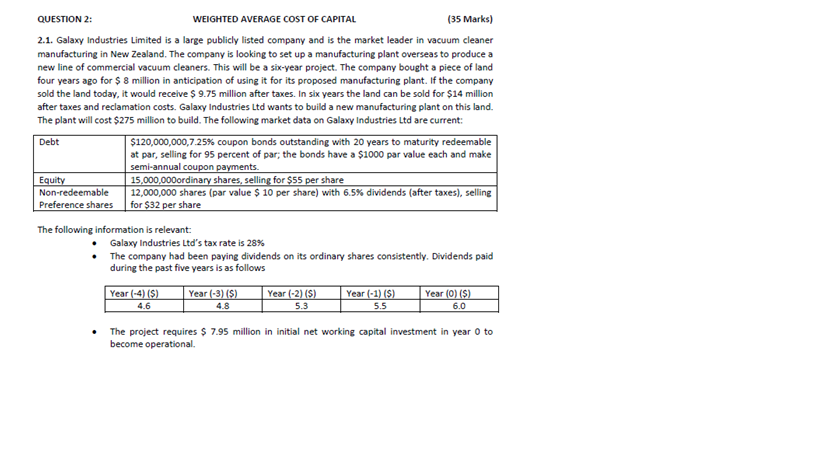

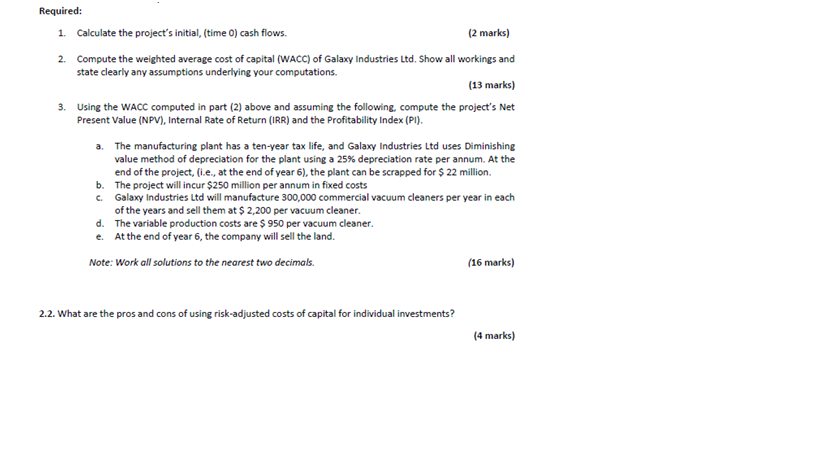

QUESTION 2: WEIGHTED AVERAGE COST OF CAPITAL (35 Marks) 2.1. Galaxy Industries Limited is a large publicly listed company and is the market leader in vacuum cleaner manufacturing in New Zealand. The company is looking to set up a manufacturing plant overseas to producea new line of commercial vacuum cleaners. This will be a six-year project. The company bought a piece of land four years ago for $8 million in anticipation of using it for its proposed manufacturing plant. If the company sold the land today, it would receive $9.75 million after taxes. In six years the land can be sold for $14 million after taxes and reclamation costs. Galaxy Industries Ltd wants to build a new manufacturing plant on this land. The plant will cost $275 million to build. The following market data on Galaxy Industries Ltd are current Debt $120,000,000,725% coupon bonds outstanding with 20 years to maturity redeemable at par, selling for 95 percent of par; the bonds have a $1000 par value each and make semi-annual c 15,000,000ordinary shares, selling for $55 per share Non-redeemable | 12,000,000 shares (par value $ 10 per share) with 6.5% dividends (after taxes), selling Preference shares or r share The following information is relevant Galaxy Industries Ltd's tax rate is 28% The company had been paying dividends on its ordinary shares consistently. Dividends paid during the past five years is as follows Year (-4) Year (-2) Year (1 Year 4.8 5.3 5.5 6.0 The project requires 7.95 million in initial net working capital investment in year 0 to become operational

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started