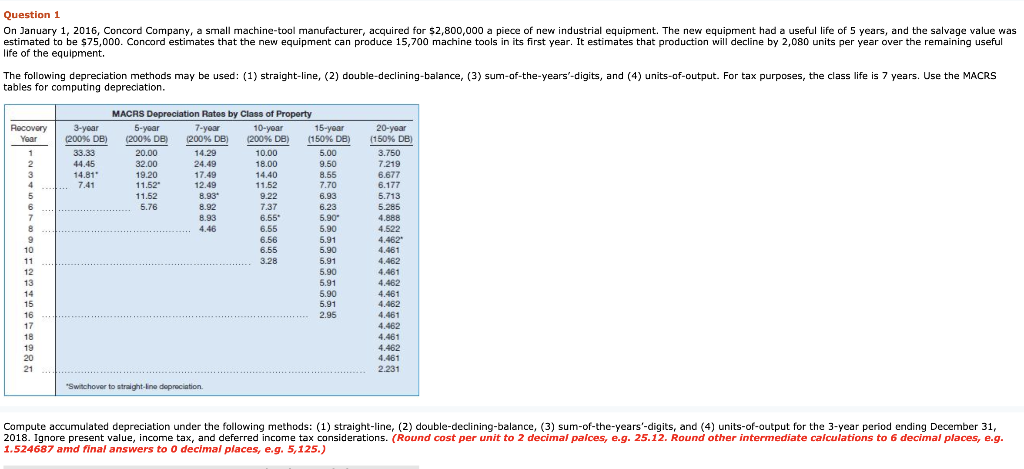

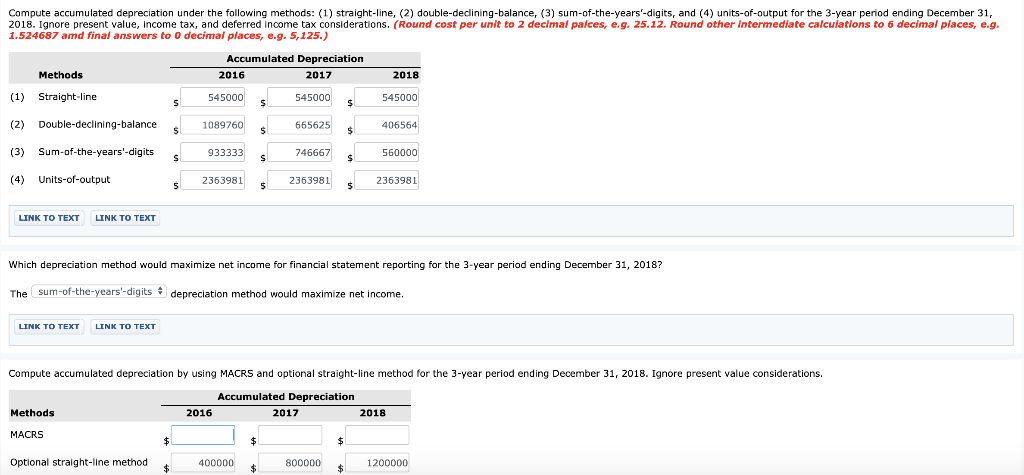

Question 1 On January 1, 2016, Concord Company, a small machine-tool manufacturer, acquired for $2,800,000 a piece of new industrial equipment. The new equipment had a useful life of 5 years, and the salvage value was estimated to be $75,000. Concord estimates that the new equipment can produce 15,700 machine tools in its first year. It estimates that production will decline by 2,080 units per year over the remaining useful life of the equipment. The following depreciation methods may be used: (1) straight-line, (2) double-declining-balance, (3) sum-of-the-years'-digits, and (4) units-of-output. For tax purposes, the class life is 7 years. Use the MACRS tables for computing depreciation. MACRS Depreciation Rates by Class of Property 7-year Recovery 3-year | Year (200% DE) (200% D 20.00 32.00 19.20 11.52 11.52 5.76 (200% DB) 14.29 24.49 17.49 12.49 8.93* 8.92 8.93 4.46 (200% DB) 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 (150% De) 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 6.91 5.90 5.91 5.90 5.91 (150% DB) 3.750 7.219 6.677 44.45 14.81 7.41 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 10 12 15 16 17 18 19 Compute accumulated depreciation under the following methods: (1) straight-line, (2) double-declining-balance, (3) sum-of-the-years'-digits, and (4) units-of-output for the 3-year period ending December 31, 2018. Ignore present value, income tax, and deferred income tax considerations. (Round cost per unit to 2 decimal palces, e.g. 25.12. Round other intermediate calculations to 6 decimal places, e.g 1.524687 amd final answers to 0 decimal places, e.g. 5,125.) Compute accumulated depreciation under the following methods: 1) straight-line, (2) double-declining-balance, (3) sum-of-the-years'-digits, and (4) units-of-output for the 3-year period ending December 31, 2018. Ignore present value, income tax, and deferred income tax considerations. (Round cost per unit to 2 decimal palces, e.g. 25.12. Round other Intermediate calculations to 6 decimal places, e.g 1.524687 amd final answers to 0 decimal places, e.g. 5,125.) Accumulated Depreciation Methods 2016 2017 2018 (1) Straight-line (2) Double-declining-balance (3) Sum-of-the-years'-digits (4) Units-of-output 545 545000 545000 665625$ 406564 10897 s 933333 746667 560000 2363981s 2363981s 2363981 LINK TO TEXT LINK TO TEXT Which depreciation method would maximize net income for financial statement reporting for the 3-year period ending December 31, 2018? sum-of-the-years-digits depreciation method would maximize net income. The Compute accumulated depreciation by using MACRS and optional straight-line method for the 3-year period ending December 31, 2018. Ignore present value considerations. Accumulated Depreciation 2017 Methods 2016 2018 MACRS 00000$ 00000$ Optional