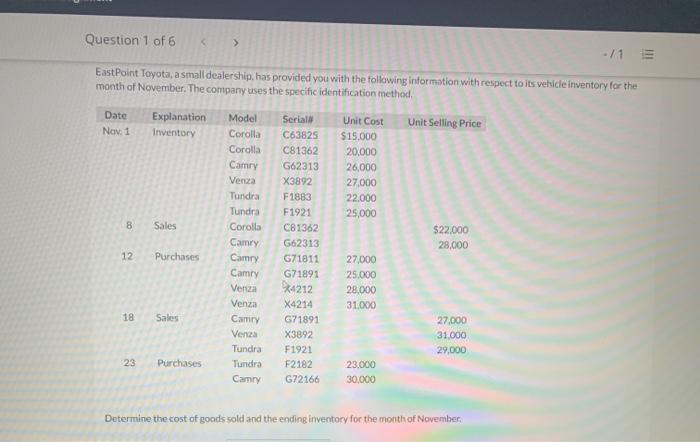

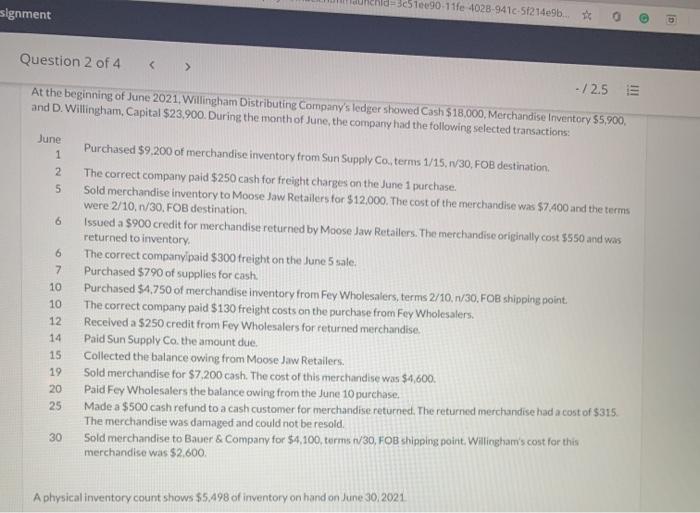

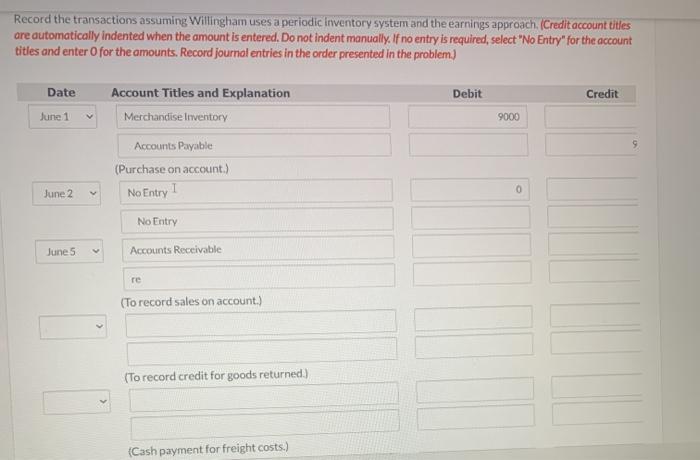

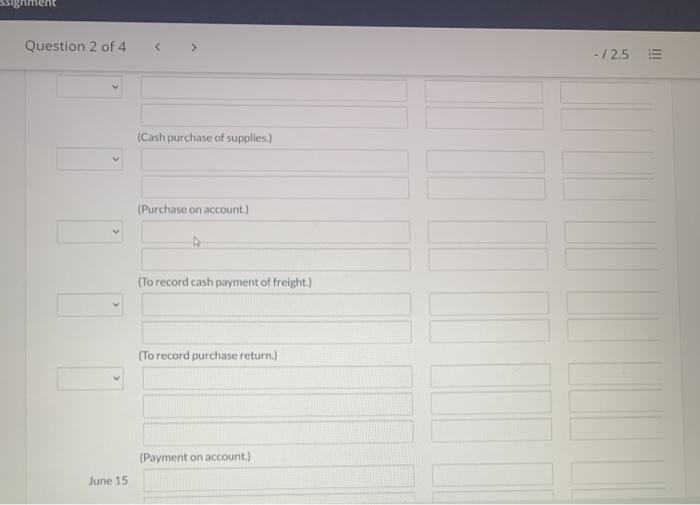

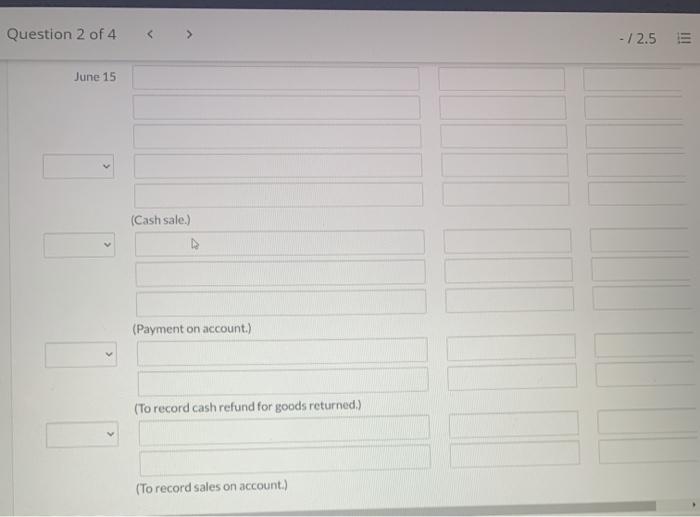

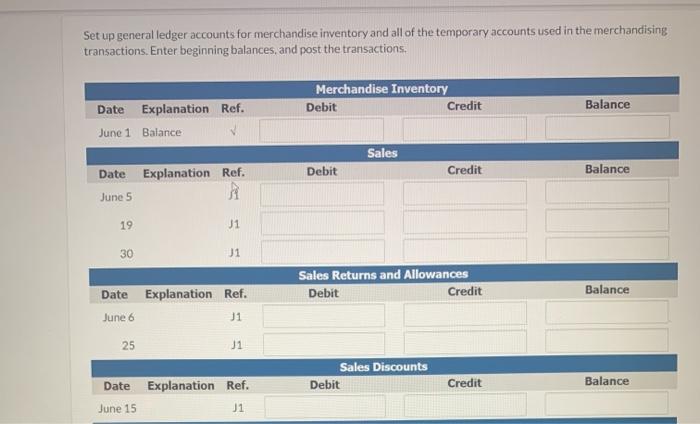

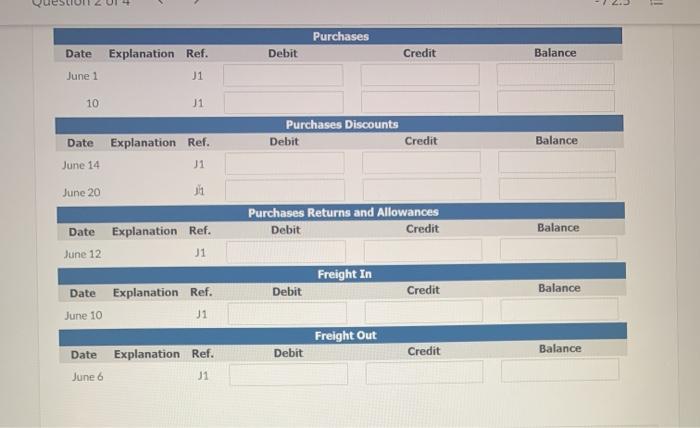

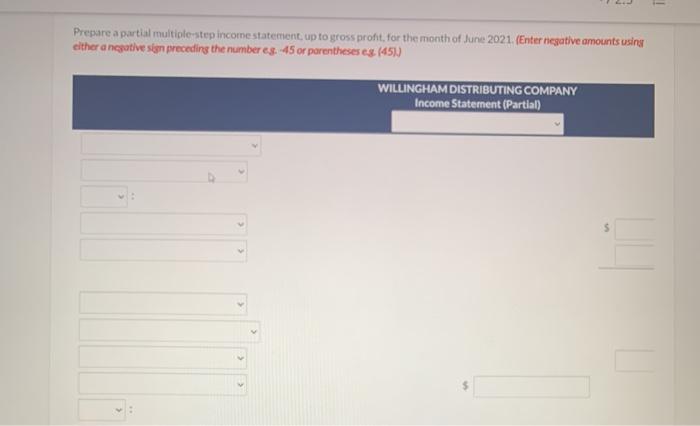

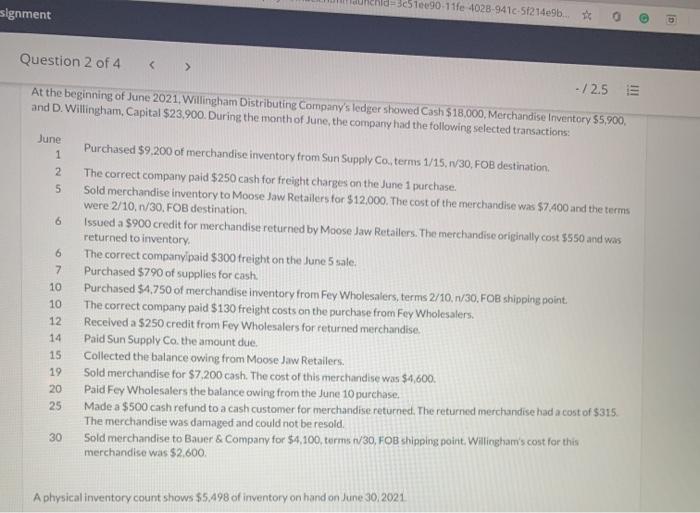

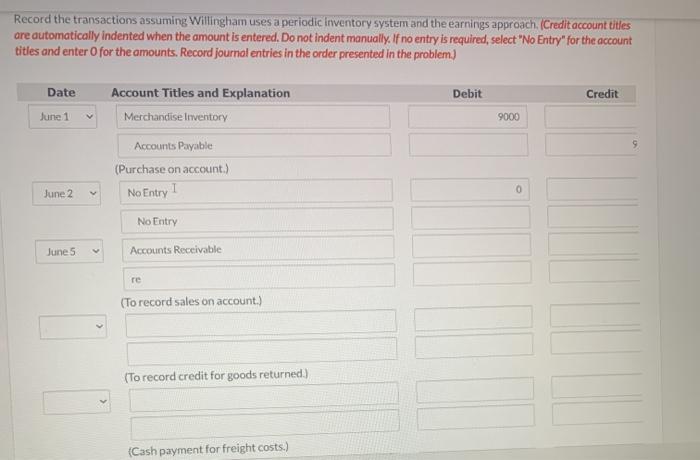

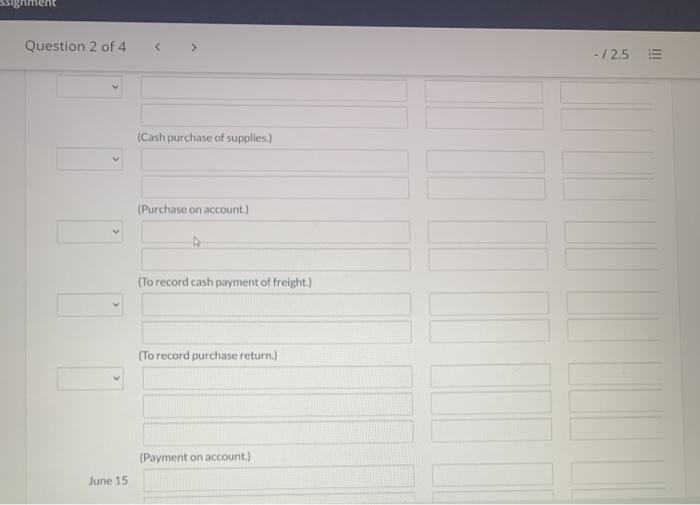

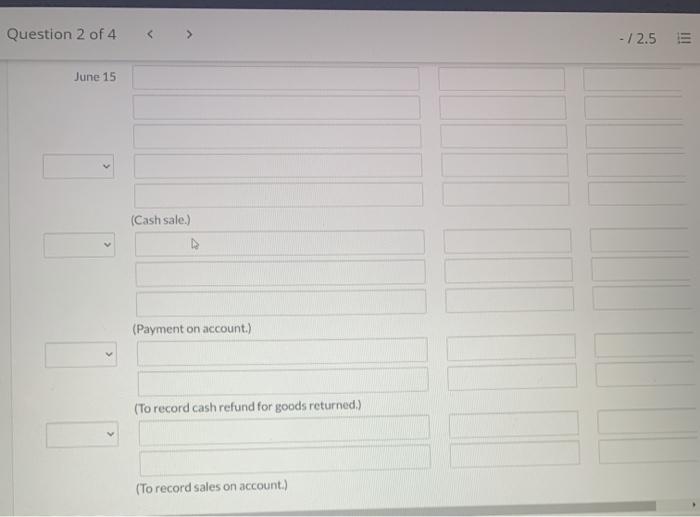

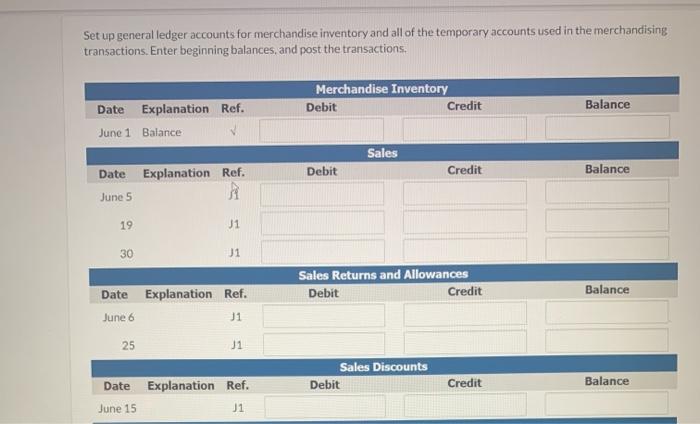

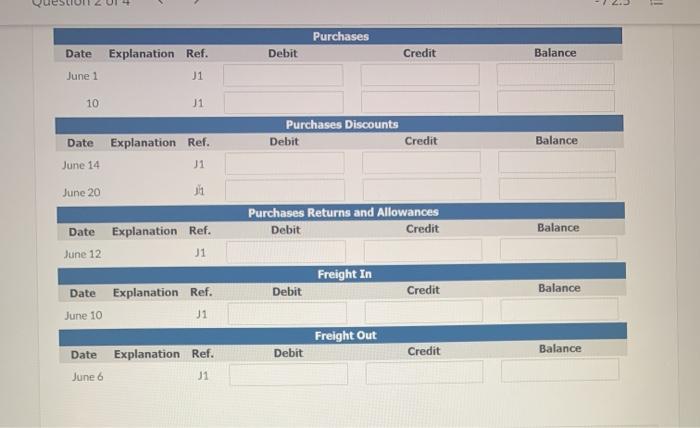

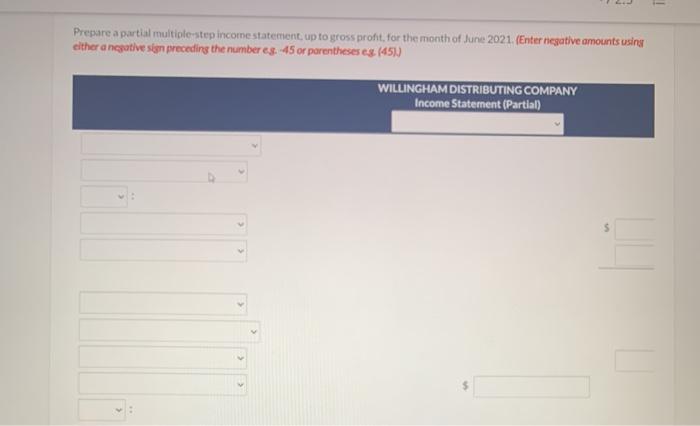

Question 1 of 6 -/1 EastPoint Toyota, a small dealership, has provided you with the following information with respect to its vehicle inventory for the month of November. The company uses the specific identification method Date Nov. 1 Explanation Inventory Unit Selling Price Unit Cost $15.000 20.000 26,000 27,000 22.000 25,000 00 Sales $22.000 28,000 Model Corolla Corolla Camry Venza Tundra Tundra Corolla