Question # 1 please.

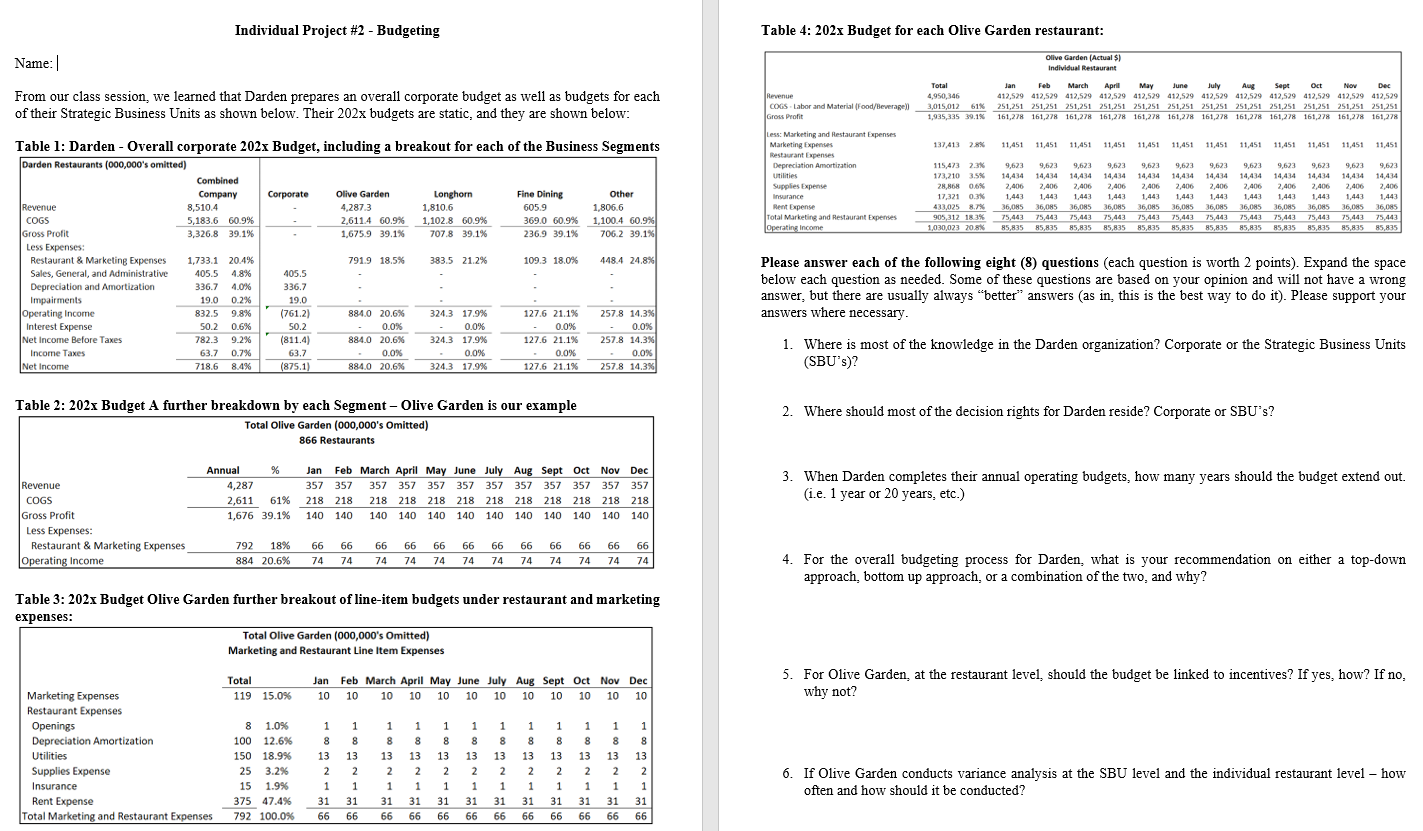

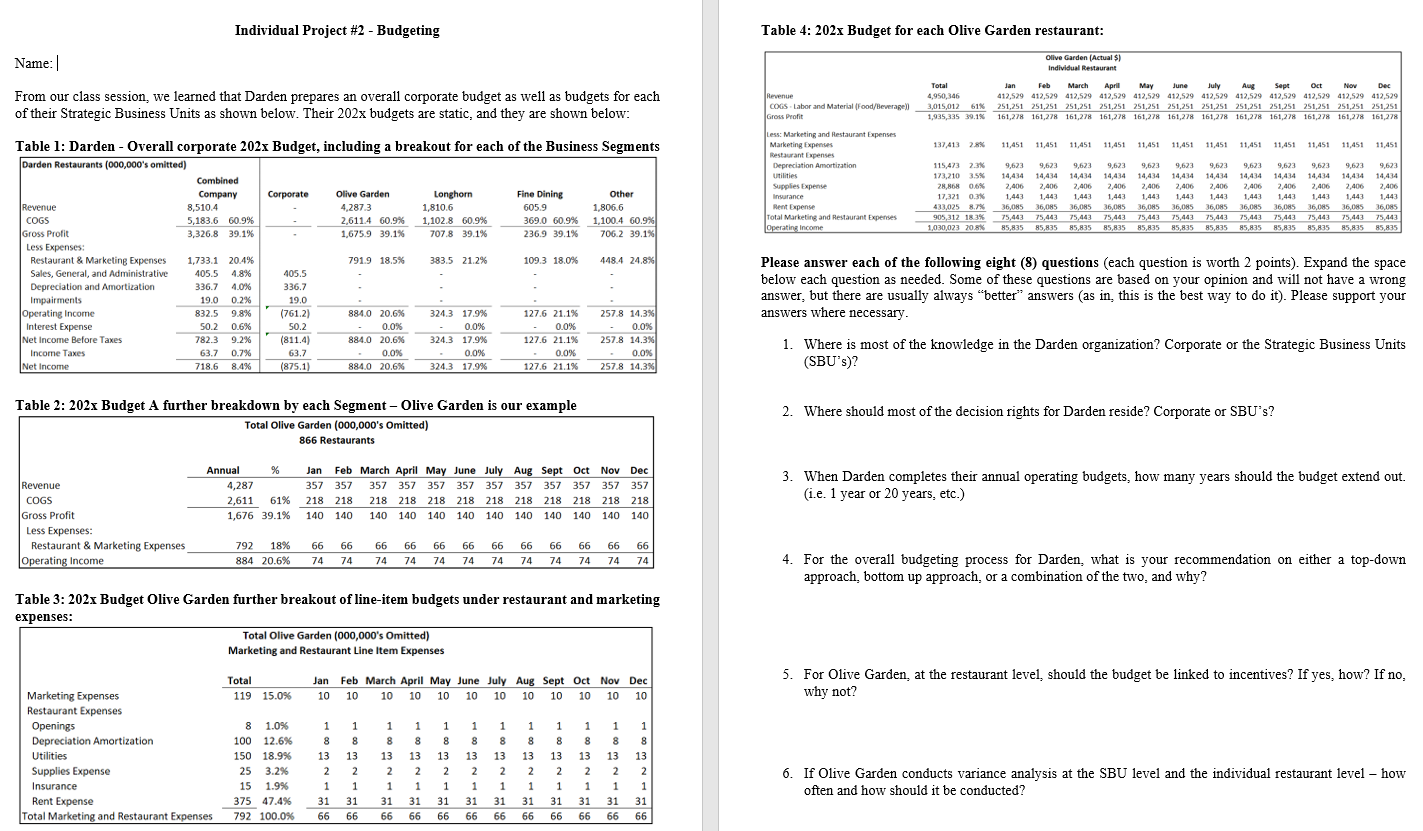

Individual Project #2 - Budgeting Table 4: 202x Budget for each Olive Garden restaurant: Name: Olive Garden (Actual S) Individual Restaurant From our class session, we learned that Darden prepares an overall corporate budget as well as budgets for each of their Strategic Business Units as shown below. Their 202x budgets are static, and they are shown below: Revenue COGS Labor and Material (Food/Beverage Gross Profit Total Jan Feb March April May June July Aug Sept Oct Nov Dec 4,950,346 412,529 412,529 412,529 412,529 412,529 412,529 412,529 412,529 412,529 412,529 412,529 412,529 3,016,012 61% 251,251 251,251 251,251 251,251 251,251 251,251 251,251 251,251 251,251 251,251 251,251 251,251 1,935,335 39.1% 161,278 161,278 161,278 161,278 161,278 161,278 161,278 161,278 161,278 161,278 161,278 161,278 137,413 2.8% Less: Marketing and Restaurant Expenses Marketing Expenses Restaurant Expenses Depreciation Amortiration Utilities Supplies Expense Insurance Rent Expense Total Marketing and Restaurant Expenses Operating income 115,473 2.3% 173,210 35 28,868 0.0% 17,321 0.3% 433,025 8. 905,312 18 3% 1,030,023 20.8% 11,451 11,451 11,451 11,451 11,451 11,451 11,451 11,451 11,451 11,451 11,451 11,451 9,623 9,623 9,623 9,623 9,623 9,623 9.623 9,623 9,623 9,623 9,623 9,623 14,434 14,434 14,434 14,434 14,434 14,434 14,434 14,414 14,414 14,434 14,434 14,434 2,406 2,406 2.400 2,406 2.400 2,406 2,406 2,400 2,406 2.400 2,406 2,406 1,443 1,443 1,443 1,443 1.443 1,443 1.443 1.443 1,443 1,443 1,443 1,443 36,085 36,0RS 36,085 36,ORS 36,085 36,085 36,085 36,085 36,085 36,085 36,085 36,085 75,44375,443 75,441 75,443 75,443 75,443 75,443 75,443 75,443 75,443 75,44375,443 85,835 85,835 85,835 85,835 85,835 85,835 85,835 85,835 85,835 85,835 85,835 85,835 Table 1: Darden - Overall corporate 202x Budget, including a breakout for each of the Business Segments Darden Restaurants (000,000's omitted) ( Combined Company Corporate Olive Garden Longhorn Fine Dining Other Revenue 8,510.4 