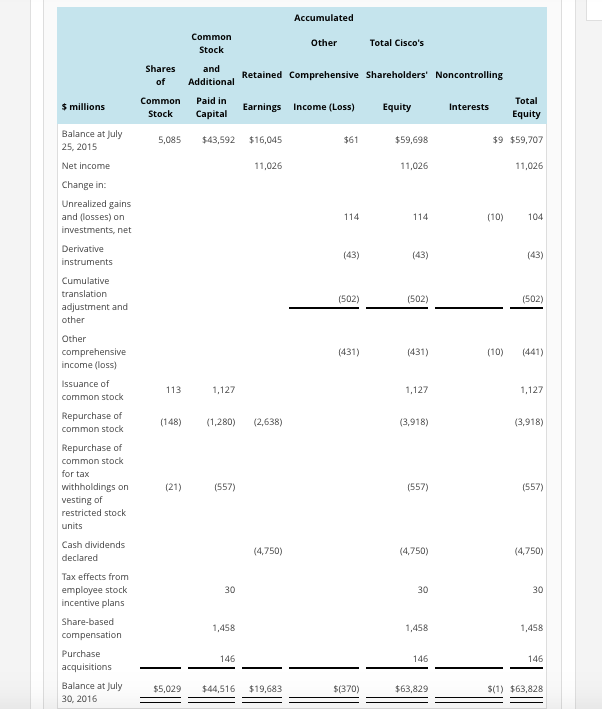

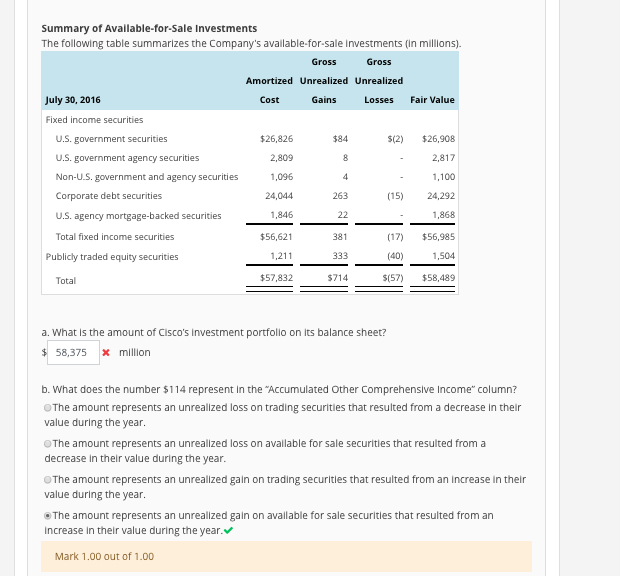

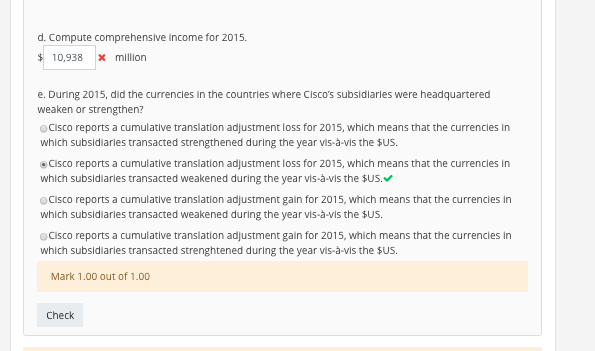

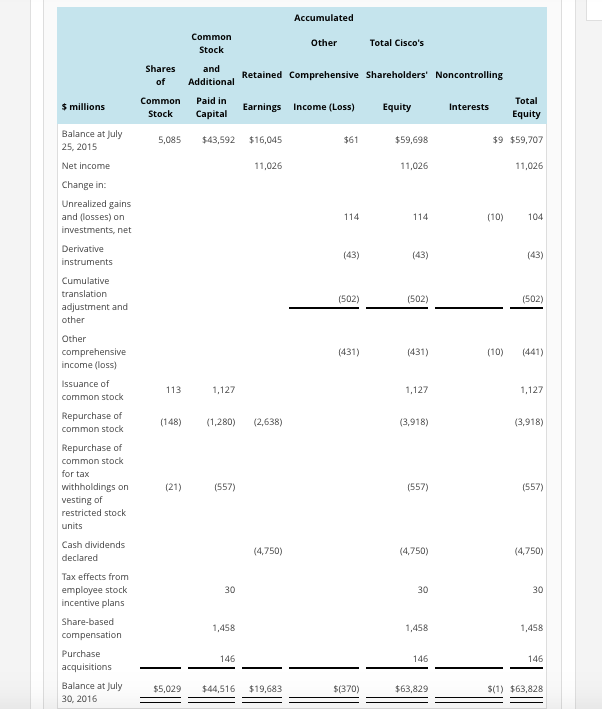

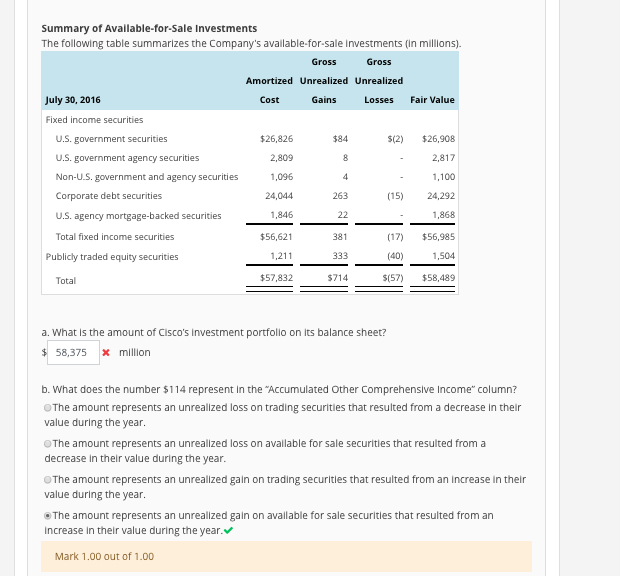

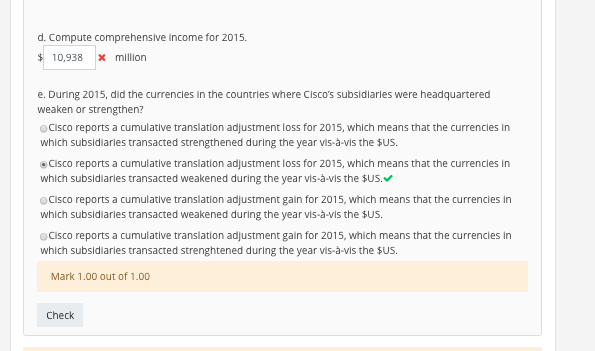

QUESTION 1 Partially correct Mark 1.20 out of 2.00 F Flag question Interpreting Footnotes on Security Investments Cisco Systems Inc. reports the following Information derived from its 2016 10-K report. (Note: Cisco's 2016 disclosures are consistent with the former accounting rules for marketable equity securities. See the Accounting Insight box on page 9-6 in the textbook.) Accumulated Common Total Cisco's Other Shares of Retained Comprehensive Shareholders Noncontrolling Additional Common Paid in Total Equity $ millions Earnings Income(Loss) Interests Stock Capital Equity Balance at July 25, 2015 5,085 $43,592 $16,045 $59,698 $9 $59,707 $61 Net income 11,026 11,026 Change in: Unrealized gains and (losses) on investments, net 114 114 (10) 104 (43) Cumulative (502) adjustment and (431) (431) 0) 441) income (loss) Issuance of common stock 113 1,127 1,127 Repurchase of common stock 148) ,280 (2,638) (3,918) (3,918) Repurchase of common stock for tax withholdings on vesting of restricted stock (21) (557) (557) (557) Cash dividends (4,750) (4,750) 4,750) Tax effects from employee stock incentive plans 1,458 1,458 Purchase acquisitions Balance at July 30, 2016 146 146 146 $5,029 $44,516 $19,683 (370) $63,829 (1) $63,828 Summary of Available-for-Sale Investments The following table summarizes the Company's available-for-sale investments (in millilons). Gross Amortized Unrealized Unrealized Gains Gross July 30, 2016 Losses Fair Value Cost Fixed income securities $26,826 2,809 1,096 24,044 1,846 $56,621 1,211 $57,832 U.S. government securities U.S. government agency securities Non-U.S. government and