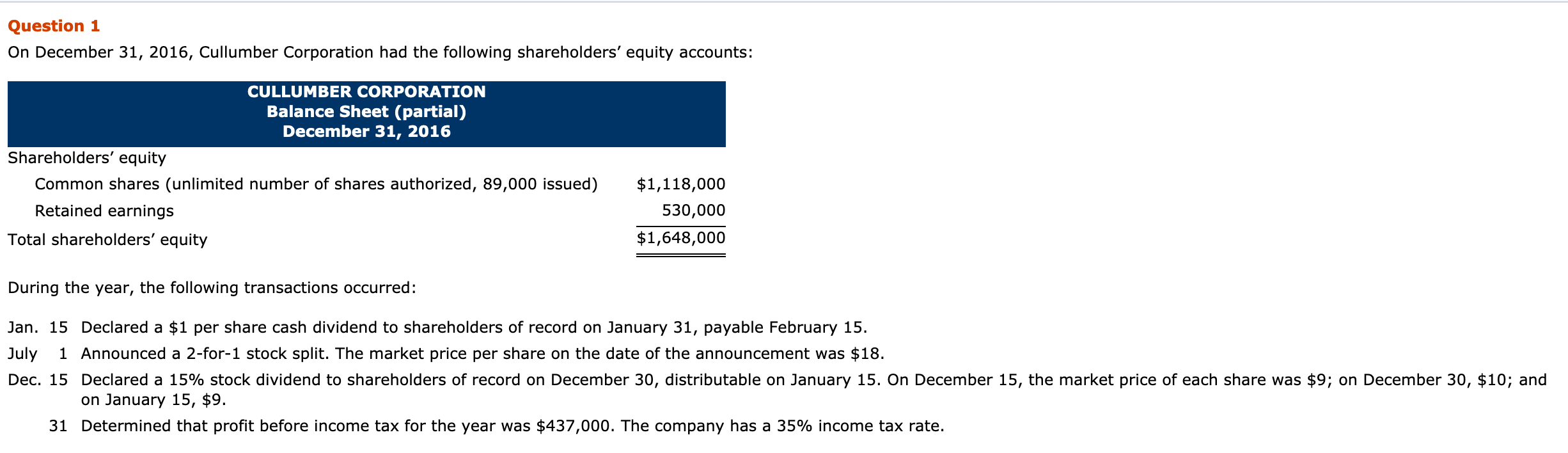

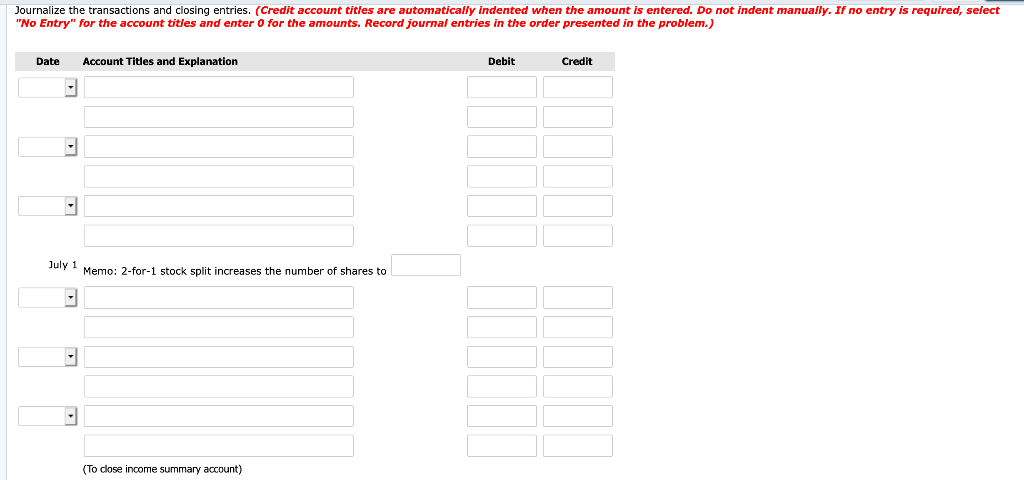

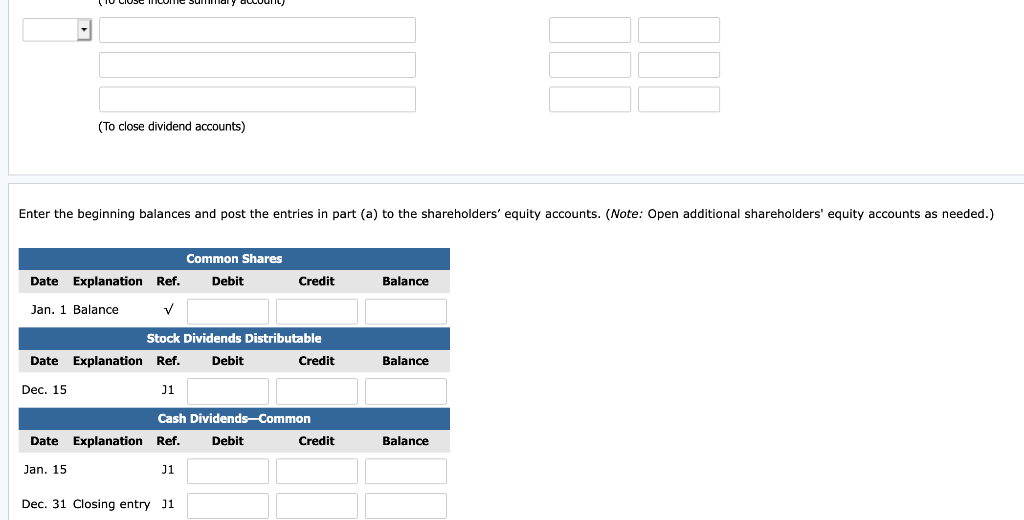

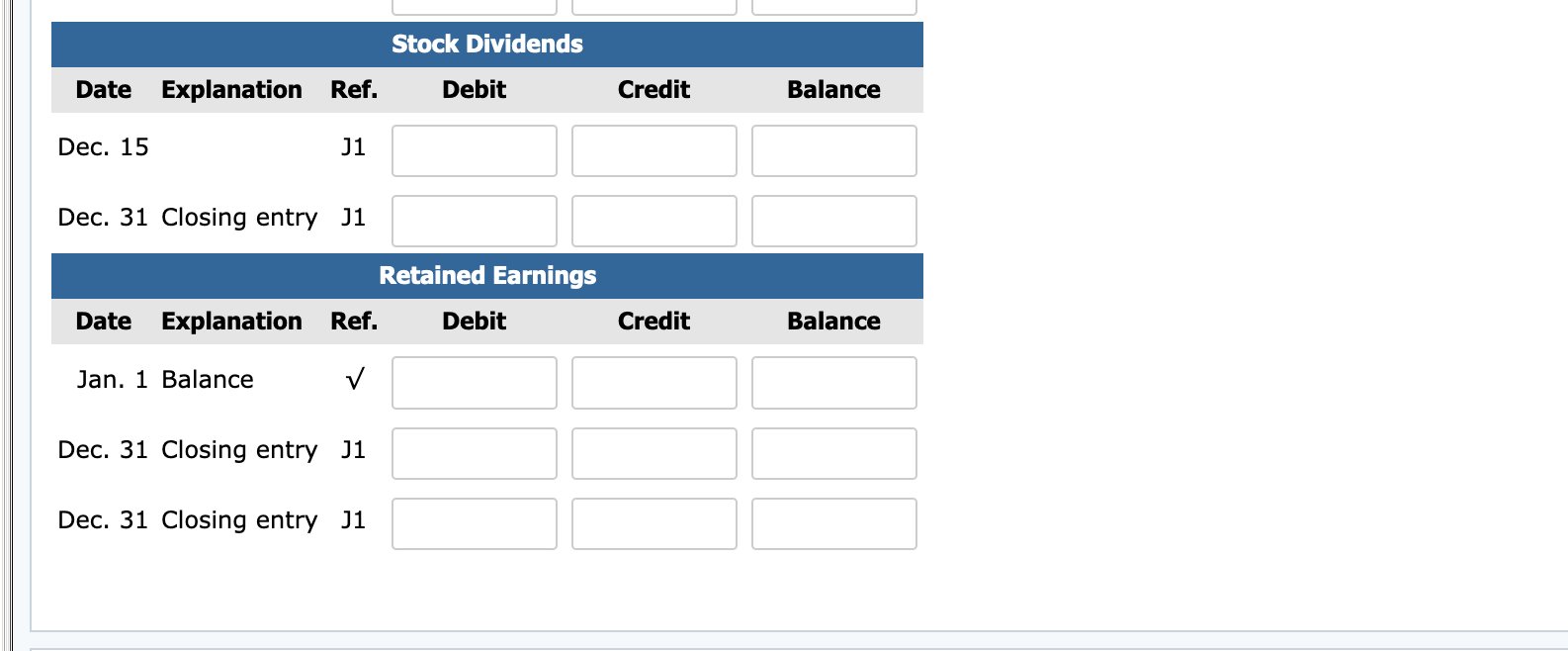

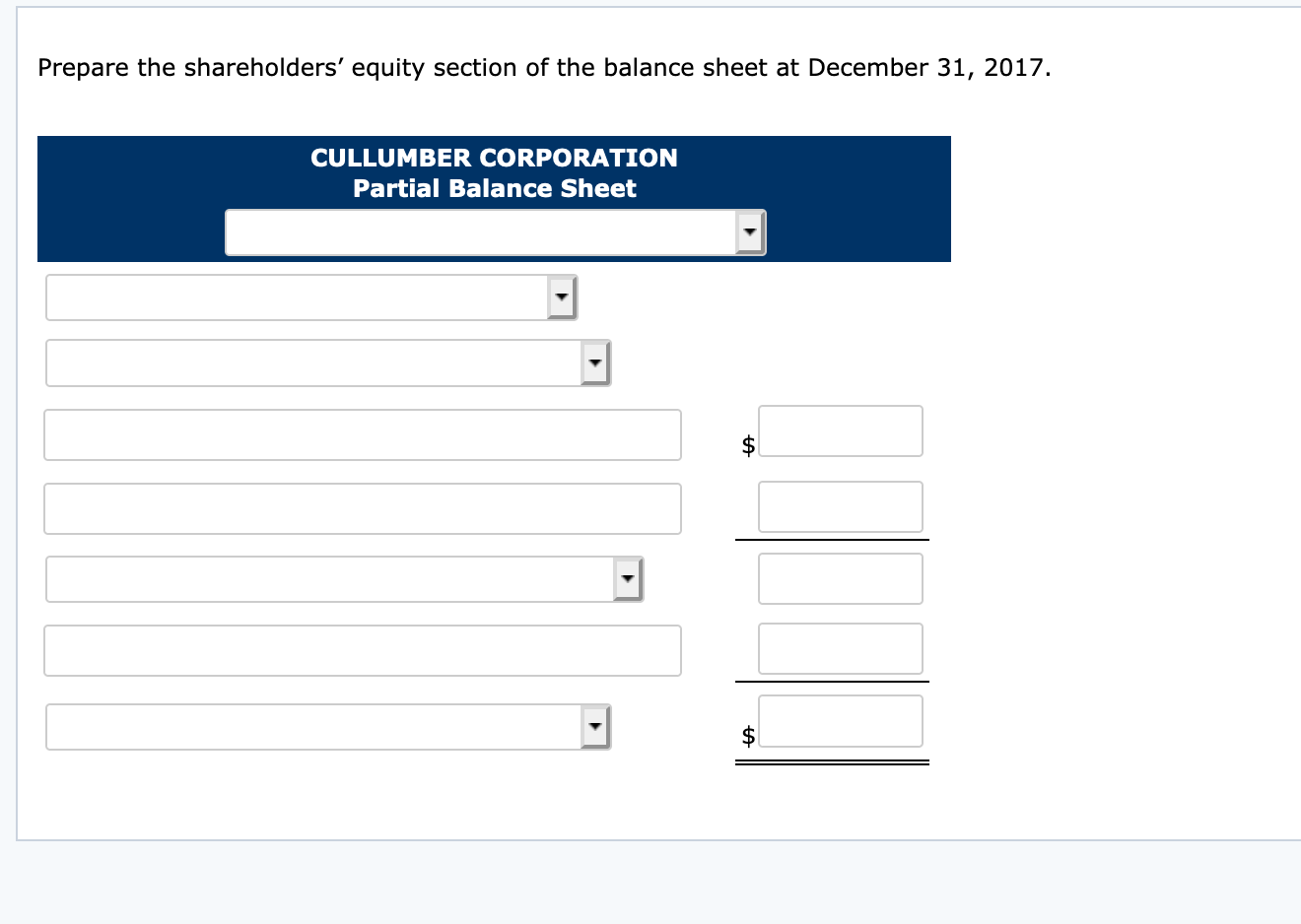

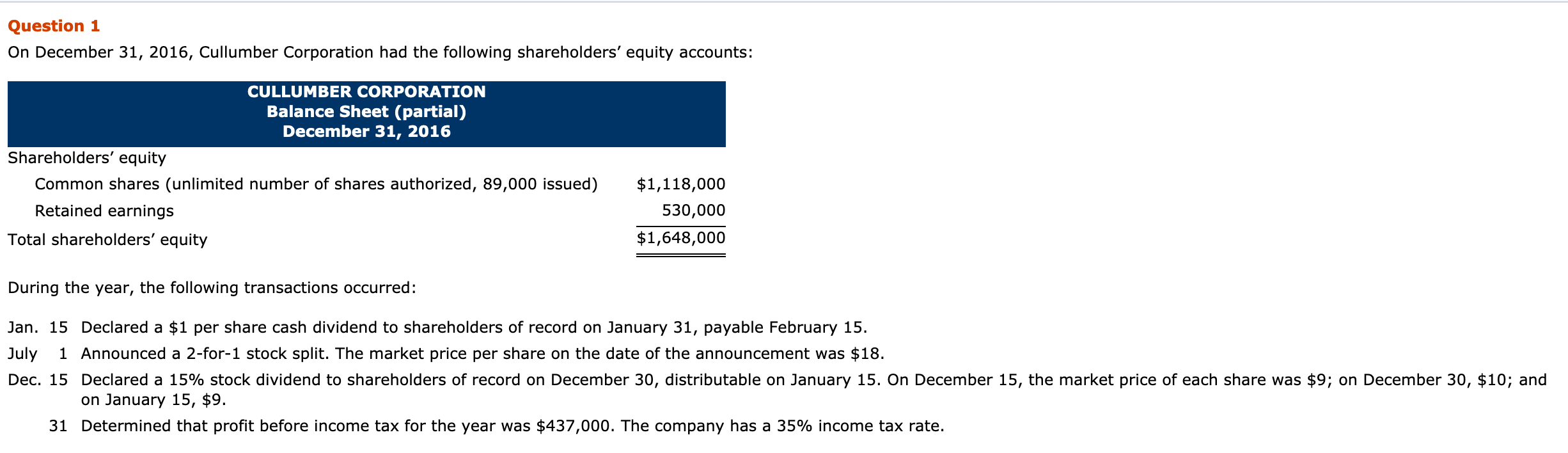

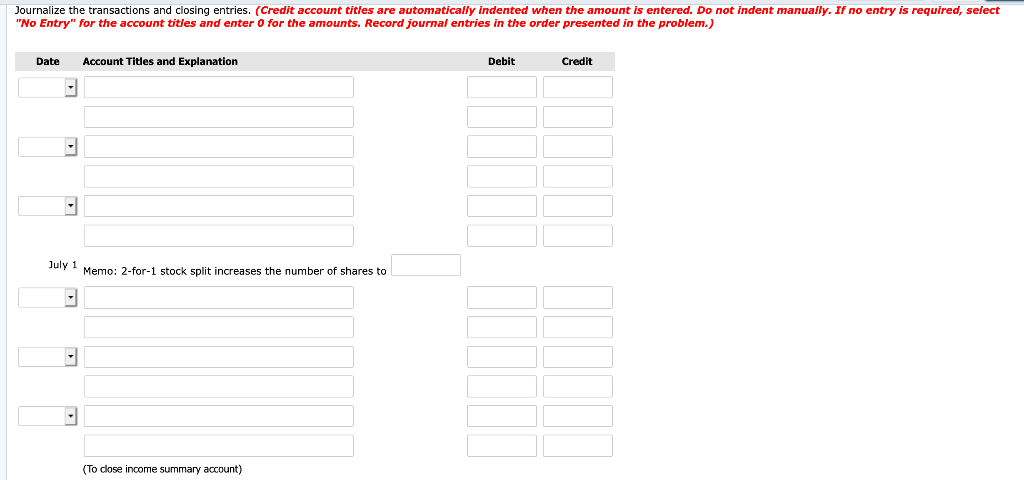

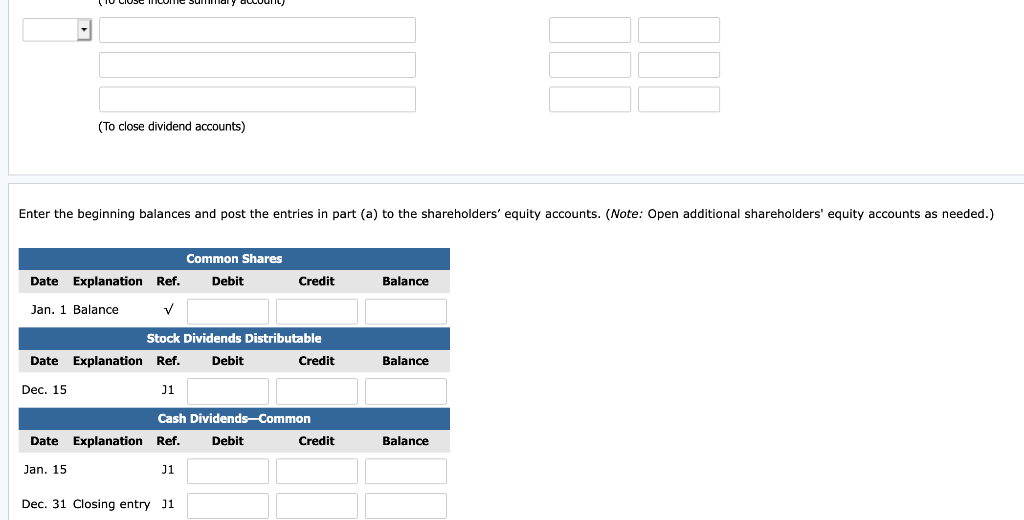