4,287.3 1,810.6 605.9 1,806.6 COGS 5,183.6 60.9% 2,6114 60.9% 1,102.8 60.9% 369.0 60.9% 1,100.4 60.9% Gross Profit 3,326.8 39.1% 1,675.9 39.1% 707.8 39.1% 236.9 39.1% 706 2 39.1% Less Expenses: Restaurant & Marketing Expenses 1,733.1 20.4% 791.9 18.5% 383.5 21.2% 109.3 18.0% 448.4 24.8% Sales, General, and Administrative 405.5 4.8% 405.5 Depreciation and Amortization 336.7 4.0% 336.7 Impairments 19.0 0.2% 19.0 Operating Income 832.5 9.8% (761.2) 884.0 20.6% 324.3 17.9% 127.6 21.1% 257.8 14.3% Interest Expense 50.2 0.6% 50.2 0.0% 0.0% 0.0% 0.0% Net Income Before Taxes 7823 9.2% (811.4) 884.0 20.6% 324.3 17.9% 127.6 21.1% 257.8 14.3% Income Taxes 63.7 0.7% 63.7 0.0% 0.0% 0.0% 0.0% Net Income 718.6 8.4% (875.1) 884.0 20.6% 324,3 17.9% 127.6 21.1% 257.8 14.3% Please answer each of the following eight (8) questions (each question is worth 2 points). Expand the space below each question as needed. Some of these questions are based on your opinion and will not have a wrong answer, but there are usually always "better" answers (as in this is the best way to do it). Please support your answers where necessary. 1. Where is most of the knowledge in the Darden organization? Corporate or the Strategic Business Units (SBU's)? 2. Where should most of the decision rights for Darden reside? Corporate or SBU's? Table 2: 202x Budget A further breakdown by each Segment - Olive Garden is our example Total Olive Garden (000,000's Omitted) 866 Restaurants Annual % 4,287 2,611 61% 1,676 39.1% Jan Feb March April May June July Aug Sept Oct Nov Dec 357 357 357 357 357 357 357 357 357 357 357 357 218 218 218 218 218 218 218 218 218 218 218 218 218 218 218 140 140 140 140 140 140 140 140 140 140 140 140 140 3. When Darden completes their annual operating budgets, how many years should the budget extend out. (i.e. 1 year or 20 years, etc.) Revenue COGS Gross Profit Less Expenses: Restaurant & Marketing Expenses Operating Income 66 792 18% 884 20.6% 66 74 66 74 66 74 66 74 66 74 66 74 66 74 66 74 66 74 66 74 66 74 74 4. For the overall budgeting process for Darden, what is your