straight-line methood 1200000 Question 1 On January 1, 2016, Concord Company, a small machine-tool manufacturer, acquired for $2,800,000 a piece of new industrial equipment. The new equipment had a useful life of 5 years, and the salvage value was estimated to be $75,000. Concord estimates that the new equipment can produce 15,700 machine tools in its first year. It estimates that production will decline by 2,080 units per year over the remaining useful life of the equipment. The following depreciation methods may be used: (1) straight-line, (2) double-declining-balance, (3) sum-of-the-years'-digits, and (4) units-of-output. For tax purposes, the class life is 7 years. Use the MACRS tables for computing depreciation. MACRS Depreciation Rates by Class of Property 7-year Recovery 3-year | Year (200% DE) (200% D 20.00 32.00 19.20 11.52 11.52 5.76 (200% DB) 14.29 24.49 17.49 12.49 8.93* 8.92 8.93 4.46 (200% DB) 10.00 18.00 14.40 11.52 9.22 7.37 6.55 6.55 6.56 6.55 (150% De) 5.00 9.50 8.55 7.70 6.93 6.23 5.90 5.90 5.91 5.90 6.91 5.90 5.91 5.90 5.91 (150% DB) 3.750 7.219 6.677 44.45 14.81 7.41 5.713 5.285 4.888 4.522 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 10 12 15 16 17 18 19 Compute accumulated depreciation under the following methods: (1) straight-line, (2) double-declining-balance, (3) sum-of-the-years'-digits, and (4) units-of-output for the 3-year period ending December 31, 2018. Ignore present value, income tax, and deferred income tax considerations. (Round cost per unit to 2 decimal palces, e.g. 25.12. Round other intermediate calculations to 6 decimal places, e.g 1.524687 amd final answers to 0 decimal places, e.g. 5,125.) Compute accumulated depreciation under the following methods: 1) straight-line, (2) double-declining-balance, (3) sum-of-the-years'-digits, and (4) units-of-output for the 3-year period ending December 31, 2018. Ignore present value, income tax, and deferred income tax considerations. (Round cost per unit to 2 decimal palces, e.g. 25.12. Round other Intermediate calculations to 6 decimal places, e.g 1.524687 amd final answers to 0 decimal places, e.g. 5,125.) Accumulated Depreciation Methods 2016 2017 2018 (1) Straight-line (2) Double-declining-balance (3) Sum-of-the-years'-digits (4) Units-of-output 545 545000 545000 665625$ 406564 10897 s 933333 746667 560000 2363981s 2363981s 2363981 LINK TO TEXT LINK TO TEXT Which depreciation method would maximize net income for financial statement reporting for the 3-year period ending December 31, 2018? sum-of-the-years-digits depreciation method would maximize net income. The Compute accumulated depreciation by using MACRS and optional straight-line method for the 3-year period ending December 31, 2018. Ignore present value considerations. Accumulated Depreciation 2017 Methods 2016 2018 MACRS 00000$ 00000$ Optional straight-line methood 1200000