Answered step by step

Verified Expert Solution

Question

1 Approved Answer

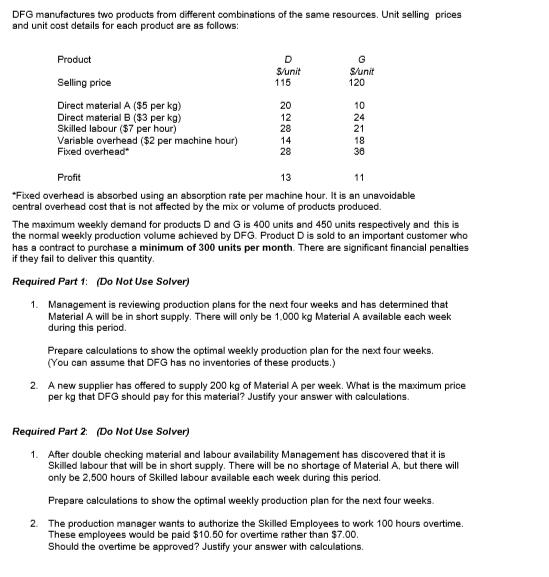

DFG manufactures two products from different combinations of the same resources. Unit selling prices and unit cost details for each product are as follows:

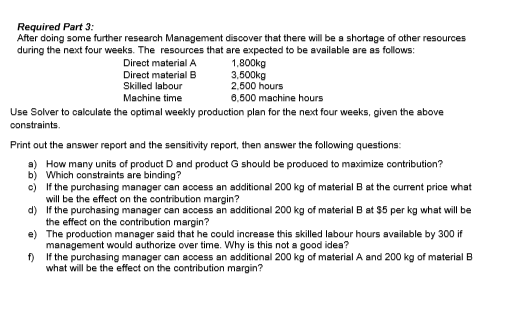

DFG manufactures two products from different combinations of the same resources. Unit selling prices and unit cost details for each product are as follows: Product Selling price D G S/unit S/unit 115 120 Direct material A ($5 per kg) 20 Direct material B ($3 per kg) 12 Skilled labour ($7 per hour) 28 Variable overhead ($2 per machine hour) Fixed overhead* NANNO 14 28 228 10 24 21 18 38 Profit 13 11 *Fixed overhead is absorbed using an absorption rate per machine hour. It is an unavoidable central overhead cost that is not affected by the mix or volume of products produced. The maximum weekly demand for products D and G is 400 units and 450 units respectively and this is the normal weekly production volume achieved by DFG. Product D is sold to an important customer who has a contract to purchase a minimum of 300 units per month. There are significant financial penalties if they fail to deliver this quantity. Required Part 1: (Do Not Use Solver) 1. Management is reviewing production plans for the next four weeks and has determined that Material A will be in short supply. There will only be 1,000 kg Material A available each week during this period. Prepare calculations to show the optimal weekly production plan for the next four weeks. (You can assume that DFG has no inventories of these products.) 2. A new supplier has offered to supply 200 kg of Material A per week. What is the maximum price per kg that DFG should pay for this material? Justify your answer with calculations. Required Part 2: (Do Not Use Solver) 1. After double checking material and labour availability Management has discovered that it is Skilled labour that will be in short supply. There will be no shortage of Material A, but there will only be 2,500 hours of Skilled labour available each week during this period. Prepare calculations to show the optimal weekly production plan for the next four weeks. 2. The production manager wants to authorize the Skilled Employees to work 100 hours overtime. These employees would be paid $10.50 for overtime rather than $7.00. Should the overtime be approved? Justify your answer with calculations. Required Part 3: After doing some further research Management discover that there will be a shortage of other resources during the next four weeks. The resources that are expected to be available are as follows: Direct material A Direct material B Skilled labour Machine time 1,800kg 3,500kg 2,500 hours 6,500 machine hours Use Solver to calculate the optimal weekly production plan for the next four weeks, given the above constraints. Print out the answer report and the sensitivity report, then answer the following questions: a) How many units of product D and product G should be produced to maximize contribution? b) Which constraints are binding? c) If the purchasing manager can access an additional 200 kg of material B at the current price what will be the effect on the contribution margin? d) If the purchasing manager can access an additional 200 kg of material B at $5 per kg what will be the effect on the contribution margin? e) The production manager said that he could increase this skilled labour hours available by 300 if management would authorize over time. Why is this not a good idea? f) If the purchasing manager can access an additional 200 kg of material A and 200 kg of material B what will be the effect on the contribution margin?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started