recommendation on either a top-down approach, bottom up approach, or a combination of the two, and why? Table 3: 202x Budget Olive Garden further breakout of line-item budgets under restaurant and marketing expenses: Total Olive Garden (000,000's Omitted) Marketing and Restaurant Line Item Expenses Total 119 15.0% Jan 10 Feb March April May June July Aug Sept Oct Nov Dec 10 10 10 10 10 10 10 10 10 10 10 5. For Olive Garden, at the restaurant level, should the budget be linked to incentives? If yes, how? If no, why not? 8 8 8 8 8 8 8 8 8 Marketing Expenses Restaurant Expenses Openings Depreciation Amortization Utilities Supplies Expense Insurance Rent Expense Total Marketing and Restaurant Expenses 8 1.0% 100 12.6% 150 18.9% 25 3.2% 15 1.9% 375 47.4% 792 100.0% 13 2 1 1 1 1 1 1 1 1 1 1 1 1 1 8 13 13 13 13 13 13 13 13 13 13 13 2 2 2 2 2 2 2 2 2 2 2 1 1 1 1 1 1 1 1 1 1 1 1 31 31 31 31 31 31 31 31 31 31 66 66 66 66 66 66 66 66 6. If Olive Garden conducts variance analysis at the SBU level and the individual restaurant level how often and how should it be conducted? 31 66 31 66 66 66 Individual Project #2 - Budgeting Table 4: 202x Budget for each Olive Garden restaurant: Name: Olive Garden (Actual S) Individual Restaurant From our class session, we learned that Darden prepares an overall corporate budget as well as budgets for each of their Strategic Business Units as shown below. Their 202x budgets are static, and they are shown below: Revenue COGS Labor and Material (Food/Beverage Gross Profit Total Jan Feb March April May June July Aug Sept Oct Nov Dec 4,950,346 412,529 412,529 412,529 412,529 412,529 412,529 412,529 412,529 412,529 412,529 412,529 412,529 3,016,012 61% 251,251 251,251 251,251 251,251 251,251 251,251 251,251 251,251 251,251 251,251 251,251 251,251 1,935,335 39.1% 161,278 161,278 161,278 161,278 161,278 161,278 161,278 161,278 161,278 161,278 161,278 161,278 137,413 2.8% Less: Marketing and Restaurant Expenses Marketing Expenses Restaurant Expenses Depreciation Amortiration Utilities Supplies Expense Insurance Rent Expense Total Marketing and Restaurant Expenses Operating income 115,473 2.3% 173,210 35 28,868 0.0% 17,321 0.3% 433,025 8. 