Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 1 Part A Glam Bridal Company, a wedding planner company, commences their business operation as of 1 January 2020. Throughout the month of January

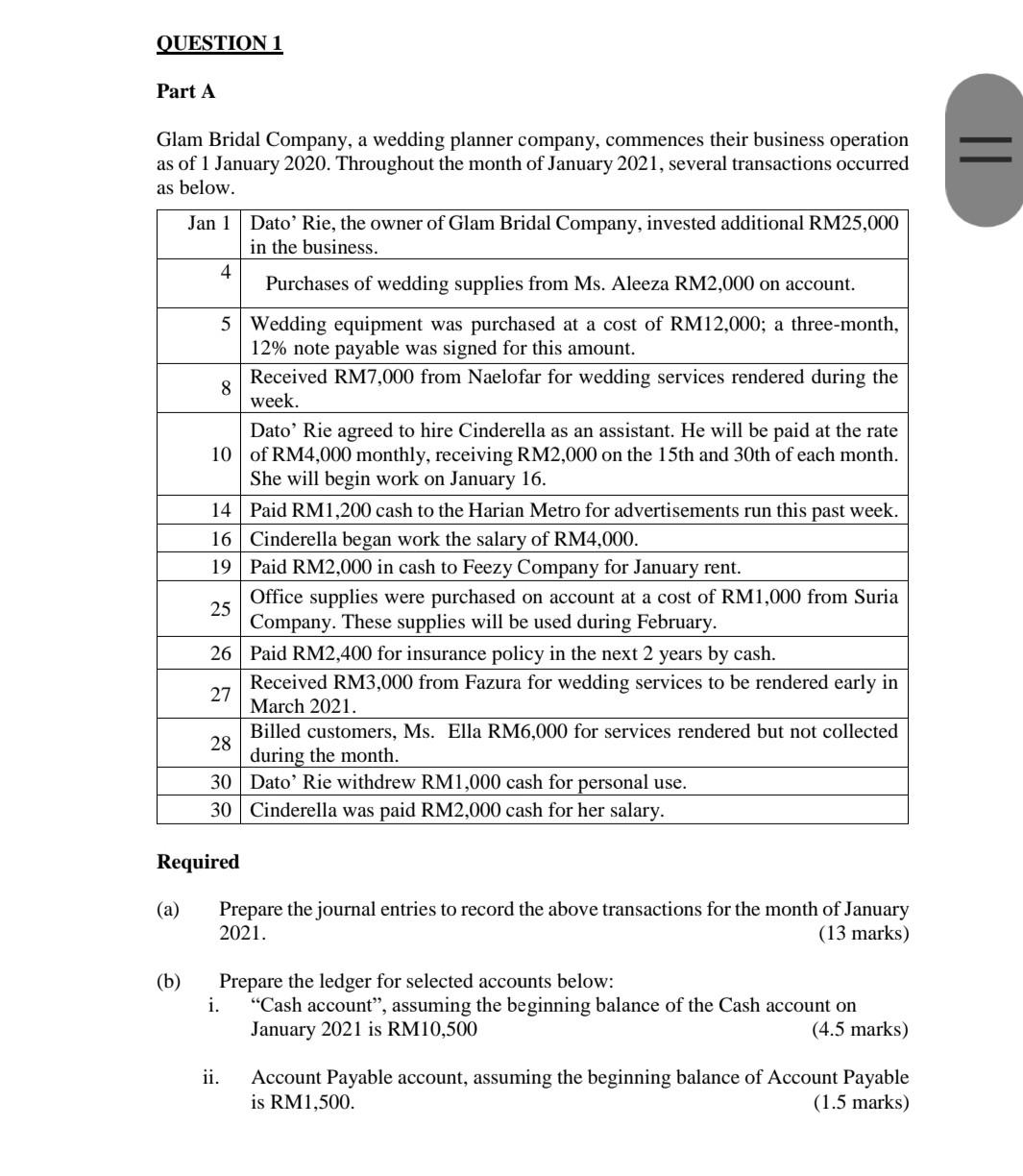

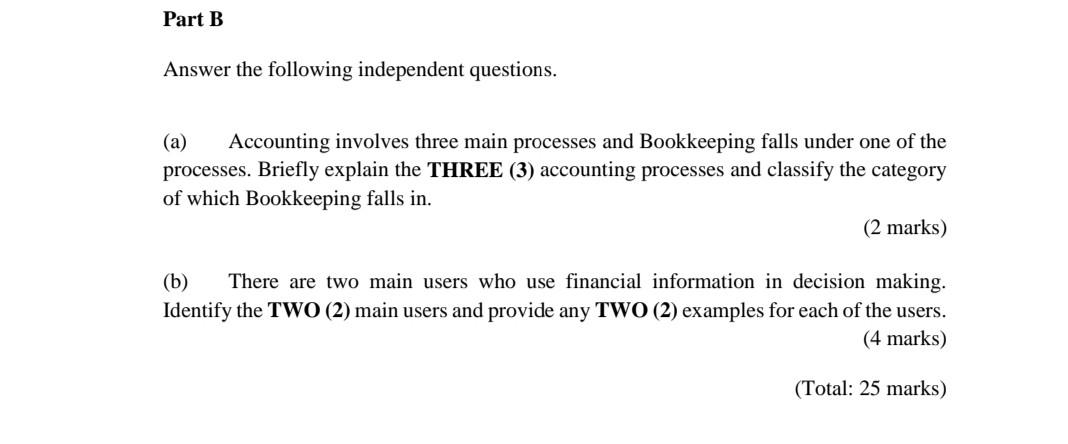

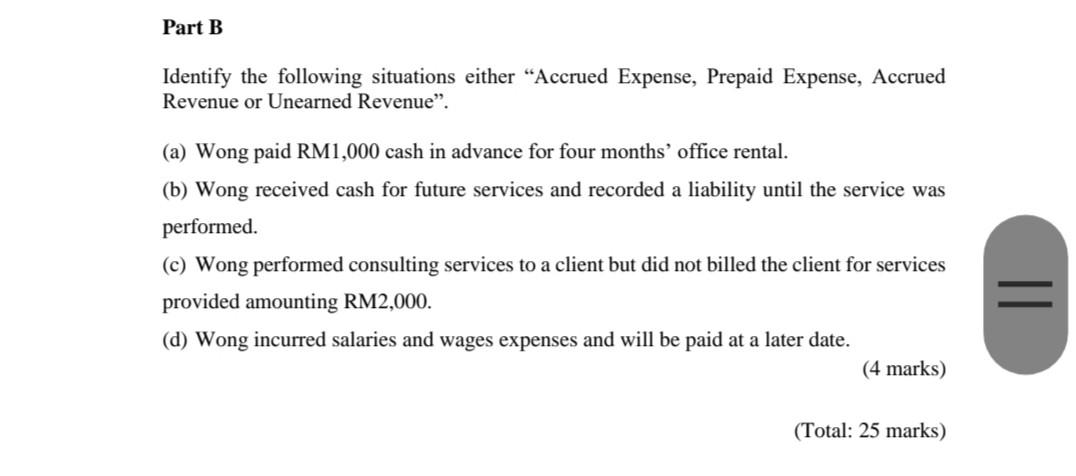

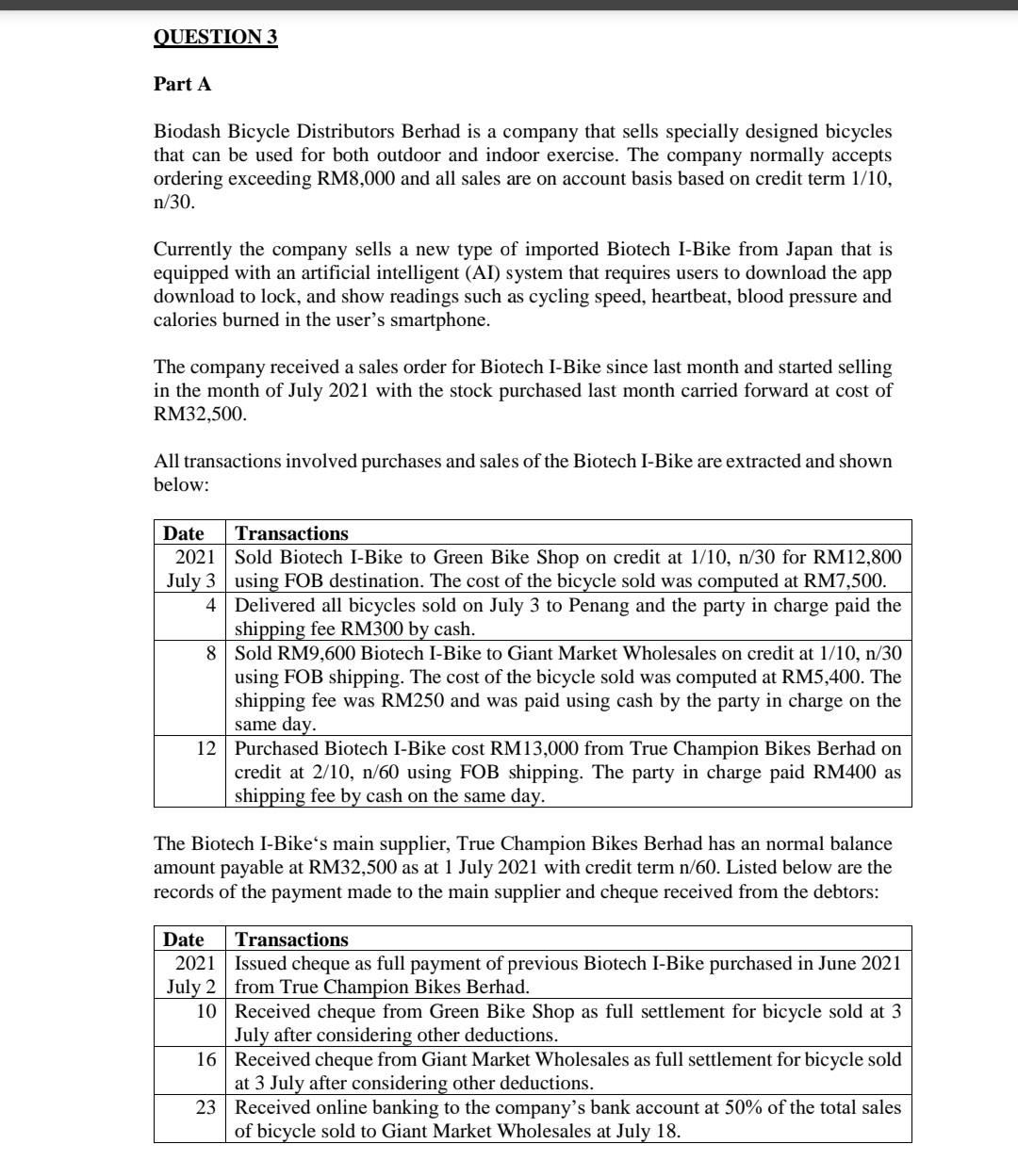

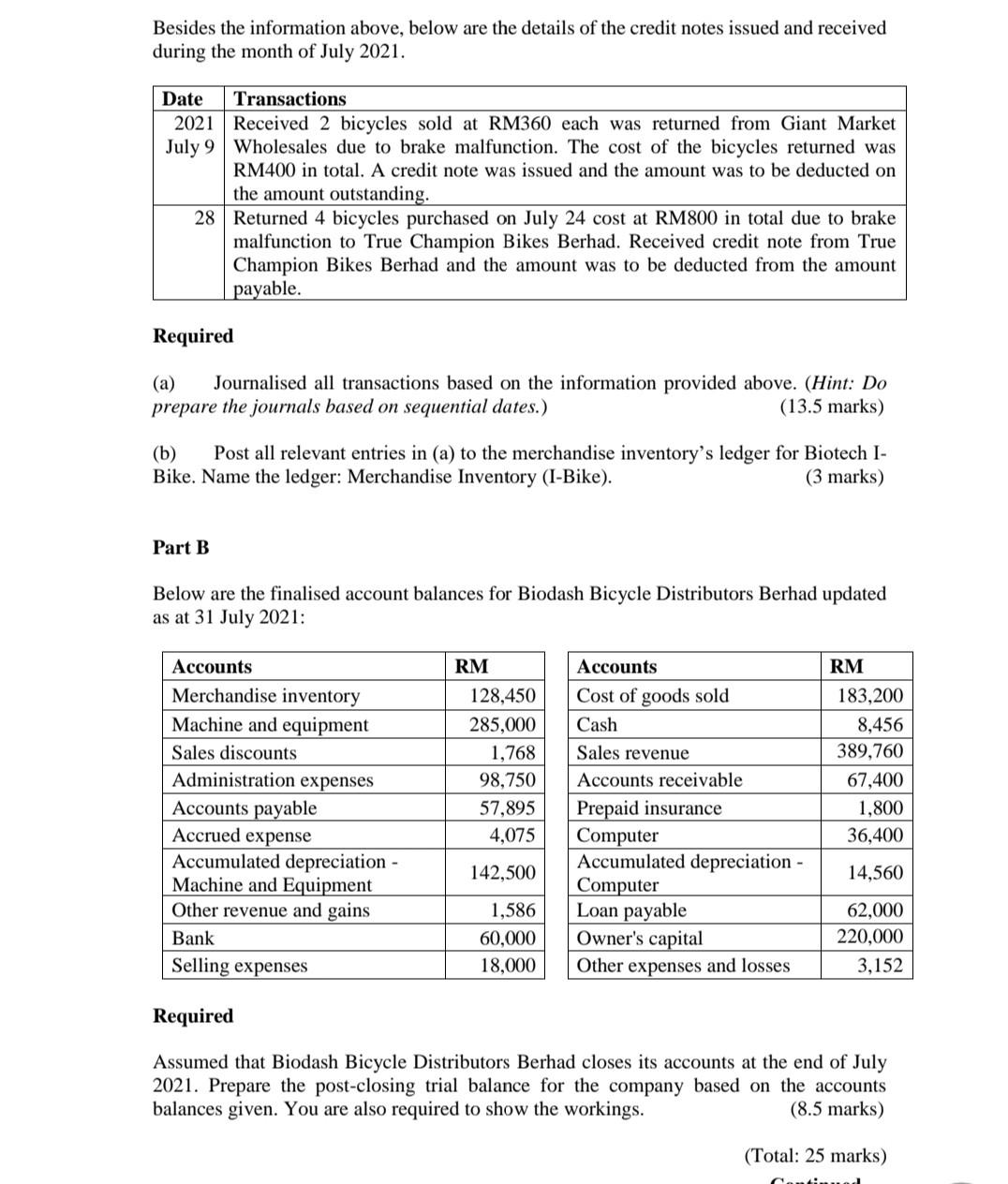

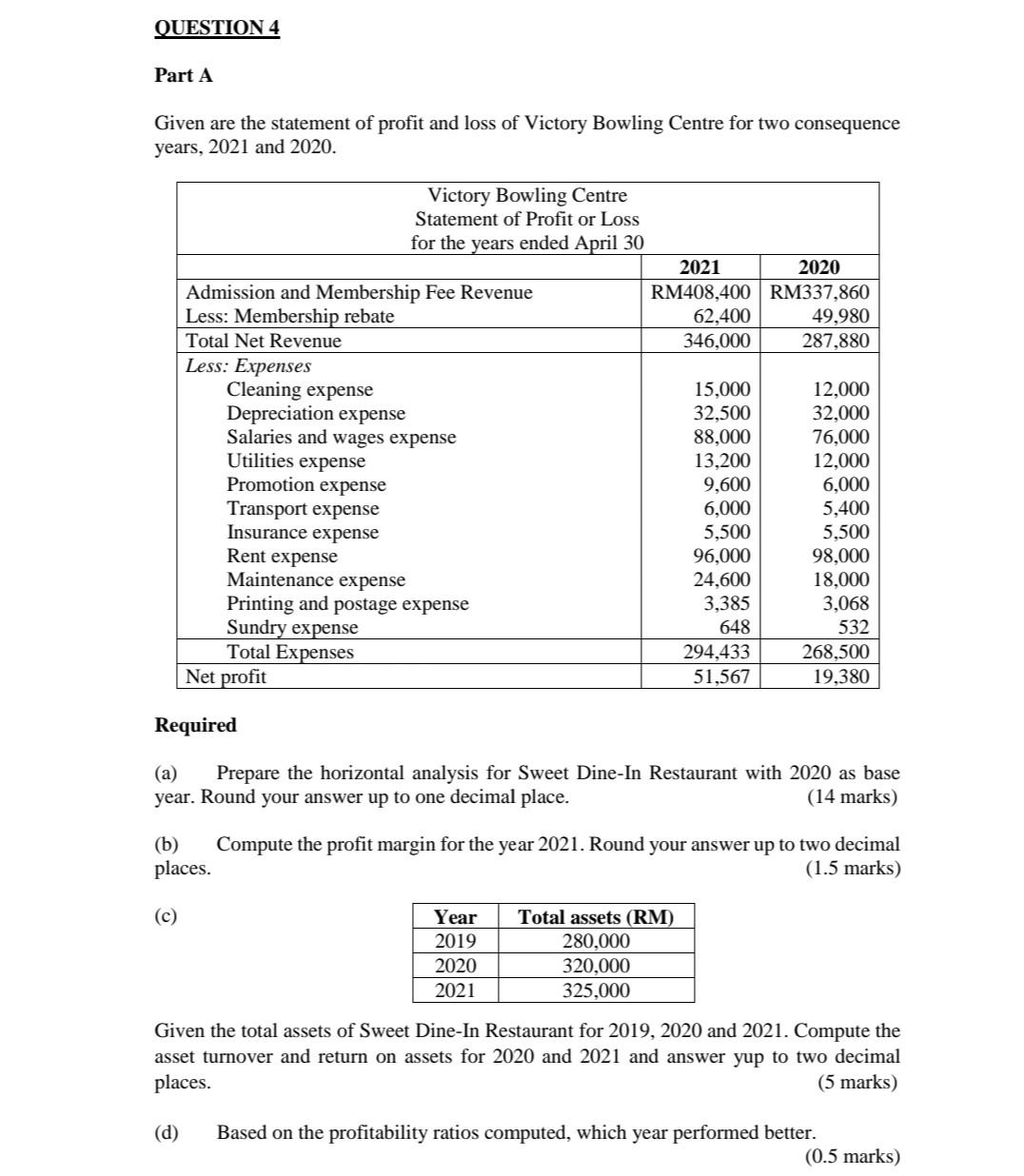

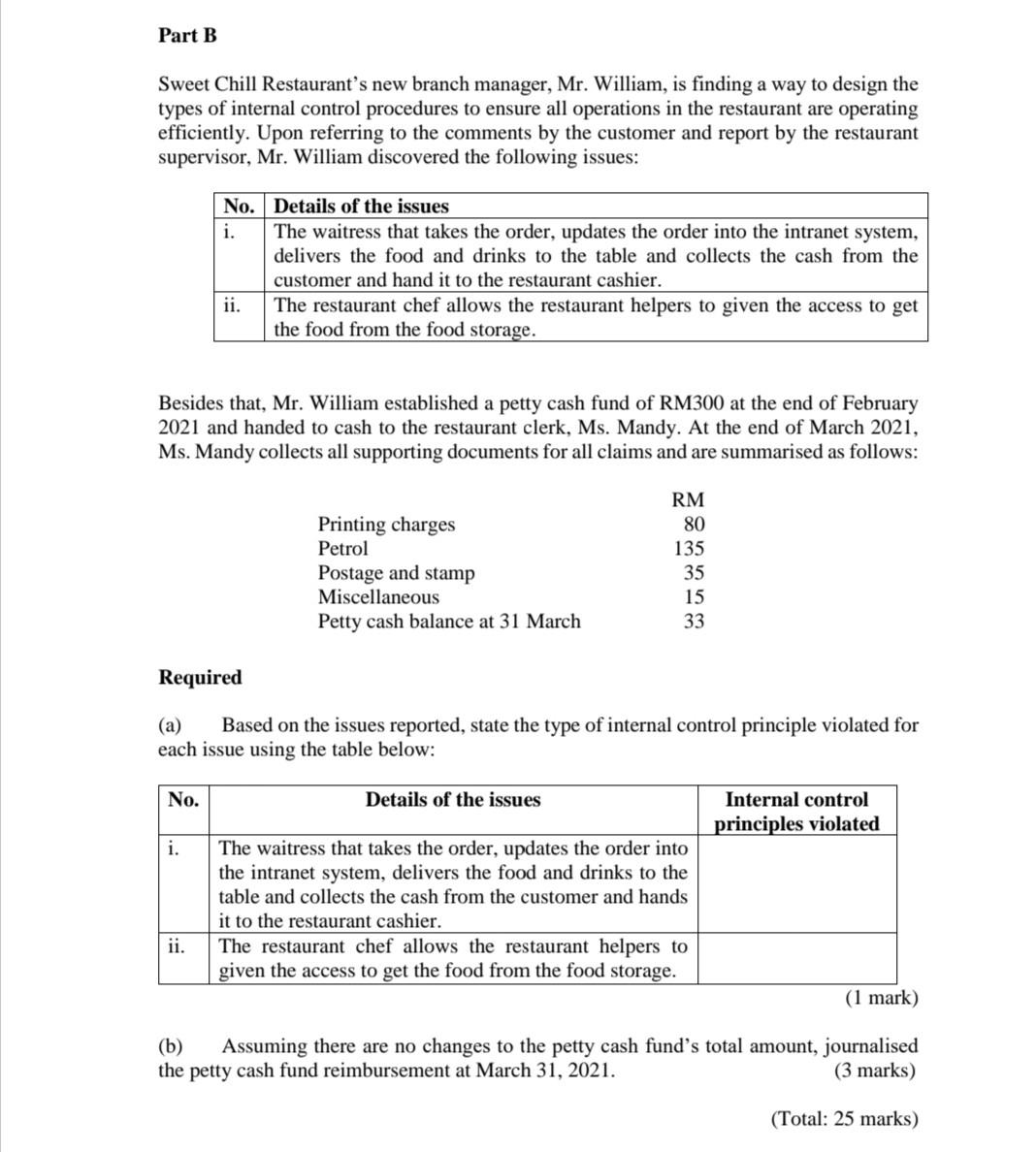

QUESTION 1 Part A Glam Bridal Company, a wedding planner company, commences their business operation as of 1 January 2020. Throughout the month of January 2021, several transactions occurred as below. Jan 1 Dato' Rie, the owner of Glam Bridal Company, invested additional RM25,000 in the business. 4 Purchases of wedding supplies from Ms. Aleeza RM2,000 on account. 5 Wedding equipment was purchased at a cost of RM12,000; a three-month, 12% note payable was signed for this amount. Received RM7,000 from Naelofar for wedding services rendered during the 8 week. Dato' Rie agreed to hire Cinderella as an assistant. He will be paid at the rate 10 of RM4,000 monthly, receiving RM2,000 on the 15th and 30th of each month. She will begin work on January 16. 14 Paid RM1,200 cash to the Harian Metro for advertisements run this past week. 16 Cinderella began work the salary of RM4,000. 19 Paid RM2,000 in cash to Feezy Company for January rent. Office supplies were purchased on account at a cost of RM1,000 from Suria 25 Company. These supplies will be used during February. 