Answered step by step

Verified Expert Solution

Question

1 Approved Answer

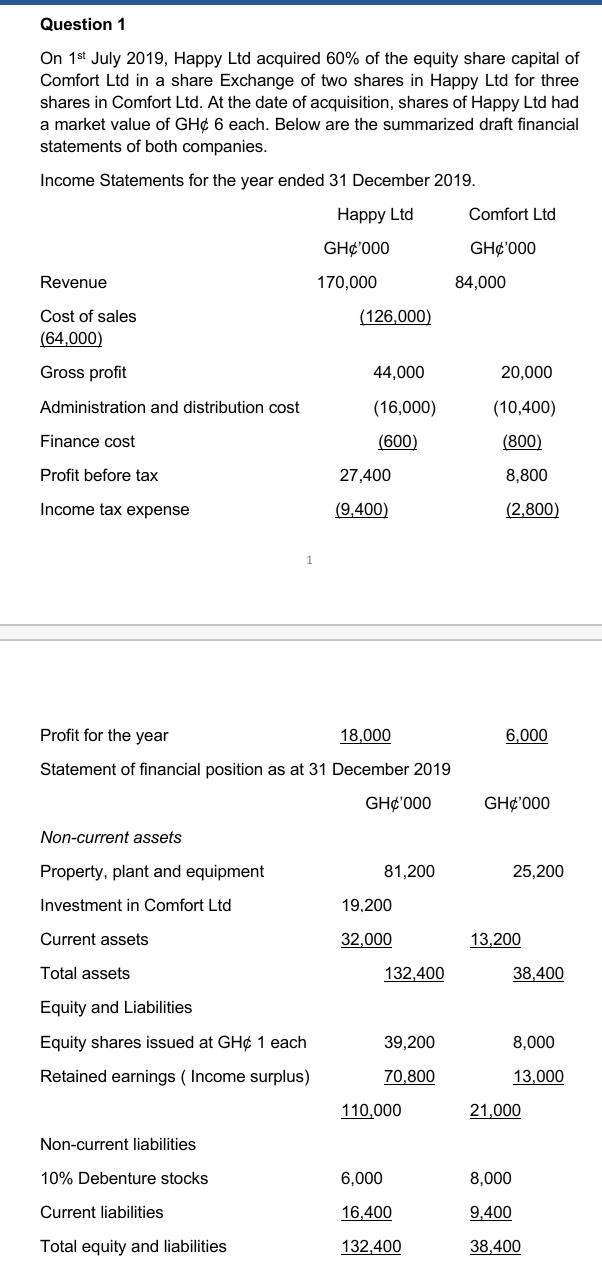

Question 1 On 1st July 2019, Happy Ltd acquired 60% of the equity share capital of Comfort Ltd in a share Exchange of two