905,312 18 3% 1,030,023 20.8% 11,451 11,451 11,451 11,451 11,451 11,451 11,451 11,451 11,451 11,451 11,451 11,451 9,623 9,623 9,623 9,623 9,623 9,623 9.623 9,623 9,623 9,623 9,623 9,623 14,434 14,434 14,434 14,434 14,434 14,434 14,434 14,414 14,414 14,434 14,434 14,434 2,406 2,406 2.400 2,406 2.400 2,406 2,406 2,400 2,406 2.400 2,406 2,406 1,443 1,443 1,443 1,443 1.443 1,443 1.443 1.443 1,443 1,443 1,443 1,443 36,085 36,0RS 36,085 36,ORS 36,085 36,085 36,085 36,085 36,085 36,085 36,085 36,085 75,44375,443 75,441 75,443 75,443 75,443 75,443 75,443 75,443 75,443 75,44375,443 85,835 85,835 85,835 85,835 85,835 85,835 85,835 85,835 85,835 85,835 85,835 85,835 Table 1: Darden - Overall corporate 202x Budget, including a breakout for each of the Business Segments Darden Restaurants (000,000's omitted) ( Combined Company Corporate Olive Garden Longhorn Fine Dining Other Revenue 8,510.4 4,287.3 1,810.6 605.9 1,806.6 COGS 5,183.6 60.9% 2,6114 60.9% 1,102.8 60.9% 369.0 60.9% 1,100.4 60.9% Gross Profit 3,326.8 39.1% 1,675.9 39.1% 707.8 39.1% 236.9 39.1% 706 2 39.1% Less Expenses: Restaurant & Marketing Expenses 1,733.1 20.4% 791.9 18.5% 383.5 21.2% 109.3 18.0% 448.4 24.8% Sales, General, and Administrative 405.5 4.8% 405.5 Depreciation and Amortization 336.7 4.0% 336.7 Impairments 19.0 0.2% 19.0 Operating Income 832.5 9.8% (761.2) 884.0 20.6% 324.3 17.9% 127.6 21.1% 257.8 14.3% Interest Expense 50.2 0.6% 50.2 0.0% 0.0% 0.0% 0.0% Net Income Before Taxes 7823 9.2% (811.4) 884.0 20.6% 324.3 17.9% 127.6 21.1% 257.8 14.3% Income Taxes 63.7 0.7% 63.7 0.0% 0.0% 0.0% 0.0% Net Income 718.6 8.4% (875.1) 884.0 20.6% 324,3 17.9% 127.6 21.1% 257.8 14.3% Please answer each of the following eight (8) questions (each question is worth 2 points). Expand the space below each question as needed. Some of these questions are based on your opinion and will not have a wrong answer, but there are usually always "better" answers (as in this is the best way to do it). Please support your answers where necessary. 