26 Paid RM2,400 for insurance policy in the next 2 years by cash. Received RM3,000 from Fazura for wedding services to be rendered early in 27 March 2021. Billed customers, Ms. Ella RM6,000 for services rendered but not collected 28 during the month. 30 Dato' Rie withdrew RM1,000 cash for personal use. 30 Cinderella was paid RM2,000 cash for her salary. Required (a) Prepare the journal entries to record the above transactions for the month of January 2021. (13 marks) (b) Prepare the ledger for selected accounts below: i. Cash account, assuming the beginning balance of the Cash account on January 2021 is RM10,500 (4.5 marks) ii. Account Payable account, assuming the beginning balance of Account Payable is RM1,500. (1.5 marks) Part B Answer the following independent questions. (a) Accounting involves three main processes and Bookkeeping falls under one of the processes. Briefly explain the THREE (3) accounting processes and classify the category of which Bookkeeping falls in. (2 marks) (b) There are two main users who use financial information in decision making. Identify the TWO (2) main users and provide any TWO (2) examples for each of the users. (4 marks) (Total: 25 marks) QUESTION 2 Part A Qi Ming started her own gym and fitness center, named QM Fitness Gym Centre on 1 May 2020. The trial balance at 31 May 2020 is as follows. QM Fitness Gym Centre Trial Balance 31 May 2020 Debit Credit Cash RM7,700 Account receivable 4,000 Prepaid insurance 2,400 Supplies 1,500 Gym equipment 12,000 Account payable RM3,500 