Camry Camry Camry Venza Venza Camry Venza Tundra Tundra Camry 12 Purchases Serial C63825 C81362 G62313 X3892 F1883 F1921 C81362 G62313 G71811 G71891 *4212 X4214 G71891 X3892 F1921 F2182 G72166 Purchases 27,000 25,000 28,000 31.000 18 Sales 27,000 31.000 29,000 23 Purchases 23.000 30,000 Determine the cost of goods sold and the ending inventory for the month of November 3c51ee90-11 e 4028-9410-56214e9b. signment ID Question 2 of 4 -/25 At the beginning of June 2021. Willingham Distributing Company's ledger showed Cash $18,000, Merchandise Inventory S5,900, and D. Willingham, Capital $23,900. During the month of June, the company had the following selected transactions: June 1 2 5 6 6 7 10 10 12 14 15 19 20 25 Purchased $9.200 of merchandise inventory from Sun Supply Co. terms 1/15, 1/30, FOB destination The correct company paid $250 cash for freight charges on the June 1 purchase. Sold merchandise inventory to Moose Jaw Retailers for $12,000. The cost of the merchandise was $7.400 and the terms were 2/10, 1/30. FOB destination Issued a $900 credit for merchandise returned by Moose Jaw Retailers. The merchandise originally cost $550 and was returned to inventory The correct company paid $300 freight on the June 5 sale. Purchased $790 of supplies for cash. Purchased $4.750 of merchandise inventory from Fey Wholesalers, terms 2/10, 1/30, FOB shipping point The correct company paid $130 freight costs on the purchase from Fey Wholesalers. Received a $250 credit from Fey Wholesalers for returned merchandise Paid Sun Supply Co. the amount due. Collected the balance owing from Moose Jaw Retailers. Sold merchandise for $7.200 cash. The cost of this merchandise was $4,600 Paid Fey Wholesalers the balance owing from the June 10 purchase. Made a $500 cash refund to a cash customer for merchandise returned. The returned merchandise had a cost of $315. The merchandise was damaged and could not be resold. Sold merchandise to Bauer & Company for $4,100, torms/30, FOB shipping point. Willingham's cost for this merchandise was $2.600 30 A physical inventory count shows $5.498 of inventory on hand on June 30 2021 Record the transactions assuming Willingham uses a periodic Inventory system and the earnings approach. