Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 of 11 View Policies Current Attempt in Progress Select the appropriate description for the following terms. 4 Intracompan Intercompany Horizontal analysis Vertical

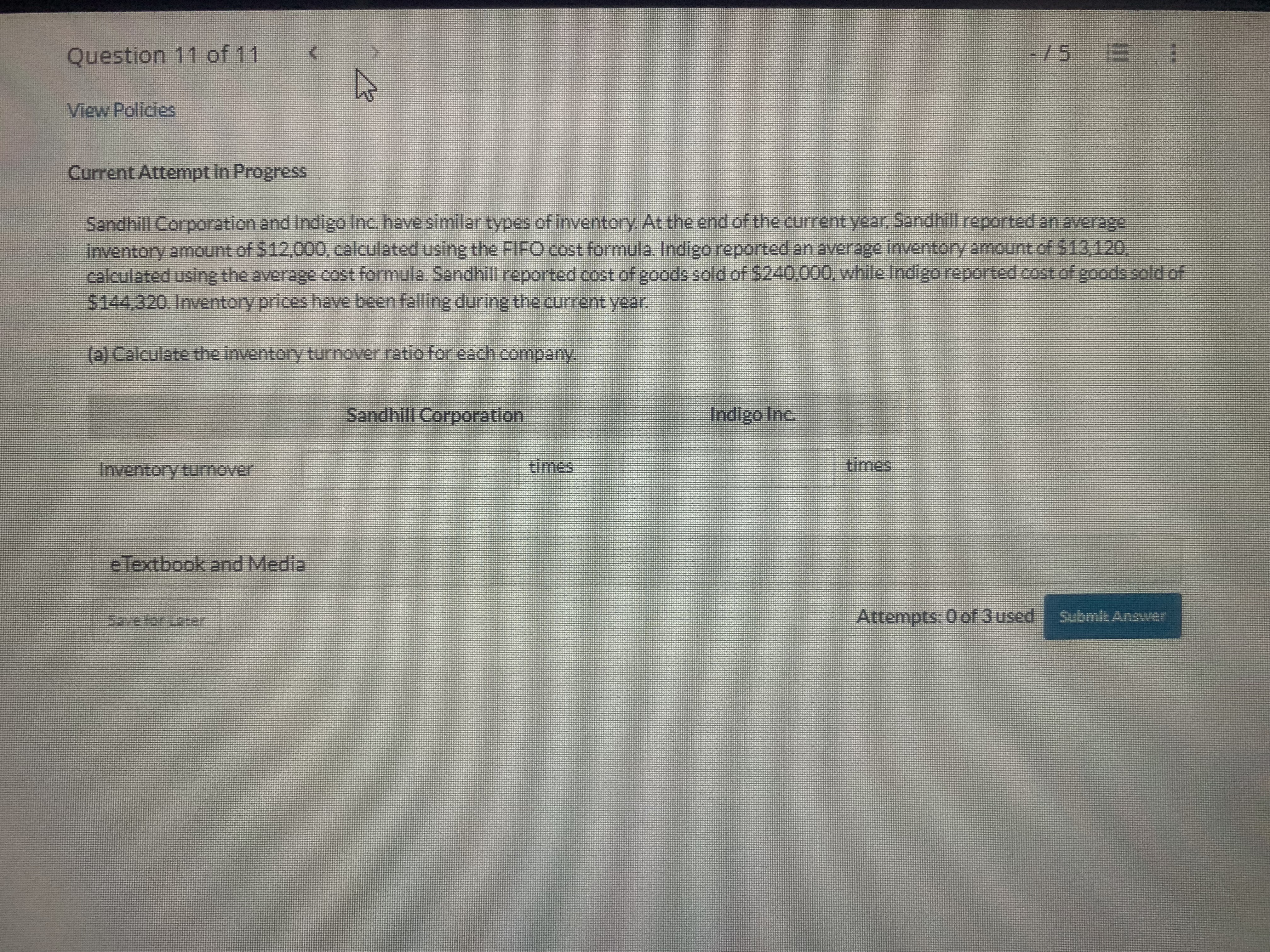

Question 1 of 11 View Policies Current Attempt in Progress Select the appropriate description for the following terms. 4 Intracompan Intercompany Horizontal analysis Vertical analysis Ratio analysis e Textbook and Media Save fenten Description Attempts: 0 of 3 used MEDEN Question 2 of 11 Comparative data (in thousands) from the balance sheet of Blossom Ltd. are shown below. Accounts receivable Inventory Prepaid expenses Total current assets Accounts receivable Inventory Prepaid expenses 500 current assets 245 $636 Using horizontal analysis, calculate the percent of base year, assuming 2021 is the base year. (Round answers to 0 decimal places, e.g. 158 21 X -/10 5 96 MAN Question 4 of 11 View Policies Net sales Current Attempt in Progress Comparative data from the income statement of Oriole Corporation are shown below. Cost of goods sold Gross profit < Operating expenses Profit before income tax Income tax expense Profit for the year Jury 41315 2024 $831,000 $591,000 556,770 378,240 149,580 124,650 31,163 $93,487 Prepare a vertical analysis for Oriole Corporation. (Round percentage answers to 1 decimal place, e.g. 52.7%) 212,760 101,280 111,480 27,870 $83,610 Amount $831,000 ORIOLE CORPORATION Income Statement 2024 Percent BA 27 Amount $591,000 378 240 2023 - /20 Percent 96 %6 Jy Prepare a vertical analysis for Oriole Corporation. (Round percentage answers to 1 decimal place, e.g. 52.7%) Question 4 of 11 Cost of goods sold Gross profit Operating expenses Profit before income tax Income tax expense Profit for the year eTextbook and Media Save for Later Amount $831,000 149,580 124.650 31,163 $93,487 ORIOLE CORPORATION Income Statement 2024 Percent * %6 X Amount $591,000 378,240 212,760 101,280 111,480 27,870 $83,610 Percent Attempts: 0 of 3 used / 20 E E: Submit Answer Current Attempt in Progress Selected data (in thousands) from the income statement of Sunland Inc. are shown below. Net sales Cost of goods sold Gross profit Operating expenses Profit before income tax Income tax expense Profit for the year Net sales Cost of goods sold Perform a vertical analysis and calculate the percentage of the base amount for the current year. (Enter amounts in thousands. Round percentage answers to 1 decimal place, e.g. 52.7%.) Gross profit $1,930 1,615 Operating expenses 209 S A Amount Income Statement Percent X Profit for the year Perform a vertical analysis and calculate the percentage of the base amount for the current year. (Enter amounts in thousands. Round percentage answers to 1 decimal place, e.g. 52.7%) Net sales Cost of goods sold Gross profit Operating expenses Profit before