Unearned membership fees revenues 3,000 Qi Ming, capital 19,100 Membership fees revenues 6,000 Salaries expense 3,000 Rent expense 1,000 RM31,600 RM31,600 Additional information for the QM Fitness Gym Centre in May 2020 are as follow: = i. RM500 of supplies have been used during the month. ii. Utilities expense incurred but not paid on 31 May 2020, RM200. Continued... INDIVIDUAL ASSIGNMENT NWM/FH/NDH/SZA/NFJ/SYE 2/7 DFA5054 FINANCIAL ACCOUNTING 11 NOVEMBER 2021 iii. The insurance policy is for 1 year and expired for a month. iv. RM1,000 of the balance in the unearned membership fees revenues account remains unearned at the end of the month. v. 31 May is a Thursday, and employees are paid on Friday. QM Fitness Gym Centre has two employees, who are paid RM500 each for 5 days' work week. vi. The Gym equipment has a 5-year life with no salvage value. It is being depreciated at RM200 per month for 60 months. vii. Invoices representing RM2,000 of coaching services performed during the month have not been recorded as of 31 May. Required (a) Prepare the adjusting entries for the month of May. (7 marks) (b) Prepare an adjusted trial balance at 31 May 2020. (5 marks) (c) Prepare the Statement of Financial Position as at 31 May 2020. (5 marks) (d) Prepare the closing entries for the month of May. (4 marks) Part B Identify the following situations either Accrued Expense, Prepaid Expense, Accrued Revenue or Unearned Revenue". (a) Wong paid RM1,000 cash in advance for four months' office rental. (b) Wong received cash for future services