Answered step by step

Verified Expert Solution

Question

1 Approved Answer

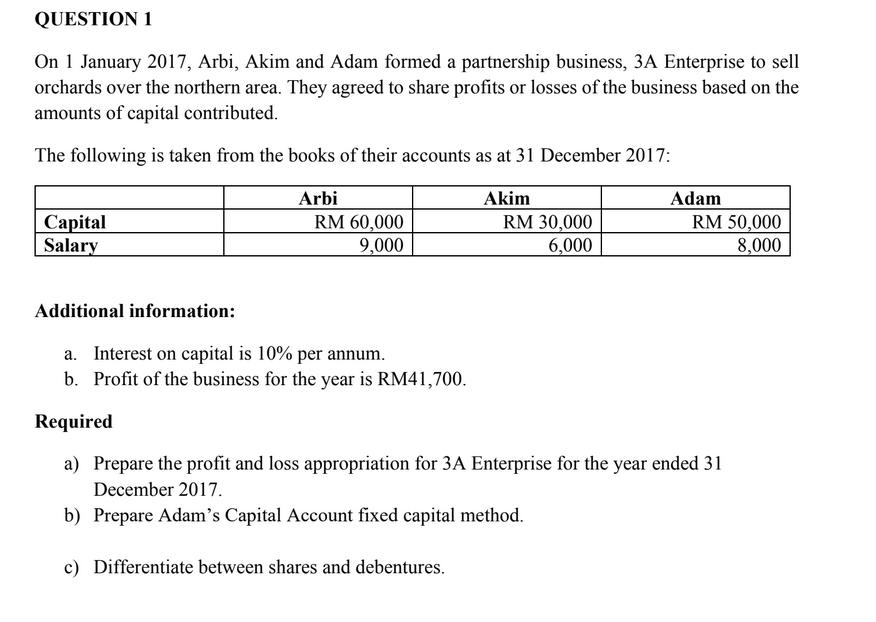

QUESTION 1 On 1 January 2017, Arbi, Akim and Adam formed a partnership business, 3A Enterprise to sell orchards over the northern area. They

QUESTION 1 On 1 January 2017, Arbi, Akim and Adam formed a partnership business, 3A Enterprise to sell orchards over the northern area. They agreed to share profits or losses of the business based on the amounts of capital contributed. The following is taken from the books of their accounts as at 31 December 2017: Capital Salary Arbi RM 60,000 9,000 Additional information: a. Interest on capital is 10% per annum. b. Profit of the business for the year is RM41,700. Akim RM 30,000 6,000 Adam RM 50,000 8,000 Required a) Prepare the profit and loss appropriation for 3A Enterprise for the year ended 31 December 2017. b) Prepare Adam's Capital Account fixed capital method. c) Differentiate between shares and debentures.

Step by Step Solution

★★★★★

3.50 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

a Profit and Loss Appropriation for 3A Enterprise for the year ended 31 December ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started