1. Where is most of the knowledge in the Darden organization? Corporate or the Strategic Business Units (SBU's)? 2. Where should most of the decision rights for Darden reside? Corporate or SBU's? Table 2: 202x Budget A further breakdown by each Segment - Olive Garden is our example Total Olive Garden (000,000's Omitted) 866 Restaurants Annual % 4,287 2,611 61% 1,676 39.1% Jan Feb March April May June July Aug Sept Oct Nov Dec 357 357 357 357 357 357 357 357 357 357 357 357 218 218 218 218 218 218 218 218 218 218 218 218 218 218 218 140 140 140 140 140 140 140 140 140 140 140 140 140 3. When Darden completes their annual operating budgets, how many years should the budget extend out. (i.e. 1 year or 20 years, etc.) Revenue COGS Gross Profit Less Expenses: Restaurant & Marketing Expenses Operating Income 66 792 18% 884 20.6% 66 74 66 74 66 74 66 74 66 74 66 74 66 74 66 74 66 74 66 74 66 74 74 4. For the overall budgeting process for Darden, what is your recommendation on either a top-down approach, bottom up approach, or a combination of the two, and why? Table 3: 202x Budget Olive Garden further breakout of line-item budgets under restaurant and marketing expenses: Total Olive Garden (000,000's Omitted) Marketing and Restaurant Line Item Expenses Total 119 15.0% Jan 10 Feb March April May June July Aug Sept Oct Nov Dec 10 10 10 10 10 10 10 10 10 10 10 5. For Olive Garden, at the restaurant level, should the budget be linked to incentives? If yes, how? If no, why not? 8 8 8 8 8 8 8 8 8 Marketing Expenses Restaurant Expenses Openings Depreciation Amortization Utilities Supplies Expense Insurance Rent Expense Total Marketing and Restaurant Expenses 8 1.0% 100 12.6% 150 18.9% 25 3.2% 15 1.9% 375 47.4% 792 100.0% 13 2 1 1 1 1 1 1 1 1 1 1 1 1 1 8 13 13 13 13 13 13 13 13 13 13 13 2 2 2 2 2 2 2 2 2 2 2 1 1 1 1 1 1 1 1 1 1 1 1 31 31 31 31 31 31 31 31 31 31 66 66 66 66 66 66 66 66 6. If Olive Garden conducts variance analysis at the SBU level and the individual restaurant level how often and how should it be conducted? 31 66 31 66 66 66