and recorded a liability until the service was performed. (c) Wong performed consulting services to a client but did not billed the client for services provided amounting RM2,000. (d) Wong incurred salaries and wages expenses and will be paid at a later date. (4 marks) = (Total: 25 marks) QUESTION 3 Part A Biodash Bicycle Distributors Berhad is a company that sells specially designed bicycles that can be used for both outdoor and indoor exercise. The company normally accepts ordering exceeding RM8,000 and all sales are on account basis based on credit term 1/10, n/30. Currently the company sells a new type of imported Biotech I-Bike from Japan that is equipped with an artificial intelligent (AI) system that requires users to download the app download to lock, and show readings such as cycling speed, heartbeat, blood pressure and calories burned in the user's smartphone. The company received a sales order for Biotech I-Bike since last month and started selling in the month of July 2021 with the stock purchased last month carried forward at cost of RM32,500. All transactions involved purchases and sales of the Biotech I-Bike are extracted and shown below: Date Transactions 2021 Sold Biotech I-Bike to Green Bike Shop on credit at 1/10, n/30 for RM12,800 July 3 using FOB destination. The cost of the bicycle sold was computed at RM7,500. 4 Delivered all bicycles sold on July 3 to Penang and the party in charge paid the shipping fee RM300 by cash. 8 Sold RM9,600 Biotech I-Bike to Giant Market Wholesales on credit at 1/10, n/30 using FOB shipping. The cost of the bicycle sold was computed at RM5,400. The shipping fee was RM250 and was paid using cash by the party in charge on the same day. 12 Purchased Biotech I-Bike cost RM13,000 from True Champion Bikes Berhad on credit at 2/10, n/60 using FOB shipping. The party in charge paid RM400 as shipping fee by cash on the same day. The Biotech I-Bike's main supplier, True Champion Bikes Berhad has an normal balance amount payable at RM32,500 as at 1 July 2021 with credit term n/60. Listed below are the records of the payment made to the main supplier and cheque received from the debtors: Date Transactions 2021 Issued cheque as full payment of previous Biotech I-Bike purchased in June 2021 July 2 from True Champion Bikes Berhad. 10 Received cheque from Green Bike Shop as full settlement for bicycle sold at 3 July after considering other deductions. 16 Received cheque from Giant Market Wholesales as full settlement for bicycle sold at 3 July after considering other deductions. 23 Received online banking to the company's bank account at 50% of the total sales of bicycle sold to Giant Market Wholesales at July 18. Besides the information above, below are the details of the credit notes issued and received during the month of July 2021. Date Transactions 2021 Received 2 bicycles sold at RM360 each was returned from Giant Market July 9 Wholesales due to brake malfunction. The cost of the bicycles returned was RM400 in total. A credit note was issued and the amount was to be deducted on the amount outstanding. 