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter for the amounts. Record journal entries in the order presented in the problem.) Date Debit Credit Account Titles and Explanation Merchandise Inventory June 1 9000 Accounts Payable (Purchase on account.) June 2 0 No Entry No Entry June 5 Accounts Receivable re (To record sales on account.) (To record credit for goods returned.) (Cash payment for freight costs.) ssignment Question 2 of 4 -72.5 (Cash purchase of supplies.) (Purchase on account) (To record cash payment of freight.) (To record purchase return.) (Payment on account.) June 15 Question 2 of 4 -/2.5 June 15 (Cash sale.) (Payment on account.) (To record cash refund for goods returned.) (To record sales on account.) Set up general ledger accounts for merchandise inventory and all of the temporary accounts used in the merchandising transactions. Enter beginning balances, and post the transactions, Merchandise Inventory Debit Credit Balance Date Explanation Ref. June 1 Balance Sales Debit Credit Balance Date Explanation Ref. June 5 A 19 J1 30 11 Sales Returns and Allowances Debit Credit Balance Date Explanation Ref. June 6 J1 25 J1 Sales Discounts Debit Date Credit Balance Explanation Ref. J1 June 15 Purchases Date Explanation Ref. Debit Credit Balance June 1 J1 10 J1 Purchases Discounts Debit Date Explanation Ref. Credit Balance June 14 J1 June 20 ji Purchases Returns and Allowances Debit Credit Explanation Ref. Balance Date June 12 J1 Freight In Debit Credit Balance Date Explanation Ref. June 10 J1 Freight Out Debit Credit Balance Date Explanation Ref. June 6 J1 Prepare a partial multiple-step income statement, up to gross profit for the month of June 2021. (Enter negative amounts using either a negative sin preceding the number eg. 45 or parentheses es (450) WILLINGHAM DISTRIBUTING COMPANY Income Statement (Partial) Question 2 of 4 - / 2.5 E $ eTextbook and Media List of Accounts