Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On December 31, 2021, the unadjusted trial balance of Pearce Services showed the following balances (all in their normal balance): Accounts receivable $400,000 Allowance

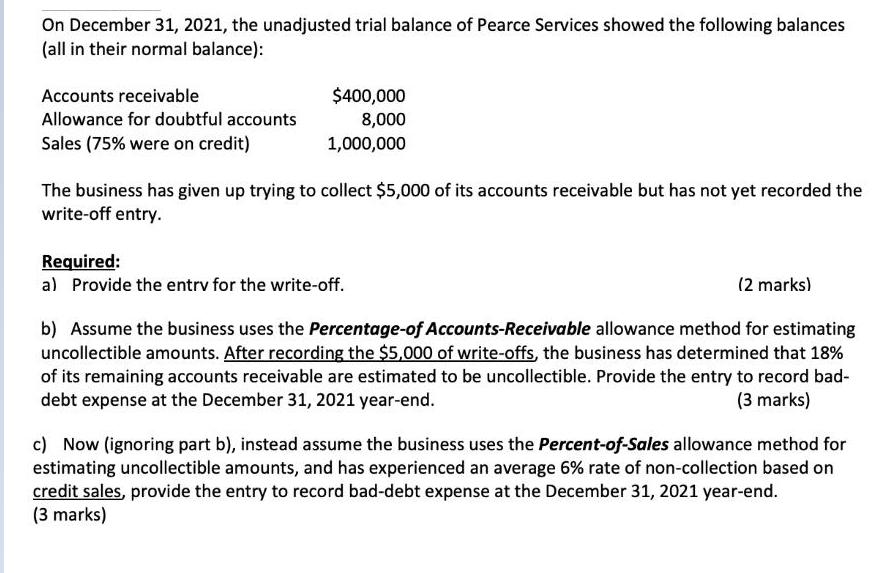

On December 31, 2021, the unadjusted trial balance of Pearce Services showed the following balances (all in their normal balance): Accounts receivable $400,000 Allowance for doubtful accounts 8,000 Sales (75% were on credit) 1,000,000 The business has given up trying to collect $5,000 of its accounts receivable but has not yet recorded the write-off entry. Required: a) Provide the entrv for the write-off. (2 marks) b) Assume the business uses the Percentage-of Accounts-Receivable allowance method for estimating uncollectible amounts. After recording the $5,000 of write-offs, the business has determined that 18% of its remaining accounts receivable are estimated to be uncollectible. Provide the entry to record bad- debt expense at the December 31, 2021 year-end. (3 marks) c) Now (ignoring part b), instead assume the business uses the Percent-of-Sales allowance method for estimating uncollectible amounts, and has experienced an average 6% rate of non-collection based on credit sales, provide the entry to record bad-debt expense at the December 31, 2021 year-end. (3 marks)

Step by Step Solution

★★★★★

3.40 Rating (166 Votes )

There are 3 Steps involved in it

Step: 1

a Journal entry to write off Date Particulars Debit Credit Allowance for doubtful debts ac 500...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started