Answered step by step

Verified Expert Solution

Question

1 Approved Answer

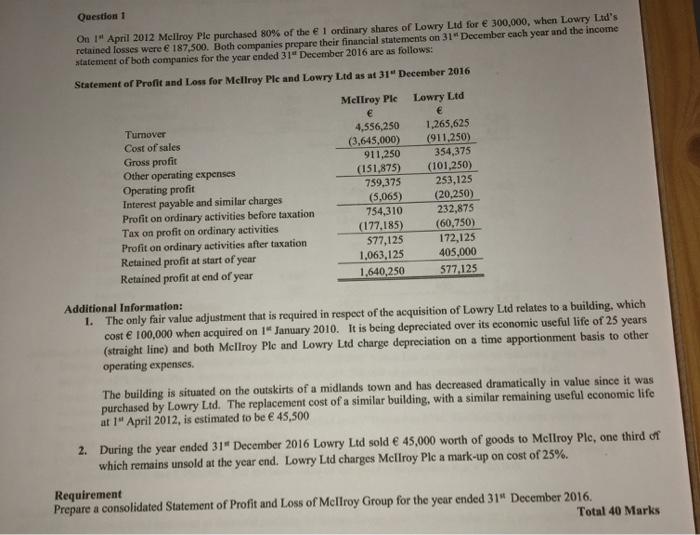

Question 1 On 1 April 2012 Mellroy Ple purchased 80% of the 1 ordinary shares of Lowry Ltd for 300,000, when Lowry Ltd's retained

Question 1 On 1 April 2012 Mellroy Ple purchased 80% of the 1 ordinary shares of Lowry Ltd for 300,000, when Lowry Ltd's retained losses were 187,500. Both companies prepare their financial statements on 31" December each year and the income statement of both companies for the year ended 31" December 2016 are as follows: Statement of Profit and Loss for Mcllroy Ple and Lowry Ltd as at 31 December 2016 Lowry Ltd Mcllroy Ple 4,556,250 1,265,625 Turnover Cost of sales (3,645,000) (911,250) Gross profit 911,250 354,375 (151,875) (101,250) Other operating expenses Operating profit 759,375 253,125 Interest payable and similar charges (5,065) (20,250) Profit on ordinary activities before taxation 754,310 232,875 Tax on profit on ordinary activities (177,185) (60,750) Profit on ordinary activities after taxation $77,125 172,125 Retained profit at start of year 1,063,125 405,000 Retained profit at end of year 1,640,250 577,125 Additional Information: 1. The only fair value adjustment that is required in respect of the acquisition of Lowry Ltd relates to a building, which cost 100,000 when acquired on 1 January 2010. It is being depreciated over its economic useful life of 25 years (straight line) and both Mcllroy Plc and Lowry Ltd charge depreciation on a time apportionment basis to other operating expenses. The building is situated on the outskirts of a midlands town and has decreased dramatically in value since it was purchased by Lowry Ltd. The replacement cost of a similar building, with a similar remaining useful economic life at 1 April 2012, is estimated to be 45,500 2. During the year ended 31" December 2016 Lowry Ltd sold 45,000 worth of goods to Mcllroy Plc, one third of which remains unsold at the year end. Lowry Ltd charges Mcllroy Plc a mark-up on cost of 25%. Requirement Prepare a consolidated Statement of Profit and Loss of Mellroy Group for the year ended 31" December 2016. Total 40 Marks

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

working notes minority interest 20 retained earning 37500 current profit 34425 719...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started