28 Returned 4 bicycles purchased on July 24 cost at RM800 in total due to brake malfunction to True Champion Bikes Berhad. Received credit note from True Champion Bikes Berhad and the amount was to be deducted from the amount payable. Required (a) Journalised all transactions based on the information provided above. (Hint: Do prepare the journals based on sequential dates.) (13.5 marks) (b) Post all relevant entries in (a) to the merchandise inventory's ledger for Biotech I- Bike. Name the ledger: Merchandise Inventory (I-Bike). (3 marks) Part B Below are the finalised account balances for Biodash Bicycle Distributors Berhad updated as at 31 July 2021: RM RM Accounts Merchandise inventory Machine and equipment Sales discounts Administration expenses Accounts payable Accrued expense Accumulated depreciation - Machine and Equipment Other revenue and gains Bank Selling expenses 128,450 285,000 1,768 98,750 57,895 4,075 Accounts Cost of goods sold Cash Sales revenue Accounts receivable Prepaid insurance Computer Accumulated depreciation - Computer Loan payable Owner's capital Other expenses and losses 183,200 8,456 389,760 67,400 1,800 36,400 142,500 14,560 1,586 60,000 18,000 62,000 220,000 3,152 Required Assumed that Biodash Bicycle Distributors Berhad closes its accounts at the end of July 2021. Prepare the post-closing trial balance for the company based on the accounts balances given. You are also required to show the workings. (8.5 marks) (Total: 25 marks) Continued QUESTION 4 Part A Given are the statement of profit and loss of