Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 1 On 1 January 2010, Top Company purchased 30% of the 1,080,000 outstanding shares of Bottom Company for $1,300,000 The fair value of

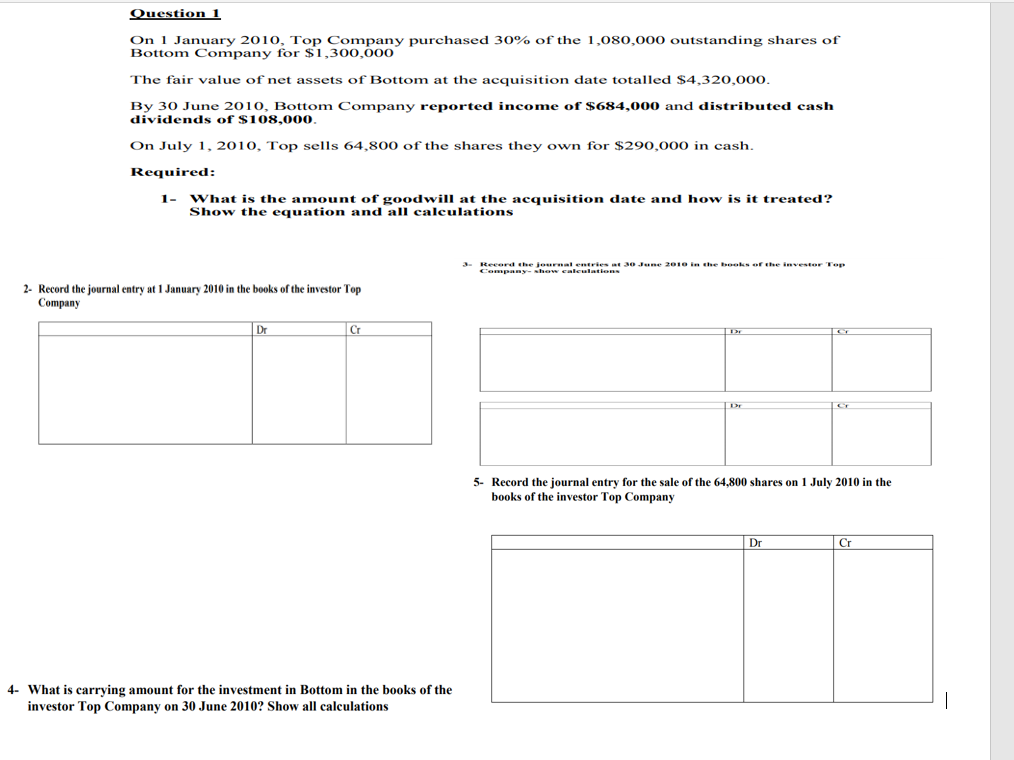

Question 1 On 1 January 2010, Top Company purchased 30% of the 1,080,000 outstanding shares of Bottom Company for $1,300,000 The fair value of net assets of Bottom at the acquisition date totalled $4,320,000. By 30 June 2010, Bottom Company reported income of $684,000 and distributed cash dividends of $108,000. On July 1, 2010, Top sells 64,800 of the shares they own for $290,000 in cash. Required: 1- What is the amount of goodwill at the acquisition date and how is it treated? Show the equation and all calculations 3. Record the journal entries at 30 June 2010 in the books of the investor Top Company-show calculations 2- Record the journal entry at 1 January 2010 in the books of the investor Top Company Dr Cr 4- What is carrying amount for the investment in Bottom in the books of the investor Top Company on 30 June 2010? Show all calculations DE Dr G 5- Record the journal entry for the sale of the 64,800 shares on 1 July 2010 in the books of the investor Top Company Dr Cr

Step by Step Solution

★★★★★

3.42 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

1 Calculation of goodwill at acquisition date Total shares of Bottom 1080000 Shares acquir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started