Answered step by step

Verified Expert Solution

Question

1 Approved Answer

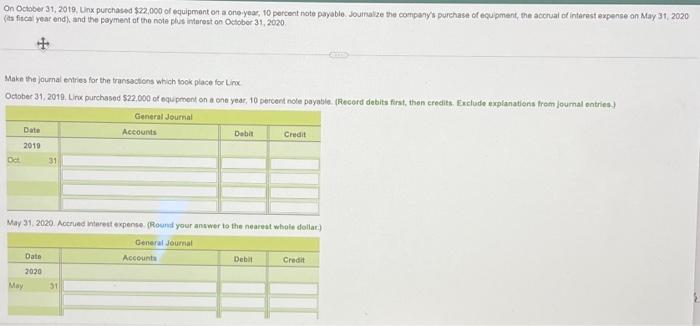

Question 1: On October 31, 2019, Linx purchased $22,000 of equipment on a one-year, 10 percent note payable. Journalize the company's purchase of equipment, the

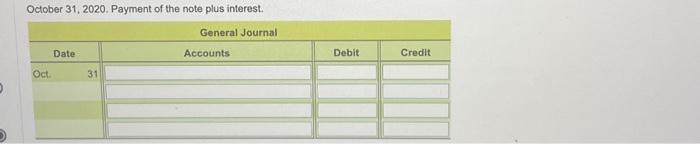

Question 1: On October 31, 2019, Linx purchased $22,000 of equipment on a one-year, 10 percent note payable. Journalize the company's purchase of equipment, the accrual of interest expense on May 31, 2020 (its fiscal year end), and the payment of the note plus interest on October 31, 2020. Make the journal entries for the transactions which took place for Linx. October 31, 2019. Linx purchased $22,000 of equipment on a one year, 10 percent note payable. (Record debits first, then credits. Exclude explanations from journal entries.) General Journal Oct. Date 2019 May Date 31 2020 May 31, 2020. Accrued interest expense. (Round your answer to the nearest whole dollar.) General Journal Accounts 31 Debit Accounts Credit Debit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started