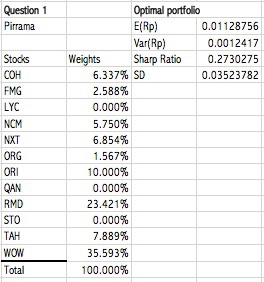

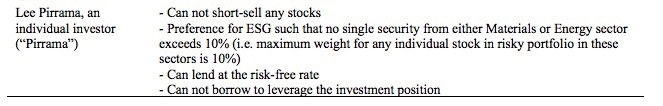

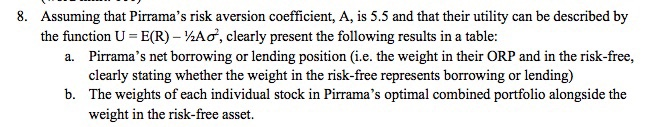

Question 1 Pirrama Stocks COH FMG LYC NCM NXT ORG ORI QAN RMD STO TAH WOW Total Optimal portfolio E(Rp) 0.01128756 Var(Rp) 0.0012417 Weights Sharp Ratio 0.2730275 6.337% SD 0.03523782 2.588% 0.000% 5.750% 6.854% 1.567% 10.000% 0.000% 23.421% 0.000% 7.889% 35.593% 100.000% Lee Pirrama, an individual investor ("Pirrama") - Can not short-sell any stocks - Preference for ESG such that no single security from either Materials or Energy sector exceeds 10% (i.e. maximum weight for any individual stock in risky portfolio in these sectors is 10%) - Can lend at the risk-free rate - Can not borrow to leverage the investment position 8. Assuming that Pirrama's risk aversion coefficient, A, is 5.5 and that their utility can be described by the function U = E(R) - YAO, clearly present the following results in a table: a. Pirrama's net borrowing or lending position (i.e. the weight in their ORP and in the risk-free, clearly stating whether the weight in the risk-free represents borrowing or lending) b. The weights of each individual stock in Pirrama's optimal combined portfolio alongside the weight in the risk-free asset. Question 1 Pirrama Stocks COH FMG LYC NCM NXT ORG ORI QAN RMD STO TAH WOW Total Optimal portfolio E(Rp) 0.01128756 Var(Rp) 0.0012417 Weights Sharp Ratio 0.2730275 6.337% SD 0.03523782 2.588% 0.000% 5.750% 6.854% 1.567% 10.000% 0.000% 23.421% 0.000% 7.889% 35.593% 100.000% Lee Pirrama, an individual investor ("Pirrama") - Can not short-sell any stocks - Preference for ESG such that no single security from either Materials or Energy sector exceeds 10% (i.e. maximum weight for any individual stock in risky portfolio in these sectors is 10%) - Can lend at the risk-free rate - Can not borrow to leverage the investment position 8. Assuming that Pirrama's risk aversion coefficient, A, is 5.5 and that their utility can be described by the function U = E(R) - YAO, clearly present the following results in a table: a. Pirrama's net borrowing or lending position (i.e. the weight in their ORP and in the risk-free, clearly stating whether the weight in the risk-free represents borrowing or lending) b. The weights of each individual stock in Pirrama's optimal combined portfolio alongside the weight in the risk-free asset