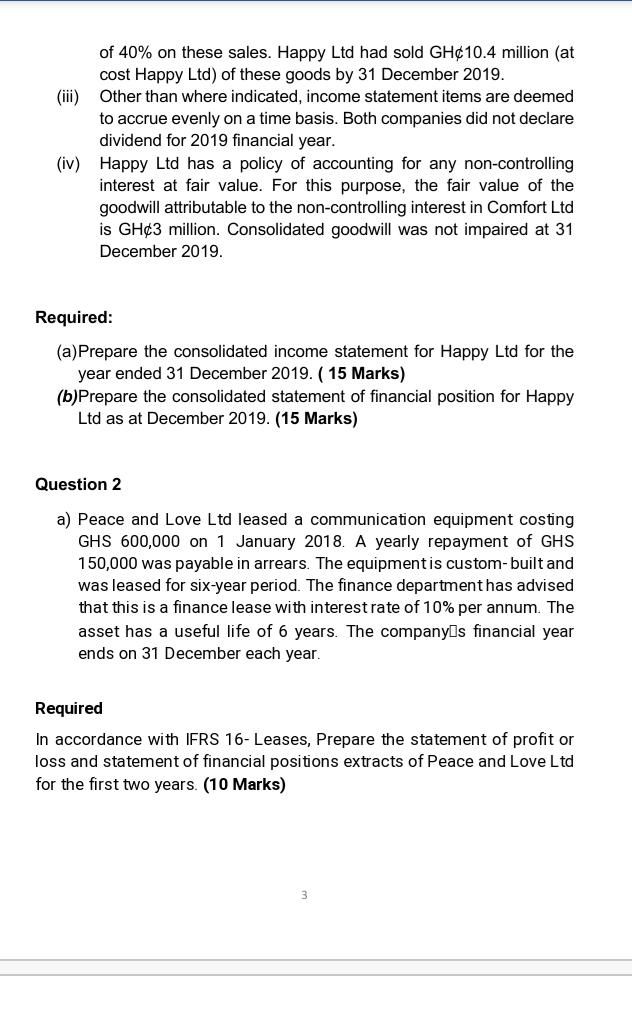

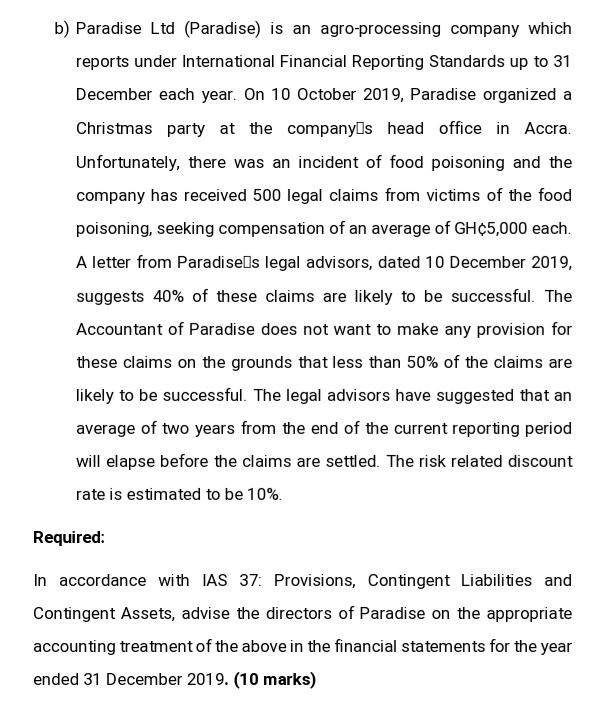

Question 1 On 1st July 2019, Happy Ltd acquired 60% of the equity share capital of Comfort Ltd in a share Exchange of two shares in Happy Ltd for three shares in Comfort Ltd. At the date of acquisition, shares of Happy Ltd had a market value of GH 6 each. Below are the summarized draft financial statements of both companies. Income Statements for the year ended 31 December 2019. Happy Ltd Revenue Cost of sales (64,000) Gross profit Administration and distribution cost Finance cost Profit before tax Income tax expense 1 Non-current assets Property, plant and equipment Investment in Comfort Ltd Current assets Total assets Equity and Liabilities Equity shares issued at GH 1 each Retained earnings (Income surplus) Non-current liabilities 10% Debenture stocks Current liabilities Total equity and liabilities GH'000 170,000 (126,000) Profit for the year 18,000 Statement of financial position as at 31 December 2019 GH'000 44,000 (16,000) (600) 27,400 (9,400) 81,200 19,200 32,000 132,400 39,200 70,800 110,000 6,000 16,400 132,400 Comfort Ltd GH'000 84,000 20,000 (10,400) (800) 8,800 (2,800) 6,000 GH'000 25,200 13,200 38,400 8,000 13,000 21,000 8,000 9,400 38,400 of 40% on these sales. Happy Ltd had sold GH10.4 million (at cost Happy Ltd) of these goods by 31 December 2019. Other than where indicated, income statement items are deemed to accrue evenly on a time basis. Both companies did not declare dividend for 2019 financial year. (iv) Happy Ltd has a policy of accounting for any non-controlling interest at fair value. For this purpose, the fair value of the goodwill attributable to the non-controlling interest in Comfort Ltd is GH3 million. Consolidated goodwill was not impaired at 31 December 2019. Required: (a) Prepare the consolidated income statement for Happy Ltd for the year ended 31 December 2019. (15 Marks) (b)Prepare the consolidated statement of financial position for Happy Ltd as at December 2019. (15 Marks) Question 2 a) Peace and Love Ltd leased a communication equipment costing GHS 600,000 on 1 January 2018. A yearly repayment of GHS 150,000 was payable in arrears. The equipment is custom-built and was leased for six-year period. The finance department has advised that this is a finance lease with interest rate of 10% per annum. The asset has a useful life of 6 years. The company's financial year ends on 31 December each year. Required In accordance with IFRS 16- Leases, Prepare the statement of profit or loss and statement of financial positions extracts of Peace and Love Ltd for the first two years. (10 Marks) b) Paradise Ltd (Paradise) is an agro-processing company which reports under International Financial Reporting Standards up to 31 December each year. On 10 October 2019, Paradise organized a Christmas party at the company s head office in Accra. Unfortunately, there was an incident of food poisoning and the company has received 500 legal claims from victims of the food poisoning, seeking compensation of an average of GH$5,000 each. A letter from Paradises legal advisors, dated 10 December 2019, suggests 40% of these claims are likely to be successful. The Accountant of Paradise does not want to make any provision for these claims on the grounds that less than 50% of the claims are likely to be successful. The legal advisors have suggested that an average of two years from the end of the current reporting period will elapse before the claims are settled. The risk related discount rate is estimated to be 10%. Required: In accordance with IAS 37: Provisions, Contingent Liabilities and Contingent Assets, advise the directors of Paradise on the appropriate accounting treatment of the above in the financial statements for the year ended 31 December 2019. (10 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

A I Consolidated Income Statement Consolidated Income Statement for the Year Ended 31 December 2019 GH000 Revenue Happy Ltd 170000 Comfort Ltd 84000 Total Revenue 254000 Cost of sales Happy Ltd 126000 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started