Victory Bowling Centre for two consequence years, 2021 and 2020. Victory Bowling Centre Statement of Profit or Loss for the years ended April 30 2021 2020 Admission and Membership Fee Revenue RM408,400 RM337,860 Less: Membership rebate 62,400 49,980 Total Net Revenue 346,000 287,880 Less: Expenses Cleaning expense 15,000 12,000 Depreciation expense 32,500 32,000 Salaries and wages expense 88,000 76,000 Utilities expense 13,200 12,000 Promotion expense 9,600 Transport expense 6,000 5,400 Insurance expense 5,500 5,500 Rent expense 96,000 98,000 Maintenance expense 24,600 18,000 Printing and postage expense 3,385 3,068 Sundry expense 648 532 Total Expenses 294,433 268,500 Net profit 51,567 19,380 6,000 Required (a) Prepare the horizontal analysis for Sweet Dine-In Restaurant with 2020 as base year. Round your answer up to one decimal place. (14 marks) (b) Compute the profit margin for the year 2021. Round your answer up to two decimal places. (1.5 marks) (c) Year 2019 2020 2021 Total assets (RM) 280.000 320,000 325,000 Given the total assets of Sweet Dine-In Restaurant for 2019, 2020 and 2021. Compute the asset turnover and return on assets for 2020 and 2021 and answer yup to two decimal places. (5 marks) (d) Based on the profitability ratios computed, which year performed better. (0.5 marks) Part B Sweet Chill Restaurant's new branch manager, Mr. William, is finding a way to design the types of internal control procedures to ensure all operations in the restaurant are operating efficiently. Upon referring to the comments by the customer and report by the restaurant supervisor, Mr. William discovered the following issues: No. Details of the issues i. The waitress that takes the order, updates the order into the intranet system, delivers the food and drinks to the table and collects the cash from the customer and hand it to the restaurant cashier. ii. The restaurant chef allows the restaurant helpers to given the access to get the food from the food storage. Besides that, Mr. William established a petty cash fund of RM300 at the end of February 2021 and handed to cash to the restaurant clerk, Ms. Mandy. At the end of March 2021, Ms. Mandy collects all supporting documents for all claims and are summarised as follows: Printing charges Petrol Postage and stamp Miscellaneous Petty cash balance at 31 March RM 80 135 35 15 33 Required (a) Based on the issues reported, state the type of internal control principle violated for each issue using the table below: No. Details of the issues Internal control principles violated i. The waitress that takes the order, updates the order into the intranet system, delivers the food and drinks to the table and collects the cash from the customer and hands it to the restaurant cashier. The restaurant chef allows the restaurant helpers to given the access to get the food from the food storage. ii. (1 mark) (b) Assuming there are no changes to the petty cash fund's total amount, journalised the petty cash fund reimbursement at March 31, 2021. (3 marks) (Total: 25 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started