income tax Income tax expense Profit for the year e Textbook and Media seve for Later $ Amount A Income Statement Percent Attempts: 0 of 3 used Submit Answer Sheridan Inc. operates gaming stores across the country. Selected comparative financial statement data are shown below. Current assets SHERIDAN ING. Balance Sheet (partial) December 31 (in millions) Short-term investments Accounts receivable Inventory Prepaid expenses Total current assets Total current liabilities Additional information: (In millions) Net credit sales Cost of goods sold & $2,389 $1,885 $1,301 $1,196 $750 2023 & $8,258 $3,936 5,328 2,648 Additional information: (in millions) Net credit sales Cost of goods sold Current ratio A Calculate the following liquidity ratios for 2024 and 2023. (Round current ratio and acid-test ratio to 2 decimal places, eg 0.75.1. receivables turnover and inventory turnover to 1 decimal place, eg, 527 and collection period, days sales in inventory and operating cycle to 0 decimal places, e.g. 125.) Acid-test ratio Receivables turnover Collection period Inventory turnover Days sales in inventory $8,258 5,328 Operating cycle $3,936 2,648 times days times days days times days days eTextbook and Media Indicate whether each of the liquidity ratios calculated in part (a) is better or worse in 2024. Current ratio Acid-test ratio Receivables turnover Collection period Inventory turnover Days sales in inventory Operating cycle e Textbook and Media Save for Later Attempts: 0 of 3 used Submit Answer Question 7 of 11 View Policies Current Attempt in Progress For each of the following liquidity ratios, indicate whether the change would be viewed as an improvement or deterioration: @ @ @ A decrease in the receivables turnover (6) A decrease in the collection period An increase in the days sales in inventory An increase in the inventory turnover (e) A decrease in the acid-test ratio An increase in the operating cycle eTextbook and Media Some for Late Attempts: 0 of 3 used PUTIN # Question 8 of 11 View Policies Current Attempt in Progress The following selected information (in thousands) is available for Ivanhoe Inc.. Total assets Total liabilities Interest expense Income tax expense Profit for the year Cash provided by operating activities Cash used by investing activities A Debt to total assets Free cash flow $3,885 61 2,200 481 Calculate the following solvency ratios of Ivanhoe Inc. for 2024 and 2023. (Round debt to total assets and interest coverage answers to 1 decimal place, eg. 52.7 or 52.7%. Enter amounts in thousands.) 1,970 2024 LA 2023 -/5 B 96 MIMIN Question 8 of 11 Calculate the following solvency ratios of Ivanhoe Inc. for 2024 and 2023. (Round debt to total assets and interest coverage answers to 1 decimal place, e.g. 52.7 or 52.7%. Enter amounts in thousands.) Debt to total assets Free cash flow Interest coverage eTextbook and Media Debt to total assets 5 Free cash flow 4 Interest coverage Indicate whether each of the solvency ratios calculated in part (a) is better or worse in 2024. 