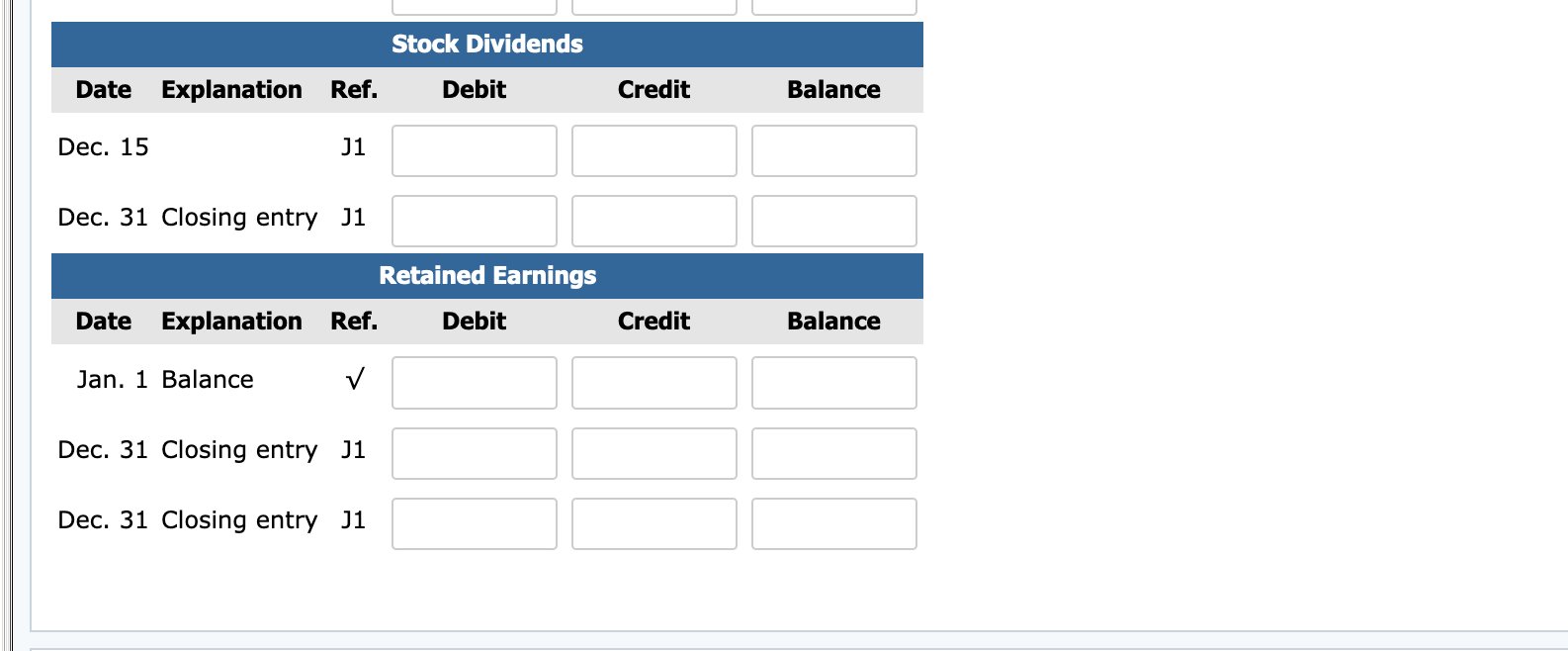

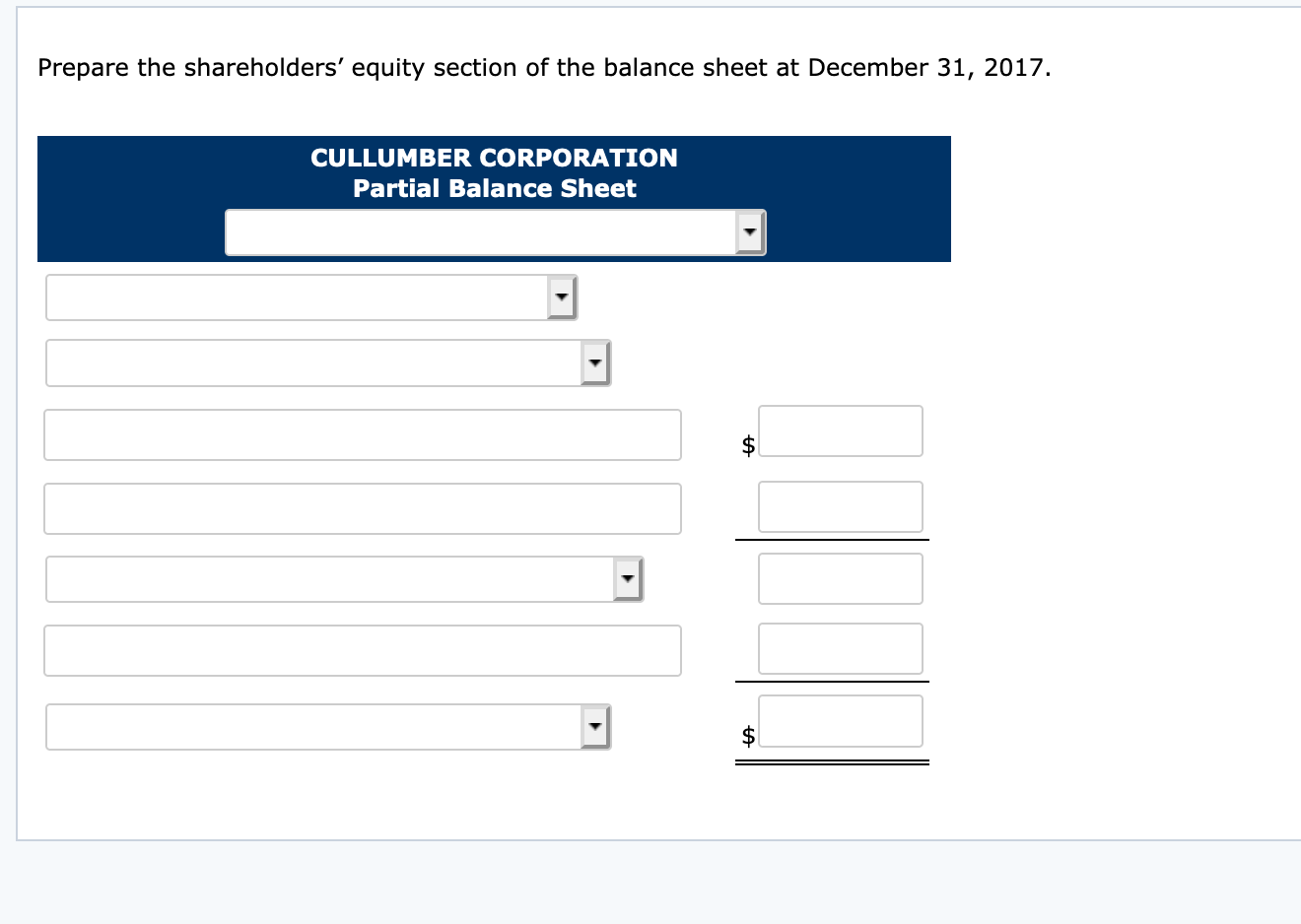

Question 1 On December 31, 2016, Cullumber Corporation had the following shareholders' equity accounts: CULLUMBER CORPORATION Balance Sheet (partial) December 31, 2016 Shareholders' equity Common shares (unlimited number of shares authorized, 89,000 