agency securities Corporate debt securities U.S. agency mortgage-backed securities Total fixed income securities $84 $(2) $26,908 2,817 1,100 (15) 24,292 1,868 (17) $56,985 1,504 57) $58,489 263 381 (40) Publicly traded equity securities 714 Total a. What is the amount of Cisco's investment portfollo on its balance sheet? 58,375x million b. What does the number $114 represent in the "Accumulated Other Comprehensive Income" column? The amount represents an unrealized loss on trading securities that resulted from a decrease in their value during the year The amount represents an unrealized loss on available for sale securities that resulted from a decrease in their value during the year The amount represents an unrealized gain on trading securities that resulted from an increase in their value during the year The amount represents an unrealized gain on avallable for sale securitles that resulted from an increase in their value during the year. Mark 1.00 out of 1.00 .Compute comprehensive income for 2015 0,938x million e. During 2015, did the currencies in the countries where Cisco's subsidlaries were headquartered weaken or strengthen? oCisco reports a cumulative translation adjustment loss for 2015, which means that the currencles In which subsidiaries transacted strengthened during the year vis--vis the $Us Cisco reports a cumulative translation adjustment loss for 2015, which means that the currencies in which subsidiaries transacted weakened during the year vis--vis the sUS. Cisco reports a cumulative translation adjustment gain for 2015, which means that the currencies In which subsidiaries transacted weakened during the year vis--vis the sUs Cisco reports a cumulative translation adjustment gain for 2015, which means that the currencies In which subsidiaries transacted strenghtened during the year vis--vis the $Us. Mark 1.00 out of 1.00 Check