2024 e Textbook and Media times $ -75 : times 66 Question 9 of 11 View Policies Current Attempt in Progress Net sales Selected comparative statement data for Ivanhoe Corporation are presented below. All balance sheet data are as at December 31 Profit for the year K Total assets Asset turnover 615,000 Total common shareholders' equity 480,000 2024 eTextbook and Media $720,000 Return on assets 86,000 2023 $700,000 Calculate asset turnover for 2024. (Round answer to 1 decimal place, e.g. 12.5.) 76,000 515,000 340,000 times Calculate return on assets for 2024. (Round answer to 1 decimal place, e.g. 12.5.) 196 5 CON A Question 9 of 11 FI eTextbook and Media Calculate return on assets for 2024. (Round answer to 1 decimal place, e.g. 12.5.) Return on assets e Textbook and Media Calculate return on equity for 2024. (Round answer to 1 decimal place, e.g. 125.) Return on equity UNS eTextbook and Media Sevel for LaRE. Attempts: 0 of 3 used 2 Submit Answer View Policies Current Attempt in Progress Canada Goose Holdings Inc. reported the following items in its consolidated statement of earnings (in millions of dollars) for 2020 and 2019. Revenue Cost of goods sold Net income 2020 2019 Calculate the gross profit margin. (Round answers to 1 decimal place, e.g. 52.7%) $8.30.5 Gross Profit Margin e Textbook and Media Calculate the profit margin. (Round answers to 2 decimal places, e.g. 52.75%) Question 10 of 11 Calculate the gross profit margin. (Round answers to 1 decimal place, eg. 52.7%) Gross Profit Margin e Textbook and Media Calculate the profit margin. (Round answers to 2 decimal places, e.g. 52.75%) Save for Laser Profit Margin eTextbook and Media A Attempts: 0 of 3 used E Submit Answer Question 11 of 11 View Policies Inventory turnover A eTextbook and Media Current Attempt in Progress Sandhill Corporation and Indigo Inc. have similar types of inventory. At the end of the current year, Sandhill reported an average inventory amount of $12,000, calculated using the FIFO cost formula. Indigo reported an average inventory amount of $13,120, calculated using the average cost formula. Sandhill reported cost of goods sold of $240,000, while Indigo reported cost of goods sold of $144,320. Inventory prices have been falling during the current year. (a) Calculate the inventory turnover ratio for each company. Sandhill Corporation times -75 Indigo Inc. E Attempts: 0 of 3 used MIMIN

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Answer Question 1 Here are the appropriate descriptions for the terms Terms Description Intracompany Analysis conducted within a single company comparing financial data over time to assess performance ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started