issued) Retained earnings Total shareholders' equity $1,118,000 530,000 $1,648,000 During the year, the following transactions occurred: Jan. 15 Declared a $1 per share cash dividend to shareholders of record on January 31, payable February 15. July 1 Announced a 2-for-1 stock split. The market price per share on the date of the announcement was $18. Dec. 15 Declared a 15% stock dividend to shareholders of record on December 30, distributable on January 15. On December 15, the market price of each share was $9; on December 30, $10; and on January 15, $9. 31 Determined that profit before income tax for the year was $437,000. The company has a 35% income tax rate. Journalize the transactions and closing entries. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit July Memo: 2-for-1 stock split increases the number of shares to . (To dose income summary account) (To close dividend accounts) Enter the beginning balances and post the entries in part (a) to the shareholders' equity accounts. (Note: Open additional shareholders' equity accounts as needed.) Common Shares Date Explanation Ref. Debit Credit Balance Jan. 1 Balance Stock Dividends Distributable Date Explanation Ref. Debit Credit Balance Dec. 15 31 Cash DividendsCommon Date Explanation Ref. Debit Credit Balance Jan. 15 J1 Dec. 31 Closing entry J1 Stock Dividends Date Explanation Ref. Debit Credit Balance Dec. 15 J1 Dec. 31 Closing entry J1 Retained Earnings Explanation Ref. Debit Date Credit Balance Jan. 1 Balance Dec. 31 Closing entry J1 Dec. 31 Closing entry J1 Prepare the shareholders' equity section of the balance sheet at December 31, 2017. CULLUMBER CORPORATION Partial Balance Sheet